Authored by Lance Roberts via RealInvestmentAdvice.com,

Lately, I have been getting many questions about investing in private equity. Such is common during raging bull markets, as individuals seek higher rates of return than the market generates. Also, during these periods, Wall Street tends to bring new companies to market to fill the demand of the investing public. Private equity is always alluring, as is the tale of someone who bought the company’s shares when it was private and made a massive fortune when it went public.

Who wouldn’t want a piece of that?

The private equity (PE) business is huge. When I say huge, I mean $4.4 Trillion huge.

Those PE companies have been extremely busy over the last several years. While there has been a surge in private equity startups, there has also been the privatizing of public companies. The Atlantic shared some data about the dwindling number of publicly traded stocks along with the corresponding growth in private equity investments:

The publicly traded company is disappearing. In 1996, about 8,000 firms were listed in the U.S. stock market. Since then, the national economy has grown by nearly $20 trillion. The population has increased by 70 million people. And yet, today, the number of American public companies stands at fewer than 4,000. How can that be?

One answer is that the private-equity industry is devouring them.

In 2000, private-equity firms managed about 4 percent of total U.S. corporate equity. By 2021, that number was closer to 20 percent. In other words, private equity has been growing nearly five times faster than the U.S. economy as a whole.

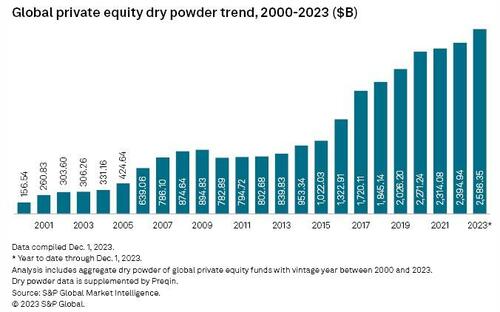

PE firms managed less than $1 billion in the mid-1970s. Today, it’s more than $4 trillion. There is more than $2.5 trillion in dry powder alone globally:

However, that “dry powder” is problematic for PE companies as they must invest it or return it to the investors. Therefore, the demand for deals often means that the deals getting funding may not be the “best” deals.

That is a substantial risk we will discuss in more detail momentarily.

Is Private Equity Right For You?

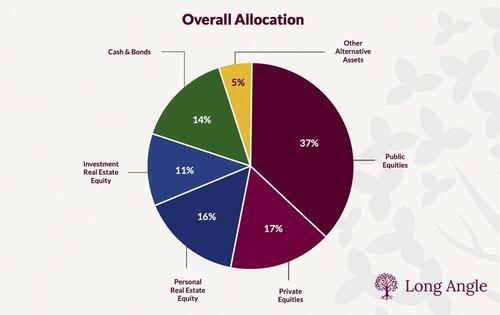

Many individuals hear tales of how high-net-worth individuals (the smart money) own private equity in their allocations. As shown in the chart below from Long Angle, roughly 17% of their allocations are to private equities. These reports don’t generally tell you that their allocation to “private equity” often tends to be their personal businesses. Nonetheless, individual investors frequently see this type of analysis and think they should be replicating that process. But should they?

There are significant differences to consider between the vast majority of retail investors and high-net-worth individuals before investing in private equity. The underlying risks of private equity investments can define these differences. There are many risks, but I want to focus on three.

-

Liquidity Risk

-

Duration

-

Loss Absorption

Liquidity Risk: Many individuals don’t realize when entering into private equity investments that they cannot liquidate them if capital is needed for another reason. While investors often enter into private equity with the anticipation of making outsized returns, they frequently leave themselves vulnerable to the impact of having capital tied up in an illiquid investment. When the eventual crisis happens, the illiquid status of private equity becomes problematic.

Duration Risk: The duration of private equity can often be much longer duration than initially estimated. When a private equity deal is pitched to an individual, it is always accompanied by the most optimistic projections. The projections always include optimistic exit assumptions where the individual will receive an enormous windfall. More often than not, the projections fall very short of reality. A market downturn, economic recession, or a change in underlying industries, interest rates, or inflation can turn an initial 3-year investment into a decade or more. That duration risk multiplies the liquidity risk of keeping capital tied up for much longer than anticipated, sometimes with little or no return. While high-net-worth individuals can absorb both the duration and liquidity issues, most individual investors can not.

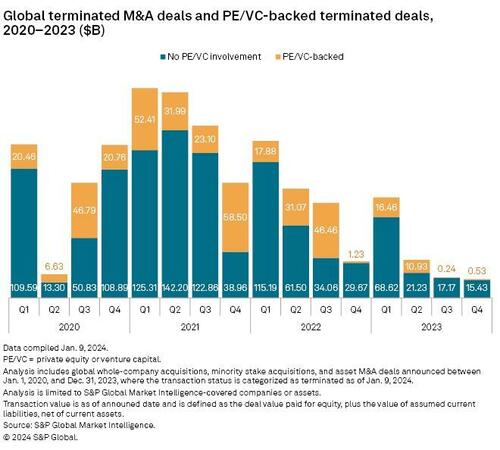

Loss Risk: Lastly, high-net-worth individuals can absorb losses. Many private equity deals inevitably fail, leaving investors with enormous losses on their balance sheets. While high-net-worth investors can invest in numerous deals, the hope is that a successful private equity venture will offset the losses of one or more that failed. Individuals often do not have the capital for that kind of diversification, and a loss on a private equity investment can be very detrimental. The chart below from S&P Global shows the number of private transactions terminated between 2020-2023.

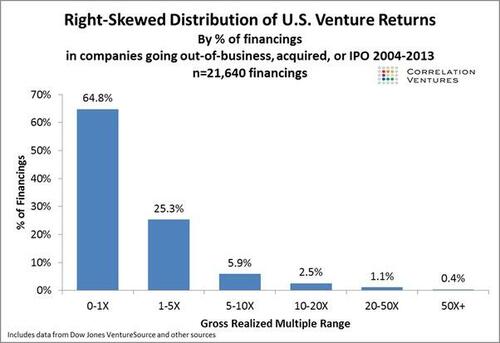

To that point, you should realize that most private equity investments (65%) either fail or return the initial investment at best.

Yes, private equity can be very lucrative. Depending on the deal you invest in, it can also be very harmful. This brings us to the most important question to ask: “Why am I so lucky?”

Why Am I So Lucky?

If you are approached by someone pitching a “private investment,” the first question you should ask is, “Why am I so lucky to be given this opportunity?”

As noted above, the global PE dry powder has soared to an unprecedented $2.59 trillion in 2023 as a slow year in dealmaking closes with limited opportunities for firms to deploy capital raised in previous years. The dry powder total as of Dec. 1st represented close to an 8% increase over December 2022, according to S&P Global Market Intelligence and Preqin data.

That capital is held by some of the largest PE companies in the world. The list below is just a view of the names that you will likely recognize.

Importantly, as noted, these firms must deploy that “dry powder,” or they will eventually lose it. As such, they have armies of employees to scout for the best opportunities, analysts, legal and accounting professionals to analyze those deals, and immediate capital to fund them.

Therefore, as an individual, several questions need to be thoroughly answered.

If this private equity investment is such a good opportunity, then:

-

Why did the company not approach one of the major P/E firms with capital ready to invest?

-

If they did and were turned down, why?

-

How many private equity investors did the company approach before you contacted me?

-

What is the track record of this salesman’s previous investments in private equity, if any?

-

Can you analyze the many investment risks associated with illiquid investments?

Yes, some private equity transactions are too small for a major private equity company like Black Rock, which must invest billions at once. However, many mid-tier private equity companies will take those types of deals.

Most importantly, for you to “exit” the investment and realize the windfall, does the person selling you the investment have the network of investment banks, market makers, and institutions to provide that exit? Finding a future buyer or taking a company from private to public can be exceedingly difficult without that network.

These are just some things to consider before committing your hard-earned capital to a risky, highly illiquid investment.

Does this mean that you should never make a private equity investment? Of course not. However, you must understand the risk of investing and the potential ramifications on your financial situation when something goes wrong.

So, “Why am I so lucky?”

Authored by Lance Roberts via RealInvestmentAdvice.com,

Lately, I have been getting many questions about investing in private equity. Such is common during raging bull markets, as individuals seek higher rates of return than the market generates. Also, during these periods, Wall Street tends to bring new companies to market to fill the demand of the investing public. Private equity is always alluring, as is the tale of someone who bought the company’s shares when it was private and made a massive fortune when it went public.

Who wouldn’t want a piece of that?

The private equity (PE) business is huge. When I say huge, I mean $4.4 Trillion huge.

Those PE companies have been extremely busy over the last several years. While there has been a surge in private equity startups, there has also been the privatizing of public companies. The Atlantic shared some data about the dwindling number of publicly traded stocks along with the corresponding growth in private equity investments:

The publicly traded company is disappearing. In 1996, about 8,000 firms were listed in the U.S. stock market. Since then, the national economy has grown by nearly $20 trillion. The population has increased by 70 million people. And yet, today, the number of American public companies stands at fewer than 4,000. How can that be?

One answer is that the private-equity industry is devouring them.

In 2000, private-equity firms managed about 4 percent of total U.S. corporate equity. By 2021, that number was closer to 20 percent. In other words, private equity has been growing nearly five times faster than the U.S. economy as a whole.

PE firms managed less than $1 billion in the mid-1970s. Today, it’s more than $4 trillion. There is more than $2.5 trillion in dry powder alone globally:

However, that “dry powder” is problematic for PE companies as they must invest it or return it to the investors. Therefore, the demand for deals often means that the deals getting funding may not be the “best” deals.

That is a substantial risk we will discuss in more detail momentarily.

Is Private Equity Right For You?

Many individuals hear tales of how high-net-worth individuals (the smart money) own private equity in their allocations. As shown in the chart below from Long Angle, roughly 17% of their allocations are to private equities. These reports don’t generally tell you that their allocation to “private equity” often tends to be their personal businesses. Nonetheless, individual investors frequently see this type of analysis and think they should be replicating that process. But should they?

There are significant differences to consider between the vast majority of retail investors and high-net-worth individuals before investing in private equity. The underlying risks of private equity investments can define these differences. There are many risks, but I want to focus on three.

-

Liquidity Risk

-

Duration

-

Loss Absorption

Liquidity Risk: Many individuals don’t realize when entering into private equity investments that they cannot liquidate them if capital is needed for another reason. While investors often enter into private equity with the anticipation of making outsized returns, they frequently leave themselves vulnerable to the impact of having capital tied up in an illiquid investment. When the eventual crisis happens, the illiquid status of private equity becomes problematic.

Duration Risk: The duration of private equity can often be much longer duration than initially estimated. When a private equity deal is pitched to an individual, it is always accompanied by the most optimistic projections. The projections always include optimistic exit assumptions where the individual will receive an enormous windfall. More often than not, the projections fall very short of reality. A market downturn, economic recession, or a change in underlying industries, interest rates, or inflation can turn an initial 3-year investment into a decade or more. That duration risk multiplies the liquidity risk of keeping capital tied up for much longer than anticipated, sometimes with little or no return. While high-net-worth individuals can absorb both the duration and liquidity issues, most individual investors can not.

Loss Risk: Lastly, high-net-worth individuals can absorb losses. Many private equity deals inevitably fail, leaving investors with enormous losses on their balance sheets. While high-net-worth investors can invest in numerous deals, the hope is that a successful private equity venture will offset the losses of one or more that failed. Individuals often do not have the capital for that kind of diversification, and a loss on a private equity investment can be very detrimental. The chart below from S&P Global shows the number of private transactions terminated between 2020-2023.

To that point, you should realize that most private equity investments (65%) either fail or return the initial investment at best.

Yes, private equity can be very lucrative. Depending on the deal you invest in, it can also be very harmful. This brings us to the most important question to ask: “Why am I so lucky?”

Why Am I So Lucky?

If you are approached by someone pitching a “private investment,” the first question you should ask is, “Why am I so lucky to be given this opportunity?”

As noted above, the global PE dry powder has soared to an unprecedented $2.59 trillion in 2023 as a slow year in dealmaking closes with limited opportunities for firms to deploy capital raised in previous years. The dry powder total as of Dec. 1st represented close to an 8% increase over December 2022, according to S&P Global Market Intelligence and Preqin data.

That capital is held by some of the largest PE companies in the world. The list below is just a view of the names that you will likely recognize.

Importantly, as noted, these firms must deploy that “dry powder,” or they will eventually lose it. As such, they have armies of employees to scout for the best opportunities, analysts, legal and accounting professionals to analyze those deals, and immediate capital to fund them.

Therefore, as an individual, several questions need to be thoroughly answered.

If this private equity investment is such a good opportunity, then:

-

Why did the company not approach one of the major P/E firms with capital ready to invest?

-

If they did and were turned down, why?

-

How many private equity investors did the company approach before you contacted me?

-

What is the track record of this salesman’s previous investments in private equity, if any?

-

Can you analyze the many investment risks associated with illiquid investments?

Yes, some private equity transactions are too small for a major private equity company like Black Rock, which must invest billions at once. However, many mid-tier private equity companies will take those types of deals.

Most importantly, for you to “exit” the investment and realize the windfall, does the person selling you the investment have the network of investment banks, market makers, and institutions to provide that exit? Finding a future buyer or taking a company from private to public can be exceedingly difficult without that network.

These are just some things to consider before committing your hard-earned capital to a risky, highly illiquid investment.

Does this mean that you should never make a private equity investment? Of course not. However, you must understand the risk of investing and the potential ramifications on your financial situation when something goes wrong.

So, “Why am I so lucky?”

Loading…