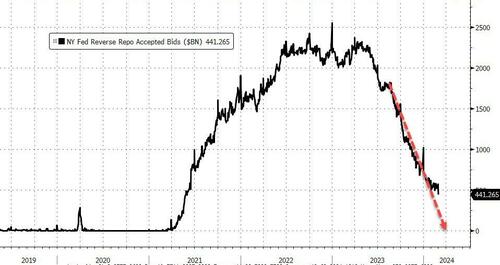

With the imminent expiration of The Fed's bank bailout facility (reminder they were 12-month collateralized term loans), and with The Fed's reverse repo facility see a massive $128BN in liquidity sucked out of it in the last two days, this week's excitement over at NYCB again is sure to have seen some depositors question their decisions (but we won't know about that for a couple of weeks as The Fed needs time to 'manage' the data).

RRP's collision with the x-axis is right on schedule...

Source: Bloomberg

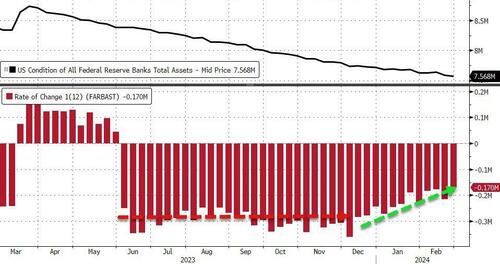

And while The Fed's balance sheet continues to contract, we do note that the pace of contraction has slowed significantly this year...

Source: Bloomberg

And at the same time, inflows to money-market funds continued to take total assets to fresh record highs...

Source: Bloomberg

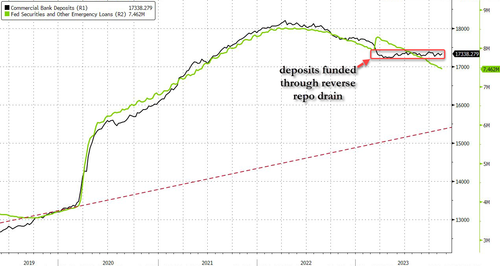

...as banks saw deposits decline $48BN (SA) last week ($86BN in the last 3 weeks)...

Source: Bloomberg

On a non-seasonally-adjusted basis, total deposits fell $74BN in the week ending 2/21 (down $206BN in 2024)...

Source: Bloomberg

And, excluding foreign banks, domestic deposits dropped $46BN SA (Large Banks -$36BN, Small Banks -$10BN), and tumbled $69BN NSA (Large Banks -$62BN, Small Banks -$7BN)

Source: Bloomberg

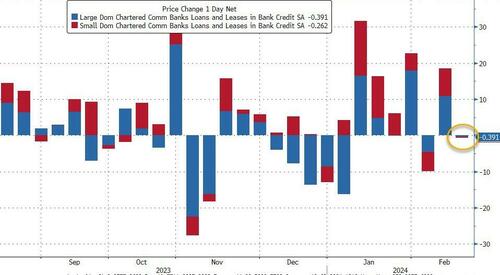

On the other side of the ledger, there basically no activity at all in loans from small or large banks. Quite an odd print...

Source: Bloomberg

US equity market cap remains dramatically decoupled from bank reserves at The Fed. The last time it was this decoupled didn't end well...

Source: Bloomberg

And finally, as if you needed a reminder after this week's NYCB debacle - despite the rebound off the lows again this week in regional bank shares, which must mean everything is awesome, right? - the regional bank crisis is still very much alive as evidenced by the red line below (without The Fed's imminently expiring BTFP facility)...

Source: Bloomberg

...what else are big banks (green line) going to do with all that cash burning a hole in their pockets (although we do note a big cash drop at large banks - which includes NYCB, but this was the week before).

As one veteran Fed watcher remarked "this is such a clusterfuck... deposits should be $500BN lower"

Source: Bloomberg

The bottom line is - this looks a lot like a 'Small Bank' crisis. The last time this happened, the crisis sparked a sudden $300BN 'run' in small bank deposits (this time it's bigger!).

Is The Fed 'hoping' for a controlled bank-run this time - so as many small bank deposits are drained voluntarily, before they are drained all at once in a panic (and the Reverse Repo facility is empty, unable to provide any cushion)?

With the imminent expiration of The Fed’s bank bailout facility (reminder they were 12-month collateralized term loans), and with The Fed’s reverse repo facility see a massive $128BN in liquidity sucked out of it in the last two days, this week’s excitement over at NYCB again is sure to have seen some depositors question their decisions (but we won’t know about that for a couple of weeks as The Fed needs time to ‘manage’ the data).

RRP’s collision with the x-axis is right on schedule…

Source: Bloomberg

And while The Fed’s balance sheet continues to contract, we do note that the pace of contraction has slowed significantly this year…

Source: Bloomberg

And at the same time, inflows to money-market funds continued to take total assets to fresh record highs…

Source: Bloomberg

…as banks saw deposits decline $48BN (SA) last week ($86BN in the last 3 weeks)…

Source: Bloomberg

On a non-seasonally-adjusted basis, total deposits fell $74BN in the week ending 2/21 (down $206BN in 2024)…

Source: Bloomberg

And, excluding foreign banks, domestic deposits dropped $46BN SA (Large Banks -$36BN, Small Banks -$10BN), and tumbled $69BN NSA (Large Banks -$62BN, Small Banks -$7BN)

Source: Bloomberg

On the other side of the ledger, there basically no activity at all in loans from small or large banks. Quite an odd print…

Source: Bloomberg

US equity market cap remains dramatically decoupled from bank reserves at The Fed. The last time it was this decoupled didn’t end well…

Source: Bloomberg

And finally, as if you needed a reminder after this week’s NYCB debacle – despite the rebound off the lows again this week in regional bank shares, which must mean everything is awesome, right? – the regional bank crisis is still very much alive as evidenced by the red line below (without The Fed’s imminently expiring BTFP facility)…

Source: Bloomberg

…what else are big banks (green line) going to do with all that cash burning a hole in their pockets (although we do note a big cash drop at large banks – which includes NYCB, but this was the week before).

As one veteran Fed watcher remarked “this is such a clusterfuck… deposits should be $500BN lower”

Source: Bloomberg

The bottom line is – this looks a lot like a ‘Small Bank’ crisis. The last time this happened, the crisis sparked a sudden $300BN ‘run’ in small bank deposits (this time it’s bigger!).

Is The Fed ‘hoping’ for a controlled bank-run this time – so as many small bank deposits are drained voluntarily, before they are drained all at once in a panic (and the Reverse Repo facility is empty, unable to provide any cushion)?

Loading…