Many years ago, before he launched his popular "Chart of the Day" note, one of the most used charts by Deutsche Bank's Jim Reid was to show how bad credit could get in a recession given the appalling technical set up of the market post-GFC. Given it’s that time again, in his latest CoTD Reid writes that it’s important to dust it down.

As Reid explains, basically in good times you can buy a huge amount of bonds at new issue but a few weeks or months later you can only really deal in fractions of that size in the secondary market at a price close to the market. This doesn’t matter in the good times when inflows are fairly consistently positive and the bulk of long only investors are comfortable buying and holding.

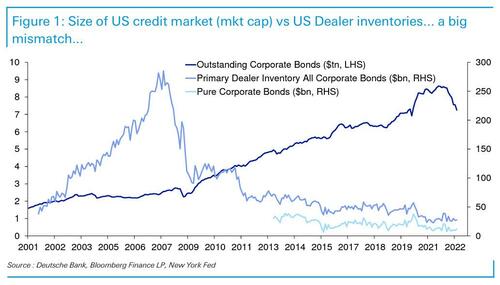

However in bad times even long only investors want to protect their short-term performance and all head to the same very narrow door for a part of their portfolio, especially if there are outflows. And, as today's chart shows, dealer inventories have never recovered from the post GFC regulatory environment and the ability or desire to warehouse risk is minimal, especially in a crisis.

Unfortunately the data from the New York Fed is not continuous and a time series for pure corporate bonds is only available from 2013 onwards. However we show the longer time series that includes things like asset backed securities, state and muni bonds which gives an idea of the trend even if it may be inflated given the deleveraging seen in structured bonds post GFC. Regardless of the problem of assessing inventories over time, Reid warns that there is no doubt that in his 27 years of working in credit markets the liquidity available has shrunk and as the chart shows there is no doubt that the size of the market has rapidly increased, notwithstanding the big mark to market draw down seen in 2022 in today’s chart.

So will this time be any different? Probably not. When we get confirmation of a proper recession that hits earnings and unemployment, illiquid products (like credit) will likely overshoot on the downside for the reasons discussed above. While painful to most, this will provide great opportunities for those nimble enough to exploit it but in illiquid markets that will be tough, according to Reid, who then takes a quick walk down memory lane:

Back in early April we raised our 2023 EU/US IG and HY spread targets to +210bps (IG) and +850bps (HY) on our call for a US recession. Its fair to say that spreads have spiked quicker than we expected, especially in Europe where the gas situation is perilous. EU IG is now just above where we thought it would peak next year. As of last night we were trading at +211bps (EU IG), +165bps (US IG), +668bps (EU HY) and +580bps (US HY). In light of everything we’ve seen in the 3 plus months since we published these forecasts it’s likely that they aren’t high enough to reflect the terminal peak in credit spreads.

His troubling conclusion...

"Poor liquidity in a structurally poor technical market will only add to the problem at the height of the recession when it arrives."

... is similar to what we said yesterday, namely that while the VIX remains subdued, the MOVE (or the VIX for bonds) is at record high levels, matched only by the covid crash. At some point the Fed will have no choice but to notice.

Remarkably the @federalreserve remains completely oblivious to just how broken the "deep" Treasury market is https://t.co/ZmFiPosccW

— zerohedge (@zerohedge) July 7, 2022

Many years ago, before he launched his popular “Chart of the Day” note, one of the most used charts by Deutsche Bank’s Jim Reid was to show how bad credit could get in a recession given the appalling technical set up of the market post-GFC. Given it’s that time again, in his latest CoTD Reid writes that it’s important to dust it down.

As Reid explains, basically in good times you can buy a huge amount of bonds at new issue but a few weeks or months later you can only really deal in fractions of that size in the secondary market at a price close to the market. This doesn’t matter in the good times when inflows are fairly consistently positive and the bulk of long only investors are comfortable buying and holding.

However in bad times even long only investors want to protect their short-term performance and all head to the same very narrow door for a part of their portfolio, especially if there are outflows. And, as today’s chart shows, dealer inventories have never recovered from the post GFC regulatory environment and the ability or desire to warehouse risk is minimal, especially in a crisis.

Unfortunately the data from the New York Fed is not continuous and a time series for pure corporate bonds is only available from 2013 onwards. However we show the longer time series that includes things like asset backed securities, state and muni bonds which gives an idea of the trend even if it may be inflated given the deleveraging seen in structured bonds post GFC. Regardless of the problem of assessing inventories over time, Reid warns that there is no doubt that in his 27 years of working in credit markets the liquidity available has shrunk and as the chart shows there is no doubt that the size of the market has rapidly increased, notwithstanding the big mark to market draw down seen in 2022 in today’s chart.

So will this time be any different? Probably not. When we get confirmation of a proper recession that hits earnings and unemployment, illiquid products (like credit) will likely overshoot on the downside for the reasons discussed above. While painful to most, this will provide great opportunities for those nimble enough to exploit it but in illiquid markets that will be tough, according to Reid, who then takes a quick walk down memory lane:

Back in early April we raised our 2023 EU/US IG and HY spread targets to +210bps (IG) and +850bps (HY) on our call for a US recession. Its fair to say that spreads have spiked quicker than we expected, especially in Europe where the gas situation is perilous. EU IG is now just above where we thought it would peak next year. As of last night we were trading at +211bps (EU IG), +165bps (US IG), +668bps (EU HY) and +580bps (US HY). In light of everything we’ve seen in the 3 plus months since we published these forecasts it’s likely that they aren’t high enough to reflect the terminal peak in credit spreads.

His troubling conclusion…

“Poor liquidity in a structurally poor technical market will only add to the problem at the height of the recession when it arrives.”

… is similar to what we said yesterday, namely that while the VIX remains subdued, the MOVE (or the VIX for bonds) is at record high levels, matched only by the covid crash. At some point the Fed will have no choice but to notice.

Remarkably the @federalreserve remains completely oblivious to just how broken the “deep” Treasury market is https://t.co/ZmFiPosccW

— zerohedge (@zerohedge) July 7, 2022