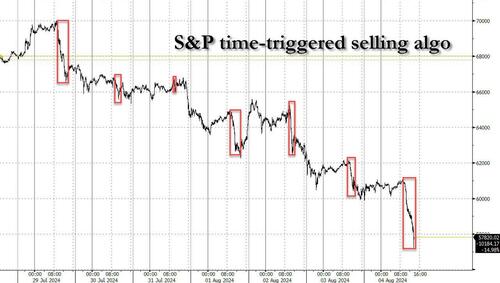

Bitcoin, and the entire crypto universe, is crashing after yet another huge sell order was unleashed by a time-triggered algo, the same algo that has activated selling momentum on each of the past 7 trading days at 10am ET, just after the US cash open (a move meant to cripple any dip-buying intentions in early market trading), yet which algo was left on for the weekend, arguably to spark an HFT-driven pile up of selling and shorting, and to force levered longs to capitulate, ahead of the Japanese open where a bloodbath is expected to take place (see below). One can see the algo in action in the red boxes below: exact same time every day, exact same sell-momentum ignition.

We have previously discussed how Sam Bankman-Fried's alma mother, HFT trading shop Jane Street, has frequently been involved in such attempts to force-liquidate the market by activating selling momentum, and it appears that this weekend Jane Street's crypto "market-making" peer, Jump Trading, joined the fray and sparked a market rout by dumping and shorting billions in various coins during the most illiquid of markets while assuring the worst execution possible by repeatedly taking out the bid stack over and over, in what is an attempt to aggressively reprice cryptos.

Jump Crypto, one of the biggest crypto shops is unwinding its crypto operations following CFTC probe (and SEC case? idk), Kanav was its President

— Wazz (@WazzCrypto) August 4, 2024

They had hundreds of millions of ETH and SOL

They've been sending dozens of millions hourly to exchanges on an illiquid weekend pic.twitter.com/x1Ou3xGPBV

The liquidation panic has been boosted by three factors:

i) Friday's crash in US stocks

ii) the rout expected in Japan when stocks there open for trading on Monday as they catch down to Friday's plunge in the USDJPY, where a rough estimate suggests about 6-8% of additional downside after the Topix lost 10% in the past 2 days, effectively putting Japanese stocks in a bear market just days after the biggest policy error by the BOJ in recent history (just as we expected)...

BOJ preview: whatever is the dumbest possible thing that can happen, is what will happen. 100% guaranteed

— zerohedge (@zerohedge) July 30, 2024

... and forcing the Bank of Japan to resume easing and rate cuts just days after it hiked ever so slightly, from 0.10% to 0.25% while Japan's economy is shrinking again.

iii) fears of an imminent (re)start of the (theatrical) war between Iran and Israel. As readers may recall, back in April when the first quote-unquote war between Iran and Israel took place, a highly choreographed, skilfully produced event, bitcoin would tumble every single time a red flashing Bloomberg headline of some new missile attack hit the tape. Expect nothing less tonight when the next scripted "war" is expected to take place.

Meanwhile, keep an eye on what Larry Fink and the rest of the ETF complex is doing. As we have observed on countless occasions, it has been Blackrock's favorite pastime to buy the dip created by the aggressive selling of futures by various HFT shops (and CZ hands) in hopes of increasingly cornering the crypto market, and the past week has been no different.

>BTC down 10%

— Arkham (@ArkhamIntel) August 1, 2024

>Grayscale dumping $2B ETH

>Middle East on the brink

but Blackrock is STILL buying. pic.twitter.com/IlNBapzaCR

Bitcoin, and the entire crypto universe, is crashing after yet another huge sell order was unleashed by a time-triggered algo, the same algo that has activated selling momentum on each of the past 7 trading days at 10am ET, just after the US cash open (a move meant to cripple any dip-buying intentions in early market trading), yet which algo was left on for the weekend, arguably to spark an HFT-driven pile up of selling and shorting, and to force levered longs to capitulate, ahead of the Japanese open where a bloodbath is expected to take place (see below). One can see the algo in action in the red boxes below: exact same time every day, exact same sell-momentum ignition.

We have previously discussed how Sam Bankman-Fried’s alma mother, HFT trading shop Jane Street, has frequently been involved in such attempts to force-liquidate the market by activating selling momentum, and it appears that this weekend Jane Street’s crypto “market-making” peer, Jump Trading, joined the fray and sparked a market rout by dumping and shorting billions in various coins during the most illiquid of markets while assuring the worst execution possible by repeatedly taking out the bid stack over and over, in what is an attempt to aggressively reprice cryptos.

Jump Crypto, one of the biggest crypto shops is unwinding its crypto operations following CFTC probe (and SEC case? idk), Kanav was its President

They had hundreds of millions of ETH and SOL

They’ve been sending dozens of millions hourly to exchanges on an illiquid weekend pic.twitter.com/x1Ou3xGPBV

— Wazz (@WazzCrypto) August 4, 2024

The liquidation panic has been boosted by three factors:

i) Friday’s crash in US stocks

ii) the rout expected in Japan when stocks there open for trading on Monday as they catch down to Friday’s plunge in the USDJPY, where a rough estimate suggests about 6-8% of additional downside after the Topix lost 10% in the past 2 days, effectively putting Japanese stocks in a bear market just days after the biggest policy error by the BOJ in recent history (just as we expected)…

BOJ preview: whatever is the dumbest possible thing that can happen, is what will happen. 100% guaranteed

— zerohedge (@zerohedge) July 30, 2024

… and forcing the Bank of Japan to resume easing and rate cuts just days after it hiked ever so slightly, from 0.10% to 0.25% while Japan’s economy is shrinking again.

iii) fears of an imminent (re)start of the (theatrical) war between Iran and Israel. As readers may recall, back in April when the first quote-unquote war between Iran and Israel took place, a highly choreographed, skilfully produced event, bitcoin would tumble every single time a red flashing Bloomberg headline of some new missile attack hit the tape. Expect nothing less tonight when the next scripted “war” is expected to take place.

Meanwhile, keep an eye on what Larry Fink and the rest of the ETF complex is doing. As we have observed on countless occasions, it has been Blackrock’s favorite pastime to buy the dip created by the aggressive selling of futures by various HFT shops (and CZ hands) in hopes of increasingly cornering the crypto market, and the past week has been no different.

>BTC down 10%

>Grayscale dumping $2B ETH

>Middle East on the brinkbut Blackrock is STILL buying. pic.twitter.com/IlNBapzaCR

— Arkham (@ArkhamIntel) August 1, 2024

Loading…