Authored by John Seiler via The Epoch Times (emphasis ours),

Commentary

I wish we could call “April fool!” on the $20 minimum wage hitting California fast-food restaurants on April 1. But the wage hike signed into law last September by Gov. Gavin Newsom is really going to hit hard.

Last December, Pizza Hut announced it would lay off more than 1,200 delivery drivers across the state. It switched to independent deliver services for home delivery. On March 25, the Wall Street Journal reported on driver Michael Ojeda, 29, “who previously supported his mother and partner on his Pizza Hut delivery wages.” He told the paper, “Pizza Hut was my career for nearly a decade and with little to no notice it was taken away.”

Round Table Pizza also laid off 73 drivers. And, “In San Jose, Brian Hom, owner of two Vitality Bowls restaurants, now runs his stores with two employees, versus four workers that he typically used in the past. That means it takes longer to make customers’ açaí bowls and other orders, and Hom said he is also raising prices by around 10 percent to help cover the increased labor costs. ”

Mr. Hom said, “I’m definitely not going to hire anymore.”

The $20 wage increase affects only chains with 60 or more restaurants nationwide. One effect might be to discourage national chains from setting up here. If a chain has, for example, 55 restaurants outside California, it would be hesitant to establish five restaurants in the Golden State because that would impact its wage structure everywhere else.

The $7.25 federal minimum wage applies in 20 states with no higher state wage. If a restaurant company operating in those states expanded to California, the disparity between $7.25 and $20 would be a shock to the company.

Another big effect will be on all other California businesses, not just restaurants with fewer than 60 operations nationwide. The state minimum wage overall went up fifty cents to $16 an hour on Jan. 1. The best workers at $16 will gravitate to the $20 jobs, effectively putting pressure on companies to pay more than $16. Companies that can’t do so will go out of business.

We won’t know for a couple of months, but California’s unemployment rate could go much higher. According to the U.S. Bureau of Labor Statistics, the state’s unemployment already has risen from 5.0 percent last September to 5.3 percent in February, the highest in the nation. The next highest is Nevada at 5.2 percent. Rival Texas is 3.9 percent and Florida is 3.1 percent.

Higher unemployment also will raise costs for the state’s troubled Employment Development Department. Due to incompetence by the Newsom administration, massive fraud during COVID-19 left the state $20 billion in debt to the federal government. Worse, reported California Globe on Feb. 29, higher interest rates from the Federal Reserve Board mean “the state can expect to have to make an interest only payment of about $500 million dollars instead of the $330 million that was planned for in Gov. Gavin Newsom’s budget for fiscal 2024-25,” which begins on July 1. It must be paid in September.

Newsom’s Political Future

Mr. Newsom can be a savvy politician. But he has a problem with economic realities. For eight years as lieutenant governor, he sat at the feet of Gov. Jerry Brown, who demonstrated how to prevent a budget from getting out of control. Instead, as governor Mr. Newsom went on spending sprees with the $97 billion surplus, everyone, including him, said couldn’t last. It didn’t.

Now he’s staring down a $38 billion budget deficit, according to his Jan. 10 budget proposal; or $73 billion, according to the Legislative Analyst’s latest projection.

The $20 minimum wage will kill many thousands of jobs, canceling the taxes of those workers while they are unemployed, while increasing unemployment costs. Albeit the $20 wage will bring in higher taxes from the workers still employed.

Employers, commonly in the upper middle-class, will suffer fewer profits, cutting into the income taxes they pay. Many even will call it quits and fold up their businesses, or move to more reasonable states.

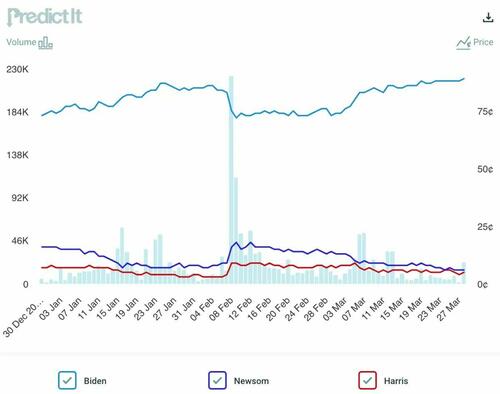

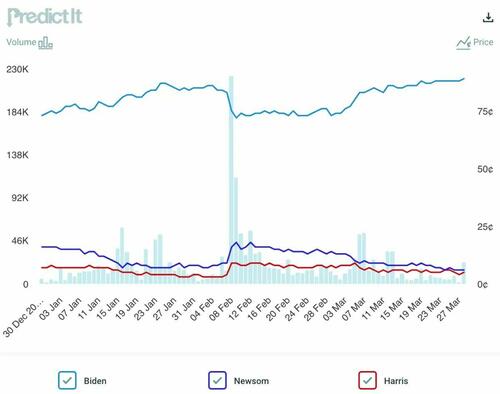

All this will hit this summer as Mr. Newsom’s presidential ambitions could still advance should President Joe Biden’s mental faculties decline much further. All that still is a long shot, of course. The PredictIt betting on Mr. Newsom gaining the nomination has been decreasing lately (middle line in the graph below), from 18 cents on Feb. 9 to 6 cents on March 29. Mr. Biden’s (top line) rose from 72 cents to 89 cents. Vice President Kamala Harris finished at 4 cents, below Mr. Newsom.

The point is it’s not impossible Mr. Newsom could get the nomination. If he does, California’s rising unemployment rate, the massive budget deficit, homelessness, high housing costs, and crime will be a target-rich environment for the Republicans’ presumptive nominee: former President Donald Trump.

Mr. Newsom could have avoided the unemployment crisis if he simply had pushed the $20 minimum wage into the future to 2027, when he will be out office. Then it would have been the next governor’s problem.

Conclusion: Expect More Joblessness

A higher minimum wage usually kills jobs, unless it is genuinely in line with an area’s cost of living. The current statewide $16 minimum wage is the second-highest of any state in the country, after Washington state’s $16.28. And Washington, D.C., not a state, is the highest at $17.00. All are areas with high expenses.

The biggest problem for California will be the $20 wage in rural areas. Although not as cheap to live in as Mississippi, it’s cheaper than living in San Francisco or Santa Monica. Which also means a lower minimum wage would be more sensible inland. Instead, the $20 wage will wipe out many more fast food jobs per capita inland than in the coastal areas.

The $20 wage is also going to increase prices for those still going to fast-food places. If inflation continues or gets worse, that will boost prices even more, leading to fewer customers, followed by even more layoffs.

Tinkering with the economy has consequences. Starting on April Fools’ Day, California will be finding out how an excessive minimum wage increase is one of the worst ones.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Authored by John Seiler via The Epoch Times (emphasis ours),

Commentary

I wish we could call “April fool!” on the $20 minimum wage hitting California fast-food restaurants on April 1. But the wage hike signed into law last September by Gov. Gavin Newsom is really going to hit hard.

Last December, Pizza Hut announced it would lay off more than 1,200 delivery drivers across the state. It switched to independent deliver services for home delivery. On March 25, the Wall Street Journal reported on driver Michael Ojeda, 29, “who previously supported his mother and partner on his Pizza Hut delivery wages.” He told the paper, “Pizza Hut was my career for nearly a decade and with little to no notice it was taken away.”

Round Table Pizza also laid off 73 drivers. And, “In San Jose, Brian Hom, owner of two Vitality Bowls restaurants, now runs his stores with two employees, versus four workers that he typically used in the past. That means it takes longer to make customers’ açaí bowls and other orders, and Hom said he is also raising prices by around 10 percent to help cover the increased labor costs. ”

Mr. Hom said, “I’m definitely not going to hire anymore.”

The $20 wage increase affects only chains with 60 or more restaurants nationwide. One effect might be to discourage national chains from setting up here. If a chain has, for example, 55 restaurants outside California, it would be hesitant to establish five restaurants in the Golden State because that would impact its wage structure everywhere else.

The $7.25 federal minimum wage applies in 20 states with no higher state wage. If a restaurant company operating in those states expanded to California, the disparity between $7.25 and $20 would be a shock to the company.

Another big effect will be on all other California businesses, not just restaurants with fewer than 60 operations nationwide. The state minimum wage overall went up fifty cents to $16 an hour on Jan. 1. The best workers at $16 will gravitate to the $20 jobs, effectively putting pressure on companies to pay more than $16. Companies that can’t do so will go out of business.

We won’t know for a couple of months, but California’s unemployment rate could go much higher. According to the U.S. Bureau of Labor Statistics, the state’s unemployment already has risen from 5.0 percent last September to 5.3 percent in February, the highest in the nation. The next highest is Nevada at 5.2 percent. Rival Texas is 3.9 percent and Florida is 3.1 percent.

Higher unemployment also will raise costs for the state’s troubled Employment Development Department. Due to incompetence by the Newsom administration, massive fraud during COVID-19 left the state $20 billion in debt to the federal government. Worse, reported California Globe on Feb. 29, higher interest rates from the Federal Reserve Board mean “the state can expect to have to make an interest only payment of about $500 million dollars instead of the $330 million that was planned for in Gov. Gavin Newsom’s budget for fiscal 2024-25,” which begins on July 1. It must be paid in September.

Newsom’s Political Future

Mr. Newsom can be a savvy politician. But he has a problem with economic realities. For eight years as lieutenant governor, he sat at the feet of Gov. Jerry Brown, who demonstrated how to prevent a budget from getting out of control. Instead, as governor Mr. Newsom went on spending sprees with the $97 billion surplus, everyone, including him, said couldn’t last. It didn’t.

Now he’s staring down a $38 billion budget deficit, according to his Jan. 10 budget proposal; or $73 billion, according to the Legislative Analyst’s latest projection.

The $20 minimum wage will kill many thousands of jobs, canceling the taxes of those workers while they are unemployed, while increasing unemployment costs. Albeit the $20 wage will bring in higher taxes from the workers still employed.

Employers, commonly in the upper middle-class, will suffer fewer profits, cutting into the income taxes they pay. Many even will call it quits and fold up their businesses, or move to more reasonable states.

All this will hit this summer as Mr. Newsom’s presidential ambitions could still advance should President Joe Biden’s mental faculties decline much further. All that still is a long shot, of course. The PredictIt betting on Mr. Newsom gaining the nomination has been decreasing lately (middle line in the graph below), from 18 cents on Feb. 9 to 6 cents on March 29. Mr. Biden’s (top line) rose from 72 cents to 89 cents. Vice President Kamala Harris finished at 4 cents, below Mr. Newsom.

The point is it’s not impossible Mr. Newsom could get the nomination. If he does, California’s rising unemployment rate, the massive budget deficit, homelessness, high housing costs, and crime will be a target-rich environment for the Republicans’ presumptive nominee: former President Donald Trump.

Mr. Newsom could have avoided the unemployment crisis if he simply had pushed the $20 minimum wage into the future to 2027, when he will be out office. Then it would have been the next governor’s problem.

Conclusion: Expect More Joblessness

A higher minimum wage usually kills jobs, unless it is genuinely in line with an area’s cost of living. The current statewide $16 minimum wage is the second-highest of any state in the country, after Washington state’s $16.28. And Washington, D.C., not a state, is the highest at $17.00. All are areas with high expenses.

The biggest problem for California will be the $20 wage in rural areas. Although not as cheap to live in as Mississippi, it’s cheaper than living in San Francisco or Santa Monica. Which also means a lower minimum wage would be more sensible inland. Instead, the $20 wage will wipe out many more fast food jobs per capita inland than in the coastal areas.

The $20 wage is also going to increase prices for those still going to fast-food places. If inflation continues or gets worse, that will boost prices even more, leading to fewer customers, followed by even more layoffs.

Tinkering with the economy has consequences. Starting on April Fools’ Day, California will be finding out how an excessive minimum wage increase is one of the worst ones.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Loading…