US cash markets may be closed for holiday, but index futures continue trading; even so, however, they have barely budged as futures kept to a very narrow range on Monday, as investors weighed the recent blowout results from Nvidia and overall solid earnings season against the outlook for higher-for-longer interest rates.

As of 9:30am, S&P 500 futures were unchanged at 5,320 as the VIX Index held well below its 12-month average, and fast approaching its record lows set in 2017. The market rallied on Friday, with the tech-heavy Nasdaq 100 jumping 1% to a fresh record.

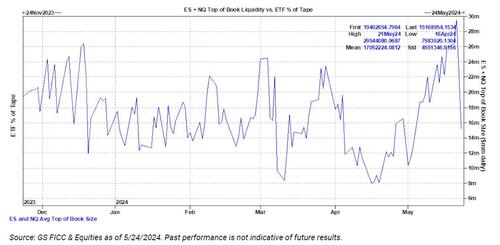

With global liquidity dumping late last week as the latest must-read Goldman weekly note showed...

... and significantly restrained by holidays on both sides of the Atlantic, the US derivatives market is taking a breather as traders assess whether the recent gains are sustainable. So far, investors have focused on the hype around artificial intelligence, while disregarding risks that the Fed will further delay its pivot to monetary easing.

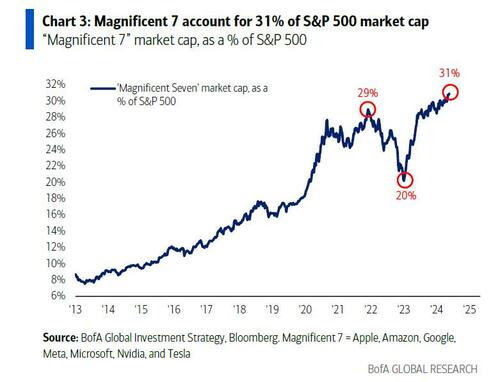

Meanwhile, as Bloomberg writes this morning, the concentration on the Magnificent 7 technology stocks, already at a record high, “is expected to remain sticky” because of their strong balance sheets, faster earnings growth, and extraordinary shareholder remuneration, according to Chiara Robba, head of LDI Equity at Generali Asset Management. Still, investors are now beginning to differentiate between the big tech names, she said in a note.

“If we have seen some catch up of performance of other stock, the market is still concentrated on the seven for their superior EPS growth expected,” she wrote. “The Magnificent 7 will continue to outperform the rest of the market growth, but with a possible three speed: Nvidia continuing to be on the podium, a big chunk of companies in the middle, and Tesla possibly lagging behind.”

Unlike the US, European stocks were open, but were largely flat on a light trading day with markets in the UK and US closed for holidays. The Stoxx 600 Index traded 0.1% higher as of 1:10 p.m. in London, with auto and energy stocks faring best, while banks and technology shares were the biggest decliners.

Among individual movers, EFG International AG rallied 4.6% following a Bloomberg news report after the market close Friday that Julius Baer Group Ltd. is exploring a potential acquisition of its rival Swiss private bank. Julius Baer slipped 0.8%.

Europe’s better-than-feared earnings season has provided support for an historic stock rally, but investors’ focus may now shift to a still-uncertain macro picture. The advance in equities also slowed as questions over the pace and extent of interest rate cuts mounted.

“Given the recent positive economic surprises in Europe and China, we remain positive on European equities, with relatively low positioning in Europe from international investors,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg.

Meanwhile, investors are keeping a close eye on comments from European Central Bank officials as they assess the prospects for monetary policy after a widely telegraphed start to easing at the next ECB meeting in June.

The ECB shouldn’t rule out lowering borrowing costs at both its June and July meetings, Governing Council member Francois Villeroy de Galhau said Monday — pushing back against other monetary officials who are uncomfortable with the idea of consecutive cuts.

In Germany, the business outlook rose for a fourth month as confidence builds that the country’s economic rebound will strengthen over the rest of the year.

Earlier in the session, Asian shipping stocks including China’s Cosco Shipping and South Korea’s HMM rise as rates increase amid market tightness due to factors including Red Sea disruptions.

“Red Sea disruptions have delayed the arrival of the downcycle,” Morgan Stanley analysts including Qianlei Fan and Tenny Song write in a note. “Supply-side risks are accumulating but in the short term are digested by re-routing and strong demand”

Upgrades Cosco Shipping and Orient Overseas to equal-weight from underweight on upside risks to earnings and cash dividends.

In FX, the dollar edges lower amid low trading volumes, with the Treasury market in Japan closed for a US public holiday. USD/JPY falls to remain below 157 while EUR/USD hovers near mid 1.08-1.09. GBP/USD is steady to hold under last week’s high of 1.2761. AUD/USD edges up toward mid 0.66-0.67.

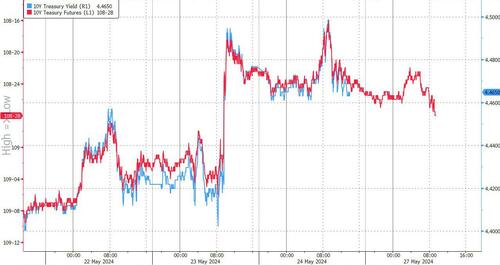

Treasury futures are little changed amid muted trading volumes with cash markets in Japan closed for a US public holiday. In Friday’s US trading session, 2-year yields rose 1bp to 4.95% while 10-year ended down 1bp to 4.67%

The biggest mover overnight is ethereum which is up more than 2% as excitement builds over last week's "shock" approval of the spot ETF.

US cash markets may be closed for holiday, but index futures continue trading; even so, however, they have barely budged as futures kept to a very narrow range on Monday, as investors weighed the recent blowout results from Nvidia and overall solid earnings season against the outlook for higher-for-longer interest rates.

As of 9:30am, S&P 500 futures were unchanged at 5,320 as the VIX Index held well below its 12-month average, and fast approaching its record lows set in 2017. The market rallied on Friday, with the tech-heavy Nasdaq 100 jumping 1% to a fresh record.

With global liquidity dumping late last week as the latest must-read Goldman weekly note showed…

… and significantly restrained by holidays on both sides of the Atlantic, the US derivatives market is taking a breather as traders assess whether the recent gains are sustainable. So far, investors have focused on the hype around artificial intelligence, while disregarding risks that the Fed will further delay its pivot to monetary easing.

Meanwhile, as Bloomberg writes this morning, the concentration on the Magnificent 7 technology stocks, already at a record high, “is expected to remain sticky” because of their strong balance sheets, faster earnings growth, and extraordinary shareholder remuneration, according to Chiara Robba, head of LDI Equity at Generali Asset Management. Still, investors are now beginning to differentiate between the big tech names, she said in a note.

“If we have seen some catch up of performance of other stock, the market is still concentrated on the seven for their superior EPS growth expected,” she wrote. “The Magnificent 7 will continue to outperform the rest of the market growth, but with a possible three speed: Nvidia continuing to be on the podium, a big chunk of companies in the middle, and Tesla possibly lagging behind.”

Unlike the US, European stocks were open, but were largely flat on a light trading day with markets in the UK and US closed for holidays. The Stoxx 600 Index traded 0.1% higher as of 1:10 p.m. in London, with auto and energy stocks faring best, while banks and technology shares were the biggest decliners.

Among individual movers, EFG International AG rallied 4.6% following a Bloomberg news report after the market close Friday that Julius Baer Group Ltd. is exploring a potential acquisition of its rival Swiss private bank. Julius Baer slipped 0.8%.

Europe’s better-than-feared earnings season has provided support for an historic stock rally, but investors’ focus may now shift to a still-uncertain macro picture. The advance in equities also slowed as questions over the pace and extent of interest rate cuts mounted.

“Given the recent positive economic surprises in Europe and China, we remain positive on European equities, with relatively low positioning in Europe from international investors,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg.

Meanwhile, investors are keeping a close eye on comments from European Central Bank officials as they assess the prospects for monetary policy after a widely telegraphed start to easing at the next ECB meeting in June.

The ECB shouldn’t rule out lowering borrowing costs at both its June and July meetings, Governing Council member Francois Villeroy de Galhau said Monday — pushing back against other monetary officials who are uncomfortable with the idea of consecutive cuts.

In Germany, the business outlook rose for a fourth month as confidence builds that the country’s economic rebound will strengthen over the rest of the year.

Earlier in the session, Asian shipping stocks including China’s Cosco Shipping and South Korea’s HMM rise as rates increase amid market tightness due to factors including Red Sea disruptions.

“Red Sea disruptions have delayed the arrival of the downcycle,” Morgan Stanley analysts including Qianlei Fan and Tenny Song write in a note. “Supply-side risks are accumulating but in the short term are digested by re-routing and strong demand”

Upgrades Cosco Shipping and Orient Overseas to equal-weight from underweight on upside risks to earnings and cash dividends.

In FX, the dollar edges lower amid low trading volumes, with the Treasury market in Japan closed for a US public holiday. USD/JPY falls to remain below 157 while EUR/USD hovers near mid 1.08-1.09. GBP/USD is steady to hold under last week’s high of 1.2761. AUD/USD edges up toward mid 0.66-0.67.

Treasury futures are little changed amid muted trading volumes with cash markets in Japan closed for a US public holiday. In Friday’s US trading session, 2-year yields rose 1bp to 4.95% while 10-year ended down 1bp to 4.67%

The biggest mover overnight is ethereum which is up more than 2% as excitement builds over last week’s “shock” approval of the spot ETF.

Loading…