Authored by Simon White, Bloomberg macro strategist,

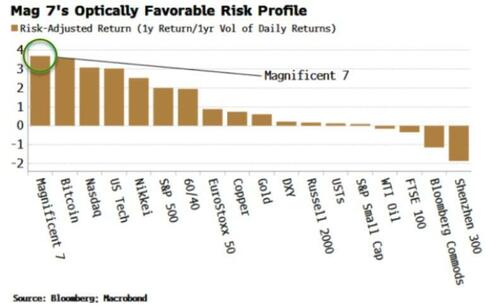

The fabled Magnificent 7’s return adjusted for volatility is higher than other main assets, and is closing in on levels that have previously been associated with pullbacks.

The combination of high returns and low volatility is catnip for investors.

Making money is good, but if you can do so in a monotonically increasing way, then even better.

The Magnificent 7 today is blowing the competition out of the water not just in straight returns, but in risk-adjusted terms too.

Its vol-adjusted return is higher than the Nasdaq, the S&P, the Nikkei, US 60/40 and Bitcoin (whose adjusted return is so high not so much due to low volatility, but due to a stratospheric 130% return over the last year).

High risk-adjusted returns can be self-fulfilling for a time. Attractive metrics pull more money in, boosting returns, and doing so in a steady way, juicing the adjusted return further.

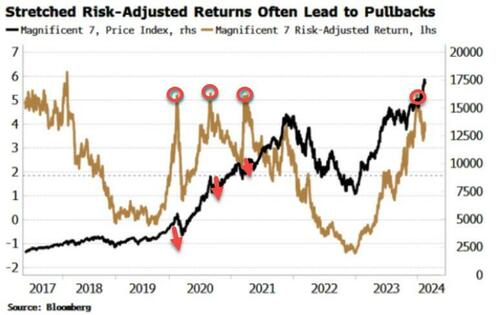

But when returns become stretched, they are typically associated with pullbacks.

Previous extreme risk-adjusted returns for the Magnificent 7 have occurred at price reversals.

Interestingly, today the risk-adjusted return is high, but not at historical extremes.

This suggests that, from this perspective, a notable pullback might not be imminent, yet one could be in the offing if the adjusted return keeps rising.

Risk-adjusted returns are often nothing more than a deep tide concealing the dignity of swimmers who have been remiss in donning their trunks.

They are boosted by falling volatility, but repressed vol typically explodes higher at some point. High risk-adjusted returns thus suddenly become very low ones.

They are thus a warning sign rather than a green light.

Authored by Simon White, Bloomberg macro strategist,

The fabled Magnificent 7’s return adjusted for volatility is higher than other main assets, and is closing in on levels that have previously been associated with pullbacks.

The combination of high returns and low volatility is catnip for investors.

Making money is good, but if you can do so in a monotonically increasing way, then even better.

The Magnificent 7 today is blowing the competition out of the water not just in straight returns, but in risk-adjusted terms too.

Its vol-adjusted return is higher than the Nasdaq, the S&P, the Nikkei, US 60/40 and Bitcoin (whose adjusted return is so high not so much due to low volatility, but due to a stratospheric 130% return over the last year).

High risk-adjusted returns can be self-fulfilling for a time. Attractive metrics pull more money in, boosting returns, and doing so in a steady way, juicing the adjusted return further.

But when returns become stretched, they are typically associated with pullbacks.

Previous extreme risk-adjusted returns for the Magnificent 7 have occurred at price reversals.

Interestingly, today the risk-adjusted return is high, but not at historical extremes.

This suggests that, from this perspective, a notable pullback might not be imminent, yet one could be in the offing if the adjusted return keeps rising.

Risk-adjusted returns are often nothing more than a deep tide concealing the dignity of swimmers who have been remiss in donning their trunks.

They are boosted by falling volatility, but repressed vol typically explodes higher at some point. High risk-adjusted returns thus suddenly become very low ones.

They are thus a warning sign rather than a green light.

Loading…