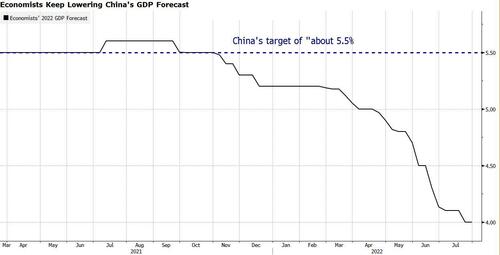

With China's economy slowing to levels not seen this century...

... and its financial system in danger of disintegration should the housing crash escalate further (which is why in a sharp reversal to months of non-action, overnight Beijing launched a multi-billion fund to support struggling developers), many have been wondering how long will local oligarchs wait before (quietly) pulling their money out of the country.

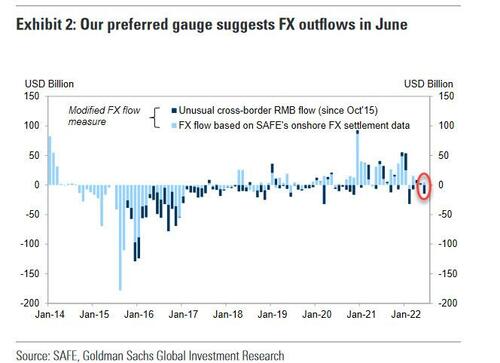

Well, according to the most accurate gauge of FX flows, June saw another month of net outflows of around US$9BN, in comparison to inflows of US$2bn in May, the biggest outflow since February and the second biggest outflow in two years going back to the Covid crash.

Cross-border RMB flows suggest net payments of RMB from onshore to offshore, which was consistent with the continued bond outflows.

Here are the main highlights:

1. In June, there were US $4BN in net inflows via onshore outright spot transactions, and US $2BN inflow via freshly entered and canceled forward transactions. Another SAFE dataset on “cross-border RMB flows” shows that domestic banks made net RMB payments of $15BN from onshore to offshore. A preferred FX flow measure therefore suggests in total $9BN outflows in June, in comparison with $2BN inflows in May.

2. Current account saw small net inflows: Goods trade surplus translated into $25BN inflows in June, vs $8BN in May. Here Goldman notes that while goods trade surplus rose to a record-high level of $98BN in June, the conversion ratio of goods trade surplus remained low at 26%, vs an average of 39% in the prior six months. Previous analyses suggested the conversion rate tends to decline when CNY weakens and interest rate spreads narrow. According to SAFE, corporates' FX hedging ratio increased to 26% in 1H 2022, 4% higher than the same period last year. Services trade deficit remained muted at $6BN. Income and transfers account showed an outflow of $16BN in June, partially on seasonality.

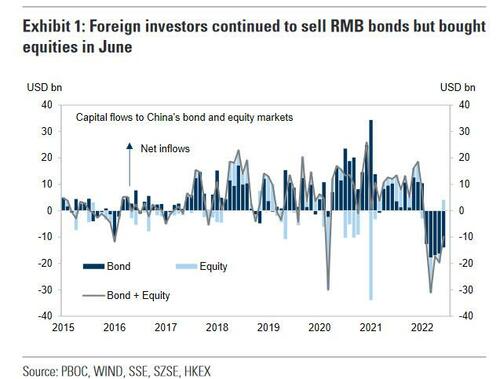

3. Portfolio investment showed outflows in June. Stock Connect data suggests more northbound buying of equities (relative to southbound buying) in the month, and thus on a net basis, translates into around $4BN inflows through Stock Connect in June. China Central Depository & Clearing and Shanghai Clearing House data suggest foreigners continued to reduce their holding of RMB bonds by US$13.9bn in June, vs US$16.3bn outflows in May.

4. Official FX reserves (released earlier in the month) fell to US$3,071bn in June from US$3,128bn in May. Estimating for FX valuation effects would have lowered FX reserves by $34BN in June, so after adjusting for FX valuation effects, FX reserves declined by US$23bn in June. Note that decline in bond and equity prices might have also contributed to the overall decline in reported FX reserves through asset price valuation effect, although SAFE does not release the exact decomposition of China’s FX reserves.

With China’s economy slowing to levels not seen this century…

… and its financial system in danger of disintegration should the housing crash escalate further (which is why in a sharp reversal to months of non-action, overnight Beijing launched a multi-billion fund to support struggling developers), many have been wondering how long will local oligarchs wait before (quietly) pulling their money out of the country.

Well, according to the most accurate gauge of FX flows, June saw another month of net outflows of around US$9BN, in comparison to inflows of US$2bn in May, the biggest outflow since February and the second biggest outflow in two years going back to the Covid crash.

Cross-border RMB flows suggest net payments of RMB from onshore to offshore, which was consistent with the continued bond outflows.

Here are the main highlights:

1. In June, there were US $4BN in net inflows via onshore outright spot transactions, and US $2BN inflow via freshly entered and canceled forward transactions. Another SAFE dataset on “cross-border RMB flows” shows that domestic banks made net RMB payments of $15BN from onshore to offshore. A preferred FX flow measure therefore suggests in total $9BN outflows in June, in comparison with $2BN inflows in May.

2. Current account saw small net inflows: Goods trade surplus translated into $25BN inflows in June, vs $8BN in May. Here Goldman notes that while goods trade surplus rose to a record-high level of $98BN in June, the conversion ratio of goods trade surplus remained low at 26%, vs an average of 39% in the prior six months. Previous analyses suggested the conversion rate tends to decline when CNY weakens and interest rate spreads narrow. According to SAFE, corporates’ FX hedging ratio increased to 26% in 1H 2022, 4% higher than the same period last year. Services trade deficit remained muted at $6BN. Income and transfers account showed an outflow of $16BN in June, partially on seasonality.

3. Portfolio investment showed outflows in June. Stock Connect data suggests more northbound buying of equities (relative to southbound buying) in the month, and thus on a net basis, translates into around $4BN inflows through Stock Connect in June. China Central Depository & Clearing and Shanghai Clearing House data suggest foreigners continued to reduce their holding of RMB bonds by US$13.9bn in June, vs US$16.3bn outflows in May.

4. Official FX reserves (released earlier in the month) fell to US$3,071bn in June from US$3,128bn in May. Estimating for FX valuation effects would have lowered FX reserves by $34BN in June, so after adjusting for FX valuation effects, FX reserves declined by US$23bn in June. Note that decline in bond and equity prices might have also contributed to the overall decline in reported FX reserves through asset price valuation effect, although SAFE does not release the exact decomposition of China’s FX reserves.