Over the weekend we wrote that "Democrats Prepare To Unleash Hell On Fed Chair Powell For The Coming Recession" for the simple reason that, well, dems will never take responsibility for their catastrophic policies which first sparked near hyperinflation and then, when Powell was browbeaten into pretending he is Volcker, sparked a dramatic slowdown in the economy.

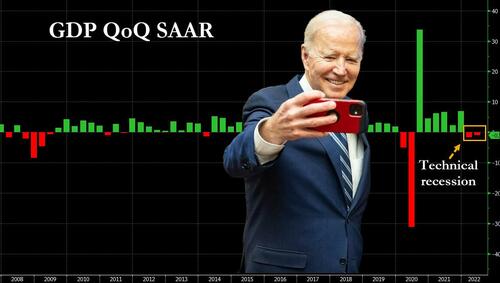

Well, now that the US is officially in a recession...

... the Democrats' brilliant plan has sprung into action, with Biden taking the lead and saying in a statement after the dismal GDP print, that “coming off of last year’s historic economic growth – and regaining all the private sector jobs lost during the pandemic crisis – it’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation."

Translation: just like rising gas prices are Putin's fault while falling gas prices are entirely thanks to Joe, so the post-covid bounce was entirely thanks to Biden... while the subsequent recession is - well - all Powell's fault.

It wasn't just Biden though: Powell's old nemesis, clueless econo-hack Elizabeth Warren, was also out for blood, and in a tweet shortly after the market open, she said that "the Fed’s aggressive interest-rate hikes risk pushing the U.S. economy into recession — and the evidence is in the data. While failing to address many drivers of inflation, the Fed is pumping the brakes on the labor market and slowing the economy."

The Fed’s aggressive interest-rate hikes risk pushing the U.S. economy into recession — and the evidence is in the data.

— Elizabeth Warren (@SenWarren) July 28, 2022

While failing to address many drivers of inflation, the Fed is pumping the brakes on the labor market and slowing the economy.

Congress needs to step up.

She concluded that "Congress needs to step up" although it wasn't clear if that means Congress should fire Powell or launch another stimmy to undo the recession, even as it pushes inflation into turbo overdrive.

As for Powell - and we thought we'd never say this - our condolences to the Fed chair who thought he was doing just what Biden wanted... at least until he got the inevitable recession. And now Biden will find out what polls (much) worse: galloping inflation or millions of layoffs as a result of an acute recession.

Over the weekend we wrote that “Democrats Prepare To Unleash Hell On Fed Chair Powell For The Coming Recession” for the simple reason that, well, dems will never take responsibility for their catastrophic policies which first sparked near hyperinflation and then, when Powell was browbeaten into pretending he is Volcker, sparked a dramatic slowdown in the economy.

Well, now that the US is officially in a recession…

… the Democrats’ brilliant plan has sprung into action, with Biden taking the lead and saying in a statement after the dismal GDP print, that “coming off of last year’s historic economic growth – and regaining all the private sector jobs lost during the pandemic crisis – it’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation.”

Translation: just like rising gas prices are Putin’s fault while falling gas prices are entirely thanks to Joe, so the post-covid bounce was entirely thanks to Biden… while the subsequent recession is – well – all Powell’s fault.

It wasn’t just Biden though: Powell’s old nemesis, clueless econo-hack Elizabeth Warren, was also out for blood, and in a tweet shortly after the market open, she said that “the Fed’s aggressive interest-rate hikes risk pushing the U.S. economy into recession — and the evidence is in the data. While failing to address many drivers of inflation, the Fed is pumping the brakes on the labor market and slowing the economy.”

The Fed’s aggressive interest-rate hikes risk pushing the U.S. economy into recession — and the evidence is in the data.

While failing to address many drivers of inflation, the Fed is pumping the brakes on the labor market and slowing the economy.

Congress needs to step up.

— Elizabeth Warren (@SenWarren) July 28, 2022

She concluded that “Congress needs to step up” although it wasn’t clear if that means Congress should fire Powell or launch another stimmy to undo the recession, even as it pushes inflation into turbo overdrive.

As for Powell – and we thought we’d never say this – our condolences to the Fed chair who thought he was doing just what Biden wanted… at least until he got the inevitable recession. And now Biden will find out what polls (much) worse: galloping inflation or millions of layoffs as a result of an acute recession.