As we previewed last month, OPEC+ agreed to extend its oil production cuts well into 2025, while also setting a timeline for gradually winding down some of those curbs later this year.

As reported by Bloomberg, the agreement reached in the Saudi capital Riyadh on Sunday exceeds market expectations in some ways, extending so-called “voluntary” cuts from key members including Saudi Arabia and Russia well into next year. However, it also begins rolling back those supply reductions in October, earlier than some OPEC-watchers had assumed.

The OPEC+ agreement prolongs roughly 2 million barrels a day of cuts, which have played a key role in supporting crude prices above $80 a barrel this year but were set to expire at the end of June. The curbs will continue in full in the third quarter then be gradually phased out over the following 12 months, according to a statement from the Saudi Energy Ministry.

This is how Energy Intel's Amina Bakr summarizes the latest OPEC+ deal:

1. The group will extend its collective cuts (a mix of voluntary and group cuts) which amount to around 3.6 million bpd until the end of 2025.

2. The 8 states which offered the 2.2 million bpd voluntary cuts will extend those till q3 2024. After that they will start being back production gradually from October 2024 till September 2025, subject to market conditions.

Highlights from the agreement: the UAE received an upward adjustment to 300k to its baseline which is now 3.5 million bpd

Another highlight is that the baseline revisions have now been pushed back to 2026, and that’s because some countries like Russia are under embargo and the independent companies are not able to have access to data to support the assessment process.

Do not underestimate the level of cohesion that is required to reach this complex policy which will be in place for the next year and a half.

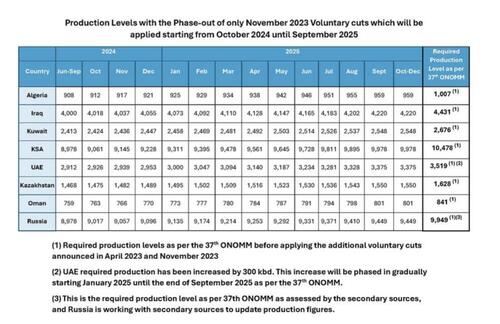

And this is what the phase out of the voluntary cuts will look like:

Lets try to keep this simple. WHAT happens to the top layer of the pyramid (ie the voluntary cuts) after Q3 2024? production will be brought back gradually in October 2024 until September 2025, if the market can support the extra volumes. #OOTT #Opec pic.twitter.com/EwMPrwOwDU

— Amena Bakr (@Amena__Bakr) June 2, 2024

Prior to the meeting, traders and analysts had widely expected OPEC+ to prolong its supply reductions in order to offset soaring output from its rivals, with some predicting they would be maintained until the end of 2024. Under the new agreement, the eight nations participating in these additional curbs will have added about 750,000 barrels a day to the market by January.

#OPEC+: The eight country with voluntary cuts agreed to extend these cuts of 2.2 million barrels per day, which were announced in November 2023, until the end of September 2024. The quantities of this reduction, amounting to 2.2 million barrels per day, will then be restored…

— Giovanni Staunovo🛢 (@staunovo) June 2, 2024

Crude prices had slumped in the past month as Middle East tensions faded and amid a fragile economic outlook in China and doubts about the pace of interest-rate reductions in major industrialized economies. Brent futures settled at $81.62 a barrel on May 31, a drop of 7.1% for the month.

Those “voluntary” cuts by the Organization of Petroleum Exporting Countries and its allies were in addition to an earlier group-wide agreement capping crude output at about 39 million barrels a day, which ran until the end of this year. The alliance said in a statement that it also agreed to prolong that accord to the end of 2025.

“It removes a significant chunk of oil from our balances both this year and next,” said Amrita Sen, director of research and co-founder of Energy Aspects Ltd. The deal “keeps OPEC+ in charge of the market.”

Sunday’s deal suggests OPEC+ leader Saudi Arabia, which hosted the meeting in its capital after initial plans for a gathering in Vienna were canceled, is attempting to strike a balance between supporting crude markets and easing the production restraints against which some members have chafed repeatedly.

Lower oil prices this year have improved the economic outlook by offering some relief to central banks grappling with persistent inflation. Yet they also threaten revenue for producers like Saudi Arabia, which needs prices close to $100 a barrel to fund the ambitious spending plans of Crown Prince Mohammed bin Salman, the International Monetary Fund estimates.

In parallel to the OPEC+ meeting on Sunday, the Saudi government completed a $12 billion sale of shares in state oil giant Aramco, raising funds to help pay for a massive economic transformation plan.

As Bloomberg notes, the agreement temporarily resolves "a potentially fraught debate on some nations’ oil capacity. The alliance had commissioned an external review of its members capabilities with the intention of resetting baseline production levels used to measure cuts in 2025."

Several major exporters were seeking to have their levels upgraded, possibly posing a risk to the group’s efforts to stabilize world markets. The deadline for completion of that process has now been pushed back by a year to November 2026. However, the UAE was given a 300,000 barrel-a-day boost to its production target for next year, making it the clear winner from Sunday’s negotiations.

As we previewed last month, OPEC+ agreed to extend its oil production cuts well into 2025, while also setting a timeline for gradually winding down some of those curbs later this year.

As reported by Bloomberg, the agreement reached in the Saudi capital Riyadh on Sunday exceeds market expectations in some ways, extending so-called “voluntary” cuts from key members including Saudi Arabia and Russia well into next year. However, it also begins rolling back those supply reductions in October, earlier than some OPEC-watchers had assumed.

The OPEC+ agreement prolongs roughly 2 million barrels a day of cuts, which have played a key role in supporting crude prices above $80 a barrel this year but were set to expire at the end of June. The curbs will continue in full in the third quarter then be gradually phased out over the following 12 months, according to a statement from the Saudi Energy Ministry.

This is how Energy Intel’s Amina Bakr summarizes the latest OPEC+ deal:

1. The group will extend its collective cuts (a mix of voluntary and group cuts) which amount to around 3.6 million bpd until the end of 2025.

2. The 8 states which offered the 2.2 million bpd voluntary cuts will extend those till q3 2024. After that they will start being back production gradually from October 2024 till September 2025, subject to market conditions.

Highlights from the agreement: the UAE received an upward adjustment to 300k to its baseline which is now 3.5 million bpd

Another highlight is that the baseline revisions have now been pushed back to 2026, and that’s because some countries like Russia are under embargo and the independent companies are not able to have access to data to support the assessment process.

Do not underestimate the level of cohesion that is required to reach this complex policy which will be in place for the next year and a half.

And this is what the phase out of the voluntary cuts will look like:

Lets try to keep this simple. WHAT happens to the top layer of the pyramid (ie the voluntary cuts) after Q3 2024? production will be brought back gradually in October 2024 until September 2025, if the market can support the extra volumes. #OOTT #Opec pic.twitter.com/EwMPrwOwDU

— Amena Bakr (@Amena__Bakr) June 2, 2024

Prior to the meeting, traders and analysts had widely expected OPEC+ to prolong its supply reductions in order to offset soaring output from its rivals, with some predicting they would be maintained until the end of 2024. Under the new agreement, the eight nations participating in these additional curbs will have added about 750,000 barrels a day to the market by January.

#OPEC+: The eight country with voluntary cuts agreed to extend these cuts of 2.2 million barrels per day, which were announced in November 2023, until the end of September 2024. The quantities of this reduction, amounting to 2.2 million barrels per day, will then be restored…

— Giovanni Staunovo🛢 (@staunovo) June 2, 2024

Crude prices had slumped in the past month as Middle East tensions faded and amid a fragile economic outlook in China and doubts about the pace of interest-rate reductions in major industrialized economies. Brent futures settled at $81.62 a barrel on May 31, a drop of 7.1% for the month.

Those “voluntary” cuts by the Organization of Petroleum Exporting Countries and its allies were in addition to an earlier group-wide agreement capping crude output at about 39 million barrels a day, which ran until the end of this year. The alliance said in a statement that it also agreed to prolong that accord to the end of 2025.

“It removes a significant chunk of oil from our balances both this year and next,” said Amrita Sen, director of research and co-founder of Energy Aspects Ltd. The deal “keeps OPEC+ in charge of the market.”

Sunday’s deal suggests OPEC+ leader Saudi Arabia, which hosted the meeting in its capital after initial plans for a gathering in Vienna were canceled, is attempting to strike a balance between supporting crude markets and easing the production restraints against which some members have chafed repeatedly.

Lower oil prices this year have improved the economic outlook by offering some relief to central banks grappling with persistent inflation. Yet they also threaten revenue for producers like Saudi Arabia, which needs prices close to $100 a barrel to fund the ambitious spending plans of Crown Prince Mohammed bin Salman, the International Monetary Fund estimates.

In parallel to the OPEC+ meeting on Sunday, the Saudi government completed a $12 billion sale of shares in state oil giant Aramco, raising funds to help pay for a massive economic transformation plan.

As Bloomberg notes, the agreement temporarily resolves “a potentially fraught debate on some nations’ oil capacity. The alliance had commissioned an external review of its members capabilities with the intention of resetting baseline production levels used to measure cuts in 2025.”

Several major exporters were seeking to have their levels upgraded, possibly posing a risk to the group’s efforts to stabilize world markets. The deadline for completion of that process has now been pushed back by a year to November 2026. However, the UAE was given a 300,000 barrel-a-day boost to its production target for next year, making it the clear winner from Sunday’s negotiations.

Loading…