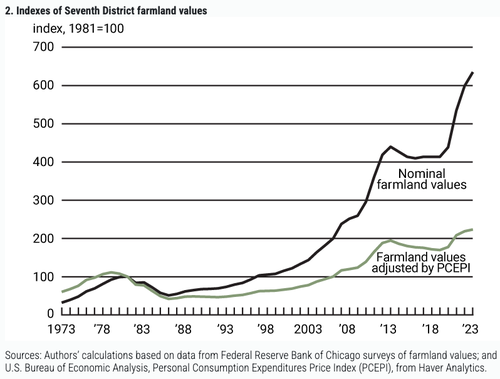

According to a new report from the Federal Reserve Bank of Chicago, farmland values across the Midwest crop belt hit a record high in the fourth quarter despite elevated interest rates.

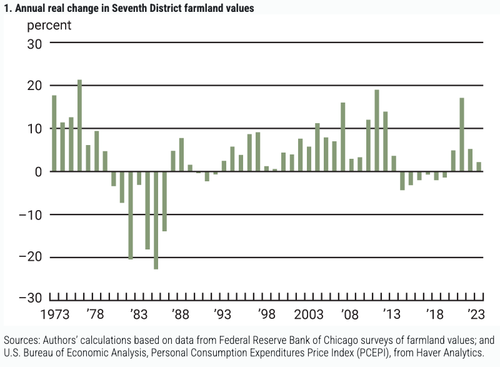

Farmland values in the region encompassing all of Iowa and most of Illinois, Indiana, Michigan, and Wisconsin increased by 6% compared to the previous year. Although this represents an increase from a 5% rise in the third quarter, the growth rate is notably slower than the 12% and 22% gains seen in the fourth quarters of 2022 and 2021, respectively.

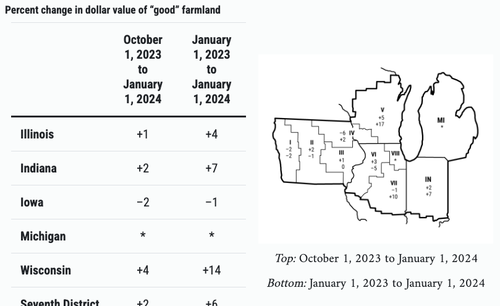

An annual increase of 6 percent in the Seventh Federal Reserve District's agricultural land values in 2023 helped them reach a new peak, though the yearly gain shrank to a single digit. Values for "good" farmland in the District moved up 2 percent in the fourth quarter of 2023 from the third quarter, according to 129 agricultural bankers who responded to the January survey.

Only 6 percent of the survey respondents expected farmland values to rise during the January through March period of 2024, with 17 percent expecting them to fall and 77 percent expecting them to be stable

Farmland values

Annual real change in Seventh District farmland values

Record high farmland values

"For the third time in a row, there were fewer funds available for lending than in the same quarter of the prior year at survey respondents' banks in the final quarter of 2023," Fed economists David Oppedahl and Elizabeth Kepner wrote in the report.

The economists cited an Iowa banker who warned of "tough times ahead" for farmers.

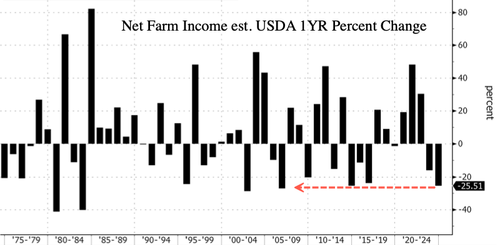

A recent US Department of Agriculture forecast showed farmers are poised for another year of financial misery, facing the most significant decline in incomes in almost two decades as crop prices slide and US dominance in ag exports wanes.

A number of billionaires have been buying hard assets like farmland over the years (read: here & here & here & here).

According to a new report from the Federal Reserve Bank of Chicago, farmland values across the Midwest crop belt hit a record high in the fourth quarter despite elevated interest rates.

Farmland values in the region encompassing all of Iowa and most of Illinois, Indiana, Michigan, and Wisconsin increased by 6% compared to the previous year. Although this represents an increase from a 5% rise in the third quarter, the growth rate is notably slower than the 12% and 22% gains seen in the fourth quarters of 2022 and 2021, respectively.

An annual increase of 6 percent in the Seventh Federal Reserve District’s agricultural land values in 2023 helped them reach a new peak, though the yearly gain shrank to a single digit. Values for “good” farmland in the District moved up 2 percent in the fourth quarter of 2023 from the third quarter, according to 129 agricultural bankers who responded to the January survey.

Only 6 percent of the survey respondents expected farmland values to rise during the January through March period of 2024, with 17 percent expecting them to fall and 77 percent expecting them to be stable

Farmland values

Annual real change in Seventh District farmland values

Record high farmland values

“For the third time in a row, there were fewer funds available for lending than in the same quarter of the prior year at survey respondents’ banks in the final quarter of 2023,” Fed economists David Oppedahl and Elizabeth Kepner wrote in the report.

The economists cited an Iowa banker who warned of “tough times ahead” for farmers.

A recent US Department of Agriculture forecast showed farmers are poised for another year of financial misery, facing the most significant decline in incomes in almost two decades as crop prices slide and US dominance in ag exports wanes.

A number of billionaires have been buying hard assets like farmland over the years (read: here & here & here & here).

Loading…