On one hand, the Atlanta Fed triumphantly blasted earlier today that Bidenomics is the greatest thing since sliced bread, helping push its Q2 GDP Nowcast to a whopping 4.2%, up from its latest estimate of 3.3%.

On the other hand, Biden's own DOE - in its latest attempt to slam oil, gas and diesel prices because nothing will crush Biden's re-election chances faster than an oil price spike in the summer - reported that demand for gasoline and diesel in the United States has plunged to its lowest seasonally since the onset of the COVID pandemic, "sparking concern that economic activity is now becoming stagnant as refining margins hit news lows not seen in months", Reuters reported.

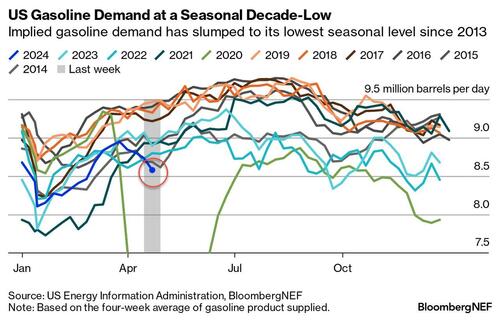

As shown in the chart below, monthly averages for the week ended May 3 show gasoline demand at 8.63 million barrels per day–a figure not seen since May 2020, at the start of the pandemic, based on EIA data.

Data also showed demand for distillates - the most accurate proxy for overall economic activity - plunged to 3.6 million bpd, which was also a seasonal low not hit since the pandemic. Additionally, for the first time in approximately three months, the 3-2-1 crack spread which serves as a barometer for refining markets, was trading under $26.50 per barrel on Wednesday, Reuters reports, for the lowest crack spread in three years.

Needless to say, this means someone is lying: either the US economy is shrinking, which bad for Biden, or gasoline demand is far higher than reported, which is also bad for Biden. But since under the current fascist regime truth is a casualty to getting re-elected, we are being served a fake Potemkin village, one where growth is exploding as energy prices are tumbling, day after day and somehow people still believe this bullshit.

"The gasoline situation was going to be looked at by everybody and it definitely disappointed," Mizuho analyst Robert Yawger told Reuters, adding that "If that's indicative of the performance of the economy, that's bad all around."

The EIA inventory report showed U.S. distillates adding 600,000 barrels to inventory for the week ended May 3, with average production at 4.8 million barrels per day. Gasoline inventory also increased by 900,000 barrels for the week ended May 3, with production averaging 9.5 million barrels per day.

Crude oil prices lost more ground on Wednesday following the EIA’s weekly inventory report, which showed a draw of 1.4 million barrels for the week to May 3, but following a significant 7-million-barrel build from the previous week that put downward pressure on prices.

On one hand, the Atlanta Fed triumphantly blasted earlier today that Bidenomics is the greatest thing since sliced bread, helping push its Q2 GDP Nowcast to a whopping 4.2%, up from its latest estimate of 3.3%.

On the other hand, Biden’s own DOE – in its latest attempt to slam oil, gas and diesel prices because nothing will crush Biden’s re-election chances faster than an oil price spike in the summer – reported that demand for gasoline and diesel in the United States has plunged to its lowest seasonally since the onset of the COVID pandemic, “sparking concern that economic activity is now becoming stagnant as refining margins hit news lows not seen in months“, Reuters reported.

As shown in the chart below, monthly averages for the week ended May 3 show gasoline demand at 8.63 million barrels per day–a figure not seen since May 2020, at the start of the pandemic, based on EIA data.

Data also showed demand for distillates – the most accurate proxy for overall economic activity – plunged to 3.6 million bpd, which was also a seasonal low not hit since the pandemic. Additionally, for the first time in approximately three months, the 3-2-1 crack spread which serves as a barometer for refining markets, was trading under $26.50 per barrel on Wednesday, Reuters reports, for the lowest crack spread in three years.

Needless to say, this means someone is lying: either the US economy is shrinking, which bad for Biden, or gasoline demand is far higher than reported, which is also bad for Biden. But since under the current fascist regime truth is a casualty to getting re-elected, we are being served a fake Potemkin village, one where growth is exploding as energy prices are tumbling, day after day and somehow people still believe this bullshit.

“The gasoline situation was going to be looked at by everybody and it definitely disappointed,” Mizuho analyst Robert Yawger told Reuters, adding that “If that’s indicative of the performance of the economy, that’s bad all around.”

The EIA inventory report showed U.S. distillates adding 600,000 barrels to inventory for the week ended May 3, with average production at 4.8 million barrels per day. Gasoline inventory also increased by 900,000 barrels for the week ended May 3, with production averaging 9.5 million barrels per day.

Crude oil prices lost more ground on Wednesday following the EIA’s weekly inventory report, which showed a draw of 1.4 million barrels for the week to May 3, but following a significant 7-million-barrel build from the previous week that put downward pressure on prices.

Loading…