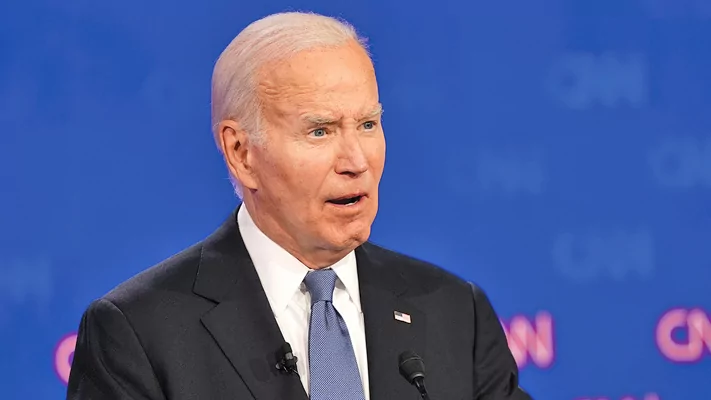

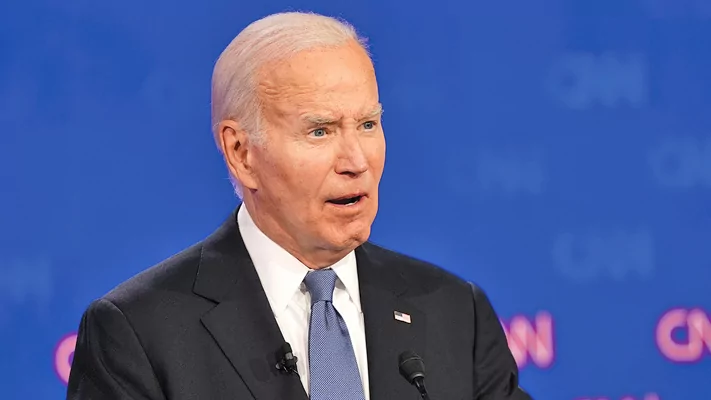

President Joe Biden‘s slack-jawed, rasping, floundering, and all-around incoherent dumpster fire debate performance has drowned out any iota of substance from the news cycle in the aftermath. Not even barbs about former President Donald Trump‘s pending criminal sentencing or whether the soon-to-be 2024 Republican nominee once had sex with a porn star have penetrated the headlines, which remain solely obsessed with the senility of our sitting president.

It’s the decrepitude and dotage that Biden staffers have carefully concealed by cordoning him off from public view between sundown and sunrise. But it’s a palpable and precipitous mental decline that has consumed the Democratic Party in a panic, our allies abroad in grave concern, and Americans across the spectrum in outrage that the commander in chief has been asleep at the wheel.

All of this is to say that given the successful distraction of Biden’s catastrophic “style” in stumbling through the debate, much less attention has been paid to the dismal substance of his answers. Considering that Biden’s 90-minute meltdown on June 27 effectively began when he stammered only to brag outlandishly that “we finally beat Medicare” in response to queries about his fiscal policies, it’s worth examining just how terrible Biden’s tax and spending plans were when he actually managed to explicate them.

Core to the Democratic Party’s overall platform is the delusion people can have their cake and eat it, too. Biden laid into Trump for cutting taxes with the Tax Cuts and Jobs Act of 2017, but he also promised to extend all the tax cuts that apply to households earning under $400,000. While Biden promised to “fix the tax system,” he didn’t explain his current tax proposal, instead attacking a straw man.

“We have a thousand trillionaires in America — I mean, billionaires in America — and what’s happening?” Biden rambled on the debate stage. “They’re in a situation where they, in fact, pay 8.2% in taxes. If they just paid 24% or 25%, either one of those numbers, they’d raise $500 million — billion dollars, I should say — in a 10-year period. We’d be able to wipe out his debt.”

It should shock nobody that none of the above is true.

The 8% lie that Biden has repeatedly touted refers to the tax rate on asset growth including unrealized gains, such as retirement plans and stock holdings that haven’t actually been sold or liquidated. In reality, Biden’s own Treasury has conceded that our income tax system remains highly progressive, with the top 1% of earners paying an effective 31.5% tax rate on their total earnings, compared to the 27% paid by the top decile of earners overall, the 10%-12% paid by average earners, and the negative income tax rate enjoyed by the bottom quintile of earners.

And Biden embracing the Bernie Sanders tact of lying that billionaires can simply foot the bill that he has expanded by the trillions conceals the sheer scope of the problem. Data from Forbes indicate that the combined wealth of all the billionaires in the country only amounts to about $5.5 trillion, and that valuation indeed includes unrealized gains and holdings. Even if you liquidated all the holdings of every billionaire in the country, Soviet-style, and threw them in the Gulag, that $5.5 trillion would cover roughly two years of our existing annual $2 trillion deficits, not a crumb extra to pay for “child care” or “elder care,” as Biden promised. (And it’s worth noting that we do have a socialized elder care system called Social Security, and Biden’s current plan is to bleed it dry until benefits are slashed by 21% in nine years.)

Biden’s actual tax plan doesn’t spare those households earning fewer than $400,000, and contrary to his claims otherwise, the TCJA was progressive, both in its immediate income tax relief for lower-income earners as well as the demonstrable downstream effect of improved GDP growth.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The real problem, of course, is spending, not taxes. Individual income and corporate tax revenue as a share of GDP for 2024, at the height of the TCJA’s implementation, is 8.6% and 1.8%, the latter of which is the same as the average of the 40 years prior and the former of which is higher than the historical average. By contrast, outlays are dramatically departing from the historical norm. Whereas federal spending only consumed 21% of our annual economic output, that number soared to 22.7% last year and 24.2% this year. As we rack up this debt, the debt itself is becoming more expensive, with net interest costs up 42% from just last year and total interest payments already outpacing what we spend on our entire defense budget.

Blaming Trump’s tax cuts is easy, but Biden’s real problem is one he refuses to solve, lest Democrats admit we have an addiction to spending.