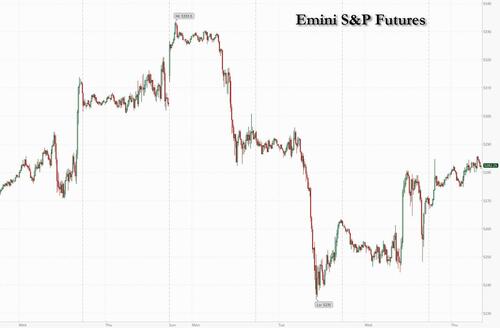

US equity futures are higher with both Tech and small-caps outperforming, while the dollar is lower even as yields are higher from Wednesday's close. As of 7:50am, S&P futures were 0.3% higher and Nasdaq futs rose 0.4%, boosted by Powell’s comments that recent inflation figures did not “materially change” the overall picture while the latest ISM Services print was far less inflationary than the ISM Manufacturing print, in fact bizarrely so. In Europe, major markets are also all higher as part of a global risk-on tone. Bond yields are +1-2 bps, even as Bloomberg’s dollar index extended its slide for a third day, following its biggest one-day fall in nearly four weeks. In commodities, energy is a tad lower with Brent trading just below $90, metals are mixed, and Ags are stronger; copper - which as we noted previously could be the first "AI commodity" is the notable outperformer. Today’s macro data focus is on jobless claims but likely will be ignored with the jobs report tomorrow; we also get seven Fed speakers today.

In premarket trading, all Mag 7 names are higher ex-GOOG, which surprised markets with news that it was launching a premium, AI-powered version of search, something which virtually nobody would pay for. Chipmakers such as Micron and AMD advanced, as analysts saw limited impact on the semiconductor market from Taiwan’s recent earthquake. Taiwan Semiconductor, which supplies chips to Apple Inc. and Nvidia Corp., said there was “no damage to critical tools.” Here are some other notable premarket movers:

- BlackBerry ADRs rise 5% after the software firm reported a surprise 4Q profit.

- Block falls 3% after Morgan Stanley cut its recommendation to underweight, noting limited additional opportunity for the company’s Cash App to expand banking/credit services.

- Hertz slips 3% as Goldman Sachs cut its rating to sell, while raising its recommendation on Avis Budget (CAR) to neutral. Avis Budget is up 2%.

- Levi Strauss jumps 13% after higher-than-expected sales and profit in the first quarter helped fuel a more optimistic full-year outlook.

- MacroGenics rises 9% after the drug developer gave interim safety data from a mid-stage trial of its experimental treatment for patients with prostate cancer.

- Staar Surgical rises 8% after the medical-devices firm reported preliminary net sales for the first quarter that topped the average analyst estimate.

- Wayfair climbs 4% after Evercore ISI raised its recommendation to outperform, noting improving fundamentals.

- Zeta Global gains 5% as Morgan Stanley upgrades to overweight, highlighting the software firm’s durable growth and improving profitability.

While stocks reversed from two days of losses on Wednesday, jitters remained as a blowout reading for March private payrolls hinted at the possibility of a similarly strong number for the monthly non-farm payrolls print on Friday. Swap markets still price less than three rate cuts for 2024, and see only a 56% chance of the easing cycle starting in June. Inflation fears are also being fanned by strength in commodity prices, with Brent oil futures approaching five-month highs after OPEC+ confirmed plans to continue tightening crude supply. Copper rose to a 14-month peak and gold is trading near record highs above $2,300 per ounce.

Optimism was also tempered by Atlanta President Raphael Bostic forecasting only one rate cut this year, which would be in the fourth quarter. A raft of other rate-setters, including the Richmond Fed’s Thomas Barkin and Cleveland Fed President Loretta Mester, are due to speak later on Thursday. Euro-area bond yields, meanwhile, slid on expectations the European Central Bank will kick off policy easing on June 6 and cut rates three more times by year-end.

"I think Powell wants to get the process started in terms of the cutting cycle,” said Jamie Niven, senior portfolio manager at Candriam. “We’ve seen some strong data in the last few days, but I don’t think it’s absurd for them to cut from quite restricted territory.”

European stocks also edged up: the Stoxx 600 index rose 0.1%, as mining and auto shares led European equity gains, with copper miners Rio Tinto Plc and Antofagasta Plc rising sharply. Among other movers, Volvo Car AB jumped as much as 6% after reporting a 25% jump in vehicle sales. Regional bond yields are all lower with multiple curves bull flattening. Eurozone PMI-Srvcs and Composite had upside surprises as PPI printed more dovishly, with both MoM and YoY PPI reflecting deflationary levels.

Earlier in the session, Asian stocks rose, rebounding from Wednesday’s selloff, led by rallies in Japan and South Korea with markets shut for holidays in Greater China. The MSCI Asia Pacific Index rose as much as 0.9%, the most in two weeks, with financials and industrials providing the biggest boosts. Markets in China, Hong Kong and Taiwan were closed. Samsung and SK Hynix boosted South Korean benchmarks as halts at DRAM plants in Taiwan due to Wednesday’s earthquake were seeing firming up prices. A Bloomberg gauge of Asian chipmakers climbed, poised to cap a third week of gains.

- ASX 200 was led by strength in gold miners after the precious metal rose above USD 2,300/oz for the first time.

- Nikkei 225 outperformed and spent most of the session above the 40,000 level with the help of a predominantly weaker currency.

- KOSPI was boosted by tech strength with Samsung underpinned ahead of its preliminary earnings results on Friday with its profit seen to rise to the largest in six quarters on higher chip prices, while SK Hynix was lifted amid plans to invest USD 3.9bln to build an Indiana plant.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Swiss franc is the weakest of the G-10 currencies, falling 0.4% versus the greenback after CPI unexpectedly slowed in March.

In rates, treasuries are slightly cheaper across the curve, spreads within 1bp of Wednesday’s closing levels. Treasury yields cheaper by up to 1.5bp across intermediates, with 10-year around 4.36%; bunds and gilts outperform by 3bp and 4bp in the sector Regional bond yields are all lower with multiple curves bull flattening: European rates outperform after euro-area PMI and PPI data and long-end supply from Spain and France. US session has several Fed speakers and data including weekly jobless claims, with March jobs report ahead Friday.

In commodities, oil prices are little changed, with WTI trading near $85.40. Spot gold falls 0.3%.

Bitcoin is a touch firmer and at the top-end of the session's range around USD 66k.

Looking at today's calendar, the economic data slate includes March Challenger job cuts (the number of job cuts was the highest since January 2023), and the February trade balance and jobless claims (8:30am); Fed speaker slate includes Harker (10am), Barkin (12:15pm), Goolsbee (12:45pm), Mester and Kashkari (2pm), Musalem (7:20pm) and Kugler (7:30pm)

Market Snapshot

- S&P 500 futures up 0.3% to 5,283.25

- STOXX Europe 600 up 0.2% to 511.00

- MXAP up 0.7% to 176.49

- MXAPJ up 0.5% to 539.66

- Nikkei up 0.8% to 39,773.14

- Topix up 0.9% to 2,732.00

- Hang Seng Index down 1.2% to 16,725.10

- Shanghai Composite down 0.2% to 3,069.30

- Sensex up 0.6% to 74,311.08

- Australia S&P/ASX 200 up 0.4% to 7,817.34

- Kospi up 1.3% to 2,742.00

- German 10Y yield little changed at 2.37%

- Euro up 0.2% to $1.0860

- Brent Futures down 0.4% to $89.03/bbl

- Gold spot down 0.3% to $2,293.50

- US Dollar Index down 0.15% to 104.10

Top Overnight News

- Chinese authorities nudged Swiss agrichemicals and seeds group Syngenta to withdraw its application for a long-delayed $9 billion IPO in Shanghai on concerns about the impact a sizeable new offering would have on a volatile market, four people said. RTRS

- The Bank of Japan cut its economic assessment for most regions on Thursday but signaled its confidence that wage hikes were broadening, leaving scope for another hike in the country's still-low interest rates. RTRS

- U.K. businesses expect wages to rise at a slower pace over the coming 12 months, a finding that will help reassure policy makers at the Bank of England that inflation has been tamed. WSJ

- Swiss inflation cools by more than anticipated, coming in at +1.1% Y/Y in Mar (on an EU harmonized basis) vs. the Street +1.4% and down from +1.2% in Feb. BBG

- Cease-fire negotiations between Israel and Hamas are stalling again, Israeli officials say, with large gaps between the sides over hostages, prisoners and the future of Gaza. BBG

- Italian authorities have arrested 23 people and seized more than €600mn as they investigate suspected fraud involving the EU’s €800bn Covid recovery funds. FT

- US institutional investors are selling more of their private equity holdings at a discount as they cut exposure to the illiquid asset class. Led by pension funds and endowments, big investors sold 99% of their private equity holdings at or below their net asset value on the secondary market last year, the most since the investment bank began tracking the figure in 2017. The figures were 95% in 2022 and 73% in 2021. FT

- Boeing’s 737 MAX production has plunged in recent weeks in response to FAA scrutiny and steps by the company to improve quality and reliability. RTRS

- Google could begin charging for a new AI-powered premium search product (AI-powered search eats up much more computing resources than traditional search, which is why Google may look to charge for the experience). FT

- Quarterly path of S&P 500 EPS year/year growth. Positive EPS surprises averaged 4 pp during the past 4 quarters...

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher as sentiment picked up from the choppy mood and mixed data releases stateside, despite thinned conditions with markets across Greater China shut for the Qingming Festival. ASX 200 was led by strength in gold miners after the precious metal rose above USD 2,300/oz for the first time. Nikkei 225 outperformed and spent most of the session above the 40,000 level with the help of a predominantly weaker currency. KOSPI was boosted by tech strength with Samsung underpinned ahead of its preliminary earnings results on Friday with its profit seen to rise to the largest in six quarters on higher chip prices, while SK Hynix was lifted amid plans to invest USD 3.9bln to build an Indiana plant.

Top Asian News

- Iron Ore Drops Toward 10-Month Low as Australian Exports Climb

- Taiwan Begins Recovery From Quake as TSMC Resumes Production

- Foreign Funds Sold Most Japanese Stocks, Futures in Six Months

- Goldman Sees Korean Deals Boom on Push for Reform: ECM Watch

- Egypt Buys LNG in Rare Move to Avoid Summer Gas Crunch

- Konica Minolta Jumps on Plan to Cut 2,400 Jobs, Boost Profit

European bourses are modestly in the green after a relatively flat/directionless cash open, Euro Stoxx 50 +0.1%; modest post-open upside emerged after revisions to the Final EZ PMIs where Composite returned to expansion. Sectors do not have any overarching theme or bias present; basic resources outperform given base metal prices. Stateside, ES +0.3%, futures are tilting higher in tandem with European futures into another session dominated by Fed appearances alongside weekly IJC data before attention focuses on Friday's payrolls.

Top European News

- Riksbank Minutes (Mar): No overt mention of preference between May or June for a rate cut among the members.

- BoE Monthly Decision Maker Panel - One-year ahead CPI inflation expectations declined further to 3.2% in March, down from 3.3% in February.

- ECB's Kazimir says he opposed reviving any “special tools of monetary policy”, according to Bloomberg; declined to comment on current monetary policy due to the ECB's quiet period ahead of next week's meeting.

FX

- USD remains under modest pressure following on from the post-ISM sell off; DXY nearing 104.00 to the downside below which the 50- & 200-DMAs reside at 103.88 and 103.76.

- EUR continues to inch higher after a softer start to the week, modest support perhaps arising from the PMI revisions while the docket ahead is headlined by ECB Minutes, though these are likely stale; last week's EUR/USD high next at 1.0864.

- Sterling steady and unaffected by PMIs or the latest BoE DMP; GBP/USD yet to convincingly surpass the 100- & 50-DMAs at 1.2663 and 1.2667 respectively.

- JPY steady and unreactive to light jawboning overnight, former top-diplomat Watanabe said intervention is not likely unless USD/JPY sharply eclipses 155.00.

- CHF the current laggard after another cool Swiss inflation print which has seen market pricing move more convincingly in favour of a second cut in June, though multiple months of data due before then.

Fixed Income

- EGBs bid despite modest pressure emerging on the morning's upwardly-revised PMIs. Action which eroded some of the concession into supply from France & Spain, though the auctions were still well received.

- Bunds firmer by around 30 ticks but within a similar magnitude of the post-PMI 132.30 base; ECB minutes ahead.

- Gilts followed EGBs into their own data points, with the benchmark unreactive to a modest revision lower (commentary focused on the stickiness of inflation) while the BoE DMP saw inflation expectations edge lower once again. Despite a robust DMO sale, Gilts lost the 99.00 mark but continue to modestly outperform EGBs.

- US Treasuries are essentially flat, have been directionally moving with the above but yet to differ from the unchanged mark by more than a handful of ticks. Action which comes as a slight breather from recent sessions and after Powell reassured those who were expecting/concerned about a hawkish shift.

Commodities

- 3M LME Copper tested USD 9.4k/T to the upside and resides at a fresh 52 week high on the morning's PMIs paint a healthy demand picture; action which comes after an APAC session which saw Chinese markets closed (mainland China returns on Monday).

- Crude benchmarks near the unchanged mark and at the mid-point of circa. USD 0.80/bbl bounds with specifics light thus far into broader macro events.

- Spot gold a touch softer irrespective of the modest USD pullback, action which comes as the yellow metal takes a modest breather from recent upside and as US yields inch higher.

Geopolitics: Middle East

- US official said the Biden administration is calling on the Israeli army to modify its way of transmitting information about the stationing of aid workers and Biden plans to demand these changes. Furthermore, Biden is angry and largely frustrated over the killing of aid workers in Gaza and is ready to clarify his view to Netanyahu during their expected phone call today, while the official added there is no shift in Washington's policy towards Israel, but there is a shift in President Biden's frustrations, according to CNN.

- US Pentagon said Defence Secretary Austin spoke with Israeli Defence Minister Gallant on Wednesday and expressed his outrage at the Israeli strike on a World Central Kitchen humanitarian aid convoy, while Austin stressed the need to immediately take concrete steps to protect aid workers and Palestinian civilians in Gaza after repeated coordination failures with foreign aid groups.

Geopolitics: Other

- France denied it showed any readiness for Ukraine dialogue in talks with Russia, according to a French government source.

- Tokyo is in talks with Manila over sending troops to the Philippines in which a possible deployment comes as they boost efforts to deter China in the South China Sea, according to FT.

- Russia's Kremlin says relations with NATO have slid to a level of direct confrontation; NATO continues "to move towards our borders"

US Event Calendar

- 07:30: March Challenger Job Cuts 0.7% YoY, prior 8.8%

- 08:30: March Continuing Claims, est. 1.81m, prior 1.82m

- 08:30: March Initial Jobless Claims, est. 214,000, prior 210,000

- 08:30: Feb. Trade Balance, est. -$67.6b, prior -$67.4b

Central banke speakers

- 10:00: Fed’s Harker Participates in Fireside Chat

- 12:15: Fed’s Barkin Speaks on Economic Outlook

- 12:45: Fed’s Goolsbee Participates in Moderated Q&A

- 14:00: Fed’s Mester Gives Remarks on Economic Outlook

- 14:00: Fed’s Kashkari Discusses US Economy

- 19:20: Fed’s Musalem Gives Introductory Remarks

- 19:30: Fed’s Kugler Speaks on Enriching Data

DB's Jim Reid concludes the overnight wrap

Markets recovered their poise over the last 24 hours, as investors were relieved after Fed Chair Powell stuck to his recent views on the economic outlook. In his remarks yesterday, he said that recent data didn’t “materially change the overall picture” and that on inflation “it is too soon to say whether the recent readings represent more than just a bump.” In addition, he reiterated that if “the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year.” So that all helped to validate market pricing, which still expects 71bps of rate cuts from the Fed by the December meeting.

Those comments from Powell supported US Treasuries, and the 2yr yield fell -1.7bps on the day as investors maintained their confidence that rate cuts were still on the agenda this year. The 10yr yield was near flat yesterday (-0.2bps) at 4.35%, but that was actually a sharp decline from earlier in the session, when it hit an intraday peak for 2024 of 4.43%, and overnight there’s only been a modest +1.8bps move back up to 4.37%. That turnaround was partly due to Powell’s remarks, but was also because of the ISM services print for March, which unexpectedly fell to 51.4 (vs. 52.8 expected). And encouragingly on inflation, the prices paid component fell to 53.4 (vs. 58.4 expected), its lowest since March 2020. That contrasted with the upside surprise in the ISM manufacturing on Monday, and combined with Powell’s comments, the release helped to push back against some of the more hawkish narratives over the last couple of sessions.

But even as investors found reassurance from Powell’s speech, it had been a very different story earlier in the day. That was particularly the case after the A DP’s report of private payrolls for March came out, which rose to 184k (vs. 150k expected), and February’s number was revised up by +15k. So that was a fresh sign that the labour market was in good shape ahead of tomorrow’s US jobs report, and it was that release which pushed the 10yr yield up to its intraday peak for 2024 so far. Moreover, it’s worth noting that yesterday saw fresh signs of concern about inflation, as oil prices closed at their highest levels since October. For instance, Brent crude was up +0.48% to $89.35/bbl, whilst WTI was up +0.33% to $85.43/bbl. In fact, Brent crude prices were just shy of $90/bbl at their intraday peak, having briefly traded at $89.99/bbl. That’s also filtering through into consumer prices as well, and the AAA’s daily average of US gasoline prices was up to $3.549/gallon as of Tuesday, which is also its highest since October. Meanwhile, Brent crude prices (+0.30%) continue to move higher overnight, and are currently at $89.62/bbl.

Of course, some of Powell’s comments could be interpreted in a more hawkish light. Among others, he said that “the job of sustainably restoring 2 percent inflation is not yet done”, and that “ We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 percent.” But for now at least, investors are still pricing in a 64% chance of a rate cut by June, so that’s considered the most likely timing for an initial rate cut. And ultimately, there’s still several important data releases between now and June that will help determine the decision, including tomorrow’s jobs report for March, along with the CPI release next week. Indeed, we’ve seen how expectations for rate cuts have shifted a lot already this year, and up until early February, investors were still pricing in a strong probability of a cut in March.

Over in the Euro Area, the prospect of ECB rate cuts this year got fresh support from developments yesterday. In particular, the flash CPI print for March saw headline CPI fall to +2.4% (vs. +2.5% expected), whilst core CPI fell to +2.9% (vs. +3.0% expected), which is its lowest since February 2022. Alongside that, we also heard from Spanish central bank governor De Cos, who said “I think that today my central scenario is that June could actually be the first reduction in interest rates”. That backdrop saw yields on 10yr bunds (-0.3bps) and OATs (-1.4bps) fall back, and those on 10yr gilts saw a larger -3.0bps decline. In terms of rate cut expectations, overnight index swaps are now pricing in 76bps of ECB cuts by the December meeting, which is more than the 71bps currently priced in by Fed Funds futures.

As investors continued to anticipate rate cuts this year, that helped to stabilise equities after two weak sessions at the start of the week. The S&P 500 (+0.11%) posted a marginal gain, helped by some of the more cyclical sectors as well as tech stocks. Both the NASDAQ (+0.23%) and the Magnificent 7 (+0.49%) outperformed, and there was also a recovery among small-cap stocks, with the Russell 2000 (+0.54%) paring back some of its losses from the start of the week. Amid the underperformers, chipmaker Intel fell -8.22% after announcing a weaker outlook for its factory network. Meanwhile in Europe, the STOXX 600 was up +0.29%, and there were also gains for the DAX (+0.46%) and the CAC 40 (+0.29%). Separately, the prospect of rate cuts meant that gold prices (+0.85%) closed at an all-time high in nominal terms of $2,300/oz.

Overnight in Asia, it’s been a quieter session this morning given markets are on holiday in China. But in general, the more positive tone has continued, with the Nikkei (+1.63%), the KOSPI (+1.06%) and the S&P/ASX 200 (+0.45%) all advancing. That’s evident among US and European equity futures too, with those on the S&P 500 (+0.27%) and the STOXX 50 (+0.12%) both pointing towards further gains. Alongside that, data showed that Australia’s composite PMI for March moved up to 53.3, marking its highest level since April 2022.

To the day ahead now, and data releases from the US include the weekly initial jobless claims and the February trade balance. Meanwhile in Europe, there’s the final services and composite PMIs for March, along with Euro Area PPI for February. Otherwise, central bank speakers include the Fed’s Harker, Barkin, Goolsbee, Mester, Kashkari, Musalem and Kugler. And we’ll get the ECB’s account of their March meeting.

US equity futures are higher with both Tech and small-caps outperforming, while the dollar is lower even as yields are higher from Wednesday’s close. As of 7:50am, S&P futures were 0.3% higher and Nasdaq futs rose 0.4%, boosted by Powell’s comments that recent inflation figures did not “materially change” the overall picture while the latest ISM Services print was far less inflationary than the ISM Manufacturing print, in fact bizarrely so. In Europe, major markets are also all higher as part of a global risk-on tone. Bond yields are +1-2 bps, even as Bloomberg’s dollar index extended its slide for a third day, following its biggest one-day fall in nearly four weeks. In commodities, energy is a tad lower with Brent trading just below $90, metals are mixed, and Ags are stronger; copper – which as we noted previously could be the first “AI commodity” is the notable outperformer. Today’s macro data focus is on jobless claims but likely will be ignored with the jobs report tomorrow; we also get seven Fed speakers today.

In premarket trading, all Mag 7 names are higher ex-GOOG, which surprised markets with news that it was launching a premium, AI-powered version of search, something which virtually nobody would pay for. Chipmakers such as Micron and AMD advanced, as analysts saw limited impact on the semiconductor market from Taiwan’s recent earthquake. Taiwan Semiconductor, which supplies chips to Apple Inc. and Nvidia Corp., said there was “no damage to critical tools.” Here are some other notable premarket movers:

- BlackBerry ADRs rise 5% after the software firm reported a surprise 4Q profit.

- Block falls 3% after Morgan Stanley cut its recommendation to underweight, noting limited additional opportunity for the company’s Cash App to expand banking/credit services.

- Hertz slips 3% as Goldman Sachs cut its rating to sell, while raising its recommendation on Avis Budget (CAR) to neutral. Avis Budget is up 2%.

- Levi Strauss jumps 13% after higher-than-expected sales and profit in the first quarter helped fuel a more optimistic full-year outlook.

- MacroGenics rises 9% after the drug developer gave interim safety data from a mid-stage trial of its experimental treatment for patients with prostate cancer.

- Staar Surgical rises 8% after the medical-devices firm reported preliminary net sales for the first quarter that topped the average analyst estimate.

- Wayfair climbs 4% after Evercore ISI raised its recommendation to outperform, noting improving fundamentals.

- Zeta Global gains 5% as Morgan Stanley upgrades to overweight, highlighting the software firm’s durable growth and improving profitability.

While stocks reversed from two days of losses on Wednesday, jitters remained as a blowout reading for March private payrolls hinted at the possibility of a similarly strong number for the monthly non-farm payrolls print on Friday. Swap markets still price less than three rate cuts for 2024, and see only a 56% chance of the easing cycle starting in June. Inflation fears are also being fanned by strength in commodity prices, with Brent oil futures approaching five-month highs after OPEC+ confirmed plans to continue tightening crude supply. Copper rose to a 14-month peak and gold is trading near record highs above $2,300 per ounce.

Optimism was also tempered by Atlanta President Raphael Bostic forecasting only one rate cut this year, which would be in the fourth quarter. A raft of other rate-setters, including the Richmond Fed’s Thomas Barkin and Cleveland Fed President Loretta Mester, are due to speak later on Thursday. Euro-area bond yields, meanwhile, slid on expectations the European Central Bank will kick off policy easing on June 6 and cut rates three more times by year-end.

“I think Powell wants to get the process started in terms of the cutting cycle,” said Jamie Niven, senior portfolio manager at Candriam. “We’ve seen some strong data in the last few days, but I don’t think it’s absurd for them to cut from quite restricted territory.”

European stocks also edged up: the Stoxx 600 index rose 0.1%, as mining and auto shares led European equity gains, with copper miners Rio Tinto Plc and Antofagasta Plc rising sharply. Among other movers, Volvo Car AB jumped as much as 6% after reporting a 25% jump in vehicle sales. Regional bond yields are all lower with multiple curves bull flattening. Eurozone PMI-Srvcs and Composite had upside surprises as PPI printed more dovishly, with both MoM and YoY PPI reflecting deflationary levels.

Earlier in the session, Asian stocks rose, rebounding from Wednesday’s selloff, led by rallies in Japan and South Korea with markets shut for holidays in Greater China. The MSCI Asia Pacific Index rose as much as 0.9%, the most in two weeks, with financials and industrials providing the biggest boosts. Markets in China, Hong Kong and Taiwan were closed. Samsung and SK Hynix boosted South Korean benchmarks as halts at DRAM plants in Taiwan due to Wednesday’s earthquake were seeing firming up prices. A Bloomberg gauge of Asian chipmakers climbed, poised to cap a third week of gains.

- ASX 200 was led by strength in gold miners after the precious metal rose above USD 2,300/oz for the first time.

- Nikkei 225 outperformed and spent most of the session above the 40,000 level with the help of a predominantly weaker currency.

- KOSPI was boosted by tech strength with Samsung underpinned ahead of its preliminary earnings results on Friday with its profit seen to rise to the largest in six quarters on higher chip prices, while SK Hynix was lifted amid plans to invest USD 3.9bln to build an Indiana plant.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Swiss franc is the weakest of the G-10 currencies, falling 0.4% versus the greenback after CPI unexpectedly slowed in March.

In rates, treasuries are slightly cheaper across the curve, spreads within 1bp of Wednesday’s closing levels. Treasury yields cheaper by up to 1.5bp across intermediates, with 10-year around 4.36%; bunds and gilts outperform by 3bp and 4bp in the sector Regional bond yields are all lower with multiple curves bull flattening: European rates outperform after euro-area PMI and PPI data and long-end supply from Spain and France. US session has several Fed speakers and data including weekly jobless claims, with March jobs report ahead Friday.

In commodities, oil prices are little changed, with WTI trading near $85.40. Spot gold falls 0.3%.

Bitcoin is a touch firmer and at the top-end of the session’s range around USD 66k.

Looking at today’s calendar, the economic data slate includes March Challenger job cuts (the number of job cuts was the highest since January 2023), and the February trade balance and jobless claims (8:30am); Fed speaker slate includes Harker (10am), Barkin (12:15pm), Goolsbee (12:45pm), Mester and Kashkari (2pm), Musalem (7:20pm) and Kugler (7:30pm)

Market Snapshot

- S&P 500 futures up 0.3% to 5,283.25

- STOXX Europe 600 up 0.2% to 511.00

- MXAP up 0.7% to 176.49

- MXAPJ up 0.5% to 539.66

- Nikkei up 0.8% to 39,773.14

- Topix up 0.9% to 2,732.00

- Hang Seng Index down 1.2% to 16,725.10

- Shanghai Composite down 0.2% to 3,069.30

- Sensex up 0.6% to 74,311.08

- Australia S&P/ASX 200 up 0.4% to 7,817.34

- Kospi up 1.3% to 2,742.00

- German 10Y yield little changed at 2.37%

- Euro up 0.2% to $1.0860

- Brent Futures down 0.4% to $89.03/bbl

- Gold spot down 0.3% to $2,293.50

- US Dollar Index down 0.15% to 104.10

Top Overnight News

- Chinese authorities nudged Swiss agrichemicals and seeds group Syngenta to withdraw its application for a long-delayed $9 billion IPO in Shanghai on concerns about the impact a sizeable new offering would have on a volatile market, four people said. RTRS

- The Bank of Japan cut its economic assessment for most regions on Thursday but signaled its confidence that wage hikes were broadening, leaving scope for another hike in the country’s still-low interest rates. RTRS

- U.K. businesses expect wages to rise at a slower pace over the coming 12 months, a finding that will help reassure policy makers at the Bank of England that inflation has been tamed. WSJ

- Swiss inflation cools by more than anticipated, coming in at +1.1% Y/Y in Mar (on an EU harmonized basis) vs. the Street +1.4% and down from +1.2% in Feb. BBG

- Cease-fire negotiations between Israel and Hamas are stalling again, Israeli officials say, with large gaps between the sides over hostages, prisoners and the future of Gaza. BBG

- Italian authorities have arrested 23 people and seized more than €600mn as they investigate suspected fraud involving the EU’s €800bn Covid recovery funds. FT

- US institutional investors are selling more of their private equity holdings at a discount as they cut exposure to the illiquid asset class. Led by pension funds and endowments, big investors sold 99% of their private equity holdings at or below their net asset value on the secondary market last year, the most since the investment bank began tracking the figure in 2017. The figures were 95% in 2022 and 73% in 2021. FT

- Boeing’s 737 MAX production has plunged in recent weeks in response to FAA scrutiny and steps by the company to improve quality and reliability. RTRS

- Google could begin charging for a new AI-powered premium search product (AI-powered search eats up much more computing resources than traditional search, which is why Google may look to charge for the experience). FT

- Quarterly path of S&P 500 EPS year/year growth. Positive EPS surprises averaged 4 pp during the past 4 quarters…

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher as sentiment picked up from the choppy mood and mixed data releases stateside, despite thinned conditions with markets across Greater China shut for the Qingming Festival. ASX 200 was led by strength in gold miners after the precious metal rose above USD 2,300/oz for the first time. Nikkei 225 outperformed and spent most of the session above the 40,000 level with the help of a predominantly weaker currency. KOSPI was boosted by tech strength with Samsung underpinned ahead of its preliminary earnings results on Friday with its profit seen to rise to the largest in six quarters on higher chip prices, while SK Hynix was lifted amid plans to invest USD 3.9bln to build an Indiana plant.

Top Asian News

- Iron Ore Drops Toward 10-Month Low as Australian Exports Climb

- Taiwan Begins Recovery From Quake as TSMC Resumes Production

- Foreign Funds Sold Most Japanese Stocks, Futures in Six Months

- Goldman Sees Korean Deals Boom on Push for Reform: ECM Watch

- Egypt Buys LNG in Rare Move to Avoid Summer Gas Crunch

- Konica Minolta Jumps on Plan to Cut 2,400 Jobs, Boost Profit

European bourses are modestly in the green after a relatively flat/directionless cash open, Euro Stoxx 50 +0.1%; modest post-open upside emerged after revisions to the Final EZ PMIs where Composite returned to expansion. Sectors do not have any overarching theme or bias present; basic resources outperform given base metal prices. Stateside, ES +0.3%, futures are tilting higher in tandem with European futures into another session dominated by Fed appearances alongside weekly IJC data before attention focuses on Friday’s payrolls.

Top European News

- Riksbank Minutes (Mar): No overt mention of preference between May or June for a rate cut among the members.

- BoE Monthly Decision Maker Panel – One-year ahead CPI inflation expectations declined further to 3.2% in March, down from 3.3% in February.

- ECB’s Kazimir says he opposed reviving any “special tools of monetary policy”, according to Bloomberg; declined to comment on current monetary policy due to the ECB’s quiet period ahead of next week’s meeting.

FX

- USD remains under modest pressure following on from the post-ISM sell off; DXY nearing 104.00 to the downside below which the 50- & 200-DMAs reside at 103.88 and 103.76.

- EUR continues to inch higher after a softer start to the week, modest support perhaps arising from the PMI revisions while the docket ahead is headlined by ECB Minutes, though these are likely stale; last week’s EUR/USD high next at 1.0864.

- Sterling steady and unaffected by PMIs or the latest BoE DMP; GBP/USD yet to convincingly surpass the 100- & 50-DMAs at 1.2663 and 1.2667 respectively.

- JPY steady and unreactive to light jawboning overnight, former top-diplomat Watanabe said intervention is not likely unless USD/JPY sharply eclipses 155.00.

- CHF the current laggard after another cool Swiss inflation print which has seen market pricing move more convincingly in favour of a second cut in June, though multiple months of data due before then.

Fixed Income

- EGBs bid despite modest pressure emerging on the morning’s upwardly-revised PMIs. Action which eroded some of the concession into supply from France & Spain, though the auctions were still well received.

- Bunds firmer by around 30 ticks but within a similar magnitude of the post-PMI 132.30 base; ECB minutes ahead.

- Gilts followed EGBs into their own data points, with the benchmark unreactive to a modest revision lower (commentary focused on the stickiness of inflation) while the BoE DMP saw inflation expectations edge lower once again. Despite a robust DMO sale, Gilts lost the 99.00 mark but continue to modestly outperform EGBs.

- US Treasuries are essentially flat, have been directionally moving with the above but yet to differ from the unchanged mark by more than a handful of ticks. Action which comes as a slight breather from recent sessions and after Powell reassured those who were expecting/concerned about a hawkish shift.

Commodities

- 3M LME Copper tested USD 9.4k/T to the upside and resides at a fresh 52 week high on the morning’s PMIs paint a healthy demand picture; action which comes after an APAC session which saw Chinese markets closed (mainland China returns on Monday).

- Crude benchmarks near the unchanged mark and at the mid-point of circa. USD 0.80/bbl bounds with specifics light thus far into broader macro events.

- Spot gold a touch softer irrespective of the modest USD pullback, action which comes as the yellow metal takes a modest breather from recent upside and as US yields inch higher.

Geopolitics: Middle East

- US official said the Biden administration is calling on the Israeli army to modify its way of transmitting information about the stationing of aid workers and Biden plans to demand these changes. Furthermore, Biden is angry and largely frustrated over the killing of aid workers in Gaza and is ready to clarify his view to Netanyahu during their expected phone call today, while the official added there is no shift in Washington’s policy towards Israel, but there is a shift in President Biden’s frustrations, according to CNN.

- US Pentagon said Defence Secretary Austin spoke with Israeli Defence Minister Gallant on Wednesday and expressed his outrage at the Israeli strike on a World Central Kitchen humanitarian aid convoy, while Austin stressed the need to immediately take concrete steps to protect aid workers and Palestinian civilians in Gaza after repeated coordination failures with foreign aid groups.

Geopolitics: Other

- France denied it showed any readiness for Ukraine dialogue in talks with Russia, according to a French government source.

- Tokyo is in talks with Manila over sending troops to the Philippines in which a possible deployment comes as they boost efforts to deter China in the South China Sea, according to FT.

- Russia’s Kremlin says relations with NATO have slid to a level of direct confrontation; NATO continues “to move towards our borders”

US Event Calendar

- 07:30: March Challenger Job Cuts 0.7% YoY, prior 8.8%

- 08:30: March Continuing Claims, est. 1.81m, prior 1.82m

- 08:30: March Initial Jobless Claims, est. 214,000, prior 210,000

- 08:30: Feb. Trade Balance, est. -$67.6b, prior -$67.4b

Central banke speakers

- 10:00: Fed’s Harker Participates in Fireside Chat

- 12:15: Fed’s Barkin Speaks on Economic Outlook

- 12:45: Fed’s Goolsbee Participates in Moderated Q&A

- 14:00: Fed’s Mester Gives Remarks on Economic Outlook

- 14:00: Fed’s Kashkari Discusses US Economy

- 19:20: Fed’s Musalem Gives Introductory Remarks

- 19:30: Fed’s Kugler Speaks on Enriching Data

DB’s Jim Reid concludes the overnight wrap

Markets recovered their poise over the last 24 hours, as investors were relieved after Fed Chair Powell stuck to his recent views on the economic outlook. In his remarks yesterday, he said that recent data didn’t “materially change the overall picture” and that on inflation “it is too soon to say whether the recent readings represent more than just a bump.” In addition, he reiterated that if “the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year.” So that all helped to validate market pricing, which still expects 71bps of rate cuts from the Fed by the December meeting.

Those comments from Powell supported US Treasuries, and the 2yr yield fell -1.7bps on the day as investors maintained their confidence that rate cuts were still on the agenda this year. The 10yr yield was near flat yesterday (-0.2bps) at 4.35%, but that was actually a sharp decline from earlier in the session, when it hit an intraday peak for 2024 of 4.43%, and overnight there’s only been a modest +1.8bps move back up to 4.37%. That turnaround was partly due to Powell’s remarks, but was also because of the ISM services print for March, which unexpectedly fell to 51.4 (vs. 52.8 expected). And encouragingly on inflation, the prices paid component fell to 53.4 (vs. 58.4 expected), its lowest since March 2020. That contrasted with the upside surprise in the ISM manufacturing on Monday, and combined with Powell’s comments, the release helped to push back against some of the more hawkish narratives over the last couple of sessions.

But even as investors found reassurance from Powell’s speech, it had been a very different story earlier in the day. That was particularly the case after the A DP’s report of private payrolls for March came out, which rose to 184k (vs. 150k expected), and February’s number was revised up by +15k. So that was a fresh sign that the labour market was in good shape ahead of tomorrow’s US jobs report, and it was that release which pushed the 10yr yield up to its intraday peak for 2024 so far. Moreover, it’s worth noting that yesterday saw fresh signs of concern about inflation, as oil prices closed at their highest levels since October. For instance, Brent crude was up +0.48% to $89.35/bbl, whilst WTI was up +0.33% to $85.43/bbl. In fact, Brent crude prices were just shy of $90/bbl at their intraday peak, having briefly traded at $89.99/bbl. That’s also filtering through into consumer prices as well, and the AAA’s daily average of US gasoline prices was up to $3.549/gallon as of Tuesday, which is also its highest since October. Meanwhile, Brent crude prices (+0.30%) continue to move higher overnight, and are currently at $89.62/bbl.

Of course, some of Powell’s comments could be interpreted in a more hawkish light. Among others, he said that “the job of sustainably restoring 2 percent inflation is not yet done”, and that “ We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 percent.” But for now at least, investors are still pricing in a 64% chance of a rate cut by June, so that’s considered the most likely timing for an initial rate cut. And ultimately, there’s still several important data releases between now and June that will help determine the decision, including tomorrow’s jobs report for March, along with the CPI release next week. Indeed, we’ve seen how expectations for rate cuts have shifted a lot already this year, and up until early February, investors were still pricing in a strong probability of a cut in March.

Over in the Euro Area, the prospect of ECB rate cuts this year got fresh support from developments yesterday. In particular, the flash CPI print for March saw headline CPI fall to +2.4% (vs. +2.5% expected), whilst core CPI fell to +2.9% (vs. +3.0% expected), which is its lowest since February 2022. Alongside that, we also heard from Spanish central bank governor De Cos, who said “I think that today my central scenario is that June could actually be the first reduction in interest rates”. That backdrop saw yields on 10yr bunds (-0.3bps) and OATs (-1.4bps) fall back, and those on 10yr gilts saw a larger -3.0bps decline. In terms of rate cut expectations, overnight index swaps are now pricing in 76bps of ECB cuts by the December meeting, which is more than the 71bps currently priced in by Fed Funds futures.

As investors continued to anticipate rate cuts this year, that helped to stabilise equities after two weak sessions at the start of the week. The S&P 500 (+0.11%) posted a marginal gain, helped by some of the more cyclical sectors as well as tech stocks. Both the NASDAQ (+0.23%) and the Magnificent 7 (+0.49%) outperformed, and there was also a recovery among small-cap stocks, with the Russell 2000 (+0.54%) paring back some of its losses from the start of the week. Amid the underperformers, chipmaker Intel fell -8.22% after announcing a weaker outlook for its factory network. Meanwhile in Europe, the STOXX 600 was up +0.29%, and there were also gains for the DAX (+0.46%) and the CAC 40 (+0.29%). Separately, the prospect of rate cuts meant that gold prices (+0.85%) closed at an all-time high in nominal terms of $2,300/oz.

Overnight in Asia, it’s been a quieter session this morning given markets are on holiday in China. But in general, the more positive tone has continued, with the Nikkei (+1.63%), the KOSPI (+1.06%) and the S&P/ASX 200 (+0.45%) all advancing. That’s evident among US and European equity futures too, with those on the S&P 500 (+0.27%) and the STOXX 50 (+0.12%) both pointing towards further gains. Alongside that, data showed that Australia’s composite PMI for March moved up to 53.3, marking its highest level since April 2022.

To the day ahead now, and data releases from the US include the weekly initial jobless claims and the February trade balance. Meanwhile in Europe, there’s the final services and composite PMIs for March, along with Euro Area PPI for February. Otherwise, central bank speakers include the Fed’s Harker, Barkin, Goolsbee, Mester, Kashkari, Musalem and Kugler. And we’ll get the ECB’s account of their March meeting.

Loading…