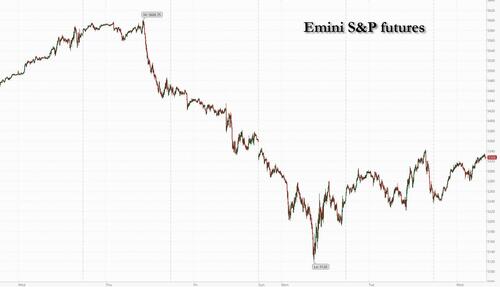

And just like that, the great carry trade freak out - which started exactly one week ago when the BOJ hiked rates by a huge 0.15% - is over, because as we had expected, the BOJ got cold feet and capitulated on its rate hiking cycle on Wednesday morning when BOJ deputy governor Shinichi Uchida sent dovish U-turn signal in the wake of historic financial market volatility by pledging to refrain from hiking interest rates when the markets are unstable. In kneejerk reaction to his comments - which were the first public remarks by a BOJ board member since the bank raised rates on July 31 - the yen, which had strengthened by a record amount in the past week as the carry trade careened sending deflationary shockwaves around the globe, weakened by more than 2%, bond yields rose and stocks soared. As of 7:30am ET, S&P 500 jumped by 1.2% with both Tech and small-caps outperforming as the BOJ capitulation relief rally continues;' Nasdaq 100 futures gained more than 1.5% after the underlying indexes rebounded more than 1% on Tuesday following a wave of dip buying. The Stoxx Europe 600 index climbed more than 1%, with mixed earnings reports from some of the region’s biggest companies doing little to dampen the risk-on mood. Japanese stocks led a broad rally in Asia. Bond yields are higher by 4-5bps, and the USD is higher, looking to erase its weekly loss. Commodities have also caught a bid as the carry trade is reestablished with WTI, base metals, and Ags all seeing strength. Mtge Applications and 10Y bond auction are the major macro data pts. Is the panic unwind finished? Are detailed thoughts are below.

In the premarket, Mag7 are all higher and semis are shrugging off SMCI (-12%) catastrophic margin collapse as NVDA, AVGO, AMD, and QCOM lead the group higher each up 1%+. Super Micro Computer crashed 14% reversing a 20% earlier spike, as the computer hardware maker’s disappointing gross margins overshadowed an otherwise strong 2025 net sales forecast. Airbnb also tumbled 14% after the company gave a disappointing outlook for a third consecutive quarter and warned of slowing demand from US vacationers. Here are some other notable premarket movers:

- Emergent BioSolutions slumps 34% after the company forecast 3Q revenue with a midpoint that fell short of analyst estimates.

- Fortinet rises 16% after the cyber-security company posted a strong margin performance in the 2Q.

- Lumen Technologies soars 24% after the company boosted its full-year free cash flow forecast.

- Porch Group sinks 19% after the home-services software company reported 2Q results that missed expectations, with severe weather weighing.

- Rivian drops 7% after the electric vehicle startup warned of a looming plant shutdown next year to prepare for a new vehicle launch.

- Novo Nordisk A/S shares dropped as much as 5% after the Danish drugmaker cut its profit forecast for the year.

- Shopify gains 17% after posting 2Q results that exceeded analysts’ estimates, suggesting that the Canadian e-commerce company is managing to navigate cautious consumer spending.

- Trex falls 17% after the manufacturer of decking cut its year revenue forecast as 2Q sales fell short of estimates.

- TripAdvisor tumbles 19% after the online travel company reported 2Q revenue that missed consensus estimates.

- Upstart soars 25% after the AI lending marketplace firm gave a 3Q forecast that is stronger than expected.

Volatility is waning as the S&P 500 recovers from its worst one-day drop since September 2022. The VIX plunged another 17% on Wednesday following its biggest plunge since 2010. The biggest event overnight was Uchida's surprising U-turn, and capitulation, which came less than a week after the BOJ's historic and unexpected rate hike which unleashed a carry trade unwind and pushed the VIX as high as 65, its biggest increase since the covid crash.

“I wouldn’t underestimate importance of what the Bank of Japan has been saying overnight,” Jennison Associates Managing Director Raj Shant said on Bloomberg TV. “I think that’s really helpful. This carry trade has been many, many years in the making, and probably indirectly affects a lot of asset classes around the world.”

Still, the recent market turmoil was a “stark reminder of how quickly things can change,” said Justin Onuekwusi, chief investment officer at St James Place. “While overall corporate balance sheets are healthy and recession risks are low, we are starting to see earnings tail off a bit and companies’ guidance is outlining a more uncertain future.”

European stocks follow US futures and Asian counterparts higher after the BOJ capitulation. The Stoxx 600 adds 1.1% with auto, construction and bank names leading gains. Novo Nordisk A/S shares dropped as much as 5% after the Danish drugmaker cut its profit forecast for the year. German lender Commerzbank AG, sportswear maker Puma SE and skin-care products maker Beiersdorf AG also slumped after earnings misses. On the other end, shares in Continental AG rose after the German manufacturer posted improving returns at its struggling car-parts unit, which it may spin off in its biggest-ever restructuring. Dutch lender ABN Amro Bank NV gained after the Dutch lender raised its outlook for lending income, showing how Europe’s high interest rates continue to provide tailwind for the banking industry. The banks sub-index outperformed the benchmark. Here are the biggest European movers:

- Glencore shares climb 1.5%, reversing earlier losses. The company decided to retain its coal and carbon steel materials business after shareholder consultations, a move analysts welcome given its profitability.

- Continental shares rise as much as 5.5% after the German automotive parts maker’s second-quarter results showed what Bernstein called some “rays of hope,” though this was dampened by the cut to the FY24 sales guidance.

- Sampo rises as much as 2.5% following the insurance brokerage firm’s second-quarter earnings report. DNB Markets expects small upgrades to full-year consensus and notes the company’s positive growth momentum.

- GEA Group shares rise as much as 4.4%, the most in five months, after the mechanical engineering firm reported earnings ahead of consensus in the latest quarter.

- Sixt shares fall as much as 1.6%, fluctuating after the vehicle rental firm reported in-line earnings and warned full-year profits will be at the lower-end of its full year guidance.

- Novo Nordisk shares drop as much as 7.7%, the most in two years, after the Danish drugmaker reported weaker-than-expected sales for its Wegovy blockbuster in the second quarter.

- Beiersdorf shares drop as much as 5.9%, to the lowest intraday since November 2023, after the maker of personal-care products reported second-quarter results that missed estimates.

- Puma shares drop as much as 14% after the sportswear brand reported second-quarter revenue in constant currency that missed consensus estimates and narrowed its full-year Ebit forecast.

- Maersk shares fall as much as 4.5% after the marine shipping company’s second quarter Ebitda missed estimates. Morgan Stanley notes that the buyback is not being reinstated and says freight rates are starting to move lower.

- Evotec slumps as much as 39%, to the lowest since November 2016, after the German pharmaceutical company announced material cuts to its full-year guidance and also postponed a planned capital markets day in October to evaluate its next strategic steps.

Earlier in the session, Asian equities advanced for a second session following Monday’s global rout, after the Bank of Japan said it won’t raise interest rates if financial markets are unstable. The MSCI Asia Pacific Index climbed as much as 2.1%. Japan’s Topix index pared earlier gains to close 2.3% higher as Bank of Japan Deputy Governor Shinichi Uchida noted the recent volatility in the nation’s markets and said its rate path will shift if there’s an impact on the policy outlook. Benchmarks in South Korea and Taiwan also climbed, with the Taiex index logging its biggest single-day rally since May 2021. Technology stocks led gains across the region as concerns about further unwinding of the yen carry trade eased, with the Japanese currency weakening more than 2% against the dollar. Still, some market watchers remained cautious.

In FX, the Bloomberg index rose for a second day while the yen is around 2% weaker against the dollar with the cross topping just short of 148.00. The weaker yen boosted higher-yielding currencies. The Mexican peso, a carry trade target that tumbled after the BOJ rate hike, rose more than 1% against the dollar Wednesday. The Swiss franc also underperforms with a 1.1% fall. The kiwi outperforms, rising 1% after the unemployment rate rose less than expected.

In rates, treasuries are cheaper across the curve following the deeper selloff in core European rates after Bank of Japan Deputy Governor Shinichi Uchida pledged to refrain from hiking interest rates while markets are unstable. Treasury yields cheaper by 4bp-5bp with curve spreads little changed; 10-year around 3.94% with bunds underperforming by roughly 4.5bp in the sector. Supply is also a factor for Wednesday’s session, with 10-year note auction at 1pm New York time: the auction cycle continues with $42b 10-year new issue, following good result for Tuesday’s $58b 3-year note sale; it ends Thursday with $25b 30-year bond sale. The WI 10-year yield at ~3.93% is roughly 35bp richer than last month’s, which stopped through by 1bp.

In commodities, oil prices advance, with WTI rising 0.8% to trade near $73.80 a barrel. Spot gold is steady around $2,393/oz. Bitcoin adds 1.7%.

Looking at today's calendar, US economic data slate includes June consumer credit at 3pm. Scheduled Fed speakers include Collins at 12pm.

Market Snapshot

- S&P 500 futures up 0.8% to 5,306.75

- STOXX Europe 600 up 0.8% to 492.13

- MXAP up 1.5% to 174.18

- MXAPJ up 1.8% to 546.30

- Nikkei up 1.2% to 35,089.62

- Topix up 2.3% to 2,489.21

- Hang Seng Index up 1.4% to 16,877.86

- Shanghai Composite little changed at 2,869.83

- Sensex up 0.8% to 79,192.71

- Australia S&P/ASX 200 up 0.2% to 7,699.83

- Kospi up 1.8% to 2,568.41

- Brent Futures up 0.4% to $76.80/bbl

- Gold spot up 0.1% to $2,393.03

- US Dollar Index up 0.14% to 103.12

- German 10Y yield +7.5bps at 2.28%

- Euro little changed at $1.0925

Top Overnight News

- Japanese stocks rallied on Wednesday and the yen fell after a central bank official appeared to play down the immediate prospects of further interest rate rises in the face of volatile global trade. The Bank of Japan’s deputy governor Shinichi Uchida noted the sharp volatility in domestic and overseas financial markets and said “it is necessary to maintain current levels of monetary easing for the time being”. FT

- China is to impose controls on the production of critical chemicals for the manufacture of fentanyl, in a sign of rising co-operation between Beijing and Washington over efforts to crack down on the deadly synthetic opioid. FT

- SoftBank announced a buyback of as much as ¥500 billion ($3.4 billion), an outlay that still leaves founder Masayoshi Son with a substantial pile of cash as he gears up to make more aggressive investments. The outlay comes as CEO Son is preparing for what appears to be a large-scale push into artificial intelligence and semiconductor investments. BBG

- Iran may be reconsidering a plan for major retaliation against Israel following intensive diplomatic and military pressure from Washington while Netanyahu moves towards the US-brokered ceasefire deal in Gaza. WaPo

- Crude stockpiles at Cushing rose by more than 1 million barrels last week, API data is said to show, the biggest surge in more than two months if confirmed by the EIA. Total inventory also rose. In China, July imports fell to the slowest pace in almost two years. BBG

- Harris is up 3 points over Trump both head-to-head and when 3rd party candidates are considered according to a new Marist poll. The Hill

- Supermicro reported a miss on FQ4 EPS at 6.25 (vs. the Street 8.25) as soft margins (11.3% gross margins vs. the Street 14%) offset inline sales and while the revenue guide is bullish, investors have persistent worries about profitability. RTRS

- Novo plummeted as Wegovy sales missed estimates and it cut its full-year profit outlook. While the drug’s miss will be in focus in the short term, volume trends are strengthening. BBG

- Airbnb reported decent Q2 results, w/revenue +11% FXN to $2.75B (vs. the Street $2.73B), EBITDA +10% FXN to $894MM (vs. the Street $862.3MM), and bookings +12% FXN to $21.2B (about inline), although nights/experiences were a bit light (+9% to 125.1M vs. the Street 126.3M) and the guidance is soft (the Q3 revenue range mid-point is $3.7B vs. the Street’s $3.83B). “We are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests”. RTRS

A more detailed look at global markets courtesy of newsquawk

APAC stocks continued their recent rebound but with some of the gains capped as markets digested mixed Chinese trade data. ASX 200 was positive albeit with the upside limited as participants reflected on the key data from Australia's largest trading partner. Nikkei 225 saw two-way price action in which initially suffered losses but then staged a gradual recovery and was further boosted following comments from BoJ Deputy Governor Uchida who said they won't hike rates when markets are unstable. Hang Seng and Shanghai Comp. conformed to the upbeat mood although the advances in the mainland are limited after the PBoC refrained from injecting funds and the latest Chinese trade data printed mixed.

Top Asian News

- BoJ Deputy Governor Uchida said their interest rate path will obviously change if as a result of market volatility, economic forecasts, view on risks, and likelihood of achieving the projection change, while he added that they won't hike rates when markets are unstable and they must maintain the current degree of monetary easing for the time being. Uchida said Japan is not in an environment where they would be behind the curve unless they hike rates at a set pace, as well as noted that a weak yen and subsequent rise in import costs pose upside risks to inflation. Furthermore, Uchida said if the economy and prices move in line with projections, it is appropriate to adjust the degree of monetary easing but also commented that Japan's real interest rate is very low, monetary conditions are very accommodative and that the scheduled tapering of bond buying likely won't cause major changes in the degree of monetary easing.

- BoJ's Uchida says market volatility is very large, will be keeping a close eye on moves and the impact on the economy and prices. Real rates remain low, will underpin the economy. There is no gap in views between Ueda and Uchida, recent Uchida remarks reflect changes in the latest market developments following the last meeting.

- Honda (7267 JT) Q1 (JPY): Net 394bln (exp. 343bln), Operating 484bln (exp. 472bln), PBT 559bln (exp. 508bln). FY Guidance: Downgraded group sales guidance; sees GY global retail sales at 3.9mln vehicles (prev. guided 4.1mln). N. American sales 1.675mln vehicles (prev. guided 1.675mln)

European bourses are firmer intraday, Euro Stoxx 50 +1.7%, with the Stoxx 50 outperforming the Stoxx 600 +1.1% as the latter is weighed on by post-earnings downside in heavyweight Novo Nordisk -3.0%. Given this, Healthcare lags after Novo missed on several key metrics incl. Wegovy sales and downgraded some components of its FY guidance. Banks outperform as yields rise and after strong numbers from ABN AMRO. Breakdown has the DAX 40 +1.5% supported by Continental, which is lifting the broader Auto sector; Commerzbank bucks the banking trend after missing on numerous metrics. Stateside, futures in the green and grinding higher throughout the morning, ES +1.0%, NQ +1.1%; though, action has been choppy at times with newsflow light thus far ex-earnings. Elsewhere, Maersk earnings were mixed with the name lower despite noting market demand has been strong but warns of slower global container demand ahead.

Top European News

- Novo Nordisk (NOVOB DC) Q2 (DKK): Sales 68.06bln (exp. 68.65bln), EBIT 25.94bln (exp. 26.85bln), Wegovy Sales 11.66bln (exp. 13.54bln). CEO: Wegovy prescriptions in the US more doubled vs the start of the year; CFO says negative impact of net impact to net sales of Wegovy in Q2 is due to rebate adjustments; Competitive dynamics will not have an impact on Wegovy sales in the near future. FY Guidance: Sales growth 22-28% at CER (prev. guided 19-27%); Operating Profit growth 20-28% at CER (prev. view 22-30%), CAPEX ~45bln. FCF 59-69bln

- Maersk (MAERSKB DC) Q2 (USD): EBITDA 2.1bln (exp. 2.27bln), EBIT 963mln (exp. 810mln), EPS 51 (exp. 55.5). Market demand has been strong, Red Sea situation remains entrenched. CEO says they could see some pulling forward of demand, most notably within the US due to the upcoming election and associated uncertainty around future import tariffs. Adds, industrial action following pending union talks in the US could lead to further supply chain disruptions.

- UK Chancellor Reeves aims to follow a "Canadian model" to consolidate GBP 360bln of smaller local government pension schemes to aid in boosting investment and "fire up the economy", according to The Times.

FX

- USD supported with the DXY bid and above 103.00 but off overnight best levels of 103.37. Strength which came as USD/JPY soared above 147.50 after remarks from BoJ's Uchida that they won't hike when markets are unstable.

- As such, JPY is the clear laggard but followed relatively closely by the CHF as the positive tone means haven demand is waning and as yields rally and weigh on the likes of CHF and JPY.

- Sterling modestly firmer, but has been below 1.27 in a 1.2681-1.2718 band. Specifics light but strength coming via EUR downside and associated pressure in EUR/GBP to back below 0.86.

- EUR/USD itself holding around 1.0905 and is close to, but yet to test, the figure to the downside; no real reaction to mixed German data this morning.

- Antipodeans benefit from the risk tone with NZD outperforming after encouraging employment data and as the AUD takes a slight breather from RBA-inspired strength; nonetheless, it remain underpinned with strong Chinese imports assisting.

- PBoC set USD/CNY mid-point at 7.1386 vs exp. 7.1481 (prev. 7.1318).

- Japan's currency intervention amounted to JPY 5.92tln on April 29th and JPY 3.87tln on May 1st, while the April 29th intervention was a single-day record and surpassed the previous record of JPY 5.62tln on 21st October 2002, according to Ministry of Finance data.

Fixed Income

- Benchmarks continue to falter despite opening the European morning with modest gains. Downside which has pushed Bunds below the 134.00 mark vs. a 136.28 peak on Monday.

- Supply was uneventful in terms of reaction from Germany and the UK, though the latter was a touch softer than recent taps; reminder, US 10yr later.

- Gilts pressured but to a slightly lesser magnitude with little by way of specific driver to note. Further downside brings the 99.00 mark into view and then numerous recent lows below this.

- Amidst this, USTs are also softer but only modestly so with the docket ahead thin ex-earnings until 10yr supply which follows an unremarkable 3yr tap on Tuesday.

- Chinese regulators are reportedly restricting the duration of new bond funds, restrictions target mutual fund managers, according to Reuters sources.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 2.87x (prev. 3.10x), average yield 3.854% (prev. 4.023%) & tail 0.9bps (prev. 0.9bps)

- Germany sells EUR 0.407bln vs exp. EUR 0.5bln 1.00% 2038 Bund & EUR 1.199bln vs exp. EUR 1.5bln 2.60% 2041 Bund

Commodities

- Crude benchmarks began with a mild positive tilt and have been gradually extending on this throughout the morning. WTI and Brent at the top-end of parameters and are holding around USD 74.11/bb and USD 77.42/bbl respectively.

- Benchmarks aided by the USD being slightly off best (though still firmer) and with gepol. risk still a key factor alongside the recent production halt at El Sharara.

- Metals are mixed, spot silver once again underperforms its gold counterpart a touch which itself is approaching a test of USD 2400/oz to the upside. Base metals are primarily weaker after mixed Chinese trade data and with Copper leading the downside after a mammoth LME stock build.

- LME Stocks: Copper +42,175t (prev. +1,225t)

- Chinese gold reserves unchanged M/M at 72.8mln fine troy ounces

- US Private Inventory Data (bbls): Crude +0.2mln (exp. -0.7mln), Distillate +1.2mln (exp. +0.2mln), Gasoline +3.3mln (exp. -1mln), Cushing +1.1mln.

Geopolitics

- Israel estimates that Hezbollah will attack before Iran, according to Israel's Kann News. Israel Broadcasting Corporation also reported that estimates indicate Hezbollah will carry out the attack before Iran and will use precision missiles, according to Al Arabiya. Furthermore, a source via X reported that Israeli intelligence said a possible Hezbollah attack could occur in the next 24-48 hours.

- Israel's Channel 12 News reported that advanced preparations and planning are underway within the Israeli Military for the launch of pre-emptive strikes against Hezbollah targets in Lebanon, prior to their coordinated attack against Israel with Iran.

- IDF struck a building in a Lebanese village targeting Hezbollah operatives, according to Times of Israel.

- US Secretary of State Blinken said they have communicated directly to Iran and Israel that no one should escalate the conflict in the Middle East, while he added that Gaza hostage negotiations have reached the final stage and it is critical that parties work to finalise the agreement as soon as possible. Blinken also said everyone in the region should understand that further attacks only perpetuate conflict, instability, and insecurity for everyone.

- US Defence Secretary Austin said the US will not tolerate attacks on US personnel in the Middle East and that they are sure Iran-backed militia was behind the attack on US troops in Iraq, according to Reuters. Austin also said they are ready to deploy more troops to the region if they see a threat to their interests and the security of allies, according to Al Arabiya.

- "Iranian News Agency: Equipping the eastern regions of the Iran with radar, air defense systems and drones", according to Sky News Arabia.

- "Sirens sound in Shtula, northern Israel", according to Sky News Arabia.

- Australia, Canada, the Philippines and the US are to hold joint maritime exercises on August 7th-8th in the South China Sea. It was later reported that China's military organised a joint combat patrol over the sea and airspace near the Scarborough Shoal in the South China Sea.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications 6.9%, prior -3.9%

- 15:00: June Consumer Credit, est. $10b, prior $11.4b

Central Bank speakers

- 12:00: Fed’s Collins Visits Rhode Island

And just like that, the great carry trade freak out – which started exactly one week ago when the BOJ hiked rates by a huge 0.15% – is over, because as we had expected, the BOJ got cold feet and capitulated on its rate hiking cycle on Wednesday morning when BOJ deputy governor Shinichi Uchida sent dovish U-turn signal in the wake of historic financial market volatility by pledging to refrain from hiking interest rates when the markets are unstable. In kneejerk reaction to his comments – which were the first public remarks by a BOJ board member since the bank raised rates on July 31 – the yen, which had strengthened by a record amount in the past week as the carry trade careened sending deflationary shockwaves around the globe, weakened by more than 2%, bond yields rose and stocks soared. As of 7:30am ET, S&P 500 jumped by 1.2% with both Tech and small-caps outperforming as the BOJ capitulation relief rally continues;’ Nasdaq 100 futures gained more than 1.5% after the underlying indexes rebounded more than 1% on Tuesday following a wave of dip buying. The Stoxx Europe 600 index climbed more than 1%, with mixed earnings reports from some of the region’s biggest companies doing little to dampen the risk-on mood. Japanese stocks led a broad rally in Asia. Bond yields are higher by 4-5bps, and the USD is higher, looking to erase its weekly loss. Commodities have also caught a bid as the carry trade is reestablished with WTI, base metals, and Ags all seeing strength. Mtge Applications and 10Y bond auction are the major macro data pts. Is the panic unwind finished? Are detailed thoughts are below.

In the premarket, Mag7 are all higher and semis are shrugging off SMCI (-12%) catastrophic margin collapse as NVDA, AVGO, AMD, and QCOM lead the group higher each up 1%+. Super Micro Computer crashed 14% reversing a 20% earlier spike, as the computer hardware maker’s disappointing gross margins overshadowed an otherwise strong 2025 net sales forecast. Airbnb also tumbled 14% after the company gave a disappointing outlook for a third consecutive quarter and warned of slowing demand from US vacationers. Here are some other notable premarket movers:

- Emergent BioSolutions slumps 34% after the company forecast 3Q revenue with a midpoint that fell short of analyst estimates.

- Fortinet rises 16% after the cyber-security company posted a strong margin performance in the 2Q.

- Lumen Technologies soars 24% after the company boosted its full-year free cash flow forecast.

- Porch Group sinks 19% after the home-services software company reported 2Q results that missed expectations, with severe weather weighing.

- Rivian drops 7% after the electric vehicle startup warned of a looming plant shutdown next year to prepare for a new vehicle launch.

- Novo Nordisk A/S shares dropped as much as 5% after the Danish drugmaker cut its profit forecast for the year.

- Shopify gains 17% after posting 2Q results that exceeded analysts’ estimates, suggesting that the Canadian e-commerce company is managing to navigate cautious consumer spending.

- Trex falls 17% after the manufacturer of decking cut its year revenue forecast as 2Q sales fell short of estimates.

- TripAdvisor tumbles 19% after the online travel company reported 2Q revenue that missed consensus estimates.

- Upstart soars 25% after the AI lending marketplace firm gave a 3Q forecast that is stronger than expected.

Volatility is waning as the S&P 500 recovers from its worst one-day drop since September 2022. The VIX plunged another 17% on Wednesday following its biggest plunge since 2010. The biggest event overnight was Uchida’s surprising U-turn, and capitulation, which came less than a week after the BOJ’s historic and unexpected rate hike which unleashed a carry trade unwind and pushed the VIX as high as 65, its biggest increase since the covid crash.

“I wouldn’t underestimate importance of what the Bank of Japan has been saying overnight,” Jennison Associates Managing Director Raj Shant said on Bloomberg TV. “I think that’s really helpful. This carry trade has been many, many years in the making, and probably indirectly affects a lot of asset classes around the world.”

Still, the recent market turmoil was a “stark reminder of how quickly things can change,” said Justin Onuekwusi, chief investment officer at St James Place. “While overall corporate balance sheets are healthy and recession risks are low, we are starting to see earnings tail off a bit and companies’ guidance is outlining a more uncertain future.”

European stocks follow US futures and Asian counterparts higher after the BOJ capitulation. The Stoxx 600 adds 1.1% with auto, construction and bank names leading gains. Novo Nordisk A/S shares dropped as much as 5% after the Danish drugmaker cut its profit forecast for the year. German lender Commerzbank AG, sportswear maker Puma SE and skin-care products maker Beiersdorf AG also slumped after earnings misses. On the other end, shares in Continental AG rose after the German manufacturer posted improving returns at its struggling car-parts unit, which it may spin off in its biggest-ever restructuring. Dutch lender ABN Amro Bank NV gained after the Dutch lender raised its outlook for lending income, showing how Europe’s high interest rates continue to provide tailwind for the banking industry. The banks sub-index outperformed the benchmark. Here are the biggest European movers:

- Glencore shares climb 1.5%, reversing earlier losses. The company decided to retain its coal and carbon steel materials business after shareholder consultations, a move analysts welcome given its profitability.

- Continental shares rise as much as 5.5% after the German automotive parts maker’s second-quarter results showed what Bernstein called some “rays of hope,” though this was dampened by the cut to the FY24 sales guidance.

- Sampo rises as much as 2.5% following the insurance brokerage firm’s second-quarter earnings report. DNB Markets expects small upgrades to full-year consensus and notes the company’s positive growth momentum.

- GEA Group shares rise as much as 4.4%, the most in five months, after the mechanical engineering firm reported earnings ahead of consensus in the latest quarter.

- Sixt shares fall as much as 1.6%, fluctuating after the vehicle rental firm reported in-line earnings and warned full-year profits will be at the lower-end of its full year guidance.

- Novo Nordisk shares drop as much as 7.7%, the most in two years, after the Danish drugmaker reported weaker-than-expected sales for its Wegovy blockbuster in the second quarter.

- Beiersdorf shares drop as much as 5.9%, to the lowest intraday since November 2023, after the maker of personal-care products reported second-quarter results that missed estimates.

- Puma shares drop as much as 14% after the sportswear brand reported second-quarter revenue in constant currency that missed consensus estimates and narrowed its full-year Ebit forecast.

- Maersk shares fall as much as 4.5% after the marine shipping company’s second quarter Ebitda missed estimates. Morgan Stanley notes that the buyback is not being reinstated and says freight rates are starting to move lower.

- Evotec slumps as much as 39%, to the lowest since November 2016, after the German pharmaceutical company announced material cuts to its full-year guidance and also postponed a planned capital markets day in October to evaluate its next strategic steps.

Earlier in the session, Asian equities advanced for a second session following Monday’s global rout, after the Bank of Japan said it won’t raise interest rates if financial markets are unstable. The MSCI Asia Pacific Index climbed as much as 2.1%. Japan’s Topix index pared earlier gains to close 2.3% higher as Bank of Japan Deputy Governor Shinichi Uchida noted the recent volatility in the nation’s markets and said its rate path will shift if there’s an impact on the policy outlook. Benchmarks in South Korea and Taiwan also climbed, with the Taiex index logging its biggest single-day rally since May 2021. Technology stocks led gains across the region as concerns about further unwinding of the yen carry trade eased, with the Japanese currency weakening more than 2% against the dollar. Still, some market watchers remained cautious.

In FX, the Bloomberg index rose for a second day while the yen is around 2% weaker against the dollar with the cross topping just short of 148.00. The weaker yen boosted higher-yielding currencies. The Mexican peso, a carry trade target that tumbled after the BOJ rate hike, rose more than 1% against the dollar Wednesday. The Swiss franc also underperforms with a 1.1% fall. The kiwi outperforms, rising 1% after the unemployment rate rose less than expected.

In rates, treasuries are cheaper across the curve following the deeper selloff in core European rates after Bank of Japan Deputy Governor Shinichi Uchida pledged to refrain from hiking interest rates while markets are unstable. Treasury yields cheaper by 4bp-5bp with curve spreads little changed; 10-year around 3.94% with bunds underperforming by roughly 4.5bp in the sector. Supply is also a factor for Wednesday’s session, with 10-year note auction at 1pm New York time: the auction cycle continues with $42b 10-year new issue, following good result for Tuesday’s $58b 3-year note sale; it ends Thursday with $25b 30-year bond sale. The WI 10-year yield at ~3.93% is roughly 35bp richer than last month’s, which stopped through by 1bp.

In commodities, oil prices advance, with WTI rising 0.8% to trade near $73.80 a barrel. Spot gold is steady around $2,393/oz. Bitcoin adds 1.7%.

Looking at today’s calendar, US economic data slate includes June consumer credit at 3pm. Scheduled Fed speakers include Collins at 12pm.

Market Snapshot

- S&P 500 futures up 0.8% to 5,306.75

- STOXX Europe 600 up 0.8% to 492.13

- MXAP up 1.5% to 174.18

- MXAPJ up 1.8% to 546.30

- Nikkei up 1.2% to 35,089.62

- Topix up 2.3% to 2,489.21

- Hang Seng Index up 1.4% to 16,877.86

- Shanghai Composite little changed at 2,869.83

- Sensex up 0.8% to 79,192.71

- Australia S&P/ASX 200 up 0.2% to 7,699.83

- Kospi up 1.8% to 2,568.41

- Brent Futures up 0.4% to $76.80/bbl

- Gold spot up 0.1% to $2,393.03

- US Dollar Index up 0.14% to 103.12

- German 10Y yield +7.5bps at 2.28%

- Euro little changed at $1.0925

Top Overnight News

- Japanese stocks rallied on Wednesday and the yen fell after a central bank official appeared to play down the immediate prospects of further interest rate rises in the face of volatile global trade. The Bank of Japan’s deputy governor Shinichi Uchida noted the sharp volatility in domestic and overseas financial markets and said “it is necessary to maintain current levels of monetary easing for the time being”. FT

- China is to impose controls on the production of critical chemicals for the manufacture of fentanyl, in a sign of rising co-operation between Beijing and Washington over efforts to crack down on the deadly synthetic opioid. FT

- SoftBank announced a buyback of as much as ¥500 billion ($3.4 billion), an outlay that still leaves founder Masayoshi Son with a substantial pile of cash as he gears up to make more aggressive investments. The outlay comes as CEO Son is preparing for what appears to be a large-scale push into artificial intelligence and semiconductor investments. BBG

- Iran may be reconsidering a plan for major retaliation against Israel following intensive diplomatic and military pressure from Washington while Netanyahu moves towards the US-brokered ceasefire deal in Gaza. WaPo

- Crude stockpiles at Cushing rose by more than 1 million barrels last week, API data is said to show, the biggest surge in more than two months if confirmed by the EIA. Total inventory also rose. In China, July imports fell to the slowest pace in almost two years. BBG

- Harris is up 3 points over Trump both head-to-head and when 3rd party candidates are considered according to a new Marist poll. The Hill

- Supermicro reported a miss on FQ4 EPS at 6.25 (vs. the Street 8.25) as soft margins (11.3% gross margins vs. the Street 14%) offset inline sales and while the revenue guide is bullish, investors have persistent worries about profitability. RTRS

- Novo plummeted as Wegovy sales missed estimates and it cut its full-year profit outlook. While the drug’s miss will be in focus in the short term, volume trends are strengthening. BBG

- Airbnb reported decent Q2 results, w/revenue +11% FXN to $2.75B (vs. the Street $2.73B), EBITDA +10% FXN to $894MM (vs. the Street $862.3MM), and bookings +12% FXN to $21.2B (about inline), although nights/experiences were a bit light (+9% to 125.1M vs. the Street 126.3M) and the guidance is soft (the Q3 revenue range mid-point is $3.7B vs. the Street’s $3.83B). “We are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests”. RTRS

A more detailed look at global markets courtesy of newsquawk

APAC stocks continued their recent rebound but with some of the gains capped as markets digested mixed Chinese trade data. ASX 200 was positive albeit with the upside limited as participants reflected on the key data from Australia’s largest trading partner. Nikkei 225 saw two-way price action in which initially suffered losses but then staged a gradual recovery and was further boosted following comments from BoJ Deputy Governor Uchida who said they won’t hike rates when markets are unstable. Hang Seng and Shanghai Comp. conformed to the upbeat mood although the advances in the mainland are limited after the PBoC refrained from injecting funds and the latest Chinese trade data printed mixed.

Top Asian News

- BoJ Deputy Governor Uchida said their interest rate path will obviously change if as a result of market volatility, economic forecasts, view on risks, and likelihood of achieving the projection change, while he added that they won’t hike rates when markets are unstable and they must maintain the current degree of monetary easing for the time being. Uchida said Japan is not in an environment where they would be behind the curve unless they hike rates at a set pace, as well as noted that a weak yen and subsequent rise in import costs pose upside risks to inflation. Furthermore, Uchida said if the economy and prices move in line with projections, it is appropriate to adjust the degree of monetary easing but also commented that Japan’s real interest rate is very low, monetary conditions are very accommodative and that the scheduled tapering of bond buying likely won’t cause major changes in the degree of monetary easing.

- BoJ’s Uchida says market volatility is very large, will be keeping a close eye on moves and the impact on the economy and prices. Real rates remain low, will underpin the economy. There is no gap in views between Ueda and Uchida, recent Uchida remarks reflect changes in the latest market developments following the last meeting.

- Honda (7267 JT) Q1 (JPY): Net 394bln (exp. 343bln), Operating 484bln (exp. 472bln), PBT 559bln (exp. 508bln). FY Guidance: Downgraded group sales guidance; sees GY global retail sales at 3.9mln vehicles (prev. guided 4.1mln). N. American sales 1.675mln vehicles (prev. guided 1.675mln)

European bourses are firmer intraday, Euro Stoxx 50 +1.7%, with the Stoxx 50 outperforming the Stoxx 600 +1.1% as the latter is weighed on by post-earnings downside in heavyweight Novo Nordisk -3.0%. Given this, Healthcare lags after Novo missed on several key metrics incl. Wegovy sales and downgraded some components of its FY guidance. Banks outperform as yields rise and after strong numbers from ABN AMRO. Breakdown has the DAX 40 +1.5% supported by Continental, which is lifting the broader Auto sector; Commerzbank bucks the banking trend after missing on numerous metrics. Stateside, futures in the green and grinding higher throughout the morning, ES +1.0%, NQ +1.1%; though, action has been choppy at times with newsflow light thus far ex-earnings. Elsewhere, Maersk earnings were mixed with the name lower despite noting market demand has been strong but warns of slower global container demand ahead.

Top European News

- Novo Nordisk (NOVOB DC) Q2 (DKK): Sales 68.06bln (exp. 68.65bln), EBIT 25.94bln (exp. 26.85bln), Wegovy Sales 11.66bln (exp. 13.54bln). CEO: Wegovy prescriptions in the US more doubled vs the start of the year; CFO says negative impact of net impact to net sales of Wegovy in Q2 is due to rebate adjustments; Competitive dynamics will not have an impact on Wegovy sales in the near future. FY Guidance: Sales growth 22-28% at CER (prev. guided 19-27%); Operating Profit growth 20-28% at CER (prev. view 22-30%), CAPEX ~45bln. FCF 59-69bln

- Maersk (MAERSKB DC) Q2 (USD): EBITDA 2.1bln (exp. 2.27bln), EBIT 963mln (exp. 810mln), EPS 51 (exp. 55.5). Market demand has been strong, Red Sea situation remains entrenched. CEO says they could see some pulling forward of demand, most notably within the US due to the upcoming election and associated uncertainty around future import tariffs. Adds, industrial action following pending union talks in the US could lead to further supply chain disruptions.

- UK Chancellor Reeves aims to follow a “Canadian model” to consolidate GBP 360bln of smaller local government pension schemes to aid in boosting investment and “fire up the economy”, according to The Times.

FX

- USD supported with the DXY bid and above 103.00 but off overnight best levels of 103.37. Strength which came as USD/JPY soared above 147.50 after remarks from BoJ’s Uchida that they won’t hike when markets are unstable.

- As such, JPY is the clear laggard but followed relatively closely by the CHF as the positive tone means haven demand is waning and as yields rally and weigh on the likes of CHF and JPY.

- Sterling modestly firmer, but has been below 1.27 in a 1.2681-1.2718 band. Specifics light but strength coming via EUR downside and associated pressure in EUR/GBP to back below 0.86.

- EUR/USD itself holding around 1.0905 and is close to, but yet to test, the figure to the downside; no real reaction to mixed German data this morning.

- Antipodeans benefit from the risk tone with NZD outperforming after encouraging employment data and as the AUD takes a slight breather from RBA-inspired strength; nonetheless, it remain underpinned with strong Chinese imports assisting.

- PBoC set USD/CNY mid-point at 7.1386 vs exp. 7.1481 (prev. 7.1318).

- Japan’s currency intervention amounted to JPY 5.92tln on April 29th and JPY 3.87tln on May 1st, while the April 29th intervention was a single-day record and surpassed the previous record of JPY 5.62tln on 21st October 2002, according to Ministry of Finance data.

Fixed Income

- Benchmarks continue to falter despite opening the European morning with modest gains. Downside which has pushed Bunds below the 134.00 mark vs. a 136.28 peak on Monday.

- Supply was uneventful in terms of reaction from Germany and the UK, though the latter was a touch softer than recent taps; reminder, US 10yr later.

- Gilts pressured but to a slightly lesser magnitude with little by way of specific driver to note. Further downside brings the 99.00 mark into view and then numerous recent lows below this.

- Amidst this, USTs are also softer but only modestly so with the docket ahead thin ex-earnings until 10yr supply which follows an unremarkable 3yr tap on Tuesday.

- Chinese regulators are reportedly restricting the duration of new bond funds, restrictions target mutual fund managers, according to Reuters sources.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 2.87x (prev. 3.10x), average yield 3.854% (prev. 4.023%) & tail 0.9bps (prev. 0.9bps)

- Germany sells EUR 0.407bln vs exp. EUR 0.5bln 1.00% 2038 Bund & EUR 1.199bln vs exp. EUR 1.5bln 2.60% 2041 Bund

Commodities

- Crude benchmarks began with a mild positive tilt and have been gradually extending on this throughout the morning. WTI and Brent at the top-end of parameters and are holding around USD 74.11/bb and USD 77.42/bbl respectively.

- Benchmarks aided by the USD being slightly off best (though still firmer) and with gepol. risk still a key factor alongside the recent production halt at El Sharara.

- Metals are mixed, spot silver once again underperforms its gold counterpart a touch which itself is approaching a test of USD 2400/oz to the upside. Base metals are primarily weaker after mixed Chinese trade data and with Copper leading the downside after a mammoth LME stock build.

- LME Stocks: Copper +42,175t (prev. +1,225t)

- Chinese gold reserves unchanged M/M at 72.8mln fine troy ounces

- US Private Inventory Data (bbls): Crude +0.2mln (exp. -0.7mln), Distillate +1.2mln (exp. +0.2mln), Gasoline +3.3mln (exp. -1mln), Cushing +1.1mln.

Geopolitics

- Israel estimates that Hezbollah will attack before Iran, according to Israel’s Kann News. Israel Broadcasting Corporation also reported that estimates indicate Hezbollah will carry out the attack before Iran and will use precision missiles, according to Al Arabiya. Furthermore, a source via X reported that Israeli intelligence said a possible Hezbollah attack could occur in the next 24-48 hours.

- Israel’s Channel 12 News reported that advanced preparations and planning are underway within the Israeli Military for the launch of pre-emptive strikes against Hezbollah targets in Lebanon, prior to their coordinated attack against Israel with Iran.

- IDF struck a building in a Lebanese village targeting Hezbollah operatives, according to Times of Israel.

- US Secretary of State Blinken said they have communicated directly to Iran and Israel that no one should escalate the conflict in the Middle East, while he added that Gaza hostage negotiations have reached the final stage and it is critical that parties work to finalise the agreement as soon as possible. Blinken also said everyone in the region should understand that further attacks only perpetuate conflict, instability, and insecurity for everyone.

- US Defence Secretary Austin said the US will not tolerate attacks on US personnel in the Middle East and that they are sure Iran-backed militia was behind the attack on US troops in Iraq, according to Reuters. Austin also said they are ready to deploy more troops to the region if they see a threat to their interests and the security of allies, according to Al Arabiya.

- “Iranian News Agency: Equipping the eastern regions of the Iran with radar, air defense systems and drones”, according to Sky News Arabia.

- “Sirens sound in Shtula, northern Israel”, according to Sky News Arabia.

- Australia, Canada, the Philippines and the US are to hold joint maritime exercises on August 7th-8th in the South China Sea. It was later reported that China’s military organised a joint combat patrol over the sea and airspace near the Scarborough Shoal in the South China Sea.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications 6.9%, prior -3.9%

- 15:00: June Consumer Credit, est. $10b, prior $11.4b

Central Bank speakers

- 12:00: Fed’s Collins Visits Rhode Island

Loading…