Authored by Jeffrey Tucker via The Epoch Times,

Last week, this space speculated that the next recession may never be called what it is. Government agencies rely entirely on the National Bureau for Economic Research to call it either way. In October 2020, the NBER posted a clarification that it does not accept the textbook definition of two successive quarters of output decline but instead deploys a more holistic view.

As an example of such a deployment, NBER lists March-April 2020 as a recession due to the severity of the downturn and the high levels of unemployment. It’s hard to disagree with that judgment, though it was one of the strangest recessions in history: it was entirely forced by lockdowns. NBER in this case was using a stricter definition than the textbook.

Now the White House is running with this looser approach, preparing a propaganda push later this week if the second quarter numbers report a negative return. You will see: the spokesperson will absolutely deny there is a recession. Saying there is one will suddenly be seen as a political statement. Affirming that all is well will be the “information” whereas saying otherwise will become “misinformation.”

As for NBER, it is a cautious organization and will likely wait several more quarters before weighing in at all.

Here is the White House statement to prepare the way: “Recession probabilities are never zero, but trends in the data through the first half of this year used to determine a recession are not indicating a downturn.”

In more detail:

“What is a recession? While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle. Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.”

What are the factors that the White House pushes to mitigate against the declaration? No inflation. Never. Instead, the statement emphasizes that “industrial production, employment, and real spending have grown this year.” Note the careful wording: “this year” does not mean right now.

The subject of employment we’ve written about extensively: the labor shortage is spooky and accounts for the whole of the seemingly low numbers in technical unemployment. The 2020 lockdowns introduce labor-market chaos that is nowhere near being resolved and likely won’t be until there are major structural reforms that deregulate markets and curb the subsidies for the idle.

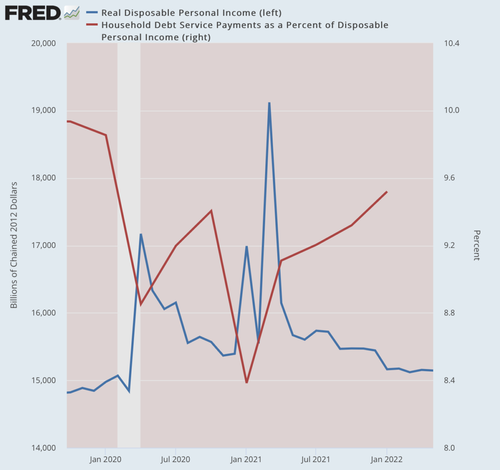

As for real spending, Americans are depleting savings at a massive rate and borrowing in ways that reverse two-year trends. To see this as a good thing would require full immersion in 90-year-old Keynesian hydraulics. The reality is more clearly discerned by the intuition that this is not a good trend. It is why most Americans today feel like they are paddling upstream and still falling back. It feels like economic regression and the data show that it is.

It’s truly hard to believe that the White House wants to invoke these trends in defense of that idea that the recession is not already here.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

That leaves industrial production as a trend celebrated by the White House. Let’s have a look. The total index is precisely where it was in 2018, which in turn reflects its level of 2008, the year that ended a full century of ever higher growth. The consumer goods index has not recovered its 2008 highs, and nor has manufacturing goods.

In all three categories, the latest data from June 2022 show declines!

This is why the press release wants to talk about “this year” rather than last month.

It’s hard to imagine that this is what the White House considers brag worthy...

...

Indeed, the economic health of the American economy isn’t much different from the job approval numbers of Biden himself, which are now drifting toward the lows of 30 percent.

It doesn’t matter how many op-eds appear in the New York Times that say otherwise. People know the truth because they see it in their bank accounts and feel it in their lost hopes and dreams for a bright future.

Authored by Jeffrey Tucker via The Epoch Times,

Last week, this space speculated that the next recession may never be called what it is. Government agencies rely entirely on the National Bureau for Economic Research to call it either way. In October 2020, the NBER posted a clarification that it does not accept the textbook definition of two successive quarters of output decline but instead deploys a more holistic view.

As an example of such a deployment, NBER lists March-April 2020 as a recession due to the severity of the downturn and the high levels of unemployment. It’s hard to disagree with that judgment, though it was one of the strangest recessions in history: it was entirely forced by lockdowns. NBER in this case was using a stricter definition than the textbook.

Now the White House is running with this looser approach, preparing a propaganda push later this week if the second quarter numbers report a negative return. You will see: the spokesperson will absolutely deny there is a recession. Saying there is one will suddenly be seen as a political statement. Affirming that all is well will be the “information” whereas saying otherwise will become “misinformation.”

As for NBER, it is a cautious organization and will likely wait several more quarters before weighing in at all.

Here is the White House statement to prepare the way: “Recession probabilities are never zero, but trends in the data through the first half of this year used to determine a recession are not indicating a downturn.”

In more detail:

“What is a recession? While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle. Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.”

What are the factors that the White House pushes to mitigate against the declaration? No inflation. Never. Instead, the statement emphasizes that “industrial production, employment, and real spending have grown this year.” Note the careful wording: “this year” does not mean right now.

The subject of employment we’ve written about extensively: the labor shortage is spooky and accounts for the whole of the seemingly low numbers in technical unemployment. The 2020 lockdowns introduce labor-market chaos that is nowhere near being resolved and likely won’t be until there are major structural reforms that deregulate markets and curb the subsidies for the idle.

As for real spending, Americans are depleting savings at a massive rate and borrowing in ways that reverse two-year trends. To see this as a good thing would require full immersion in 90-year-old Keynesian hydraulics. The reality is more clearly discerned by the intuition that this is not a good trend. It is why most Americans today feel like they are paddling upstream and still falling back. It feels like economic regression and the data show that it is.

It’s truly hard to believe that the White House wants to invoke these trends in defense of that idea that the recession is not already here.

(Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker)

That leaves industrial production as a trend celebrated by the White House. Let’s have a look. The total index is precisely where it was in 2018, which in turn reflects its level of 2008, the year that ended a full century of ever higher growth. The consumer goods index has not recovered its 2008 highs, and nor has manufacturing goods.

In all three categories, the latest data from June 2022 show declines!

This is why the press release wants to talk about “this year” rather than last month.

It’s hard to imagine that this is what the White House considers brag worthy…

…

Indeed, the economic health of the American economy isn’t much different from the job approval numbers of Biden himself, which are now drifting toward the lows of 30 percent.

It doesn’t matter how many op-eds appear in the New York Times that say otherwise. People know the truth because they see it in their bank accounts and feel it in their lost hopes and dreams for a bright future.