Despite a solid bear steepener today - with Macros selling 10s in what may be an early frontrunning of the Norinchukin liquidation - Nomura's Charlie McElligott writes that the bank's Treasury desk flows have continued to favor Customer buying of both rallies and dips, "particularly with foreign Real Money / Japan / Officials, and extending the recent theme where buying is pushing deeper into Duration (as expressed by the strong 30Y and 20Y auctions)…all a function of growing “Confidence in the Slowdown" which is coming just in time for the September, and why not, July Fed meeting so that Biden can enjoy at least 1-2 rate cuts ahead of the election.

Indeed, today’s mixed data extended on this “Slowdown / Normalizing” vibe, with Housing Starts / Building Permits plunging to Covid lockdown lows...

... while Initial and Continuing Claims continue their grind higher...

... yet at the same time, that uncomfortable - rather stagflationary - place too where Philly Fed Prices Paid actually moved higher again...

... despite the broader index tumbling back near to contraction territory.

Putting it all together, the US economy is clearly rolling over, and as the Bloomberg economic surprise index shows as it tumbles to a 5 year low, the magnitude of downside surprises across data are the largest since March 2019.

And to underscore the slowdown in the economy, McElligott notes that the bank's "economic quadrant" has pushed back into 7 of the past 8 weeks after having spent a year in recovery.

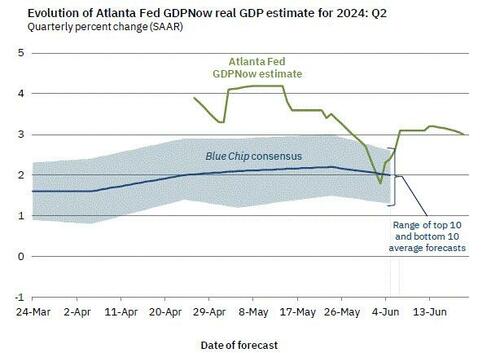

And with the Atlanta Fed about to fade the recent dead cat bounce hard...

... the only question is does the number fade slowly but consistently by the July FOMC to leave the window open for an outside chance at a rate cut then, and an open door for a September cut which is now virtually assured, as the central bank will try to get at least one rate cut in the book before the Nov 5 elections, as the alternative are violent (i.e., sponsored by Soros) Antifa riots in the Marriner Eccles building, as the narrative then changes to Powell being the sole reason why Biden is about to lose to Trump.

Despite a solid bear steepener today – with Macros selling 10s in what may be an early frontrunning of the Norinchukin liquidation – Nomura’s Charlie McElligott writes that the bank’s Treasury desk flows have continued to favor Customer buying of both rallies and dips, “particularly with foreign Real Money / Japan / Officials, and extending the recent theme where buying is pushing deeper into Duration (as expressed by the strong 30Y and 20Y auctions)…all a function of growing “Confidence in the Slowdown” which is coming just in time for the September, and why not, July Fed meeting so that Biden can enjoy at least 1-2 rate cuts ahead of the election.

Indeed, today’s mixed data extended on this “Slowdown / Normalizing” vibe, with Housing Starts / Building Permits plunging to Covid lockdown lows…

… while Initial and Continuing Claims continue their grind higher…

… yet at the same time, that uncomfortable – rather stagflationary – place too where Philly Fed Prices Paid actually moved higher again…

… despite the broader index tumbling back near to contraction territory.

Putting it all together, the US economy is clearly rolling over, and as the Bloomberg economic surprise index shows as it tumbles to a 5 year low, the magnitude of downside surprises across data are the largest since March 2019.

And to underscore the slowdown in the economy, McElligott notes that the bank’s “economic quadrant” has pushed back into 7 of the past 8 weeks after having spent a year in recovery.

And with the Atlanta Fed about to fade the recent dead cat bounce hard…

… the only question is does the number fade slowly but consistently by the July FOMC to leave the window open for an outside chance at a rate cut then, and an open door for a September cut which is now virtually assured, as the central bank will try to get at least one rate cut in the book before the Nov 5 elections, as the alternative are violent (i.e., sponsored by Soros) Antifa riots in the Marriner Eccles building, as the narrative then changes to Powell being the sole reason why Biden is about to lose to Trump.

Loading…