Authored by Jeffrey Tucker via The Epoch Times,

By some miracle - actually, by the printing of $5.4 trillion that has shown itself in persistent inflation - the United States has so far avoided a financial crisis. That’s the one sector that so far the establishment has been able to protect from disaster.

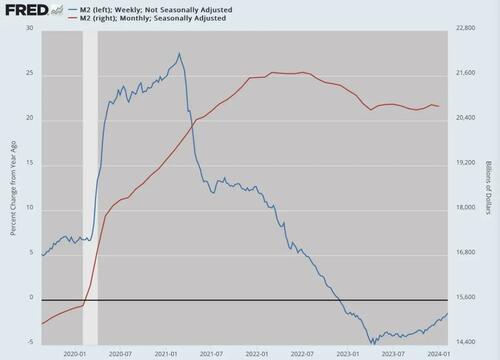

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

How long can this be forestalled?

Watching the highly leveraged economic environment carefully, it seemed fairly likely that this would begin with a commercial real estate bust in the big cities. New York in particular is the hot spot and bellwether.

The story goes like this.

After a long real estate boom in the cities, with workers commuting long distances, and zero interest rate policies that massively subsidized corporate leverage and an unhinged hiring binge, the sudden lockdowns of four years ago changed everything.

Suddenly vast swaths of the professional managerial class were forced to do their fake work from home. This not only led to a sudden shortage of household toilet paper. It introduced into corporate America a new way of managing the workforce. Even after all this time, the habit of the daily commute will not come back the way it was.

Looking from the outside in, it might seem like the obvious answer was to convert huge office skyscrapers to apartments, of which there is a tremendous shortage. But that turns out not to be so easy. These office spaces are set up to be what they are and cannot simply become apartments. There was really only one choice: either get the workforce back on a full-time basis or shrink the amount of leased space.

These commercial leases typically run for 5 to 10 years. Two years ago, the clock began to tick on many of them. Many began to expire last year and many more this year. Companies are looking at their huge office spaces and realizing that they could cut their footprint by half or more. The hybrid work schedule simply didn’t require the multifloor leases that they previously had.

As a result, many are cutting back, resulting in fewer revenue flows to the mortgage holders and thus less available to service the gigantic loans on large properties as held by big financial companies.

A major player in the New York City market is New York Community Bancorp. Last year, it began reporting that it was missing its metrics and falling on some hard times. Its stock started taking a beating. As the reports grew worse, the sell order mounted.

From a high of nearly $14, the stock began to tank, falling even lower than $2. That’s when the panic began from the banking community. Its CEO was fired and replaced. Then several major lenders ponied up $1 billion in a rescue package to make things right again. The stock has recovered slightly.

Notable is the source of the funds: former Treasury Secretary Steven Mnuchin. Involved are Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital, and Reverence Capital Partners and including Citadel. The new CEO is the former Comptroller of the Currency.

In other words, this is a deep-state bailout, an all-hands-on-deck attempt to stop contagion. It’s very serious. And though the action did get many headlines, it might be, in the poetic phrase, a cloud no bigger than a man’s hand.

“Moody’s Investors Service and Fitch Ratings have both downgraded New York Community Bancorp’s credit ratings to below investment grade,” writes the Wall Street Journal.

All the bailouts in the world are not going to solve the underlying problem. The commercial real estate issue in the big cities, particularly in Boston, New York, and Chicago, is not going away. They will worsen this entire year, leading to more weakness among the major lenders. This will provoke more centralization and bailouts. The Fed and the U.S. Treasury Department will be watching closely throughout.

Will they be able to contain it? Not likely, not over the long term. The financial crisis is coming. They are only kicking the can down the road.

If you wonder why the Fed keeps talking up rate cuts—despite the reality that inflation is nowhere near under control by any historical marker—this is why. It’s a means by which the Fed assures markets that it is ready to crank up the printing press at a moment’s notice. They will not let the system unravel.

What does this mean for you? Well, for starters, it means that inflation is not going away, not for a very long time. It might get vastly worse starting next year and the next. We could be headed into a repeat of the 1970s with three distinct inflationary waves. We might have been through the first and only waiting for two and three.

Sophisticated investors have figured this out, which is why gold and Bitcoin have hit new highs. It’s the only real safe haven in such an environment. No matter who is elected president, this is going to be a huge problem for the next term. It might emerge as the central issue. When that happens, please remember the roots of the problem, which trace not only to lockdowns but to the response to the 2008 crisis and even earlier with the loosening of credit after 2001.

So far, it’s been a century of inflationary finance. How could this not end in financial crisis? The only question is what pathway it will take to unfold. We are only now seeing the beginning of it.

Authored by Jeffrey Tucker via The Epoch Times,

By some miracle – actually, by the printing of $5.4 trillion that has shown itself in persistent inflation – the United States has so far avoided a financial crisis. That’s the one sector that so far the establishment has been able to protect from disaster.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

How long can this be forestalled?

Watching the highly leveraged economic environment carefully, it seemed fairly likely that this would begin with a commercial real estate bust in the big cities. New York in particular is the hot spot and bellwether.

The story goes like this.

After a long real estate boom in the cities, with workers commuting long distances, and zero interest rate policies that massively subsidized corporate leverage and an unhinged hiring binge, the sudden lockdowns of four years ago changed everything.

Suddenly vast swaths of the professional managerial class were forced to do their fake work from home. This not only led to a sudden shortage of household toilet paper. It introduced into corporate America a new way of managing the workforce. Even after all this time, the habit of the daily commute will not come back the way it was.

Looking from the outside in, it might seem like the obvious answer was to convert huge office skyscrapers to apartments, of which there is a tremendous shortage. But that turns out not to be so easy. These office spaces are set up to be what they are and cannot simply become apartments. There was really only one choice: either get the workforce back on a full-time basis or shrink the amount of leased space.

These commercial leases typically run for 5 to 10 years. Two years ago, the clock began to tick on many of them. Many began to expire last year and many more this year. Companies are looking at their huge office spaces and realizing that they could cut their footprint by half or more. The hybrid work schedule simply didn’t require the multifloor leases that they previously had.

As a result, many are cutting back, resulting in fewer revenue flows to the mortgage holders and thus less available to service the gigantic loans on large properties as held by big financial companies.

A major player in the New York City market is New York Community Bancorp. Last year, it began reporting that it was missing its metrics and falling on some hard times. Its stock started taking a beating. As the reports grew worse, the sell order mounted.

From a high of nearly $14, the stock began to tank, falling even lower than $2. That’s when the panic began from the banking community. Its CEO was fired and replaced. Then several major lenders ponied up $1 billion in a rescue package to make things right again. The stock has recovered slightly.

Notable is the source of the funds: former Treasury Secretary Steven Mnuchin. Involved are Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital, and Reverence Capital Partners and including Citadel. The new CEO is the former Comptroller of the Currency.

In other words, this is a deep-state bailout, an all-hands-on-deck attempt to stop contagion. It’s very serious. And though the action did get many headlines, it might be, in the poetic phrase, a cloud no bigger than a man’s hand.

“Moody’s Investors Service and Fitch Ratings have both downgraded New York Community Bancorp’s credit ratings to below investment grade,” writes the Wall Street Journal.

All the bailouts in the world are not going to solve the underlying problem. The commercial real estate issue in the big cities, particularly in Boston, New York, and Chicago, is not going away. They will worsen this entire year, leading to more weakness among the major lenders. This will provoke more centralization and bailouts. The Fed and the U.S. Treasury Department will be watching closely throughout.

Will they be able to contain it? Not likely, not over the long term. The financial crisis is coming. They are only kicking the can down the road.

If you wonder why the Fed keeps talking up rate cuts—despite the reality that inflation is nowhere near under control by any historical marker—this is why. It’s a means by which the Fed assures markets that it is ready to crank up the printing press at a moment’s notice. They will not let the system unravel.

What does this mean for you? Well, for starters, it means that inflation is not going away, not for a very long time. It might get vastly worse starting next year and the next. We could be headed into a repeat of the 1970s with three distinct inflationary waves. We might have been through the first and only waiting for two and three.

Sophisticated investors have figured this out, which is why gold and Bitcoin have hit new highs. It’s the only real safe haven in such an environment. No matter who is elected president, this is going to be a huge problem for the next term. It might emerge as the central issue. When that happens, please remember the roots of the problem, which trace not only to lockdowns but to the response to the 2008 crisis and even earlier with the loosening of credit after 2001.

So far, it’s been a century of inflationary finance. How could this not end in financial crisis? The only question is what pathway it will take to unfold. We are only now seeing the beginning of it.

Loading…