While hiring rates for those in the bottom-third of US income distribution has been on a tear (and largely going to part time workers, most of whom are illegal immigrants), white collar jobs hiring is stalling out across much of the US, with industries such as finance, technology, media, and professional services such as law and accounting all suffering despite the national unemployment rate hovering near historic lows.

To wit, nearly 120,000 corporate positions have vanished from San Francisco, Los Angeles and Chicago combined over the past year, according to an analysis by Bloomberg. White-collar payrolls have also declined in various metros such as Phoenix and Seattle, as well as in pandemic boomtowns such as Miami and Austin, which have seen white-collar growth flatline.

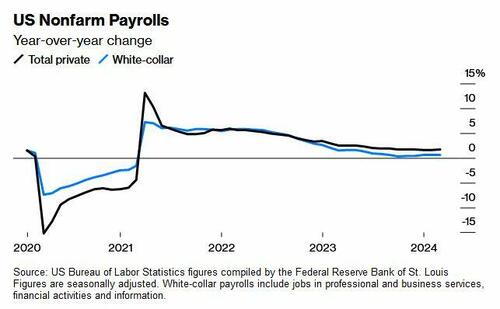

Nationally, payrolls for white-collar types of jobs were up just 0.6% from a year ago in March, about a third of the overall pace of job creation, according to data published by the Bureau of Labor Statistics. Wage growth for high-paid workers has also largely cooled from its peaks.

Banks, consulting firms and tech companies all went on hiring sprees at the height of the pandemic, when low interest rates, easy access to credit and government support made it easier to expand. Many of those incentives have since faded, paving the way for layoffs. Citigroup, McKinsey and Tesla are among the high-profile employers slashing jobs in recent weeks. -Bloomberg

"We’re not seeing the big post-Covid booms anymore," said Alexandra-Dana Gusita, who heads the New York office of Tiger Recruitment. "Employers are more cautious in hiring."

"Even though the labor market looks strong, there’s a lack of job security, especially in tech," said Jack Benedict, 25, who learned that he and 42 other YouTube Music employees had been laid off in February. "All these massive companies are trying to downsize or replace people with AI," he continued, adding that he worries college degrees are "not enough when companies are asking for 10 years of experience."

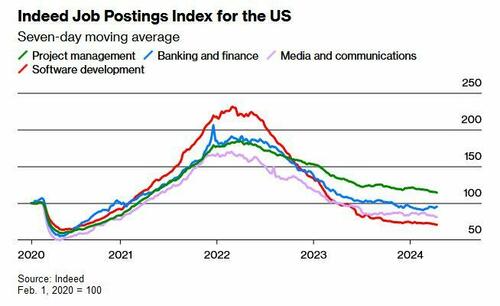

According to jobs website Indeed, the number of openings in banking, finance, media / communications, and software development are all running below levels seen in February 2020, as the pandemic was kicking into high gear.

Part-time white collar?

According to the report, part of the white-collar weakness is the result of a large pullback in 'temporary-help employment' according to the BLS. The category, considered something of an economic bellwether, indicates that businesses are shedding part-time positions before full-time ones. Since the sector peaked two years ago, 420,000 of those jobs have vanished.

In March note, Vanguard's chief global economist, Joe Davis, wrote that demand is greatest for workers making under $55,000 per year, as hiring rates for those in the bottom-third of the US income distribution far outpaced that of higher-income workers.

"Many higher-income workers accepted slower wage growth as a trade-off for remote work flexibility," wrote Davis. "These dynamics have all contributed to the faster rise in wages for lower-income workers."

While hiring rates for those in the bottom-third of US income distribution has been on a tear (and largely going to part time workers, most of whom are illegal immigrants), white collar jobs hiring is stalling out across much of the US, with industries such as finance, technology, media, and professional services such as law and accounting all suffering despite the national unemployment rate hovering near historic lows.

To wit, nearly 120,000 corporate positions have vanished from San Francisco, Los Angeles and Chicago combined over the past year, according to an analysis by Bloomberg. White-collar payrolls have also declined in various metros such as Phoenix and Seattle, as well as in pandemic boomtowns such as Miami and Austin, which have seen white-collar growth flatline.

Nationally, payrolls for white-collar types of jobs were up just 0.6% from a year ago in March, about a third of the overall pace of job creation, according to data published by the Bureau of Labor Statistics. Wage growth for high-paid workers has also largely cooled from its peaks.

Banks, consulting firms and tech companies all went on hiring sprees at the height of the pandemic, when low interest rates, easy access to credit and government support made it easier to expand. Many of those incentives have since faded, paving the way for layoffs. Citigroup, McKinsey and Tesla are among the high-profile employers slashing jobs in recent weeks. -Bloomberg

“We’re not seeing the big post-Covid booms anymore,” said Alexandra-Dana Gusita, who heads the New York office of Tiger Recruitment. “Employers are more cautious in hiring.”

“Even though the labor market looks strong, there’s a lack of job security, especially in tech,” said Jack Benedict, 25, who learned that he and 42 other YouTube Music employees had been laid off in February. “All these massive companies are trying to downsize or replace people with AI,” he continued, adding that he worries college degrees are “not enough when companies are asking for 10 years of experience.”

According to jobs website Indeed, the number of openings in banking, finance, media / communications, and software development are all running below levels seen in February 2020, as the pandemic was kicking into high gear.

Part-time white collar?

According to the report, part of the white-collar weakness is the result of a large pullback in ‘temporary-help employment’ according to the BLS. The category, considered something of an economic bellwether, indicates that businesses are shedding part-time positions before full-time ones. Since the sector peaked two years ago, 420,000 of those jobs have vanished.

In March note, Vanguard’s chief global economist, Joe Davis, wrote that demand is greatest for workers making under $55,000 per year, as hiring rates for those in the bottom-third of the US income distribution far outpaced that of higher-income workers.

“Many higher-income workers accepted slower wage growth as a trade-off for remote work flexibility,” wrote Davis. “These dynamics have all contributed to the faster rise in wages for lower-income workers.“

Loading…