Is India starting to get cold feet about breaching US sanctions?

On Tuesday, Indian state and private refiners suspended purchases of crude from Venezuela as the U.S. sanctions waiver on Venezuela’s oil exports expires on April 18 and could lead to complications if not renewed, Bloomberg reported citing sources familiar.

As OilPrice adds, private refiner Reliance Industries, which is India’s largest buyer of Venezuelan crude grade Merey, looks to avoid complications with cargoes if the U.S. were to re-impose the sanctions that were temporarily lifted for six months in the middle of October 2023. As the deadline for the waiver expiry nears, state refiner Indian Oil Corporation has also halted buying Venezuelan crude.

At the end of last year, the U.S. introduced a temporary sanctions relief from October 2023 to April 2024, which now allows the production, lifting, sale, and exportation of oil or gas from Venezuela, and the provision of related goods and services, as well as payment of invoices for goods or services related to oil or gas sector operations in Venezuela.

As a result, the top international oil trading houses are back in the business of trading with oil from Venezuela, and refiners in India returned at the end of last year to the market of purchasing Venezuela’s crude.

In December, India resumed imports of crude oil from Venezuela for the first purchases since 2020 after the U.S. lifted most of the sanctions on Venezuela’s oil industry in October.

For India, the world’s third-largest crude oil importer, Venezuelan oil is welcome as some refineries are designed to process the South American country’s heavy crude. The biggest refiners, including Reliance Industries, Indian Oil Corporation, and HPCL-Mittal Energy started securing crude cargoes from Venezuela as soon as the sanctions were lifted temporarily in October.

Most refiners have resumed the purchases via intermediaries, sources familiar with the development told Reuters at the time. Reliance is also looking to discuss direct sales with Venezuela’s state-owned oil firm PDVSA, according to Reuters’ sources.

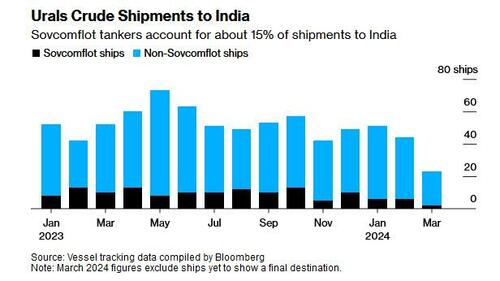

It's not just Venezuela, however: last week Bloomberg also reported that all of India's oil refineries have stopped accepting Russian crude oil delivered by tankers operated by Sovcomflot, Russia’s largest commercial shipping company that has been sanctioned by the US, potentially dealing a blow to Moscow’s economy as India is one of the largest importers of its fossil fuels since the start of the Ukraine war.

According to the report, private and state-run processors including the biggest - Indian Oil - have stopped taking cargoes if they’re on Sovcomflot tankers, as refiners scrutinize the ownership of each ship to make sure they’re not affiliated with the company, or other sanctioned groups.

About 1.5 million barrels of Urals crude were shipped so far on Sovcomflot vessels in March, down from 4.4 million barrels in January and 4.7 million barrels in February.

India has been a major buyer of Russian oil since the invasion of Ukraine, but tighter enforcement of US sanctions has disrupted the trade and led to refiners seeking more expensive crude from other regions such as the US. Sovcomflot said this week that the penalties were putting pressure on its operations.

The Sovcomflot issue means there are fewer tankers to deliver Russian crude, which has led to discounts for the nation’s oil narrowing to compensate for higher freight costs. Of course, the end result of this supply congestion will be higher oil prices which is precisely the opposite of what Biden needs with elections looming, so we would not be surprise if Venezuela's sanctions are indefinitely postponed while the White House quietly backchannels with India to advise them that Russian oil remains perfectly eligible for under the table purchases.

Is India starting to get cold feet about breaching US sanctions?

On Tuesday, Indian state and private refiners suspended purchases of crude from Venezuela as the U.S. sanctions waiver on Venezuela’s oil exports expires on April 18 and could lead to complications if not renewed, Bloomberg reported citing sources familiar.

As OilPrice adds, private refiner Reliance Industries, which is India’s largest buyer of Venezuelan crude grade Merey, looks to avoid complications with cargoes if the U.S. were to re-impose the sanctions that were temporarily lifted for six months in the middle of October 2023. As the deadline for the waiver expiry nears, state refiner Indian Oil Corporation has also halted buying Venezuelan crude.

At the end of last year, the U.S. introduced a temporary sanctions relief from October 2023 to April 2024, which now allows the production, lifting, sale, and exportation of oil or gas from Venezuela, and the provision of related goods and services, as well as payment of invoices for goods or services related to oil or gas sector operations in Venezuela.

As a result, the top international oil trading houses are back in the business of trading with oil from Venezuela, and refiners in India returned at the end of last year to the market of purchasing Venezuela’s crude.

In December, India resumed imports of crude oil from Venezuela for the first purchases since 2020 after the U.S. lifted most of the sanctions on Venezuela’s oil industry in October.

For India, the world’s third-largest crude oil importer, Venezuelan oil is welcome as some refineries are designed to process the South American country’s heavy crude. The biggest refiners, including Reliance Industries, Indian Oil Corporation, and HPCL-Mittal Energy started securing crude cargoes from Venezuela as soon as the sanctions were lifted temporarily in October.

Most refiners have resumed the purchases via intermediaries, sources familiar with the development told Reuters at the time. Reliance is also looking to discuss direct sales with Venezuela’s state-owned oil firm PDVSA, according to Reuters’ sources.

It’s not just Venezuela, however: last week Bloomberg also reported that all of India’s oil refineries have stopped accepting Russian crude oil delivered by tankers operated by Sovcomflot, Russia’s largest commercial shipping company that has been sanctioned by the US, potentially dealing a blow to Moscow’s economy as India is one of the largest importers of its fossil fuels since the start of the Ukraine war.

According to the report, private and state-run processors including the biggest – Indian Oil – have stopped taking cargoes if they’re on Sovcomflot tankers, as refiners scrutinize the ownership of each ship to make sure they’re not affiliated with the company, or other sanctioned groups.

About 1.5 million barrels of Urals crude were shipped so far on Sovcomflot vessels in March, down from 4.4 million barrels in January and 4.7 million barrels in February.

India has been a major buyer of Russian oil since the invasion of Ukraine, but tighter enforcement of US sanctions has disrupted the trade and led to refiners seeking more expensive crude from other regions such as the US. Sovcomflot said this week that the penalties were putting pressure on its operations.

The Sovcomflot issue means there are fewer tankers to deliver Russian crude, which has led to discounts for the nation’s oil narrowing to compensate for higher freight costs. Of course, the end result of this supply congestion will be higher oil prices which is precisely the opposite of what Biden needs with elections looming, so we would not be surprise if Venezuela’s sanctions are indefinitely postponed while the White House quietly backchannels with India to advise them that Russian oil remains perfectly eligible for under the table purchases.

Loading…