By Simon White, Bloomberg markets live commentator and reporter

Flows and long-run Fed expectations anticipate the dollar is entering the final stages of its bull run. Long positions will begin to struggle, while currencies better placed to soon start outperforming will look more attractive, such as the EUR or SEK.

The dollar as measured by the DXY has rallied about 20% over the last year, breaking all sorts of things on its way. It breached parity with the euro for the first time in 20 years and took the yen to its weakest level in almost a quarter of a century.

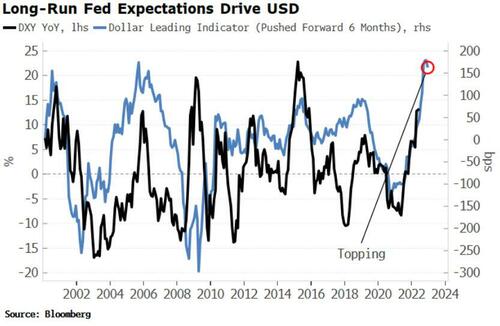

But the market is beginning to see the limits of the Fed hiking cycle. Despite the prospect of a 100 bps hike at the July FOMC, deeper cuts starting in 2023 are also being priced as the expectation is the Fed will create a recession that will be met with easier policy.

The result is that long-run Fed rate expectations are beginning to fall, even with aggressive hike bets for meetings to the end of the year. Long-run Fed expectations have given an excellent lead on the dollar, but now they are topping, the dollar may soon run out of steam.

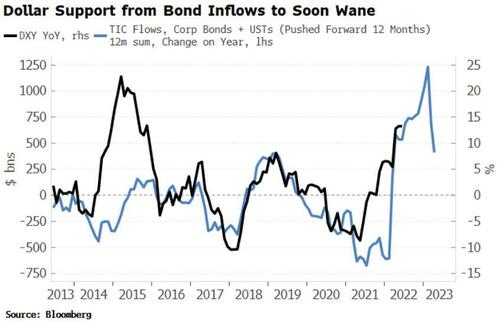

We are seeing the same message from the real yield curve, which is showing the first signs of flattening for over a year. The intuition here is that the real yield curve is a proxy for the inflation-adjusted carry foreign investors in the US earn when buying US debt, borrowing dollars at the short end of the curve and using the proceeds to buy USTs or corporate debt.

Indeed, TIC (Treasury International Data) in the US for foreign transactions for government and corporate bonds leads the dollar by about a year. Foreign demand for US fixed income is waning, suggesting demand for dollars will follow suit soon.

Fixed-income inflows tend to be hedged, but the hedge ratio does not always need to be 100%. Moreover, it is even less likely to be so when the dollar is in a strong upwards trend, making the prospect of extra uplift for foreign investors perhaps too tantalizing to forego. (The data show a much weaker relationship with equity inflows and the dollar, perhaps as bond inflows dwarf equity ones through time.)

Ways to selectively short the dollar will begin to look more inviting, e.g. versus the euro as China stimulus slowly feeds through to Europe, or the SEK, which has been the weakest G-10 currency in recent months, and would act as a higher beta version of the euro.

By Simon White, Bloomberg markets live commentator and reporter

Flows and long-run Fed expectations anticipate the dollar is entering the final stages of its bull run. Long positions will begin to struggle, while currencies better placed to soon start outperforming will look more attractive, such as the EUR or SEK.

The dollar as measured by the DXY has rallied about 20% over the last year, breaking all sorts of things on its way. It breached parity with the euro for the first time in 20 years and took the yen to its weakest level in almost a quarter of a century.

But the market is beginning to see the limits of the Fed hiking cycle. Despite the prospect of a 100 bps hike at the July FOMC, deeper cuts starting in 2023 are also being priced as the expectation is the Fed will create a recession that will be met with easier policy.

The result is that long-run Fed rate expectations are beginning to fall, even with aggressive hike bets for meetings to the end of the year. Long-run Fed expectations have given an excellent lead on the dollar, but now they are topping, the dollar may soon run out of steam.

We are seeing the same message from the real yield curve, which is showing the first signs of flattening for over a year. The intuition here is that the real yield curve is a proxy for the inflation-adjusted carry foreign investors in the US earn when buying US debt, borrowing dollars at the short end of the curve and using the proceeds to buy USTs or corporate debt.

Indeed, TIC (Treasury International Data) in the US for foreign transactions for government and corporate bonds leads the dollar by about a year. Foreign demand for US fixed income is waning, suggesting demand for dollars will follow suit soon.

Fixed-income inflows tend to be hedged, but the hedge ratio does not always need to be 100%. Moreover, it is even less likely to be so when the dollar is in a strong upwards trend, making the prospect of extra uplift for foreign investors perhaps too tantalizing to forego. (The data show a much weaker relationship with equity inflows and the dollar, perhaps as bond inflows dwarf equity ones through time.)

Ways to selectively short the dollar will begin to look more inviting, e.g. versus the euro as China stimulus slowly feeds through to Europe, or the SEK, which has been the weakest G-10 currency in recent months, and would act as a higher beta version of the euro.