By John Liu and Zheng Wu, Bloomberg Markets Live reporters and analysts

Three things we learned last week:

1. China stocks continued to rally as Beijing escalated its efforts to stabilize the market, starting just before the Lunar New Year. The benchmark CSI 300 index has climbed for nine straight days in the longest run of gains since 2018, taking its advance from a February low to about 10%.

The sudden replacement of the nation’s chief securities regulator underscored the leadership’s determination to stem a rout that has erased some $4 trillion from the market value of equities and undermined confidence in the economy.

Wu Qing, the new chairman of the China Securities Regulatory Commission, got down to work right away by cracking down on short sellers, and even froze the accounts of a major quantitative hedge fund after it dumped $360 million of shares within a minute. Wu also sat down with retail and institutional investors to gather their opinions.

But, there is no room for complacency despite Wu’s initial success. His predecessor Yi Huiman had tried repeatedly to end China’s stock meltdown since last summer but failed to deliver a sustained recovery. History suggests that the selloff will resume if investors find that policy support is underwhelming.

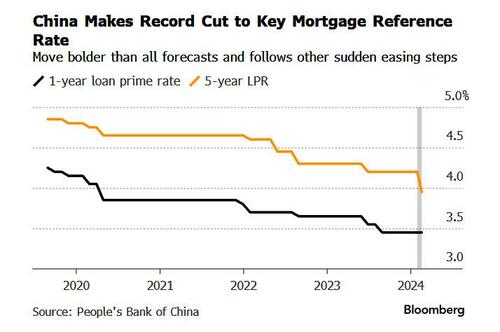

2. Chinese lenders announced a larger-than-expected quarter point reduction in the five-year loan prime rate. The move was clearly aimed at supporting the housing market as the bulk of the nation’s $5.3 trillion outstanding mortgage loans use the rate as a pricing benchmark. New funding support was also made available for property projects placed on the authorities’ “white list.” To be clear, some traders thought the People’s Bank of China could have done more earlier. Authorities held the key one-year policy rate at 2.5% this month even as the 10-year government bond yield dropped to a two-decade low and consumer-price deflation persisted.

The PBOC may have been mindful of the yuan’s weakness and the squeeze on banks’ margins when it decided not to ease more aggressively. Given the competing factors at play, the central bank was probably looking to deploy the most effective stimulus without abandoning its restrained approach to supporting growth. The overall picture remains subdued. China’s home prices declined again in January, and car sales probably dropped 15.7% in February. Banks’ margins narrowed to a record low last quarter. All this shows that while the stock market has staged a strong rebound, it will take much more to revive the economy.

3. HSBC took a $3 billion impairment charge on its holding in a Chinese bank. The lender’s Hong Kong-listed stock underperformed the Hang Seng Index last week even after CEO Noel Quinn described the charge as “a technical accounting issue.” The financial impact should be limited to HSBC although the case served as a reminder of the potential pitfalls of having an exposure to Chinese assets. But as Bloomberg Intelligence noted, the impairment reflected China’s deteriorating economic outlook and shouldn’t have come as a surprise.

By John Liu and Zheng Wu, Bloomberg Markets Live reporters and analysts

Three things we learned last week:

1. China stocks continued to rally as Beijing escalated its efforts to stabilize the market, starting just before the Lunar New Year. The benchmark CSI 300 index has climbed for nine straight days in the longest run of gains since 2018, taking its advance from a February low to about 10%.

The sudden replacement of the nation’s chief securities regulator underscored the leadership’s determination to stem a rout that has erased some $4 trillion from the market value of equities and undermined confidence in the economy.

Wu Qing, the new chairman of the China Securities Regulatory Commission, got down to work right away by cracking down on short sellers, and even froze the accounts of a major quantitative hedge fund after it dumped $360 million of shares within a minute. Wu also sat down with retail and institutional investors to gather their opinions.

But, there is no room for complacency despite Wu’s initial success. His predecessor Yi Huiman had tried repeatedly to end China’s stock meltdown since last summer but failed to deliver a sustained recovery. History suggests that the selloff will resume if investors find that policy support is underwhelming.

2. Chinese lenders announced a larger-than-expected quarter point reduction in the five-year loan prime rate. The move was clearly aimed at supporting the housing market as the bulk of the nation’s $5.3 trillion outstanding mortgage loans use the rate as a pricing benchmark. New funding support was also made available for property projects placed on the authorities’ “white list.” To be clear, some traders thought the People’s Bank of China could have done more earlier. Authorities held the key one-year policy rate at 2.5% this month even as the 10-year government bond yield dropped to a two-decade low and consumer-price deflation persisted.

The PBOC may have been mindful of the yuan’s weakness and the squeeze on banks’ margins when it decided not to ease more aggressively. Given the competing factors at play, the central bank was probably looking to deploy the most effective stimulus without abandoning its restrained approach to supporting growth. The overall picture remains subdued. China’s home prices declined again in January, and car sales probably dropped 15.7% in February. Banks’ margins narrowed to a record low last quarter. All this shows that while the stock market has staged a strong rebound, it will take much more to revive the economy.

3. HSBC took a $3 billion impairment charge on its holding in a Chinese bank. The lender’s Hong Kong-listed stock underperformed the Hang Seng Index last week even after CEO Noel Quinn described the charge as “a technical accounting issue.” The financial impact should be limited to HSBC although the case served as a reminder of the potential pitfalls of having an exposure to Chinese assets. But as Bloomberg Intelligence noted, the impairment reflected China’s deteriorating economic outlook and shouldn’t have come as a surprise.

Loading…