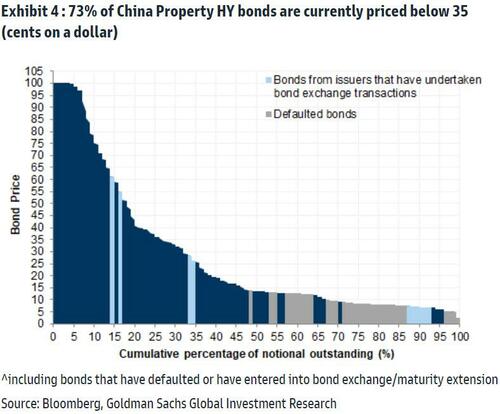

With Chinese property sentiment sinking from bad to worse amid the growing mortgage boycott - which for now remains contained affecting about 1%-2% of China’s $5.8 trillion in mortgages. but spreading rapidly - and Goldman observing over the weekend that over 70% of Chinese property junk bonds (as there are virtually no investment grade bonds left in China real estate) are trading below 35 cents...

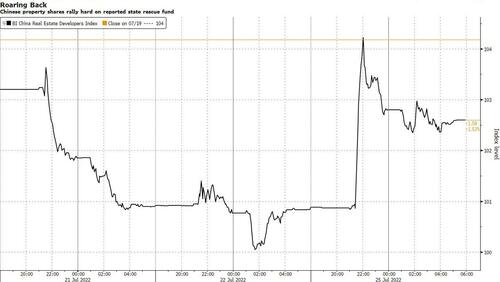

... on Monday, Chinese property stocks and dollar bonds rallied sharply after a reported move by Beijing to establish a fund to support developers fueled optimism about a turnaround for the struggling sector. A Bloomberg Intelligence index of the country’s real estate firms jumped 1.7%, the most in a week...

... while China’s high-yield dollar notes, predominately issued by developers, rose at least 1 cent on the dollar, according to credit traders, with a Bloomberg gauge tracking the sector set for the longest winning streak in two months.

The catalyst for the mood reversal was a report by REDD that China’s State Council has approved a plan to set up a fund to support 12 developers and a few new distressed real estate firms nominated by local authorities. If confirmed, the move would mark one of the most direct measures yet taken by Beijing to salvage a sector roiled by massive defaults, slumping sales and a widening boycott on bank loans.

According to REDD, the fund secured 50 billion yuan ($7.4 billion) from China Construction Bank Corp. and a 30 billion yuan relending facility from the People’s Bank of China, and can be upsized to between 200 billion yuan and 300 billion yuan, it added.

"The mortgage boycott is effectively forcing Beijing to ease credit conditions for developers,” said Amy Xie Patrick, a portfolio manager at Pendal Group Ltd. “The real estate fund, if confirmed, is a stronger initiative compared to previously guiding state banks to lend to property developers, but it won’t be enough to solve the problem unless it can be capitalized by a blank check from the Chinese government,” she said.

Bloomberg was first to report some aspects of the plan last week, revealing that regulators have asked China Construction Bank, the nation’s largest mortgage lender, to explore a pilot program to set up a fund with selected local governments to purchase projects under construction that have yet to find buyers, with the aim of converting them into apartments for long-term rentals.

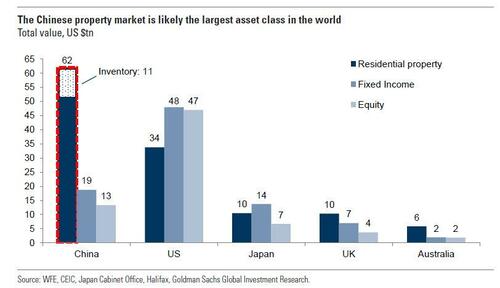

The reported plan for the state fund offers the latest indication of growing ease among policymakers over a deepening housing bust that threatens both financial and social stability, as it sends shock waves through China’s 400-million-strong middle class and upends the belief that real estate is a surefire way to build wealth. As a reminder, Goldman last year calculated that the Chinese property market is the world's biggest asset; needless to say, a crash here would lead to an unprecedented global deflationary shockwave.

In response to the news, property developers surged: Guangzhou R&F Properties Co. gained 5.7%, with Country Garden Holdings Co. was up 4.5%. In the credit market, dollar bonds of investment-grade Chinese developers jumped in tandem with their junk peers, led by China Vanke and Longfor Group Holdings. In the credit market, dollar bonds of investment-grade Chinese developers jumped in tandem with their junk peers, led by China Vanke Co. and Longfor Group Holdings.

Of course, as Jim Chanos was quick to point, the current iteration of the rescue fund is a drop in the bucket...

This $12B “rescue” fund should be seen in proper context. Residential RE is an annual $3T spend in China.

— Diogenes (@WallStCynic) July 25, 2022

... and as Bloomberg notes, the 12 developers expected to benefit from the fund rescue have a combined short-term debt of 742 billion yuan, UBS analysts calculated. The number would swell to 4.05 trillion yuan when taking into account the amount owed to homebuyers and suppliers, they added.

In other words, now that Beijing has cracked and is willing to backstop housing, this is just the start and UBS agrees: despite the fund’s limited size, “clearly the government is signaling it wants to restore homebuyers’ confidence and encourage them to start purchasing houses again,” said Steve Wong, an analyst at Essence International Financial Holdings Ltd. “Setting up a fund is more feasible since a broad-based easing for the sector is unlikely.”

With Chinese property sentiment sinking from bad to worse amid the growing mortgage boycott – which for now remains contained affecting about 1%-2% of China’s $5.8 trillion in mortgages. but spreading rapidly – and Goldman observing over the weekend that over 70% of Chinese property junk bonds (as there are virtually no investment grade bonds left in China real estate) are trading below 35 cents…

… on Monday, Chinese property stocks and dollar bonds rallied sharply after a reported move by Beijing to establish a fund to support developers fueled optimism about a turnaround for the struggling sector. A Bloomberg Intelligence index of the country’s real estate firms jumped 1.7%, the most in a week…

… while China’s high-yield dollar notes, predominately issued by developers, rose at least 1 cent on the dollar, according to credit traders, with a Bloomberg gauge tracking the sector set for the longest winning streak in two months.

The catalyst for the mood reversal was a report by REDD that China’s State Council has approved a plan to set up a fund to support 12 developers and a few new distressed real estate firms nominated by local authorities. If confirmed, the move would mark one of the most direct measures yet taken by Beijing to salvage a sector roiled by massive defaults, slumping sales and a widening boycott on bank loans.

According to REDD, the fund secured 50 billion yuan ($7.4 billion) from China Construction Bank Corp. and a 30 billion yuan relending facility from the People’s Bank of China, and can be upsized to between 200 billion yuan and 300 billion yuan, it added.

“The mortgage boycott is effectively forcing Beijing to ease credit conditions for developers,” said Amy Xie Patrick, a portfolio manager at Pendal Group Ltd. “The real estate fund, if confirmed, is a stronger initiative compared to previously guiding state banks to lend to property developers, but it won’t be enough to solve the problem unless it can be capitalized by a blank check from the Chinese government,” she said.

Bloomberg was first to report some aspects of the plan last week, revealing that regulators have asked China Construction Bank, the nation’s largest mortgage lender, to explore a pilot program to set up a fund with selected local governments to purchase projects under construction that have yet to find buyers, with the aim of converting them into apartments for long-term rentals.

The reported plan for the state fund offers the latest indication of growing ease among policymakers over a deepening housing bust that threatens both financial and social stability, as it sends shock waves through China’s 400-million-strong middle class and upends the belief that real estate is a surefire way to build wealth. As a reminder, Goldman last year calculated that the Chinese property market is the world’s biggest asset; needless to say, a crash here would lead to an unprecedented global deflationary shockwave.

In response to the news, property developers surged: Guangzhou R&F Properties Co. gained 5.7%, with Country Garden Holdings Co. was up 4.5%. In the credit market, dollar bonds of investment-grade Chinese developers jumped in tandem with their junk peers, led by China Vanke and Longfor Group Holdings. In the credit market, dollar bonds of investment-grade Chinese developers jumped in tandem with their junk peers, led by China Vanke Co. and Longfor Group Holdings.

Of course, as Jim Chanos was quick to point, the current iteration of the rescue fund is a drop in the bucket…

This $12B “rescue” fund should be seen in proper context. Residential RE is an annual $3T spend in China.

— Diogenes (@WallStCynic) July 25, 2022

… and as Bloomberg notes, the 12 developers expected to benefit from the fund rescue have a combined short-term debt of 742 billion yuan, UBS analysts calculated. The number would swell to 4.05 trillion yuan when taking into account the amount owed to homebuyers and suppliers, they added.

In other words, now that Beijing has cracked and is willing to backstop housing, this is just the start and UBS agrees: despite the fund’s limited size, “clearly the government is signaling it wants to restore homebuyers’ confidence and encourage them to start purchasing houses again,” said Steve Wong, an analyst at Essence International Financial Holdings Ltd. “Setting up a fund is more feasible since a broad-based easing for the sector is unlikely.”