US consumers have been well aware of the 'shrinkflation' phenomenon in recent years, but now there's a new emerging trend: Some of the world's largest packaged goods makers are getting very creative by rebranding existing products for expanding uses, then marked up substantially, and marketed in a way to trick consumers about some new blockbuster innovation. This is happening at a time when consumers are pulling back spending, and the goal of the new sales tactic is to drive more revenue with less.

Bloomberg's Leslie Patton and Deena Shanker penned a note explaining how packaged goods giants are quickly adopting a new strategy after years of 'shrinkflation' - called 'upflation' - an attempt to create new applications with existing products.

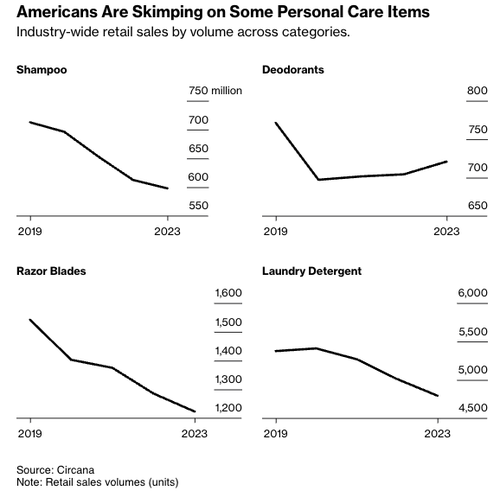

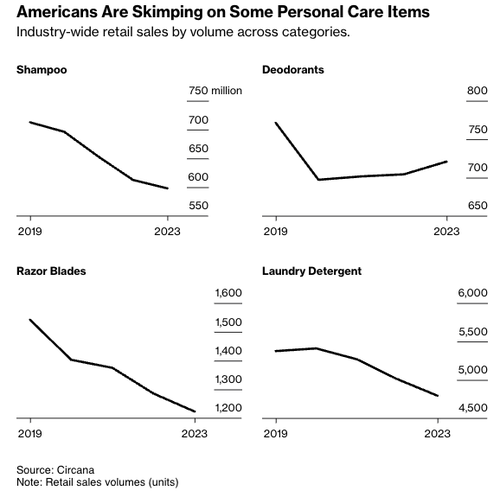

What's clear is that while the consumer in aggregate appears healthy, under the surface, low/mid-tier consumers are struggling and have entered an ultra-thrift phase. This means working poor consumers are pulling back on essential items that P&G, Unilever, and Edgewell sell. These companies have recorded declining sales volumes in recent quarters.

In many cases, consumers are trading down products for more affordable private-label brands. Even more wealthy consumers are trading down high-end retailers for Walmart. Now, top brands are attempting to convince consumers to ditch private-label brands for their new innovative products.

Companies have pointed out that upflation is working, and these existing products with expanded use are performing much better than previous forecasts.

"P&G's most recent earnings report highlighted an almost two-year trend where revenue growth came from people buying fewer things at higher prices. The consumer-goods giant did, however, post higher than expected sales in its grooming division, which it partly attributed to its total body shaving and intimate hair removal products. In an interview, the company said the total body deodorants are growing, too," the journalists noted.

However, not everyone is convinced about upflation.

Maia James, who runs a product review site Gimme the Good Stuff, told Bloomberg, "Is this really something new or are they just marketing this as something different?"

One example of upflation is grooming startup Manscaped, which describes its shavers like a toothbrush: "Everyone needs it, no one wants to share it."

Another is all-over-body deodorants, who Aleta Simmons, a dermatologist in Nashville, said, "I don't think most people need them." She added that anyone with severe body odor should seek a doctor.

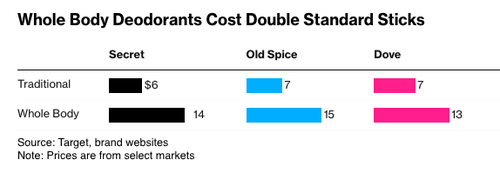

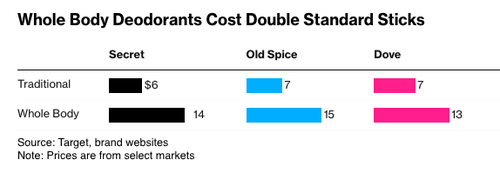

With expanded use and new marketing, these all-over-body deodorants are sold for double the price by major brands.

The emergence of upflation appears to be only a North American phenomenon at the moment. It comes as companies attempt to boost sliding sales.

"I think a lot of people are craving simplicity," said Kathryn Kellogg, who runs a lifestyle brand called Going Zero Waste. She said more consumers are shifting towards a low-consumption lifestyle.

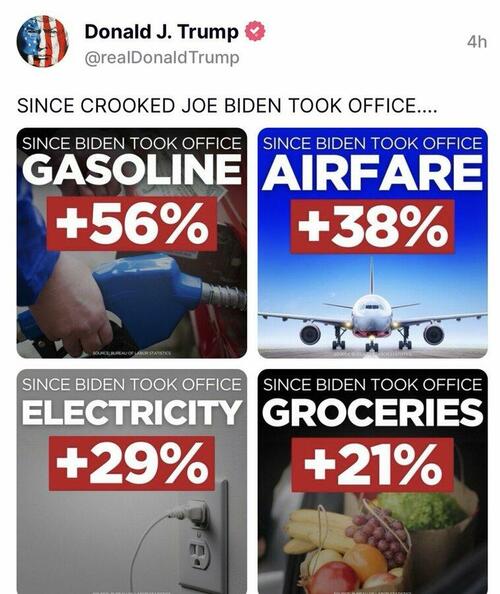

And we wonder why...

Andrea Wilkerson, vice president of P&G's skin and personal care analytics and insights, said consumers are willing to pay for innovation.

The question remains whether upflation—or essentially just rebranding an existing item for new applications—is enough to spur consumer demand for top brands amid sliding sales.

A slew of companies have warned about a challenging macroeconomic backdrop, including General Mills Chairman and Chief Executive Officer Jeff Harmening last week, who said the current operating environment is becoming more complex.

Godman told clients in recent weeks that it's time to short the 'middle-income consumer'...

Earlier this year, "volume" cast a dark cloud over the annual Consumer Analyst Group of New York conference, where the major packaged food makers gathered to discuss industry trends.

According to General Mills CEO Harmening, ice cream isn't just a dessert anymore—it's a snack for between meals with Haagen-Dazs Bites. Food companies are also getting creative to take old products and excite consumers about new applications.

However, the outlook for upflation in the medium term remains uncertain, as consumers are grappling with elevated inflation, depleted personal savings, and insurmountable credit card debt. People will likely see through the upflation gimmick, opting instead to purchase cheaper private label brands and use them for multiple purposes.

US consumers have been well aware of the ‘shrinkflation’ phenomenon in recent years, but now there’s a new emerging trend: Some of the world’s largest packaged goods makers are getting very creative by rebranding existing products for expanding uses, then marked up substantially, and marketed in a way to trick consumers about some new blockbuster innovation. This is happening at a time when consumers are pulling back spending, and the goal of the new sales tactic is to drive more revenue with less.

Bloomberg’s Leslie Patton and Deena Shanker penned a note explaining how packaged goods giants are quickly adopting a new strategy after years of ‘shrinkflation’ – called ‘upflation’ – an attempt to create new applications with existing products.

What’s clear is that while the consumer in aggregate appears healthy, under the surface, low/mid-tier consumers are struggling and have entered an ultra-thrift phase. This means working poor consumers are pulling back on essential items that P&G, Unilever, and Edgewell sell. These companies have recorded declining sales volumes in recent quarters.

In many cases, consumers are trading down products for more affordable private-label brands. Even more wealthy consumers are trading down high-end retailers for Walmart. Now, top brands are attempting to convince consumers to ditch private-label brands for their new innovative products.

Companies have pointed out that upflation is working, and these existing products with expanded use are performing much better than previous forecasts.

“P&G’s most recent earnings report highlighted an almost two-year trend where revenue growth came from people buying fewer things at higher prices. The consumer-goods giant did, however, post higher than expected sales in its grooming division, which it partly attributed to its total body shaving and intimate hair removal products. In an interview, the company said the total body deodorants are growing, too,” the journalists noted.

However, not everyone is convinced about upflation.

Maia James, who runs a product review site Gimme the Good Stuff, told Bloomberg, “Is this really something new or are they just marketing this as something different?”

One example of upflation is grooming startup Manscaped, which describes its shavers like a toothbrush: “Everyone needs it, no one wants to share it.”

Another is all-over-body deodorants, who Aleta Simmons, a dermatologist in Nashville, said, “I don’t think most people need them.” She added that anyone with severe body odor should seek a doctor.

With expanded use and new marketing, these all-over-body deodorants are sold for double the price by major brands.

The emergence of upflation appears to be only a North American phenomenon at the moment. It comes as companies attempt to boost sliding sales.

“I think a lot of people are craving simplicity,” said Kathryn Kellogg, who runs a lifestyle brand called Going Zero Waste. She said more consumers are shifting towards a low-consumption lifestyle.

And we wonder why…

Andrea Wilkerson, vice president of P&G’s skin and personal care analytics and insights, said consumers are willing to pay for innovation.

The question remains whether upflation—or essentially just rebranding an existing item for new applications—is enough to spur consumer demand for top brands amid sliding sales.

A slew of companies have warned about a challenging macroeconomic backdrop, including General Mills Chairman and Chief Executive Officer Jeff Harmening last week, who said the current operating environment is becoming more complex.

Godman told clients in recent weeks that it’s time to short the ‘middle-income consumer‘…

Earlier this year, “volume” cast a dark cloud over the annual Consumer Analyst Group of New York conference, where the major packaged food makers gathered to discuss industry trends.

According to General Mills CEO Harmening, ice cream isn’t just a dessert anymore—it’s a snack for between meals with Haagen-Dazs Bites. Food companies are also getting creative to take old products and excite consumers about new applications.

However, the outlook for upflation in the medium term remains uncertain, as consumers are grappling with elevated inflation, depleted personal savings, and insurmountable credit card debt. People will likely see through the upflation gimmick, opting instead to purchase cheaper private label brands and use them for multiple purposes.

Loading…