With 22-year-old portfolio managers shorting energy stocks and commodities beyond record levels to avoid "career risk" and fund NVDA longs by jumping on the biggest bubble bandwagon since the dot.com days , the inevitable short squeeze will be a sight to behold, and according to Reuters it may have started.

As Reuters energy analyst John Kemp write4s, portfolio investors "recoiled" from short positions in U.S. crude futures and options in the most recent week as rapidly depleting inventories at the Cushing delivery point "underscored the risk of a squeeze on deliverable barrels."

Hedge funds and other money managers purchased the equivalent of 46 million barrels across the six most important futures and options contracts over the seven days ending on Jan. 23.

Fund buying was dominated by NYMEX and ICE WTI (+56 million barrels) with smaller purchases of U.S. gasoline (+8 million) and European gas oil (+7 million). Investors sold Brent (-19 million barrels) and U.S. diesel (-6 million), according to records filed with ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

But most of the buying came from covering existing bearish short positions (-28 million barrels) rather than initiating new bullish long ones (+18 million).

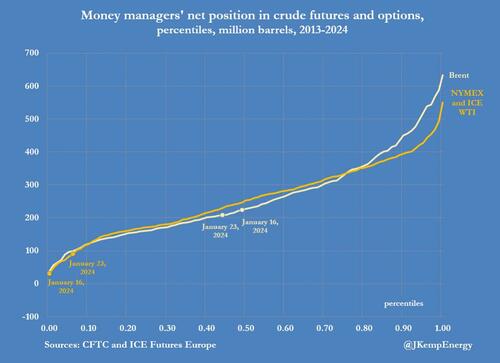

The imbalance was especially pronounced in WTI where managers reduced short positions sharply (-38 million barrels) while initiating a smaller number of new longs (+18 million). As shown in the chart below, money managers cut their short positions in WTI by the most since April.

At the same time, money managers boosted net longs in WTI by 44k lots last week, the most since September.

As a result, WTI short positions were slashed to 79 million barrels from 112 million on Jan. 16 and a high of 128 million on Dec. 12.

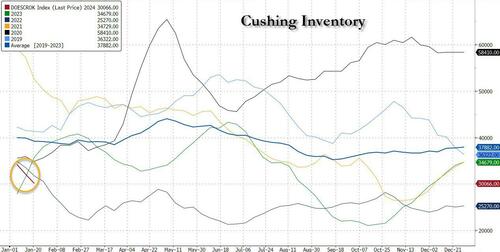

Crude inventories around the NYMEX delivery point at Cushing in Oklahoma had depleted to 30 million barrels on Jan. 19 down from 35 million barrels three weeks earlier.

Cushing inventories stood at the lowest for the time of year since 2012 and were 14 million barrels (-32% or -1.26 standard deviations) below the prior ten-year seasonal average.

With inventories shrinking, many fund managers concluded it was no longer safe to run short positions potentially requiring delivery at Cushing.

The net position in WTI jumped to 99 million barrels (6th percentile for all weeks since 2013) up from just 43 million (1st percentile) the previous week.

The gap between ultra-bearish positioning on WTI and neutral positioning in Brent narrowed slightly but remained very wide.

There was still significant scope for short-covering to lift WTI flat prices and calendar spreads if inventories continue to deplete.

Still, despite the squeeze, short positions in NYMEX WTI were still almost 4 times higher than at the start of the current short-selling cycle on Oct. 3. But with the amount of "pent up" wars around the world, they won't be there for long.

— zerohedge (@zerohedge) January 29, 2024

Natural Gas

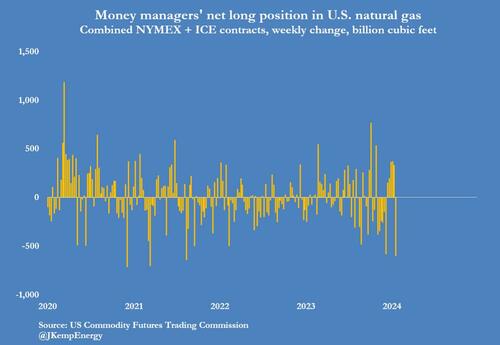

Elsewhere, investors trimmed positions in the two major futures and options contracts tied to gas prices at Henry Hub in Louisiana. Investors reverted to selling after trying to build a bullish position, as the big freeze earlier in January was followed by milder weather.

Hedge funds and other money managers sold the equivalent of 596 billion cubic feet (bcf) over the seven days ending on Jan. 23, the fastest rate of sales since August 2021.

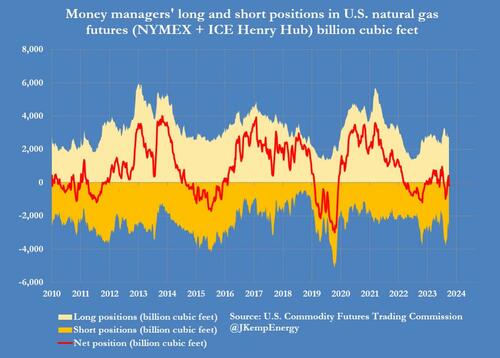

It came after fund managers had purchased a total of 1,409 bcf over the previous five weeks, according to regulatory records. Funds cut their position to 186 bcf net short (26th percentile for all weeks since 2010) from 410 bcf net long (42nd percentile) seven days before.

Nat gas front-month futures prices continued to slide and have averaged just $2.81 per million British thermal units so far in January (8th percentile for all months since the start of the century once adjusted for inflation).

The end-of-winter calendar spread between March and April 2024 has fallen to flat from a backwardation of 21 cents at beginning of winter in early October, as traders expect the market to remain oversupplied.

Investors anticipate gas stocks will end winter well above the long-term average so lower prices will be needed to encourage more consumption from power generators and slow production further.

With 22-year-old portfolio managers shorting energy stocks and commodities beyond record levels to avoid “career risk” and fund NVDA longs by jumping on the biggest bubble bandwagon since the dot.com days , the inevitable short squeeze will be a sight to behold, and according to Reuters it may have started.

As Reuters energy analyst John Kemp write4s, portfolio investors “recoiled” from short positions in U.S. crude futures and options in the most recent week as rapidly depleting inventories at the Cushing delivery point “underscored the risk of a squeeze on deliverable barrels.”

Hedge funds and other money managers purchased the equivalent of 46 million barrels across the six most important futures and options contracts over the seven days ending on Jan. 23.

Fund buying was dominated by NYMEX and ICE WTI (+56 million barrels) with smaller purchases of U.S. gasoline (+8 million) and European gas oil (+7 million). Investors sold Brent (-19 million barrels) and U.S. diesel (-6 million), according to records filed with ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

But most of the buying came from covering existing bearish short positions (-28 million barrels) rather than initiating new bullish long ones (+18 million).

The imbalance was especially pronounced in WTI where managers reduced short positions sharply (-38 million barrels) while initiating a smaller number of new longs (+18 million). As shown in the chart below, money managers cut their short positions in WTI by the most since April.

At the same time, money managers boosted net longs in WTI by 44k lots last week, the most since September.

As a result, WTI short positions were slashed to 79 million barrels from 112 million on Jan. 16 and a high of 128 million on Dec. 12.

Crude inventories around the NYMEX delivery point at Cushing in Oklahoma had depleted to 30 million barrels on Jan. 19 down from 35 million barrels three weeks earlier.

Cushing inventories stood at the lowest for the time of year since 2012 and were 14 million barrels (-32% or -1.26 standard deviations) below the prior ten-year seasonal average.

With inventories shrinking, many fund managers concluded it was no longer safe to run short positions potentially requiring delivery at Cushing.

The net position in WTI jumped to 99 million barrels (6th percentile for all weeks since 2013) up from just 43 million (1st percentile) the previous week.

The gap between ultra-bearish positioning on WTI and neutral positioning in Brent narrowed slightly but remained very wide.

There was still significant scope for short-covering to lift WTI flat prices and calendar spreads if inventories continue to deplete.

Still, despite the squeeze, short positions in NYMEX WTI were still almost 4 times higher than at the start of the current short-selling cycle on Oct. 3. But with the amount of “pent up” wars around the world, they won’t be there for long.

— zerohedge (@zerohedge) January 29, 2024

Natural Gas

Elsewhere, investors trimmed positions in the two major futures and options contracts tied to gas prices at Henry Hub in Louisiana. Investors reverted to selling after trying to build a bullish position, as the big freeze earlier in January was followed by milder weather.

Hedge funds and other money managers sold the equivalent of 596 billion cubic feet (bcf) over the seven days ending on Jan. 23, the fastest rate of sales since August 2021.

It came after fund managers had purchased a total of 1,409 bcf over the previous five weeks, according to regulatory records. Funds cut their position to 186 bcf net short (26th percentile for all weeks since 2010) from 410 bcf net long (42nd percentile) seven days before.

Nat gas front-month futures prices continued to slide and have averaged just $2.81 per million British thermal units so far in January (8th percentile for all months since the start of the century once adjusted for inflation).

The end-of-winter calendar spread between March and April 2024 has fallen to flat from a backwardation of 21 cents at beginning of winter in early October, as traders expect the market to remain oversupplied.

Investors anticipate gas stocks will end winter well above the long-term average so lower prices will be needed to encourage more consumption from power generators and slow production further.

Loading…