Authored by Simon White, Bloomberg macro strategist,

After Nvidia’s earnings beat on Wednesday, rising CEO confidence points to a general increase in US earnings growth. How long it lasts, though, depends on how much more the economic cycle has left in the tank.

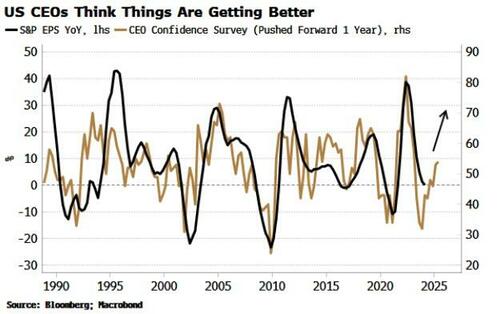

You may have heard there’s going to be a UK election soon. When Rishi Sunak made the announcement outside Downing Street, D Ream’s 1990s’ pop-synth hit Things Can Only Get Better echoed in the background. Based on survey data, US CEOs might be bopping along to the same tune. CEO confidence has been rising, which often means earnings soon follow suit.

EPS growth for the S&P 500 has been flat, and if CEO confidence isn’t misplaced, it should soon start to rise. That’s even more the case, as when CEOs are upbeat stock buybacks tend to rise too, reducing the share count and providing another EPS tailwind.

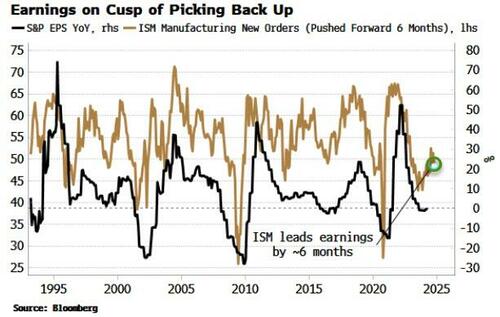

Nvidia and other firms’ earnings began to inflect higher last summer, but earnings more broadly should start to pick up too. Relationships in the economy operate with lags, so the re-acceleration in the cycle about six-to-nine months ago is expected to start to feed through more broadly around now.

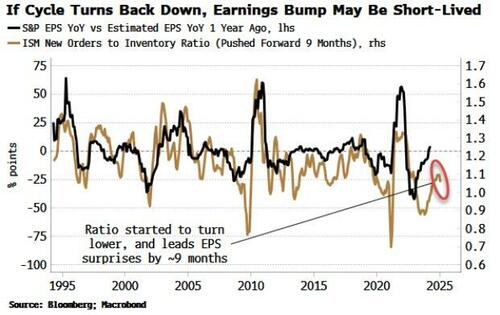

An increase in earnings growth should be baked in the cake. How long it lasts is another question. The new orders-to-inventory ratio in the ISM, i.e. whether purchasing managers are expecting to accumulate inventory or will have to produce more to keep up with orders, has been falling and has slipped below one.

If sustained, it shows that earnings could be disappointing expectations by early next year.

The chart below shows the ISM ratio leads the difference between EPS and forward EPS one year ago, by about nine months.

Near-term recession risk remains low for now, although that could change quickly. That means that things can only get better for earnings growth in the coming months, but not for too long.

Authored by Simon White, Bloomberg macro strategist,

After Nvidia’s earnings beat on Wednesday, rising CEO confidence points to a general increase in US earnings growth. How long it lasts, though, depends on how much more the economic cycle has left in the tank.

You may have heard there’s going to be a UK election soon. When Rishi Sunak made the announcement outside Downing Street, D Ream’s 1990s’ pop-synth hit Things Can Only Get Better echoed in the background. Based on survey data, US CEOs might be bopping along to the same tune. CEO confidence has been rising, which often means earnings soon follow suit.

EPS growth for the S&P 500 has been flat, and if CEO confidence isn’t misplaced, it should soon start to rise. That’s even more the case, as when CEOs are upbeat stock buybacks tend to rise too, reducing the share count and providing another EPS tailwind.

Nvidia and other firms’ earnings began to inflect higher last summer, but earnings more broadly should start to pick up too. Relationships in the economy operate with lags, so the re-acceleration in the cycle about six-to-nine months ago is expected to start to feed through more broadly around now.

An increase in earnings growth should be baked in the cake. How long it lasts is another question. The new orders-to-inventory ratio in the ISM, i.e. whether purchasing managers are expecting to accumulate inventory or will have to produce more to keep up with orders, has been falling and has slipped below one.

If sustained, it shows that earnings could be disappointing expectations by early next year.

The chart below shows the ISM ratio leads the difference between EPS and forward EPS one year ago, by about nine months.

Near-term recession risk remains low for now, although that could change quickly. That means that things can only get better for earnings growth in the coming months, but not for too long.

Loading…