Oil prices have been chopping around overnight as traders focused on China's latest efforts to stimulate its stock market economy, and no new chaos in the Red Seas (and Libya reopened its largest oil field).

Oil also benefited from a weaker dollar and a big crude draw reported by API overnight (albeit offset by a major build in gasoline stocks).

All eyes now on whether the official data will confirm it -but bear in mind some of this data could be affected by the deep freeze across the US.

API

-

Crude -6.67mm (-1.4mm exp)

-

Cushing -2.03mm

-

Gasoline +7.18mm (+1.5mm exp)

-

Distillates -245K (-700k exp)

DOE

-

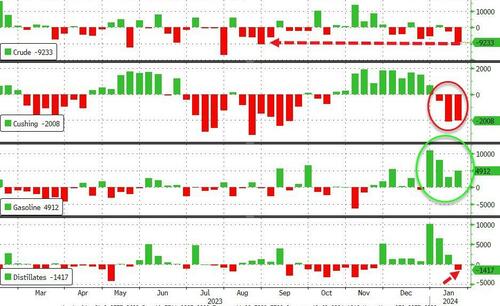

Crude -9.2mm (-1.4mm exp) - largest draw since August 2023

-

Cushing -2mm

-

Gasoline +4.9mm (+1.5mm exp)

-

Distillates -1.4mm (-700k exp)

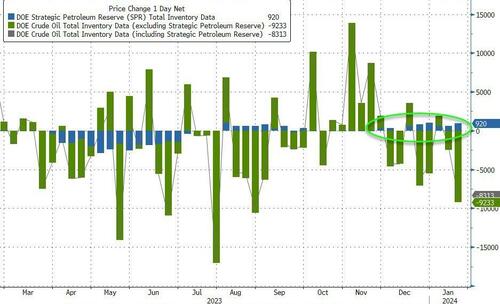

The official data confirmed API's large crude draw (9.2mm barrels - the biggest since Aug 23) and also gasoline stocks built (but less than API reported). Distillate stocks drew down for the first time in 9 weeks...

Source: Bloomberg

Crude stocks in the Midwest plunged by the most since May 2020 and in the Rockies region, crude inventories plummeted by the most since 1996.

The Biden administration added 920k barrels to the SPR last week - the 9th straight weekly addition...

Source: Bloomberg

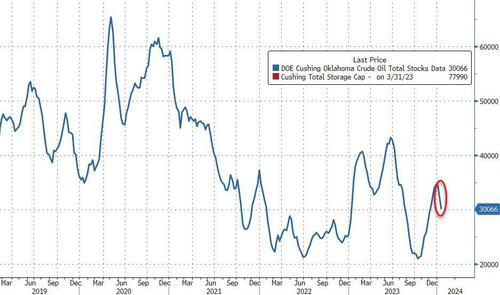

Stocks at the Cushing Hub declined for the 3rd week in a row by a large 2mm barrels...

Source: Bloomberg

US crude production plunged by 1mm b/d last week - impacted by the freezing storm that hit the US... (or is the M&A-driven overdrive output finally over?)

Source: Bloomberg

WTI was hovering around $74.80 ahead of the official data and rallied after the production cut and crude draw...

Oil market dynamics started to change over the last week, Tyler Richey, co-editor at Sevens Report Research told MarketWatch.

"The combination of cold weather knocking out a big portion of oil production in North Dakota since late last week, and news of an apparent Ukrainian drone attack on a Russian fuel export that temporarily halted operations at the facility this week, have tipped the fundamental scales in favor of the bulls for the very near term."

Still, a critical oil-market barometer for supply and demand known as the prompt-spread has been bolstered by the increased risks in the Red Sea.

WTI crude’s front-month futures are trading at a 10-15-cent premium to the next contract, near the highest since November, excluding expiration days.

Oil prices have been chopping around overnight as traders focused on China’s latest efforts to stimulate its stock market economy, and no new chaos in the Red Seas (and Libya reopened its largest oil field).

Oil also benefited from a weaker dollar and a big crude draw reported by API overnight (albeit offset by a major build in gasoline stocks).

All eyes now on whether the official data will confirm it -but bear in mind some of this data could be affected by the deep freeze across the US.

API

-

Crude -6.67mm (-1.4mm exp)

-

Cushing -2.03mm

-

Gasoline +7.18mm (+1.5mm exp)

-

Distillates -245K (-700k exp)

DOE

-

Crude -9.2mm (-1.4mm exp) – largest draw since August 2023

-

Cushing -2mm

-

Gasoline +4.9mm (+1.5mm exp)

-

Distillates -1.4mm (-700k exp)

The official data confirmed API’s large crude draw (9.2mm barrels – the biggest since Aug 23) and also gasoline stocks built (but less than API reported). Distillate stocks drew down for the first time in 9 weeks…

Source: Bloomberg

Crude stocks in the Midwest plunged by the most since May 2020 and in the Rockies region, crude inventories plummeted by the most since 1996.

The Biden administration added 920k barrels to the SPR last week – the 9th straight weekly addition…

Source: Bloomberg

Stocks at the Cushing Hub declined for the 3rd week in a row by a large 2mm barrels…

Source: Bloomberg

US crude production plunged by 1mm b/d last week – impacted by the freezing storm that hit the US… (or is the M&A-driven overdrive output finally over?)

Source: Bloomberg

WTI was hovering around $74.80 ahead of the official data and rallied after the production cut and crude draw…

Oil market dynamics started to change over the last week, Tyler Richey, co-editor at Sevens Report Research told MarketWatch.

“The combination of cold weather knocking out a big portion of oil production in North Dakota since late last week, and news of an apparent Ukrainian drone attack on a Russian fuel export that temporarily halted operations at the facility this week, have tipped the fundamental scales in favor of the bulls for the very near term.”

Still, a critical oil-market barometer for supply and demand known as the prompt-spread has been bolstered by the increased risks in the Red Sea.

WTI crude’s front-month futures are trading at a 10-15-cent premium to the next contract, near the highest since November, excluding expiration days.

Loading…