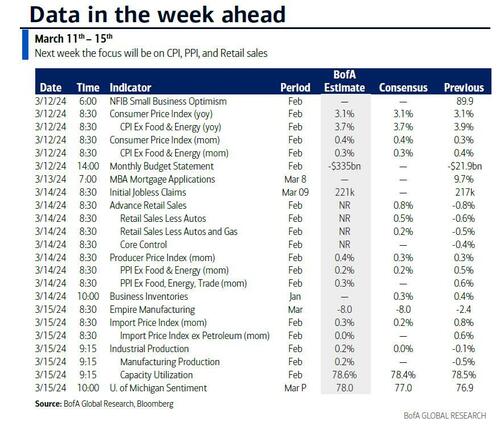

With 10yr US yields around -10bps lower, and the S&P 500 around +2% higher than where they were just before last month’s higher-than-expected CPI, DB's Jim Reid concludes that "it’s fair to say that markets have shrugged off this upside print alongside the high PPI and core PCE prints that followed." The question now is whether this week we get to do it all over again, but before we preview the US CPI (tomorrow) and PPI (Thursday), the other main US highlights are the NY Fed 1-yr inflation expectations survey (today), retail sales (Thursday) and UoM consumer sentiment (Friday). There are also 3-, 10- and 30-yr UST auctions today through Wednesday.

Expanding on the main event - tomorrow's CPI print - with gas prices up around 4.1% from January, DB's economists expect headline CPI (+0.41% forecast, consensus +0.4%, vs. +0.31% previously) to grow faster than core (+0.30%, consensus +0.3%, vs. +0.39% previously). This would bring YoY core CPI two-tenths lower to 3.7%, with headline flat at 3.1%. Of some concern would be the three-month annualized rate 'only' ticking down a tenth to 3.9% while the six-month annualised rate would rise a tenth to 3.7%. See our economists preview and post-print webinar registration details here.

For Thursday's PPI, the main interest will be the sub components that feed into core PCE forecasts. One of the more important will be the PPI for portfolio management and investment advice, which tends to follow equity prices with a one-month lag. We've seen a further equity rally since last month so it could be firm again. This remarkably added about 8bps to the January core PCE print despite only being about 1.6% of the basket. Also keep an eye on the PPI for selected health care industries, as this category currently has the highest weight in core PCE.

In Europe, the monthly UK GDP for January on Wednesday and labor market indicators tomorrow come a week before the next BoE meeting. In Asia, we have China's 1-yr MLF rate where DB economists think we will see a 15bps cut. In Japan, the 1st survey results from the important shunto wage negotiations will be released on Friday, which will be key ahead of the BoJ meeting a week tomorrow where speculation mounts that negative rates will end. These are the main highlights but see the full week ahead at the end for all the week's key global events.

here is a day-by-day calendar of events

Monday March 11

- Data: US February NY Fed 1-yr inflation expectations, Japan February PPI, machine tool orders

- Central banks: BoE Quarterly Bulletin article on investment

- Earnings: Oracle

- Auctions: US 3-yr Notes ($56bn)

Tuesday March 12

- Data: US February CPI, NFIB small business optimism, monthly budget statement, UK January weekly earnings, employment change

- Central banks: ECB's Holzmann speaks, BoE's Mann speaks

- Earnings: Porsche

- Auctions: US 10-yr Notes (reopening, $39bn)

Wednesday March 13

- Data: UK January monthly GDP, trade balance, industrial production, index of services, construction output, Italy Q4 unemployment rate quarterly, Eurozone January industrial production

- Central banks: ECB's Stournaras speaks

- Earnings: Inditex, Adidas, Dollar Tree, Volkswagen

- Auctions: US 30-yr Bonds (reopening, $22bn)

Thursday March 14

- Data: US February retail sales, PPI, January business inventories, initial jobless claims, UK February RICS house price balance, Germany January current account balance, Canada January manufacturing sales

- Central banks: ECB's Stournaras speaks

- Earnings: Adobe, RWE, Rheinmetall, Dollar General

Friday March 15

- Data: US March University of Michigan consumer sentiment, Empire manufacturing index, February industrial production, import price index, export price index, capacity utilization, China February new home prices, Japan January tertiary industry index, Italy January trade balance, retail sales, general government debt, Canada January international securities transactions, February housing starts

- Central banks: BoE's inflation attitudes survey, China 1-yr MLF rate, ECB's Vujcic speaks

* * *

Fianlly, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and PPI reports on Thursday. There are no speaking engagements by Fed officials scheduled this week, reflecting the blackout period in advance of the FOMC meeting on March 19-20.

Monday, March 11

- There are no major economic data releases scheduled.

Tuesday, March 12

- 06:00 AM NFIB Small business optimism, February (consensus 90.6, last 89.9)

- 08:30 AM CPI (mom), February (GS +0.44%, consensus +0.4%, last +0.3%); Core CPI (mom), February (GS +0.32%, consensus +0.3%, last +0.4%); CPI (yoy), February (GS +3.15%, consensus +3.1%, last +3.1%); Core CPI (yoy), February (GS +3.71%, consensus +3.7%, last +3.9%): We estimate a 0.32% increase in February core CPI (mom sa), which would lower the year-on-year rate by two tenths to 3.7%. Start-of-year price increases temporarily boosted prices in labor-reliant services categories in January, and with this January effect now behind us, we forecast a return to the previous inflation trend, specifically for medical care, personal care, car repair, and day care services. We also assume a step down in the OER category following outsized volatility in January (we estimate +0.47% for OER and +0.42% for rent, compared to +0.56% and +0.36% in January). We assume small declines in new (-0.3%) and used (-0.4%) car prices, reflecting higher incentives and lower auction prices. On the positive side, we assume a 1.5% rise in airfares and another strong gain in car insurance (+1.6%), based on online price data. We estimate a 0.44% rise in headline CPI, reflecting higher energy (+2.4%) and food (+0.15%) prices.

Wednesday, March 13

- There are no major economic data releases scheduled

Thursday, March 14

- 08:30 AM Retail sales, February (GS +0.7%, consensus +0.8%, last -0.8%); Retail sales ex-auto, February (GS +0.3%, consensus +0.5%, last -0.6%); Retail sales ex-auto & gas, February (GS +0.2%, consensus +0.3%, last -0.5%); Core retail sales, February (GS +0.2%, consensus +0.4%, last -0.4%): We estimate core retail sales rose 0.2% in February (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects mixed credit card spending data following strength during the holiday season. We estimate a 0.7% rise in headline retail sales, reflecting a rebound in auto sales and higher gasoline prices.

- 08:30 AM PPI final demand, February (GS +0.3%, consensus +0.3%, last +0.3%); PPI ex-food and energy, February (GS +0.2%, consensus +0.2%, last +0.5%); PPI ex-food, energy, and trade, February (GS +0.3%, consensus +0.3%, last +0.6%);

- 08:30 AM Initial jobless claims, week ended March 9 (GS 210k, consensus 217k, last 217k); Continuing jobless claims, week ended March 2 (GS 1,915k, last 1,906k)

- 10:00 AM Business inventories, January (consensus +0.2%, last +0.4%)

Friday, March 15

- 08:30 AM Empire State manufacturing survey, March (consensus -8.0, last -2.4)

- 08:30 AM Import price index, February (consensus +0.3%, last +0.8%)

- 09:15 AM Industrial production, February (GS +0.5%, consensus flat, last -0.1%); Manufacturing production, February (GS +0.4%, consensus +0.3%, last -0.5%); Capacity utilization, February (GS 78.7%, consensus 78.5%, last 78.5%): We estimate industrial production increased 0.3%, as strong oil and gas and mining production outweigh weak natural gas and electricity production. We estimate capacity utilization increased to 78.7%.

- 10:00 AM University of Michigan consumer sentiment, March preliminary (GS 77.6, consensus 77.3, last 76.9): University of Michigan 5-10-year inflation expectations, March Preliminary (GS 3.0%, consensus 2.9%, last 2.9%): We expect the University of Michigan consumer sentiment index increased to 77.6 in the preliminary March reading. We estimate the report's measure of long-term inflation expectations rose 0.1pp to 3.0%, reflecting higher gasoline prices and the higher-than-expected price data reported in February.

Source: DB, Goldman, BofA

With 10yr US yields around -10bps lower, and the S&P 500 around +2% higher than where they were just before last month’s higher-than-expected CPI, DB’s Jim Reid concludes that “it’s fair to say that markets have shrugged off this upside print alongside the high PPI and core PCE prints that followed.” The question now is whether this week we get to do it all over again, but before we preview the US CPI (tomorrow) and PPI (Thursday), the other main US highlights are the NY Fed 1-yr inflation expectations survey (today), retail sales (Thursday) and UoM consumer sentiment (Friday). There are also 3-, 10- and 30-yr UST auctions today through Wednesday.

Expanding on the main event – tomorrow’s CPI print – with gas prices up around 4.1% from January, DB’s economists expect headline CPI (+0.41% forecast, consensus +0.4%, vs. +0.31% previously) to grow faster than core (+0.30%, consensus +0.3%, vs. +0.39% previously). This would bring YoY core CPI two-tenths lower to 3.7%, with headline flat at 3.1%. Of some concern would be the three-month annualized rate ‘only’ ticking down a tenth to 3.9% while the six-month annualised rate would rise a tenth to 3.7%. See our economists preview and post-print webinar registration details here.

For Thursday’s PPI, the main interest will be the sub components that feed into core PCE forecasts. One of the more important will be the PPI for portfolio management and investment advice, which tends to follow equity prices with a one-month lag. We’ve seen a further equity rally since last month so it could be firm again. This remarkably added about 8bps to the January core PCE print despite only being about 1.6% of the basket. Also keep an eye on the PPI for selected health care industries, as this category currently has the highest weight in core PCE.

In Europe, the monthly UK GDP for January on Wednesday and labor market indicators tomorrow come a week before the next BoE meeting. In Asia, we have China’s 1-yr MLF rate where DB economists think we will see a 15bps cut. In Japan, the 1st survey results from the important shunto wage negotiations will be released on Friday, which will be key ahead of the BoJ meeting a week tomorrow where speculation mounts that negative rates will end. These are the main highlights but see the full week ahead at the end for all the week’s key global events.

here is a day-by-day calendar of events

Monday March 11

- Data: US February NY Fed 1-yr inflation expectations, Japan February PPI, machine tool orders

- Central banks: BoE Quarterly Bulletin article on investment

- Earnings: Oracle

- Auctions: US 3-yr Notes ($56bn)

Tuesday March 12

- Data: US February CPI, NFIB small business optimism, monthly budget statement, UK January weekly earnings, employment change

- Central banks: ECB’s Holzmann speaks, BoE’s Mann speaks

- Earnings: Porsche

- Auctions: US 10-yr Notes (reopening, $39bn)

Wednesday March 13

- Data: UK January monthly GDP, trade balance, industrial production, index of services, construction output, Italy Q4 unemployment rate quarterly, Eurozone January industrial production

- Central banks: ECB’s Stournaras speaks

- Earnings: Inditex, Adidas, Dollar Tree, Volkswagen

- Auctions: US 30-yr Bonds (reopening, $22bn)

Thursday March 14

- Data: US February retail sales, PPI, January business inventories, initial jobless claims, UK February RICS house price balance, Germany January current account balance, Canada January manufacturing sales

- Central banks: ECB’s Stournaras speaks

- Earnings: Adobe, RWE, Rheinmetall, Dollar General

Friday March 15

- Data: US March University of Michigan consumer sentiment, Empire manufacturing index, February industrial production, import price index, export price index, capacity utilization, China February new home prices, Japan January tertiary industry index, Italy January trade balance, retail sales, general government debt, Canada January international securities transactions, February housing starts

- Central banks: BoE’s inflation attitudes survey, China 1-yr MLF rate, ECB’s Vujcic speaks

* * *

Fianlly, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and PPI reports on Thursday. There are no speaking engagements by Fed officials scheduled this week, reflecting the blackout period in advance of the FOMC meeting on March 19-20.

Monday, March 11

- There are no major economic data releases scheduled.

Tuesday, March 12

- 06:00 AM NFIB Small business optimism, February (consensus 90.6, last 89.9)

- 08:30 AM CPI (mom), February (GS +0.44%, consensus +0.4%, last +0.3%); Core CPI (mom), February (GS +0.32%, consensus +0.3%, last +0.4%); CPI (yoy), February (GS +3.15%, consensus +3.1%, last +3.1%); Core CPI (yoy), February (GS +3.71%, consensus +3.7%, last +3.9%): We estimate a 0.32% increase in February core CPI (mom sa), which would lower the year-on-year rate by two tenths to 3.7%. Start-of-year price increases temporarily boosted prices in labor-reliant services categories in January, and with this January effect now behind us, we forecast a return to the previous inflation trend, specifically for medical care, personal care, car repair, and day care services. We also assume a step down in the OER category following outsized volatility in January (we estimate +0.47% for OER and +0.42% for rent, compared to +0.56% and +0.36% in January). We assume small declines in new (-0.3%) and used (-0.4%) car prices, reflecting higher incentives and lower auction prices. On the positive side, we assume a 1.5% rise in airfares and another strong gain in car insurance (+1.6%), based on online price data. We estimate a 0.44% rise in headline CPI, reflecting higher energy (+2.4%) and food (+0.15%) prices.

Wednesday, March 13

- There are no major economic data releases scheduled

Thursday, March 14

- 08:30 AM Retail sales, February (GS +0.7%, consensus +0.8%, last -0.8%); Retail sales ex-auto, February (GS +0.3%, consensus +0.5%, last -0.6%); Retail sales ex-auto & gas, February (GS +0.2%, consensus +0.3%, last -0.5%); Core retail sales, February (GS +0.2%, consensus +0.4%, last -0.4%): We estimate core retail sales rose 0.2% in February (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects mixed credit card spending data following strength during the holiday season. We estimate a 0.7% rise in headline retail sales, reflecting a rebound in auto sales and higher gasoline prices.

- 08:30 AM PPI final demand, February (GS +0.3%, consensus +0.3%, last +0.3%); PPI ex-food and energy, February (GS +0.2%, consensus +0.2%, last +0.5%); PPI ex-food, energy, and trade, February (GS +0.3%, consensus +0.3%, last +0.6%);

- 08:30 AM Initial jobless claims, week ended March 9 (GS 210k, consensus 217k, last 217k); Continuing jobless claims, week ended March 2 (GS 1,915k, last 1,906k)

- 10:00 AM Business inventories, January (consensus +0.2%, last +0.4%)

Friday, March 15

- 08:30 AM Empire State manufacturing survey, March (consensus -8.0, last -2.4)

- 08:30 AM Import price index, February (consensus +0.3%, last +0.8%)

- 09:15 AM Industrial production, February (GS +0.5%, consensus flat, last -0.1%); Manufacturing production, February (GS +0.4%, consensus +0.3%, last -0.5%); Capacity utilization, February (GS 78.7%, consensus 78.5%, last 78.5%): We estimate industrial production increased 0.3%, as strong oil and gas and mining production outweigh weak natural gas and electricity production. We estimate capacity utilization increased to 78.7%.

- 10:00 AM University of Michigan consumer sentiment, March preliminary (GS 77.6, consensus 77.3, last 76.9): University of Michigan 5-10-year inflation expectations, March Preliminary (GS 3.0%, consensus 2.9%, last 2.9%): We expect the University of Michigan consumer sentiment index increased to 77.6 in the preliminary March reading. We estimate the report’s measure of long-term inflation expectations rose 0.1pp to 3.0%, reflecting higher gasoline prices and the higher-than-expected price data reported in February.

Source: DB, Goldman, BofA

Loading…