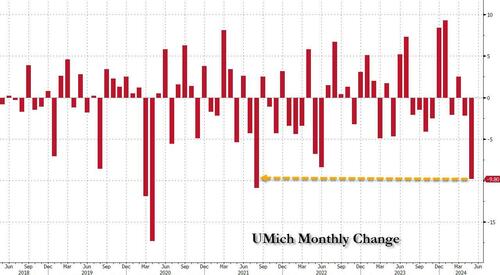

Moments ago the University of Michigan released the latest "report card" on Bidenomics, and to nobody's surprise - except perhaps a certain senile teleprompter reading, diaper wearing puppet in the White House - it was a total disaster, as Sentiment "unexpectedly" plunged from 77.2 to 67.4, the 9.8 point drop the biggest since August 2021...

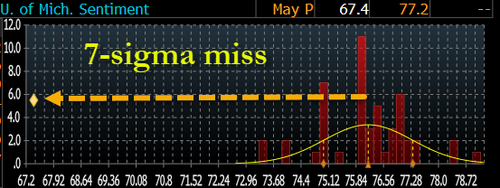

... and was not only a 7-sigma miss to expectations of a 76.2 print...

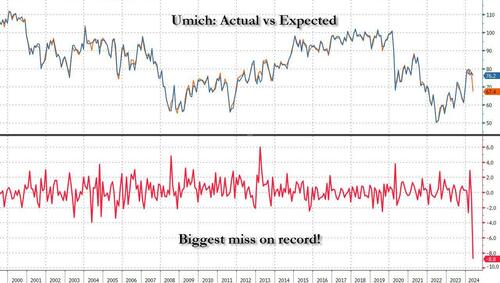

... but was the biggest miss on record!

The collapse in sentiment was broad based, and hammered both current conditions - which plunged from 79.0 to 68.8, badly missing estimates of 79.0 - and also expectations, which plunged from 76.0 to 66.5 (and far below the 75.0 estimated).

The decline in sentiment was broad across age, income and education groups, and also reflected growing concerns about high interest rates. While the labor market has driven economic growth over the last year, the downbeat assessment highlighted in the report adds to evidence of a slowdown.

“Strength in household incomes has been the primary source of support for robust consumer spending over the past couple of years, so a softening in labor market expectations is concerning and -- if it continues -- may lead to a pullback in consumers’ willingness to spend,’’ Joanne Hsu, director of the survey, said in a statement.

But wait there's more, because if that was the "stag" part of the report, the UMich report also confirmed that the "flation" isn't far behind, as the inflation outlook suddenly deteriorated quite dramatically, to wit: 1Year inflation expectations jumped from 3.2% to 2.5%, the highest since November 2023 (and far above estimates of 3.2%), while 5-10 Year inflation expectations also rose from 3.0% to 3.1%, the highest since November.

If that wasn't enough, the university's measure of buying conditions for durable goods, some of which are financed, also decreased to a one-year low. And finally, consumers’ perception of their financial situation, as well as short- and long-term economic outlooks, decreased this month.

“Worse yet, consumers expect the pain to continue, as expectations for interest rates deteriorated considerably this month,” Hsu said. “Only one quarter of consumers expect interest rates to fall in the year ahead, compared with 32% in April.”

One possible reason for the shocking collapse in the print is that, as Pantheon Macro noted ahead of the print, UMich is in the process of switching from phone to an online survey, which according to Pantheon was, get this, "likely to weigh on the headline sentiment because people on the phone are more optimistic than the online applications." Riiight. If anything the transition from phone to online just means that people are actually more truthful in their responses and, well... we just saw the result!

In short: the verdict for Bidenomics is in, and it's a complete disaster, as for Powell's recent laughable comment that he can't see the "stag" nor the "flation"... well, Fed chair, they just bit you on the ass.

Moments ago the University of Michigan released the latest “report card” on Bidenomics, and to nobody’s surprise – except perhaps a certain senile teleprompter reading, diaper wearing puppet in the White House – it was a total disaster, as Sentiment “unexpectedly” plunged from 77.2 to 67.4, the 9.8 point drop the biggest since August 2021…

… and was not only a 7-sigma miss to expectations of a 76.2 print…

… but was the biggest miss on record!

The collapse in sentiment was broad based, and hammered both current conditions – which plunged from 79.0 to 68.8, badly missing estimates of 79.0 – and also expectations, which plunged from 76.0 to 66.5 (and far below the 75.0 estimated).

The decline in sentiment was broad across age, income and education groups, and also reflected growing concerns about high interest rates. While the labor market has driven economic growth over the last year, the downbeat assessment highlighted in the report adds to evidence of a slowdown.

“Strength in household incomes has been the primary source of support for robust consumer spending over the past couple of years, so a softening in labor market expectations is concerning and — if it continues — may lead to a pullback in consumers’ willingness to spend,’’ Joanne Hsu, director of the survey, said in a statement.

But wait there’s more, because if that was the “stag” part of the report, the UMich report also confirmed that the “flation” isn’t far behind, as the inflation outlook suddenly deteriorated quite dramatically, to wit: 1Year inflation expectations jumped from 3.2% to 2.5%, the highest since November 2023 (and far above estimates of 3.2%), while 5-10 Year inflation expectations also rose from 3.0% to 3.1%, the highest since November.

If that wasn’t enough, the university’s measure of buying conditions for durable goods, some of which are financed, also decreased to a one-year low. And finally, consumers’ perception of their financial situation, as well as short- and long-term economic outlooks, decreased this month.

“Worse yet, consumers expect the pain to continue, as expectations for interest rates deteriorated considerably this month,” Hsu said. “Only one quarter of consumers expect interest rates to fall in the year ahead, compared with 32% in April.”

One possible reason for the shocking collapse in the print is that, as Pantheon Macro noted ahead of the print, UMich is in the process of switching from phone to an online survey, which according to Pantheon was, get this, “likely to weigh on the headline sentiment because people on the phone are more optimistic than the online applications.” Riiight. If anything the transition from phone to online just means that people are actually more truthful in their responses and, well… we just saw the result!

In short: the verdict for Bidenomics is in, and it’s a complete disaster, as for Powell’s recent laughable comment that he can’t see the “stag” nor the “flation”… well, Fed chair, they just bit you on the ass.

Loading…