Boeing's plane deliveries tumbled 29% in January - compared to the previous month, driven primarily by seasonal trends and fallout from a near-mid-air disaster of a fuselage panel that ripped off one of its 737 Max 9s.

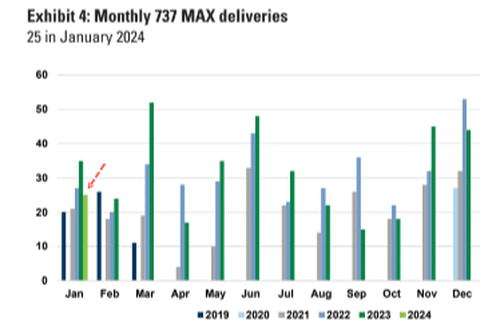

Last month, the company handed over 27 aircraft, marking its lowest delivery count since September, in contrast to 67 deliveries in December. As for Max jets, it delivered 25 aircraft, down from 44 in December.

"New aircraft orders are light in the month, but are typically seasonally light early in any year, while new aircraft order backlog remains very large compared to supply," Goldman analysts wrote in a note.

The analysts, led by Noah Poponak and Anthony Valentini, continued: "Deliveries slowed in January, in part due to seasonality and in part from Boeing slowing down the system to renew the focus on product quality."

They expect the slowdown in January to be temporary as an "acceleration in output" will occur "in the near-term and through the rest of 2024."

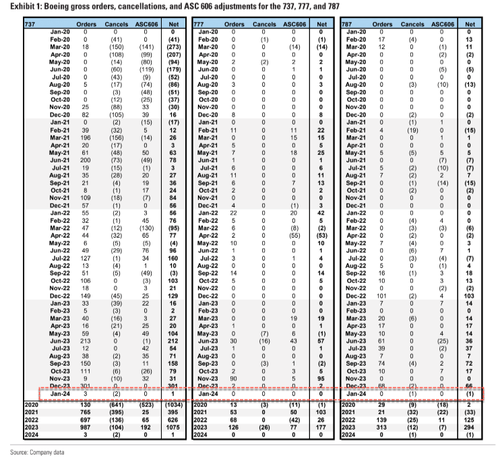

Here are Boeing's gross orders, cancellations, and ASC 606 adjustments for the 737, 777, and 787 planes.

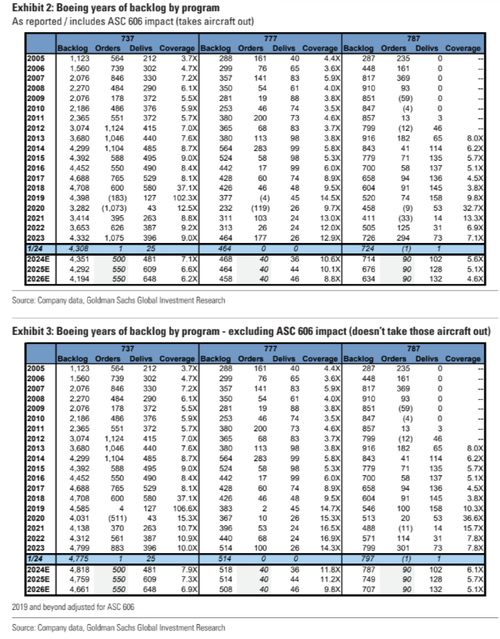

As of Jan. 31, Boeing's backlog decreased from 5,626 to 5,599 aircraft. It has 6,189 unfilled orders when accounting for adjustments.

"Boeing would have adequate backlog coverage to support production rate plans over the near-to-medium term, with ~6X years of 737 backlog coverage even if the ASC 606 movements are not recognized in the backlog by 2026, and ~5X/9X years for the 787 and 777, respectively," the analysts said.

Since the Jan. 5 incident involving a door plug on a brand new Alaska Airlines Max 9 jet, Boeing executives have been scrambling to ensure safety in its manufacturing supply chain. The US Federal Aviation Administration briefly grounded the Max 9 jets for inspections and has since capped Boeing's production of the planes while an audit of the manufacturing process is ongoing.

Meanwhile, Boeing CEO Dave Calhoun has promised to carefully review manufacturing processes at the company's factory. The FAA won't lift the production cap on Max jets until the agency is "satisfied that the quality control issues uncovered during this process are resolved."

Despite the mounting risks for Boeing, the analysts continued with a buy rating on Boeing, with a 12-month price target of $268.

They also outlined three key risks for Boeing shares:

- the pace of air traffic growth,

- supply chain recovery timing, and

- defense program margins in the medium-term

Given Goldman's price target, shares are at a deep discount, trading around $204 as of Wednesday morning.

Boeing’s plane deliveries tumbled 29% in January – compared to the previous month, driven primarily by seasonal trends and fallout from a near-mid-air disaster of a fuselage panel that ripped off one of its 737 Max 9s.

Last month, the company handed over 27 aircraft, marking its lowest delivery count since September, in contrast to 67 deliveries in December. As for Max jets, it delivered 25 aircraft, down from 44 in December.

“New aircraft orders are light in the month, but are typically seasonally light early in any year, while new aircraft order backlog remains very large compared to supply,” Goldman analysts wrote in a note.

The analysts, led by Noah Poponak and Anthony Valentini, continued: “Deliveries slowed in January, in part due to seasonality and in part from Boeing slowing down the system to renew the focus on product quality.”

They expect the slowdown in January to be temporary as an “acceleration in output” will occur “in the near-term and through the rest of 2024.”

Here are Boeing’s gross orders, cancellations, and ASC 606 adjustments for the 737, 777, and 787 planes.

As of Jan. 31, Boeing’s backlog decreased from 5,626 to 5,599 aircraft. It has 6,189 unfilled orders when accounting for adjustments.

“Boeing would have adequate backlog coverage to support production rate plans over the near-to-medium term, with ~6X years of 737 backlog coverage even if the ASC 606 movements are not recognized in the backlog by 2026, and ~5X/9X years for the 787 and 777, respectively,” the analysts said.

Since the Jan. 5 incident involving a door plug on a brand new Alaska Airlines Max 9 jet, Boeing executives have been scrambling to ensure safety in its manufacturing supply chain. The US Federal Aviation Administration briefly grounded the Max 9 jets for inspections and has since capped Boeing’s production of the planes while an audit of the manufacturing process is ongoing.

Meanwhile, Boeing CEO Dave Calhoun has promised to carefully review manufacturing processes at the company’s factory. The FAA won’t lift the production cap on Max jets until the agency is “satisfied that the quality control issues uncovered during this process are resolved.”

Despite the mounting risks for Boeing, the analysts continued with a buy rating on Boeing, with a 12-month price target of $268.

They also outlined three key risks for Boeing shares:

- the pace of air traffic growth,

- supply chain recovery timing, and

- defense program margins in the medium-term

Given Goldman’s price target, shares are at a deep discount, trading around $204 as of Wednesday morning.

Loading…