“We are expecting an upward trajectory in the US equity markets,” wrote Scott Bessent, a former Soros Fund Management investing chief as he bets on a "Trump rally".

“Barring Biden pulling ahead in substantial fashion, all pullbacks should be bought.”

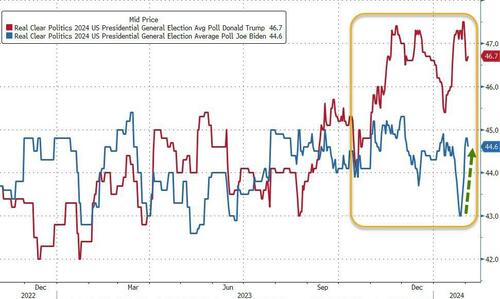

Bessent's bet appears well based as the polls (averaged by Real Clear Politics), Trump has a solid lead over Biden (although Biden - for some reason - saw a surge in the last few days?)...

Source: Bloomberg

“Markets are now anchoring on the potential market-friendly policies of a Trump victory on Nov. 5,” Bessent wrote Wednesday to investors in his Key Square Capital Management macro fund.

And he is right, as we detailed previously, 2024 Republican Policy Pair basket (full details here) has tracked Trump’s victory odds since late 2022... notably tracking very tightly with the recent surge in Trump's odds...

Source: Bloomberg

Investors anticipating a Trump victory also expect “an extended market-friendly economic, tax and regulatory environment,” Bessent wrote.

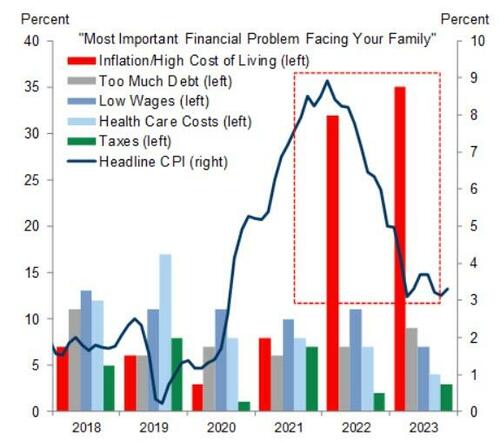

So far the so-called improvement in economic conditions has only had a limited impact on voter sentiment about the economy.

As Goldman shows in the chart below, voters still rated inflation as the most important financial problem for their family in 2023, despite its pace slowing...

Source: Goldman Sachs

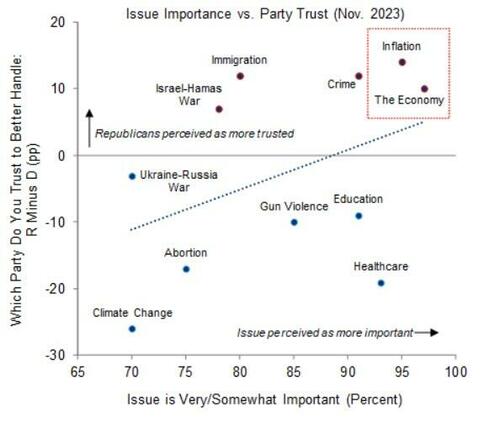

...and that is a positive for Trump as Goldman shows that Republicans score higher when voters are asked which party they trust more to handle inflation and the economy...

Source: Goldman Sachs

And, as Bessent wrote, don't expect a shift any time soon... “The Biden White House economic team has already thrown cold water on a renewal of most Trump-era tax cuts and called for higher taxes on corporates and upper-income Americans."

While the Biden White House keeps exclaiming that 'real incomes are rising... so STFU and say thank you America', the fact is that aggregate incomes have risen less than the cost of gasoline, food, and rent - so unless you're homeless and on full welfare,,, this explains the lack of 'belief' in Bidenomics...

Finally, Trump’s success in the polls is also influencing policymakers, according to Bessent. The Biden administration is inclined to “keep the economy buoyant, provide ample liquidity, contain interest rates” and avoid blowups such as the collapse of Silicon Valley Bank last year, he wrote.

Bessent also pointed to Fed Chair Jay Powell’s “dovish pivot” in December when he signaled rate cuts were ahead rather than more hikes.

“While we don’t think the Fed is an explicitly political institution, we think nearly all of Washington, DC is united in wanting to prevent the return of Donald Trump,” he wrote.

As Bloomberg reports, the hedge fund manager pushed back against the notion that another Trump administration would sow chaos, and that the former president would use his second term to seek revenge.

If re-elected, it’s likely that Trump “would seek rejuvenation/redemption,” Bessent wrote.

“We are expecting an upward trajectory in the US equity markets,”wrote Scott Bessent, a former Soros Fund Management investing chief as he bets on a “Trump rally”.

“Barring Biden pulling ahead in substantial fashion, all pullbacks should be bought.”

Bessent’s bet appears well based as the polls (averaged by Real Clear Politics), Trump has a solid lead over Biden (although Biden – for some reason – saw a surge in the last few days?)…

Source: Bloomberg

“Markets are now anchoring on the potential market-friendly policies of a Trump victory on Nov. 5,” Bessent wrote Wednesday to investors in his Key Square Capital Management macro fund.

And he is right, as we detailed previously, 2024 Republican Policy Pair basket (full details here) has tracked Trump’s victory odds since late 2022… notably tracking very tightly with the recent surge in Trump’s odds…

Source: Bloomberg

Investors anticipating a Trump victory also expect “an extended market-friendly economic, tax and regulatory environment,” Bessent wrote.

So far the so-called improvement in economic conditions has only had a limited impact on voter sentiment about the economy.

As Goldman shows in the chart below, voters still rated inflation as the most important financial problem for their family in 2023, despite its pace slowing…

Source: Goldman Sachs

…and that is a positive for Trump as Goldman shows that Republicans score higher when voters are asked which party they trust more to handle inflation and the economy…

Source: Goldman Sachs

And, as Bessent wrote, don’t expect a shift any time soon… “The Biden White House economic team has already thrown cold water on a renewal of most Trump-era tax cuts and called for higher taxes on corporates and upper-income Americans.”

While the Biden White House keeps exclaiming that ‘real incomes are rising… so STFU and say thank you America’, the fact is that aggregate incomes have risen less than the cost of gasoline, food, and rent – so unless you’re homeless and on full welfare,,, this explains the lack of ‘belief’ in Bidenomics…

Finally, Trump’s success in the polls is also influencing policymakers, according to Bessent. The Biden administration is inclined to “keep the economy buoyant, provide ample liquidity, contain interest rates” and avoid blowups such as the collapse of Silicon Valley Bank last year, he wrote.

Bessent also pointed to Fed Chair Jay Powell’s “dovish pivot” in December when he signaled rate cuts were ahead rather than more hikes.

“While we don’t think the Fed is an explicitly political institution, we think nearly all of Washington, DC is united in wanting to prevent the return of Donald Trump,” he wrote.

As Bloomberg reports, the hedge fund manager pushed back against the notion that another Trump administration would sow chaos, and that the former president would use his second term to seek revenge.

If re-elected, it’s likely that Trump “would seek rejuvenation/redemption,” Bessent wrote.

Loading…