Things are not great in Germany.

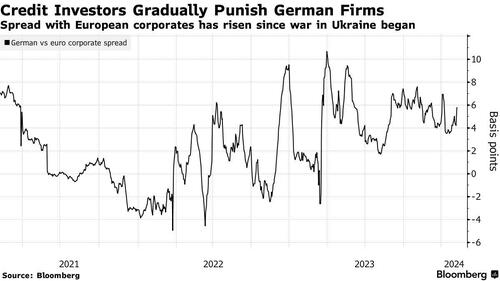

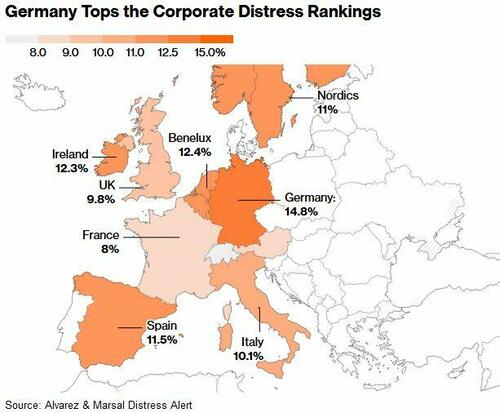

A confluence of economic stagnation, higher energy prices (due to anti-nuclear idiocy), and the highest corporate distress rates in Europe suggest Deutschland is in for a sharp contraction - a sentiment shared among fund managers, credit traders and crestfallen German executives moping around Davos last month, according to Bloomberg.

The bad news is continuing to pile up. After the economy shrank in the final quarter of last year, downbeat early surveys for 2024 signal there’s little respite ahead.

Demand from borrowers for investment in the likes of machinery, factories and technology has fallen, creating a risk that domestic growth is impeded in the longer term as companies focus on getting through the current struggle. And now there’s growing concern about some lenders’ exposure to the shaky US corporate real estate market. -Bloomberg

"Germany is really in trouble," according to Barings fund manager Brian Mangwiro. "All the big manufacturing economies are slowing but, in Germany, this is compounded by higher energy costs. There are also challenges in the auto sector with competition coming from China."

Meanwhile, German executives were decidedly in a bad mood at Davos last month - and were of the view that Europe's largest economy could no longer be counted on for steady growth - and instead faces a period of chaos amid competition in everything from machinery to automobiles.

"The country’s economic outlook remains bleak," reads the Weil European Distress Index, citing stagnant profitability on top of liquidity pressures.

Germany emerges as the most distressed market in Europe, influenced by several factors such as deteriorating investment metrics, liquidity pressures and stagnant profitability, which have persisted since the beginning of the year. The country’s economic outlook remains bleak, with both its government and the European Commission projecting a 0.4% contraction in its economy for 2024 due to high inflation, elevated energy prices and sluggish international trade. -European Distress Index

What's more, rising interest rates over the past two years have compounded problems - particularly in the property market. On Wednesday, Morgan Stanley analysts told clients to sell senior bonds linked to Deutsche Pfandbriefbank AG due to the lender's high exposure to the US Commercial Real-Estate market.

Shares of Pfandbriefbank have slid about 15% this month, while other German financial institutions have had significant declines in a Bloomberg index of euro-dominated bank bonds - including a €750 million AT1 by Landesbank Baden-Wuerttemberg and €300 million note by Aareal Bank AG on Tuesday.

According to Bloomberg, over $13.6 billion of loans and bonds issued by German companies were distressed last month - over 13x that of Italy.

"Distress is spreading to other sectors," beyond real estate, construction and retail - according to Christian Ebner, managing director of Alvarez & Marsal's financial restructuring advisory team. "Manufacturing is starting to be affected," he continued - adding that automotive "will continue to be a problem child."

Also a factor is Germany's changing politics - with Deutsche Bank AG Chief Executive Officer Christian Sewing recently expressing concern that the conservative AfD party is contributing to declining investments.

Finance Minister Christian Lindner wasted no opportunity to agree.

"The AfD is a location risk," he said Monday. "This is a party that’s calling into question the basic consensus of our country, namely European integration."

Opportunities abound?

While German executives fret, other Davos attendees smelled blood in the water - as whispers among bankers and advisers have revealed a significant uptick in interest from private equity firms and direct lenders, according to the report.

Leading the charge, according to insights from a Bloomberg Television interview, is Victor Kholsa, founder and chief investment officer at Strategic Value Partners. Kholsa wants to secure high-rate loans, and/or acquire significantly leveraged companies, by injecting much-needed equity.

According to Kholsa, there's an "opportunity to make those high rate loans or to buy companies that are pretty levered where you inject equity," adding "That opportunity set we can really see."

The trend is underscored by the arrival of heavy hitters like Ares Management Corp. and Blackstone Inc., which have set up shop in Frankfurt with the aim of lending to German businesses or financing private equity buyouts. This influx of foreign capital seeking to capitalize on domestic distress signals a troubling dynamic, as entities such as Techem GmbH become transaction targets amidst a backdrop of quality concerns and lender takeovers due to breached loan agreements.

The scenario unfolding is not just limited to equity and debt markets. Short sellers are also in play, with a staggering €5.7 billion wager placed against German companies. Groups such as Qube Research & Technologies Ltd. are betting against national stalwarts including Deutsche Bank AG, Volkswagen AG, and Vonovia AG, pointing to a broader skepticism about the resilience of Germany's corporate sector amidst economic turbulence.

Real Estate is screwed...

Reeling under the weight of declining residential prices and the specter of significant value declines for office spaces, the real estate sector's woes have only been exacerbated by rising interest rates - with fallout that could precipitate severe writedowns for both borrowers and lenders. Entities like the Adler Group SA and Rene Benko’s Signa in particular are teetering on the edge of financial abysses - a precarious situation compounded by a banking sector that, despite past resilience, faces looming concerns over commercial real estate exposures and economic stagnation.

The Bundesbank warned in November that at the start of 2023, the “present value of the banking book” was negative for 15 savings banks and 37 credit cooperatives,” adding they seem particularly vulnerable to an increase in interest rates. Since then, ECB rates have risen by 2 percentage points.

One-third of commercial real estate loans in Germany face higher borrowing costs over three years, which could cause credit defaults and impairments to rise more sharply, the watchdog said.

Fixed-income investors have become more reluctant to add exposure to lenders exposed to CRE, as seen in the issuance of covered bonds, the safest type of debt that banks can sell. Aareal Bank AG had to lean on its lead managers, who put €125 million in the order book, to get a €500m four-year offering over the line in January. Aareal declined to comment. -Bloomberg

The Bundesbank's warnings about the vulnerabilities of savings banks and credit cooperatives to interest rate hikes underscore the fragility of the financial ecosystem. The potential for credit defaults and impairments looms large, with a significant portion of commercial real estate loans at risk. The reluctance of fixed-income investors to engage with lenders exposed to these risks highlights a growing crisis of confidence, even as companies and landlords cling to the hope of a rate reprieve under the mantra "Survive 'Til 2025."

Things are not great in Germany.

A confluence of economic stagnation, higher energy prices (due to anti-nuclear idiocy), and the highest corporate distress rates in Europe suggest Deutschland is in for a sharp contraction – a sentiment shared among fund managers, credit traders and crestfallen German executives moping around Davos last month, according to Bloomberg.

The bad news is continuing to pile up. After the economy shrank in the final quarter of last year, downbeat early surveys for 2024 signal there’s little respite ahead.

Demand from borrowers for investment in the likes of machinery, factories and technology has fallen, creating a risk that domestic growth is impeded in the longer term as companies focus on getting through the current struggle. And now there’s growing concern about some lenders’ exposure to the shaky US corporate real estate market. -Bloomberg

“Germany is really in trouble,” according to Barings fund manager Brian Mangwiro. “All the big manufacturing economies are slowing but, in Germany, this is compounded by higher energy costs. There are also challenges in the auto sector with competition coming from China.”

Meanwhile, German executives were decidedly in a bad mood at Davos last month – and were of the view that Europe’s largest economy could no longer be counted on for steady growth – and instead faces a period of chaos amid competition in everything from machinery to automobiles.

“The country’s economic outlook remains bleak,” reads the Weil European Distress Index, citing stagnant profitability on top of liquidity pressures.

Germany emerges as the most distressed market in Europe, influenced by several factors such as deteriorating investment metrics, liquidity pressures and stagnant profitability, which have persisted since the beginning of the year. The country’s economic outlook remains bleak, with both its government and the European Commission projecting a 0.4% contraction in its economy for 2024 due to high inflation, elevated energy prices and sluggish international trade. –European Distress Index

What’s more, rising interest rates over the past two years have compounded problems – particularly in the property market. On Wednesday, Morgan Stanley analysts told clients to sell senior bonds linked to Deutsche Pfandbriefbank AG due to the lender’s high exposure to the US Commercial Real-Estate market.

Shares of Pfandbriefbank have slid about 15% this month, while other German financial institutions have had significant declines in a Bloomberg index of euro-dominated bank bonds – including a €750 million AT1 by Landesbank Baden-Wuerttemberg and €300 million note by Aareal Bank AG on Tuesday.

According to Bloomberg, over $13.6 billion of loans and bonds issued by German companies were distressed last month – over 13x that of Italy.

“Distress is spreading to other sectors,” beyond real estate, construction and retail – according to Christian Ebner, managing director of Alvarez & Marsal’s financial restructuring advisory team. “Manufacturing is starting to be affected,” he continued – adding that automotive “will continue to be a problem child.”

Also a factor is Germany’s changing politics – with Deutsche Bank AG Chief Executive Officer Christian Sewing recently expressing concern that the conservative AfD party is contributing to declining investments.

Finance Minister Christian Lindner wasted no opportunity to agree.

“The AfD is a location risk,” he said Monday. “This is a party that’s calling into question the basic consensus of our country, namely European integration.”

Opportunities abound?

While German executives fret, other Davos attendees smelled blood in the water – as whispers among bankers and advisers have revealed a significant uptick in interest from private equity firms and direct lenders, according to the report.

Leading the charge, according to insights from a Bloomberg Television interview, is Victor Kholsa, founder and chief investment officer at Strategic Value Partners. Kholsa wants to secure high-rate loans, and/or acquire significantly leveraged companies, by injecting much-needed equity.

According to Kholsa, there’s an “opportunity to make those high rate loans or to buy companies that are pretty levered where you inject equity,” adding “That opportunity set we can really see.”

The trend is underscored by the arrival of heavy hitters like Ares Management Corp. and Blackstone Inc., which have set up shop in Frankfurt with the aim of lending to German businesses or financing private equity buyouts. This influx of foreign capital seeking to capitalize on domestic distress signals a troubling dynamic, as entities such as Techem GmbH become transaction targets amidst a backdrop of quality concerns and lender takeovers due to breached loan agreements.

The scenario unfolding is not just limited to equity and debt markets. Short sellers are also in play, with a staggering €5.7 billion wager placed against German companies. Groups such as Qube Research & Technologies Ltd. are betting against national stalwarts including Deutsche Bank AG, Volkswagen AG, and Vonovia AG, pointing to a broader skepticism about the resilience of Germany’s corporate sector amidst economic turbulence.

Real Estate is screwed…

Reeling under the weight of declining residential prices and the specter of significant value declines for office spaces, the real estate sector’s woes have only been exacerbated by rising interest rates – with fallout that could precipitate severe writedowns for both borrowers and lenders. Entities like the Adler Group SA and Rene Benko’s Signa in particular are teetering on the edge of financial abysses – a precarious situation compounded by a banking sector that, despite past resilience, faces looming concerns over commercial real estate exposures and economic stagnation.

The Bundesbank warned in November that at the start of 2023, the “present value of the banking book” was negative for 15 savings banks and 37 credit cooperatives,” adding they seem particularly vulnerable to an increase in interest rates. Since then, ECB rates have risen by 2 percentage points.

One-third of commercial real estate loans in Germany face higher borrowing costs over three years, which could cause credit defaults and impairments to rise more sharply, the watchdog said.

Fixed-income investors have become more reluctant to add exposure to lenders exposed to CRE, as seen in the issuance of covered bonds, the safest type of debt that banks can sell. Aareal Bank AG had to lean on its lead managers, who put €125 million in the order book, to get a €500m four-year offering over the line in January. Aareal declined to comment. -Bloomberg

The Bundesbank’s warnings about the vulnerabilities of savings banks and credit cooperatives to interest rate hikes underscore the fragility of the financial ecosystem. The potential for credit defaults and impairments looms large, with a significant portion of commercial real estate loans at risk. The reluctance of fixed-income investors to engage with lenders exposed to these risks highlights a growing crisis of confidence, even as companies and landlords cling to the hope of a rate reprieve under the mantra “Survive ‘Til 2025.”

Loading…