Amid Russia’s invasion of Ukraine, the inflation-adjusted price of oil reached a seven-year high. Russia is one of the world’s largest producers of crude oil, and many countries have announced a ban on Russian oil imports amid the war.

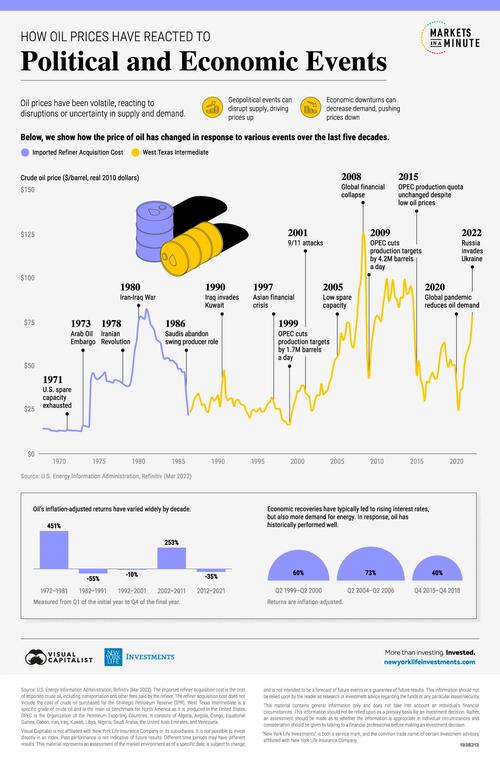

This has led to supply uncertainties and, therefore, rising prices. But, as Visual Capitalist's Jenna Ross asks (and answers) below, how does the price increase compare to previous political and economic events? In this Markets in a Minute from New York Life Investments, we look at historical oil prices since 1968.

The Fundamentals Behind Oil Prices

Before diving into the data, it’s worth explaining why historical oil prices have seen so much volatility. This mainly stems from the fact that the supply and demand of oil tends to have a low responsiveness to price changes in the short term.

For these reasons, in order to re-balance supply and demand, it takes a sufficiently large price change to occur. For example, if gas prices were to double, only then may enough commuters consider taking public transit or changing behavior in other ways.

What kind of events can shock the system enough to drive big price changes?

A large portion of the world’s oil is located in regions that are prone to political conflict. Political events can disrupt the actual or perceived supply of oil, and drive prices upwards. On the other hand, an economic downturn reduces energy demand and can depress prices.

Looking Back at Historical Oil Prices

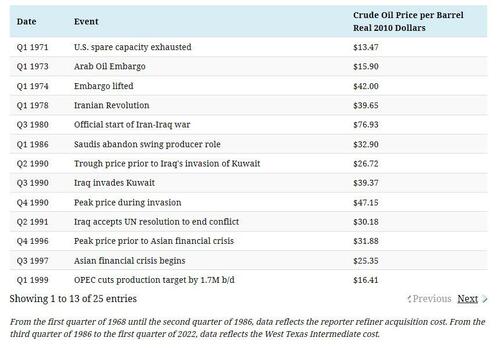

To compare how events have influenced historical oil prices, we used data from the U.S. Energy Information Administration. It should be noted that the data extends to March 31, 2022, and does not reflect the recent price dips in response to Shanghai lockdowns and U.S. rate hikes.

Here is the inflation-adjusted price of a barrel of crude oil during select events.

- On the supply side, oil production capacity can be challenging to change quickly. Drilling a new oil well is a lengthy and complex process.

- On the demand side, it can be quite difficult to change equipment that uses petroleum products. For instance, in the short term, people will keep driving their cars to work despite higher gas prices.

In 1973, the Organization of the Petroleum Exporting Countries (OPEC) announced an embargo (ban) on oil exports to the United States. The move was in response to the U.S. providing military aid to Israel. By the time the embargo ended in March 1974, the inflation-adjusted price of crude oil had risen 164%. The embargo also led to a selloff in the stock market, with the recovery taking almost six years.

Historical oil prices rose rapidly from 2004-2008. During that time, economic growth was fueling oil demand but there was little spare production capacity. By the second quarter of 2008, inflation-adjusted oil prices hit a high of $125 per barrel. They crashed by 66% shortly thereafter due to the global financial crisis.

Most recently, the COVID-19 pandemic and associated containment measures caused historical oil prices to drop by nearly 40% in three months. Oil prices have since risen 216% from their pandemic low, as of the first quarter of 2022. This is due to the economic recovery and Russia’s invasion of Ukraine.

Oil as an Investment

Investors’ interest in oil as an alternative investment has risen in recent years. Given the high volatility in historical oil prices, investors may want to consider their comfort with this level of risk. Of course, an investor’s sustainability goals may also be a factor when choosing whether to invest in oil.

However, oil also presents opportunities. It has had low-to-negative correlation with U.S. bonds in recent years and may help investors diversify their portfolios. Not only that, it may help investors manage rising interest rates. An economic recovery typically leads to rising interest rates, but also more energy demand. Oil prices have historically climbed during these periods.

Amid Russia’s invasion of Ukraine, the inflation-adjusted price of oil reached a seven-year high. Russia is one of the world’s largest producers of crude oil, and many countries have announced a ban on Russian oil imports amid the war.

This has led to supply uncertainties and, therefore, rising prices. But, as Visual Capitalist’s Jenna Ross asks (and answers) below, how does the price increase compare to previous political and economic events? In this Markets in a Minute from New York Life Investments, we look at historical oil prices since 1968.

The Fundamentals Behind Oil Prices

Before diving into the data, it’s worth explaining why historical oil prices have seen so much volatility. This mainly stems from the fact that the supply and demand of oil tends to have a low responsiveness to price changes in the short term.

For these reasons, in order to re-balance supply and demand, it takes a sufficiently large price change to occur. For example, if gas prices were to double, only then may enough commuters consider taking public transit or changing behavior in other ways.

What kind of events can shock the system enough to drive big price changes?

A large portion of the world’s oil is located in regions that are prone to political conflict. Political events can disrupt the actual or perceived supply of oil, and drive prices upwards. On the other hand, an economic downturn reduces energy demand and can depress prices.

Looking Back at Historical Oil Prices

To compare how events have influenced historical oil prices, we used data from the U.S. Energy Information Administration. It should be noted that the data extends to March 31, 2022, and does not reflect the recent price dips in response to Shanghai lockdowns and U.S. rate hikes.

Here is the inflation-adjusted price of a barrel of crude oil during select events.

- On the supply side, oil production capacity can be challenging to change quickly. Drilling a new oil well is a lengthy and complex process.

- On the demand side, it can be quite difficult to change equipment that uses petroleum products. For instance, in the short term, people will keep driving their cars to work despite higher gas prices.

In 1973, the Organization of the Petroleum Exporting Countries (OPEC) announced an embargo (ban) on oil exports to the United States. The move was in response to the U.S. providing military aid to Israel. By the time the embargo ended in March 1974, the inflation-adjusted price of crude oil had risen 164%. The embargo also led to a selloff in the stock market, with the recovery taking almost six years.

Historical oil prices rose rapidly from 2004-2008. During that time, economic growth was fueling oil demand but there was little spare production capacity. By the second quarter of 2008, inflation-adjusted oil prices hit a high of $125 per barrel. They crashed by 66% shortly thereafter due to the global financial crisis.

Most recently, the COVID-19 pandemic and associated containment measures caused historical oil prices to drop by nearly 40% in three months. Oil prices have since risen 216% from their pandemic low, as of the first quarter of 2022. This is due to the economic recovery and Russia’s invasion of Ukraine.

Oil as an Investment

Investors’ interest in oil as an alternative investment has risen in recent years. Given the high volatility in historical oil prices, investors may want to consider their comfort with this level of risk. Of course, an investor’s sustainability goals may also be a factor when choosing whether to invest in oil.

However, oil also presents opportunities. It has had low-to-negative correlation with U.S. bonds in recent years and may help investors diversify their portfolios. Not only that, it may help investors manage rising interest rates. An economic recovery typically leads to rising interest rates, but also more energy demand. Oil prices have historically climbed during these periods.