Southwest Airlines released a new filing that warned it must trim its capacity and reassess financial forecasts. The airline attributed these adjustments to a decrease in Boeing 737 Max jet deliveries this year amid the aircraft manufacturer's ongoing regulatory and criminal investigations. This news comes ahead of Chief Executive Officer Bob Jordan's presentation at the JP Morgan Industrials Conference at 1000 ET.

"To that end, and especially in light of further second half 2024 planned capacity reductions discussed below, the Company has halted hiring classes for multiple workgroups, including Pilots and Flight Attendants, and now intends to end the year with headcount down on a year-over-year basis, compared with its previous expectation of flat to down, year-over-year," the filing said.

Boeing informed the Dallas-based airline to expect only 46 Max model deliveries this year, down from 79:

Boeing has advised the Company to expect 46 737-8 ("-8") aircraft deliveries in 2024, a reduction from the Company's previous expectation of 79 737 MAX aircraft deliveries, which included 58 -8 aircraft. Further, the Company now assumes no 737-7 ("-7") aircraft deliveries and continues to assume no -7 aircraft are placed into service this year based on the current certification status.

As a result of Boeing's continued challenges, the Company expects the delivery schedule to be fluid and, therefore, plans to reduce capacity and re-optimize schedules, primarily for the back half of 2024, which will likely result in at least a one point reduction to the Company's full year 2024 capacity plans on a year-over-year basis.

Boeing's troubles stem from a US Justice Department criminal investigation into the door plug that ripped off a 737 Max operated by Alaska Air Group. The Federal Aviation Administration also placed a production cap on the Max manufacturing program to ensure that the "incident must never happen again."

Southwest's situation highlights how Boeing's problems are rippling across the industry. The airline must "reevaluate all prior full-year 2024 guidance."

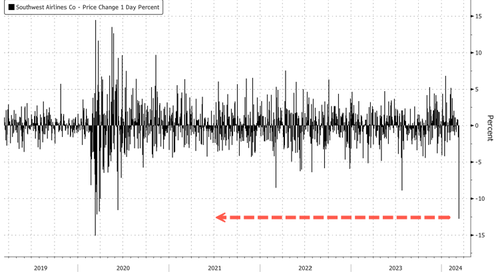

Shares of Boeing plunged 13% in the early cash session.

Today's decline is the largest since the early Covid panic.

Last week, United Airlines said it would have to pause pilot hiring because of a delay in Boeing aircraft deliveries.

Great job, Boeing.

Southwest Airlines released a new filing that warned it must trim its capacity and reassess financial forecasts. The airline attributed these adjustments to a decrease in Boeing 737 Max jet deliveries this year amid the aircraft manufacturer’s ongoing regulatory and criminal investigations. This news comes ahead of Chief Executive Officer Bob Jordan’s presentation at the JP Morgan Industrials Conference at 1000 ET.

“To that end, and especially in light of further second half 2024 planned capacity reductions discussed below, the Company has halted hiring classes for multiple workgroups, including Pilots and Flight Attendants, and now intends to end the year with headcount down on a year-over-year basis, compared with its previous expectation of flat to down, year-over-year,” the filing said.

Boeing informed the Dallas-based airline to expect only 46 Max model deliveries this year, down from 79:

Boeing has advised the Company to expect 46 737-8 (“-8”) aircraft deliveries in 2024, a reduction from the Company’s previous expectation of 79 737 MAX aircraft deliveries, which included 58 -8 aircraft. Further, the Company now assumes no 737-7 (“-7”) aircraft deliveries and continues to assume no -7 aircraft are placed into service this year based on the current certification status.

As a result of Boeing’s continued challenges, the Company expects the delivery schedule to be fluid and, therefore, plans to reduce capacity and re-optimize schedules, primarily for the back half of 2024, which will likely result in at least a one point reduction to the Company’s full year 2024 capacity plans on a year-over-year basis.

Boeing’s troubles stem from a US Justice Department criminal investigation into the door plug that ripped off a 737 Max operated by Alaska Air Group. The Federal Aviation Administration also placed a production cap on the Max manufacturing program to ensure that the “incident must never happen again.”

Southwest’s situation highlights how Boeing’s problems are rippling across the industry. The airline must “reevaluate all prior full-year 2024 guidance.”

Shares of Boeing plunged 13% in the early cash session.

Today’s decline is the largest since the early Covid panic.

Last week, United Airlines said it would have to pause pilot hiring because of a delay in Boeing aircraft deliveries.

Great job, Boeing.

Loading…