Authored by Charles Hugh Smith via OfTwoMinds blog,

The problem for global corporations feasting on "Inflation" profiteering is that the vast majority of consumers can't afford another lavish vacation, overpriced vehicle or specious subscription.

A funny thing seems to be happening within "Inflation": companies are using "inflation" as cover for outrageous price increases that have little to do with actual inflation. Consider a water or electric utility that is directly impacted by rising costs of natural gas / oil. To stay solvent, the utility must pass along their higher energy costs to consumers. OK, we get it: higher input costs such as energy and shipping are passed along to the consumer.

But what about auto and property insurance? Exactly what input costs justify jacking up auto insurance by 14% or property insurance by 20%? Does insurance consume huge quantities of energy and is therefore exposed to higher fuel costs and container rates from Asia No. Did higher energy costs trigger massive increases in auto or property claims? No.

Readers report getting huge increases in insurance coverage that are quickly rescinded once the reader called their agent and said they're dropping the policies due to the crazy price increases: voila, the increases go away.

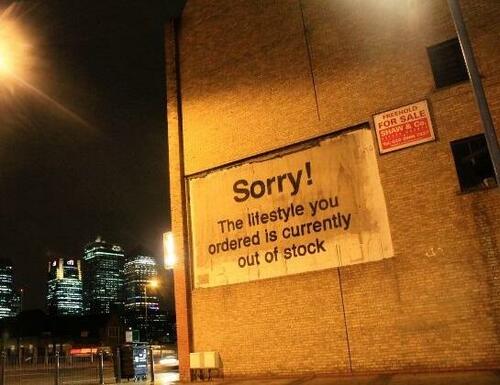

In other words, "Inflation" is an ideal cover for corporations, landlords, vendors, etc. to jack up prices and see if they stick. If unwary consumers just pay the new price, yowzah--instant increase in pure profit. Dropping the jacked-up prices when a few frugal customers complain is a small price to pay for the gravy train generated by consumers who passively accept every increase as "inflation" they can't do anything about.

I'm also hearing of short-term vacation rentals doubling their daily fee overnight, resorts jacking up daily rates by 50% or more and other egregious examples of jacking up prices and seeing what sticks.

Maybe real input costs have risen 10% due to energy, healthcare, wages, etc., but this provides an excuse for raising prices 20% or more. "Inflation" is a great cover for rapacious profiteering.

The post-lockdown spending-spree of consumers going wild offered a golden opportunity for seeing what other skims and scams will stick. In what qualifies as a parody come to life, a luxury automaker is trying to turn seat-warmers into a monthly subscription.

If that sticks, why not make the engine a subscription, too? Did global corporations finally catch on to Big Tech's gravy train of turning ownership into subscriptions?

The problem for global corporations feasting on "Inflation" profiteering is that the vast majority of consumers can't afford another lavish vacation, overpriced vehicle or specious subscription. Their desperate desire to splurge has emptied their coffers, and so once the current splurge fades, there won't be a secondary wave of splurging that will buy regardless of price.

Frugality will transition from an option to a necessity. And as that transition is reflected in plummeting demand, consumer "Inflation" will drop as tapped-out buyers go on strike--voluntarily or involuntarily.

* * *

My new book is now available at a 10% discount this month: When You Can't Go On: Burnout, Reckoning and Renewal. If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Authored by Charles Hugh Smith via OfTwoMinds blog,

The problem for global corporations feasting on “Inflation” profiteering is that the vast majority of consumers can’t afford another lavish vacation, overpriced vehicle or specious subscription.

A funny thing seems to be happening within “Inflation”: companies are using “inflation” as cover for outrageous price increases that have little to do with actual inflation. Consider a water or electric utility that is directly impacted by rising costs of natural gas / oil. To stay solvent, the utility must pass along their higher energy costs to consumers. OK, we get it: higher input costs such as energy and shipping are passed along to the consumer.

But what about auto and property insurance? Exactly what input costs justify jacking up auto insurance by 14% or property insurance by 20%? Does insurance consume huge quantities of energy and is therefore exposed to higher fuel costs and container rates from Asia? No. Did higher energy costs trigger massive increases in auto or property claims? No.

Readers report getting huge increases in insurance coverage that are quickly rescinded once the reader called their agent and said they’re dropping the policies due to the crazy price increases: voila, the increases go away.

In other words, “Inflation” is an ideal cover for corporations, landlords, vendors, etc. to jack up prices and see if they stick. If unwary consumers just pay the new price, yowzah–instant increase in pure profit. Dropping the jacked-up prices when a few frugal customers complain is a small price to pay for the gravy train generated by consumers who passively accept every increase as “inflation” they can’t do anything about.

I’m also hearing of short-term vacation rentals doubling their daily fee overnight, resorts jacking up daily rates by 50% or more and other egregious examples of jacking up prices and seeing what sticks.

Maybe real input costs have risen 10% due to energy, healthcare, wages, etc., but this provides an excuse for raising prices 20% or more. “Inflation” is a great cover for rapacious profiteering.

The post-lockdown spending-spree of consumers going wild offered a golden opportunity for seeing what other skims and scams will stick. In what qualifies as a parody come to life, a luxury automaker is trying to turn seat-warmers into a monthly subscription.

If that sticks, why not make the engine a subscription, too? Did global corporations finally catch on to Big Tech’s gravy train of turning ownership into subscriptions?

The problem for global corporations feasting on “Inflation” profiteering is that the vast majority of consumers can’t afford another lavish vacation, overpriced vehicle or specious subscription. Their desperate desire to splurge has emptied their coffers, and so once the current splurge fades, there won’t be a secondary wave of splurging that will buy regardless of price.

Frugality will transition from an option to a necessity. And as that transition is reflected in plummeting demand, consumer “Inflation” will drop as tapped-out buyers go on strike–voluntarily or involuntarily.

* * *

My new book is now available at a 10% discount this month: When You Can’t Go On: Burnout, Reckoning and Renewal. If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.