Following yesterday's soaring CPI which prompted Nomura and others to call for a 100bps hike in July - and the market to price in a 75% chance of it - The Fed has unleashed Christopher Waller to jawbone back expectations this morning, courtesy - once again - of WSJ's Nick Timiraos who quoted Waller as saying:

"What the CPI report did "was anchor--for me--that we are going to go...75."

"You don't want to overdo the rate hikes. A 75 basis point hike is huge. Don't think because you're not going 100, you're not doing your job."

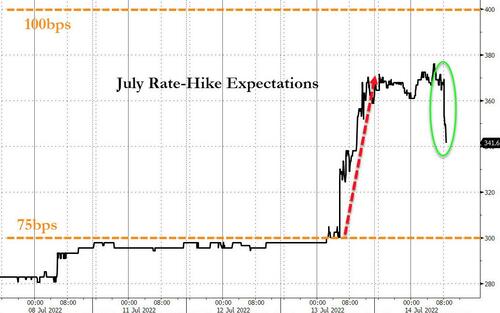

The instant reaction is very clear... expectations for a 100bps hike plunged...

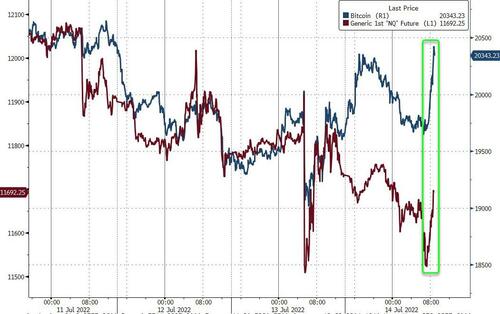

Stocks and crypto surged on the relief...

As a reminder, shortly after the spiking CPI print yesterday, Timiraos took the 100bps off the table...

In an article titled "Inflation Report Likely to Seal Case for Fed’s 0.75-Point Rate Rise in July", Timiraos writes that "another big increase in consumer prices last month keeps the Federal Reserve on track to raise its benchmark interest rate by 0.75 percentage point at its meeting later this month."

Which Nomura then screwed up by explaining why it was necessary.

The choice between 75bp and 100bp in July may still be close for participants, but we believe 100bp is the “right” call, both from a forecasting perspective and from the perspective of optimal monetary policy. When asked about 100bp at the June press conference, Chair Powell noted that “we’re going to react to the incoming data and appropriately.” Incoming data suggest the Fed’s inflation problem has worsened, and we expect policymakers to react by scaling up the pace of rate hikes to reinforce their credibility.

And now, given the market's response (very negative), Timiraos unleashed Waller to jawbone it all back again...

Waller: The June CPI was a "major league disappointment" but even with that, a 0.75-point rate rise is my base case for the July FOMC

— Nick Timiraos (@NickTimiraos) July 14, 2022

If retail or housing data point to stronger demand, Waller would lean to a larger rate rise https://t.co/XwwS8M433U

Now where have we seen this narrative-shaping bullshit before?

Anyone remember Bostic's infamous "pause in September" comments that triggered a brief short-squeeze in stocks before being completely dismantled by Brainard.

Developing...

Following yesterday’s soaring CPI which prompted Nomura and others to call for a 100bps hike in July – and the market to price in a 75% chance of it – The Fed has unleashed Christopher Waller to jawbone back expectations this morning, courtesy – once again – of WSJ’s Nick Timiraos who quoted Waller as saying:

“What the CPI report did “was anchor–for me–that we are going to go…75.”

“You don’t want to overdo the rate hikes. A 75 basis point hike is huge. Don’t think because you’re not going 100, you’re not doing your job.”

The instant reaction is very clear… expectations for a 100bps hike plunged…

Stocks and crypto surged on the relief…

As a reminder, shortly after the spiking CPI print yesterday, Timiraos took the 100bps off the table…

In an article titled “Inflation Report Likely to Seal Case for Fed’s 0.75-Point Rate Rise in July“, Timiraos writes that “another big increase in consumer prices last month keeps the Federal Reserve on track to raise its benchmark interest rate by 0.75 percentage point at its meeting later this month.”

Which Nomura then screwed up by explaining why it was necessary.

The choice between 75bp and 100bp in July may still be close for participants, but we believe 100bp is the “right” call, both from a forecasting perspective and from the perspective of optimal monetary policy. When asked about 100bp at the June press conference, Chair Powell noted that “we’re going to react to the incoming data and appropriately.” Incoming data suggest the Fed’s inflation problem has worsened, and we expect policymakers to react by scaling up the pace of rate hikes to reinforce their credibility.

And now, given the market’s response (very negative), Timiraos unleashed Waller to jawbone it all back again…

Waller: The June CPI was a “major league disappointment” but even with that, a 0.75-point rate rise is my base case for the July FOMC

If retail or housing data point to stronger demand, Waller would lean to a larger rate rise https://t.co/XwwS8M433U

— Nick Timiraos (@NickTimiraos) July 14, 2022

Now where have we seen this narrative-shaping bullshit before?

Anyone remember Bostic’s infamous “pause in September” comments that triggered a brief short-squeeze in stocks before being completely dismantled by Brainard.

Developing…