Over the past year, there has been a surge in doom-and-gloom headlines about China's economy. The country's mercantilist policymakers have spent months attempting to stimulate a fragile economy through monetary easing while keeping the real estate crisis at bay. However, a more optimistic view is emerging as Chinese macroeconomic data and stocks stabilize, with the commodity market now indicating signs of a more favorable economic outlook heading into spring.

Bloomberg reports iron ore prices in Asia are headed for the largest two-day rally in more than two years, fueled by prospects of a bump in steel demand and output in the world's second-largest economy.

According to financial firm Macquarie Group, April and May are the most active periods for construction across China. They noted that iron ore inventories are peaking at ports, and steel output at the nation's blast furnaces has already increased.

There's a "bit of a reversion back to normal seasonal trends where you have higher hot metal production throughout the middle of the year," Rob Stein, a metals analyst at Macquarie, told Bloomberg in a phone interview. Stein added that this should help iron ore to achieve a price range between $110 and $120 a ton.

Nick Savone, global head of equity sales at Morgan Stanley, wrote in a note to clients that his "team's supply/demand model shows a closely balanced market, supporting prices well above the cash cost curve, which continues to move higher. They see upside to spot price, to $120/t in Q3, as Chinese stocks draw down on stable demand and lack of further upside to seaborne supply."

Despite China's economy being plagued with many problems, including a real estate bust, deflation, debt troubles, demographic winter, foreign investor exodus, supply chain fracturing, and deteriorating Sino-US ties, recent macroeconomic data shows a potential bottom forming.

China's official factory purchasing managers index moved into expansion last month, the first time since September. The services sector index hit the highest level since June, and a separate factory index from and S&P Global hit to a 13-month high.

Late last month, China's President Xi Jinping met with more than a dozen American business leaders, including Stephen Schwarzman of Blackstone Inc. and Cristiano Amon of Qualcomm Inc., to restore confidence in the Chinese economy.

The CSI 300 Index found a floor at the start of February and rose 13% through early April. After halving since February 2021, the multi-year equity rout appears stabilized (for now).

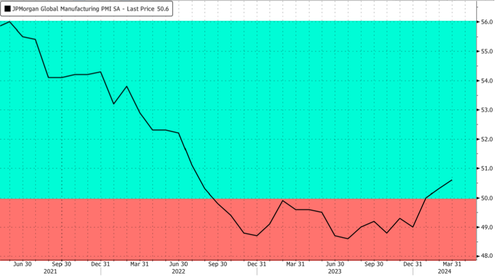

Meanwhile, the JPM Global MFG PMI index bottomed for the past year and recently moved into expansion territory.

The question on everyone's mind is if the world's second-largest economy has finally bottomed. If so, the global economy could be on a soft landing path. If not, look out below...

Over the past year, there has been a surge in doom-and-gloom headlines about China’s economy. The country’s mercantilist policymakers have spent months attempting to stimulate a fragile economy through monetary easing while keeping the real estate crisis at bay. However, a more optimistic view is emerging as Chinese macroeconomic data and stocks stabilize, with the commodity market now indicating signs of a more favorable economic outlook heading into spring.

Bloomberg reports iron ore prices in Asia are headed for the largest two-day rally in more than two years, fueled by prospects of a bump in steel demand and output in the world’s second-largest economy.

According to financial firm Macquarie Group, April and May are the most active periods for construction across China. They noted that iron ore inventories are peaking at ports, and steel output at the nation’s blast furnaces has already increased.

There’s a “bit of a reversion back to normal seasonal trends where you have higher hot metal production throughout the middle of the year,” Rob Stein, a metals analyst at Macquarie, told Bloomberg in a phone interview. Stein added that this should help iron ore to achieve a price range between $110 and $120 a ton.

Nick Savone, global head of equity sales at Morgan Stanley, wrote in a note to clients that his “team’s supply/demand model shows a closely balanced market, supporting prices well above the cash cost curve, which continues to move higher. They see upside to spot price, to $120/t in Q3, as Chinese stocks draw down on stable demand and lack of further upside to seaborne supply.”

Despite China’s economy being plagued with many problems, including a real estate bust, deflation, debt troubles, demographic winter, foreign investor exodus, supply chain fracturing, and deteriorating Sino-US ties, recent macroeconomic data shows a potential bottom forming.

China’s official factory purchasing managers index moved into expansion last month, the first time since September. The services sector index hit the highest level since June, and a separate factory index from and S&P Global hit to a 13-month high.

Late last month, China’s President Xi Jinping met with more than a dozen American business leaders, including Stephen Schwarzman of Blackstone Inc. and Cristiano Amon of Qualcomm Inc., to restore confidence in the Chinese economy.

The CSI 300 Index found a floor at the start of February and rose 13% through early April. After halving since February 2021, the multi-year equity rout appears stabilized (for now).

Meanwhile, the JPM Global MFG PMI index bottomed for the past year and recently moved into expansion territory.

The question on everyone’s mind is if the world’s second-largest economy has finally bottomed. If so, the global economy could be on a soft landing path. If not, look out below…

Loading…