In his highly anticipated 60-Minutes interview, Jerome Powell did not deliver any new shocks, and unlike the Fed's dovish December pivot, there were no major surprises: instead, the Fed Chair echoed what he said last week, predicting that the Fed policymakers will likely wait after March to cut interest rates as he sought to explain the central bank’s rationale for eventual reductions to a broad public audience (amid mounting pressure by Democrats to cut aggressively ahead of December even as the Biden Dept of Labor fabricated jobs data to make it seem like the US is enjoying a golden ago for workers).

In an interview conducted on Thursday with CBS’s 60 Minutes and airing Sunday evening, Powell reiterated that Fed officials want to see more economic data to assure that inflation is on a sustainable path to their 2% goal.

"The danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading,” Powell said in the interview adding that while “we don’t think that’s the case... the prudent thing to do is to, is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way.”

Powell then said it isn’t likely that the Fed “will reach that level of confidence” about inflation’s path by its March 19-20 gathering, echoing remarks he made at a press conference Wednesday, and certainly not after the latest laughably ridiculous and political manipulated jobs number. He clarified that while most FOMC members are now dovish and expect rate cuts, that's certainly not the case for all, to wit: “all but a couple of our participants do believe it will be appropriate to, for us to begin to dial back the restrictive stance by cutting rates this year,” Powell said. “And so, it is certainly the base case that, that we will do that. We’re just trying to pick the right time, given the overall context.” Here is the full exchange:

PELLEY: The next meeting around this table that will decide the direction of interest rates is in this coming March. Knowing what you know now, is a rate cut more likely or less likely at that time?

POWELL: So, the broader situation is that the economy is strong, the labor market is strong, and inflation is coming down. And my colleagues and I are trying to pick the right point at which to begin to dial back our restrictive policy stance. That time is coming. We've said that we want to be more confident that inflation is moving down to 2%. And I would say, and I did say yesterday, that I think it's not likely that this committee will reach that level of confidence in time for the March meeting, which is in seven weeks.

So, I would say that's not the most likely or base case. However, all but a couple of our participants do believe it will be appropriate to, for us to begin to dial back the restrictive stance by cutting rates this year. And so, it is certainly the base case that, that we will do that. We're just trying to pick the right time, given the overall context.

While inflation has subsided substantially in recent months, Powell has repeatedly emphasized the central bank’s need to see more data before lowering borrowing costs. He indicated last week a rate cut is unlikely in the first quarter.

The central banker also said he didn’t expect policymakers to “dramatically” change their forecasts for rates next year, which in December showed they expect their benchmark lending rate to reach 4.6% by the end of 2024, suggesting three rate cuts remains the baseline.

PELLEY: This past December in your quarterly report, the Fed predicted rate cuts this year down to about 4.6%. Still likely?

POWELL: Those forecasts were made in December. And those are individual forecasts made by participants. It's not a committee plan. We don't update those at every meeting. We'll update them at the March meeting. I will say, though, nothing has happened in the meantime that would lead me to think that people would dramatically change their forecasts.

PELLEY: So something around a 4.6% interest rate is likely?

POWELL: I would say it this way. It's really going to depend on the data. The data will drive these decisions. And we can't do any better than to look at the data and ask ourselves, "How is this affecting the outlook and the balance of risks?" That's what we'll be doing. So, what we actually do will depend on how the economy evolves.

Curiously, while there was a Bloomberg headline that...

- CBS REPORTER SAYS POWELL SUGGESTED THE FIRST CUT AROUND MIDYEAR

The actual transcript did not show Powell commenting on a midyear cut.

- *CBS TRANSCRIPT DOESN’T SHOW POWELL COMMENT ON MIDYEAR CUT

While Powell is unlikely to confirm something he may have said in conversation off camera, the notion of delayed rate cuts certainly affirms the narrative after Friday's "very strong" (ridiculously so) US jobs report. Still, Powell again underlined the lack of unanimous consensus:

PELLEY: How would you characterize the consensus around this table for rate cuts? Is everyone onboard? Most people?

POWELL: Almost all. Almost all of the 19 participants who sit around this table believe that it will be appropriate in their most likely case for us to cut the federal funds rate this year. So, the consensus, though, the thing that really comes out in people's thinking as we discuss this around the table, is that what we actually do is really going to depend on the evolution of the economy. So, if the economy were to weaken, then we could reduce rates earlier and perhaps faster. If the economy were to prove -- if inflation were to prove more persistent, that could call for us to reduce rates later and perhaps slower. So, it really is going to be dependent on the incoming data as that affects the outlook.

The timing of this year’s policy pivot poses unique challenges for the Fed as rapid price increases have angered Americans, weighed on President Joe Biden’s approval ratings and thrust Powell and the Fed into election-year politics. Cutting rates this year will subject the Fed to Republican accusations that the central bank is trying give Democrats a boost by aiding the economy ahead of the election. And, sure enough, Democrats such as Senators Sherrod Brown and Elizabeth Warrren sent letters last week urging Powell to lower interest rates.

And former President Donald Trump told Fox Business Network on Friday that he wouldn’t reappoint Powell, even though he chose him to lead the central bank in 2017.

And so, touching on a topic we discussed extensively after the Fed's shocking dovish pivot in December, namely how much water the Fed is now carrying for the Biden admin, Powell naturally denied the Nov election had anything to do with the Fed's dramatic U-turn on rate cuts.

PELLEY: Your decisions inevitably are going to have a bearing on this year's election. And I wonder, to what degree does politics determine your timing?

POWELL: We do not consider politics in our decisions. We never do. And we never will. And I think the record -- fortunately, the historical record really backs that up. People have gone back and looked. This is my fourth presidential election in the Fed, and it just doesn't come into our thinking, and I'll tell you why.

Two reasons. One, we are a non-political organization that serves all Americans. It would be wrong for us to start taking politics into account. Secondly, though, it's not easy to get the economics of this right in the first place. These are complicated, you know, risk-balancing decisions. If we tried to incorporate a whole 'nother set of factors in politics into those decisions, it could only lead to worse economic outcomes. So, we simply don't do that, and we're not going to do it. We haven't done it in the past, and we're not going to do it now.

And then there was this epic lie:

PELLEY: There are people watching this interview who are skeptical about that.

POWELL: You know, I would just say this. Integrity is priceless. And at the end, that's all you have. And we in, we plan on keeping ours.

You know what else is priceless, Jerome? Former Fed President Bill Dudley writing an op-ed in August 2019 urging the Fed to crush the economy and destroy Trump's re-election chances. You'll never guess what happened to the economy just a few months later... But yeah, you go ahead and enjoy your "priceless integrity."

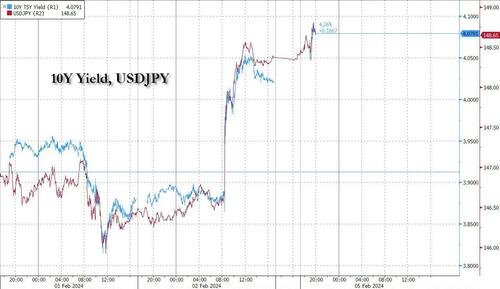

As for the market reaction, while Powell did not say anything he didn't already bring up in last week's FOMC meeting, the fact that the Fed chair pushed back on March sent Treasury futures lower as investors interpret the Fed chair's words as ruling out a Fed interest rate cut before June. And after jumping on Friday after the "blowout" jobs report, the USDJPY - which has been tied to the 10Y yield's hip - also pushed higher leading a broad dollar bid in early Asian trading Monday.

A tangent here, if you weren't worried about commercial real estate below, now is a good time to start because, according to Powell, CRE is contained:

PELLEY: The value of commercial office buildings all across the country is dropping as people work from home. Those buildings support the balance sheets of banks all across the country. What is the likelihood of another real estate-led banking crisis?

POWELL: I don't think that's likely. So, what's happening is, as you point out, we have work-from-home, and you have weakness in office real estate, and also retail, downtown retail. You have some of that. And there will be losses in that.

We looked at the larger banks' balance sheets, and it appears to be a manageable problem. There's some smaller and regional banks that have concentrated exposures in these areas that are challenged. And, you know, we're working with them. This is something we've been aware of for, you know, a long time, and we're working with them to make sure that they have the resources and a plan to work their way through the expected losses. There will be expected losses.

It feels like a problem we'll be working on for years. It's a sizable problem. I don't think -- it doesn't appear to have the makings of the kind of crisis things that we've seen sometimes in the past, for example, with the global financial crisis.

PELLEY: You believe it's a manageable problem?

POWELL: I think it appears to be

PELLEY: We're not gonna see bank failures across the country as we did in 2008?

POWELL: I don't think there's much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the -- particularly about the future. Things have surprised us a lot. But no, on this, on this, I do think it's a manageable problem. I think we're doing a lot to manage it.

There will be certainly -- there will be some banks that have to be closed or merged out of, out of existence because of this. That'll be smaller banks, I suspect, for the most part. You know, these are losses. It's a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable.

Powell may believe it will be a "manageable problem" but when pressed about last year's bank crisis, the Fed chief admitted the Fed got everything dead wrong (and even, so once again blamed X/twitter):

PELLEY: A follow-up, Mr. Chairman, to our banking line of question. You seem confident in the banks, and yet the Silicon Valley Bank, second largest failure in U.S. history. Did the Fed miss that?

POWELL: So, yes, we did. And I would say it this way. You know, that happened, and we forthrightly saw that we needed to do better. So, we've spent a lot of time working on ways to make supervision more effective and also to adapt regulation to a more, to a modern context in which a bank run can happen so much faster than it could have even 20 years ago. So, we have -- we accepted that right away. And, yes.

PELLEY: A bank run happening faster than it could have 20 years ago because of the communications that are available today?

POWELL: Yes.

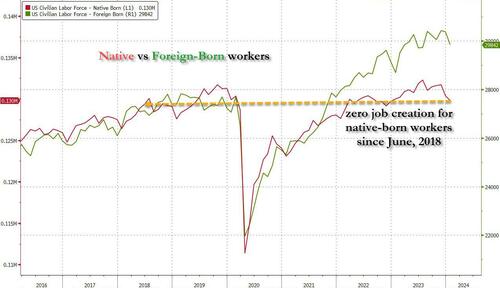

Finally, we pointed out on Friday that all the job gains since 2018 have gone to immigrants (non-native born workers)...

... and here is Powell defending them:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants (we hope he means legal immigrants here, not the flood of illegal immigrants) work hard, and Americans are lazy.

Here is the full transcript from Powell's 60 Minutes interview.

In his highly anticipated 60-Minutes interview, Jerome Powell did not deliver any new shocks, and unlike the Fed’s dovish December pivot, there were no major surprises: instead, the Fed Chair echoed what he said last week, predicting that the Fed policymakers will likely wait after March to cut interest rates as he sought to explain the central bank’s rationale for eventual reductions to a broad public audience (amid mounting pressure by Democrats to cut aggressively ahead of December even as the Biden Dept of Labor fabricated jobs data to make it seem like the US is enjoying a golden ago for workers).

In an interview conducted on Thursday with CBS’s 60 Minutes and airing Sunday evening, Powell reiterated that Fed officials want to see more economic data to assure that inflation is on a sustainable path to their 2% goal.

“The danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading,” Powell said in the interview adding that while “we don’t think that’s the case… the prudent thing to do is to, is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way.”

Powell then said it isn’t likely that the Fed “will reach that level of confidence” about inflation’s path by its March 19-20 gathering, echoing remarks he made at a press conference Wednesday, and certainly not after the latest laughably ridiculous and political manipulated jobs number. He clarified that while most FOMC members are now dovish and expect rate cuts, that’s certainly not the case for all, to wit: “all but a couple of our participants do believe it will be appropriate to, for us to begin to dial back the restrictive stance by cutting rates this year,” Powell said. “And so, it is certainly the base case that, that we will do that. We’re just trying to pick the right time, given the overall context.” Here is the full exchange:

PELLEY: The next meeting around this table that will decide the direction of interest rates is in this coming March. Knowing what you know now, is a rate cut more likely or less likely at that time?

POWELL: So, the broader situation is that the economy is strong, the labor market is strong, and inflation is coming down. And my colleagues and I are trying to pick the right point at which to begin to dial back our restrictive policy stance. That time is coming. We’ve said that we want to be more confident that inflation is moving down to 2%. And I would say, and I did say yesterday, that I think it’s not likely that this committee will reach that level of confidence in time for the March meeting, which is in seven weeks.

So, I would say that’s not the most likely or base case. However, all but a couple of our participants do believe it will be appropriate to, for us to begin to dial back the restrictive stance by cutting rates this year. And so, it is certainly the base case that, that we will do that. We’re just trying to pick the right time, given the overall context.

While inflation has subsided substantially in recent months, Powell has repeatedly emphasized the central bank’s need to see more data before lowering borrowing costs. He indicated last week a rate cut is unlikely in the first quarter.

The central banker also said he didn’t expect policymakers to “dramatically” change their forecasts for rates next year, which in December showed they expect their benchmark lending rate to reach 4.6% by the end of 2024, suggesting three rate cuts remains the baseline.

PELLEY: This past December in your quarterly report, the Fed predicted rate cuts this year down to about 4.6%. Still likely?

POWELL: Those forecasts were made in December. And those are individual forecasts made by participants. It’s not a committee plan. We don’t update those at every meeting. We’ll update them at the March meeting. I will say, though, nothing has happened in the meantime that would lead me to think that people would dramatically change their forecasts.

PELLEY: So something around a 4.6% interest rate is likely?

POWELL: I would say it this way. It’s really going to depend on the data. The data will drive these decisions. And we can’t do any better than to look at the data and ask ourselves, “How is this affecting the outlook and the balance of risks?” That’s what we’ll be doing. So, what we actually do will depend on how the economy evolves.

Curiously, while there was a Bloomberg headline that…

- CBS REPORTER SAYS POWELL SUGGESTED THE FIRST CUT AROUND MIDYEAR

The actual transcript did not show Powell commenting on a midyear cut.

- *CBS TRANSCRIPT DOESN’T SHOW POWELL COMMENT ON MIDYEAR CUT

While Powell is unlikely to confirm something he may have said in conversation off camera, the notion of delayed rate cuts certainly affirms the narrative after Friday’s “very strong” (ridiculously so) US jobs report. Still, Powell again underlined the lack of unanimous consensus:

PELLEY: How would you characterize the consensus around this table for rate cuts? Is everyone onboard? Most people?

POWELL: Almost all. Almost all of the 19 participants who sit around this table believe that it will be appropriate in their most likely case for us to cut the federal funds rate this year. So, the consensus, though, the thing that really comes out in people’s thinking as we discuss this around the table, is that what we actually do is really going to depend on the evolution of the economy. So, if the economy were to weaken, then we could reduce rates earlier and perhaps faster. If the economy were to prove — if inflation were to prove more persistent, that could call for us to reduce rates later and perhaps slower. So, it really is going to be dependent on the incoming data as that affects the outlook.

The timing of this year’s policy pivot poses unique challenges for the Fed as rapid price increases have angered Americans, weighed on President Joe Biden’s approval ratings and thrust Powell and the Fed into election-year politics. Cutting rates this year will subject the Fed to Republican accusations that the central bank is trying give Democrats a boost by aiding the economy ahead of the election. And, sure enough, Democrats such as Senators Sherrod Brown and Elizabeth Warrren sent letters last week urging Powell to lower interest rates.

And former President Donald Trump told Fox Business Network on Friday that he wouldn’t reappoint Powell, even though he chose him to lead the central bank in 2017.

And so, touching on a topic we discussed extensively after the Fed’s shocking dovish pivot in December, namely how much water the Fed is now carrying for the Biden admin, Powell naturally denied the Nov election had anything to do with the Fed’s dramatic U-turn on rate cuts.

PELLEY: Your decisions inevitably are going to have a bearing on this year’s election. And I wonder, to what degree does politics determine your timing?

POWELL: We do not consider politics in our decisions. We never do. And we never will. And I think the record — fortunately, the historical record really backs that up. People have gone back and looked. This is my fourth presidential election in the Fed, and it just doesn’t come into our thinking, and I’ll tell you why.

Two reasons. One, we are a non-political organization that serves all Americans. It would be wrong for us to start taking politics into account. Secondly, though, it’s not easy to get the economics of this right in the first place. These are complicated, you know, risk-balancing decisions. If we tried to incorporate a whole ‘nother set of factors in politics into those decisions, it could only lead to worse economic outcomes. So, we simply don’t do that, and we’re not going to do it. We haven’t done it in the past, and we’re not going to do it now.

And then there was this epic lie:

PELLEY: There are people watching this interview who are skeptical about that.

POWELL: You know, I would just say this. Integrity is priceless. And at the end, that’s all you have. And we in, we plan on keeping ours.

You know what else is priceless, Jerome? Former Fed President Bill Dudley writing an op-ed in August 2019 urging the Fed to crush the economy and destroy Trump’s re-election chances. You’ll never guess what happened to the economy just a few months later… But yeah, you go ahead and enjoy your “priceless integrity.”

As for the market reaction, while Powell did not say anything he didn’t already bring up in last week’s FOMC meeting, the fact that the Fed chair pushed back on March sent Treasury futures lower as investors interpret the Fed chair’s words as ruling out a Fed interest rate cut before June. And after jumping on Friday after the “blowout” jobs report, the USDJPY – which has been tied to the 10Y yield’s hip – also pushed higher leading a broad dollar bid in early Asian trading Monday.

A tangent here, if you weren’t worried about commercial real estate below, now is a good time to start because, according to Powell, CRE is contained:

PELLEY: The value of commercial office buildings all across the country is dropping as people work from home. Those buildings support the balance sheets of banks all across the country. What is the likelihood of another real estate-led banking crisis?

POWELL: I don’t think that’s likely. So, what’s happening is, as you point out, we have work-from-home, and you have weakness in office real estate, and also retail, downtown retail. You have some of that. And there will be losses in that.

We looked at the larger banks’ balance sheets, and it appears to be a manageable problem. There’s some smaller and regional banks that have concentrated exposures in these areas that are challenged. And, you know, we’re working with them. This is something we’ve been aware of for, you know, a long time, and we’re working with them to make sure that they have the resources and a plan to work their way through the expected losses. There will be expected losses.

It feels like a problem we’ll be working on for years. It’s a sizable problem. I don’t think — it doesn’t appear to have the makings of the kind of crisis things that we’ve seen sometimes in the past, for example, with the global financial crisis.

PELLEY: You believe it’s a manageable problem?

POWELL: I think it appears to be

PELLEY: We’re not gonna see bank failures across the country as we did in 2008?

POWELL: I don’t think there’s much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the — particularly about the future. Things have surprised us a lot. But no, on this, on this, I do think it’s a manageable problem. I think we’re doing a lot to manage it.

There will be certainly — there will be some banks that have to be closed or merged out of, out of existence because of this. That’ll be smaller banks, I suspect, for the most part. You know, these are losses. It’s a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable.

Powell may believe it will be a “manageable problem” but when pressed about last year’s bank crisis, the Fed chief admitted the Fed got everything dead wrong (and even, so once again blamed X/twitter):

PELLEY: A follow-up, Mr. Chairman, to our banking line of question. You seem confident in the banks, and yet the Silicon Valley Bank, second largest failure in U.S. history. Did the Fed miss that?

POWELL: So, yes, we did. And I would say it this way. You know, that happened, and we forthrightly saw that we needed to do better. So, we’ve spent a lot of time working on ways to make supervision more effective and also to adapt regulation to a more, to a modern context in which a bank run can happen so much faster than it could have even 20 years ago. So, we have — we accepted that right away. And, yes.

PELLEY: A bank run happening faster than it could have 20 years ago because of the communications that are available today?

POWELL: Yes.

Finally, we pointed out on Friday that all the job gains since 2018 have gone to immigrants (non-native born workers)…

… and here is Powell defending them:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that’s largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed’s job. The immigration policy of the United States is really important and really much under discussion right now, and that’s none of our business. We don’t set immigration policy. We don’t comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that’s what’s been happening.

Translation: Immigrants (we hope he means legal immigrants here, not the flood of illegal immigrants) work hard, and Americans are lazy.

Here is the full transcript from Powell’s 60 Minutes interview.

[embedded content]

Loading…