Authored by Simon White, Bloomberg macro strategist,

The rise in valuations driving the stock rally points to further narrowing in investment-grade credit spreads.

Credit looked markedly worse in 2023, with a downturn this year looking like a sure-fire bet. But conditions in credit markets appear to be improving. There are several reasons why, with one of the most important and under-appreciated being equity valuations.

Revenues’ influence on the S&P’s returns has been waning, while margins have been a drag. But multiples – mainly in the tech sector – have been powering the index to new highs.

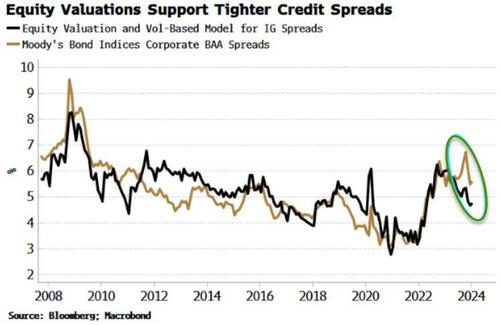

It’s intuitive that better valuations of a firm should improve its credit. But I had never tried to explicitly model it. It turns out we can derive a very good coincident indicator for IG credit spreads using only measures of equity valuation and implied volatility.

The chart above shows the indicator tracks IG spreads well. It also shows that valuations justify a continued tightening in them. Of course, if it turns out valuations are overcooked and the AI revolution will be another victim of the Amara effect, then spreads will widen. But the model is only saying further tightening is consistent with current valuations, whether they’re fundamentally justified or not.

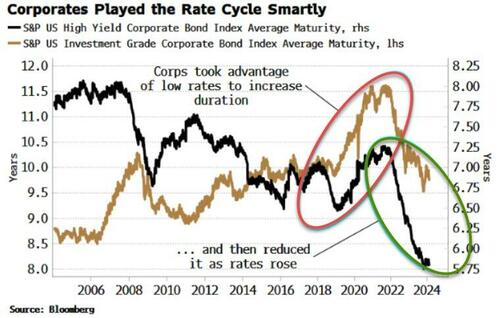

The credit cycle has benefited from corporates playing the rate cycle deftly. Firms took advantage of rock-bottom rates at the start of the pandemic to extend the average duration of their debt. They have since been reducing average duration as rates have risen (either volitionally or out of necessity).

Firms in the aggregate have also structured their assets and liabilities so that they have been net interest receivers. That will slowly change as higher rates continue to bite, but for now corporate cash flows are unexpectedly healthy given the backdrop of the fastest rate-hiking cycle for decades.

There are risks: repressed volatility in equity markets may explode higher, and private credit markets could be concealing some very poor-quality loans. But for now, the credit cycle is in the midst of an upturn, with stock-market valuations a potent tailwind.

Authored by Simon White, Bloomberg macro strategist,

The rise in valuations driving the stock rally points to further narrowing in investment-grade credit spreads.

Credit looked markedly worse in 2023, with a downturn this year looking like a sure-fire bet. But conditions in credit markets appear to be improving. There are several reasons why, with one of the most important and under-appreciated being equity valuations.

Revenues’ influence on the S&P’s returns has been waning, while margins have been a drag. But multiples – mainly in the tech sector – have been powering the index to new highs.

It’s intuitive that better valuations of a firm should improve its credit. But I had never tried to explicitly model it. It turns out we can derive a very good coincident indicator for IG credit spreads using only measures of equity valuation and implied volatility.

The chart above shows the indicator tracks IG spreads well. It also shows that valuations justify a continued tightening in them. Of course, if it turns out valuations are overcooked and the AI revolution will be another victim of the Amara effect, then spreads will widen. But the model is only saying further tightening is consistent with current valuations, whether they’re fundamentally justified or not.

The credit cycle has benefited from corporates playing the rate cycle deftly. Firms took advantage of rock-bottom rates at the start of the pandemic to extend the average duration of their debt. They have since been reducing average duration as rates have risen (either volitionally or out of necessity).

Firms in the aggregate have also structured their assets and liabilities so that they have been net interest receivers. That will slowly change as higher rates continue to bite, but for now corporate cash flows are unexpectedly healthy given the backdrop of the fastest rate-hiking cycle for decades.

There are risks: repressed volatility in equity markets may explode higher, and private credit markets could be concealing some very poor-quality loans. But for now, the credit cycle is in the midst of an upturn, with stock-market valuations a potent tailwind.

Loading…