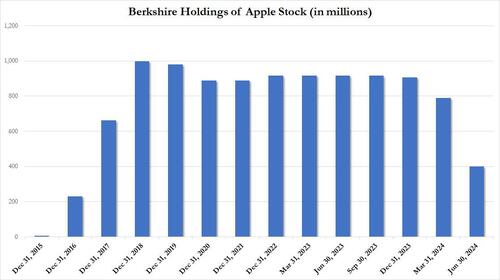

At the start of August, we reported the shocking news revealed deep inside the Berkshire 10Q, that billionaire Warren Buffett had sold more than half of his AAPL holdings (approximately 400 million shares according to our calculations)...

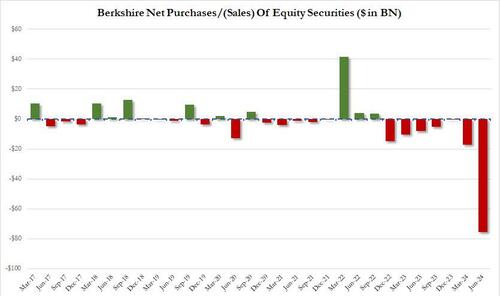

... as part of Berkshire's biggest portfolio liquidation on record, one which saw some $75.5 billion in stock sales during the second quarter of 2024.

Of course, all these were only approximations since the 10Q did not break out the specifics of the Berkshire portfolio, which is why were were eagerly awaiting today's release of the Berkshire 13F for the second quarter. It confirmed what we already knew:

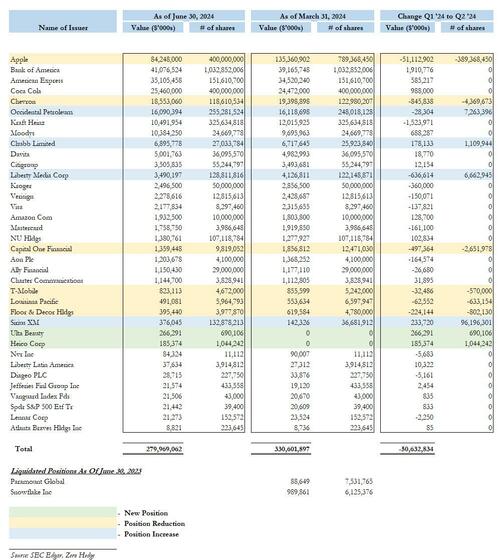

Buffett indeed sold some 389.4 million shares of AAPL in Q2, bringing his total to exactly 400 million shares as of June 30. What is remarkable is that Buffett managed to unwind more than half his massive position (which at March 31 amounted to $135.4 billion), while the stock was levitating for much of Q2. Also remarkable is that even with the huge sale, Apple still remains Berkshire's top holding, valued at $84.2 billion as of June 30.

Going down the list, Buffett also sold 3.6%, or 4.4 million, of his shares in Chveron, which remained the 5th largest position in Berkshire's portfolio.

The other 3 names in the top 5 were unchanged during the quarter, but as previously reported, we already know that Berkshire has been slowly dumping a lot of BofA shares, as he is now also liquidating his 2nd largest position (amounted to $41.1 billion as of June 30, but certainly less now).

There were some other stake reductions including:

- Capital One Financial, where Buffett sold 21.3% of his March 31 stake, reducing his ownership from 12.5 million to 9.8 million shares.

- T-Mobile, where Buffett sold 10.9% of his stake, reducing ownership from 5.2 million to 4.7 million shares.

- Louisiana-Pacific, where Buffett sold 9.6% of his stake, cutting ownership from 6.6 million to 6.0 million shares.

- Floor & Design, where Buffett sold 16.8% of his stake, cutting ownership from 4.8 million to 4.0 million shares.

It wasn't all sales: Buffett also added to existing positions in the following names:

- Occidental: added 2.9%, or 7.3 million shares, bringing the total to 255.3 million shares. OXY is his 6th largest position, behind Chevron.

- Chubb: added 4.3%, or 1.1 million shares, bringing the total to 27 million shares in what is now his 9th largest position by value.

- Liberty Media: added 5.5%, or 6.7 million shares, bringing the total to 128.8 million shares.

- Sirius XM: added 262% or 96.2 million shares, bringing the total to 132.9 million shares.

Also of note, there were two liquidations, as Berkshire dumped its entire stake in Snowflake, selling 6.125 million shares worth $990 million as of Q2, and also liquidated his stake in Paramount Global; this amounted to 7.5 million shares of the flaming dumpster fire worth $88.6 million.

Finally, Buffett added two new positions:

- HEICO Corp: Berkshire purchased 1 million shares of the aerospace product manufacturer, worth $185 million

- Ulta Beaty: Berkshire purchased 690K shares of the beauty store operator, worth $267 million.

That said, both of these positions are tiny and barely make a dent in the firm's $280 billion portfolio.

Finally, one thing which we find odd is that while the 13F showed some $50.6 billion in stock sales (by value) in Q1, Berkshire's 10Q cash flows statement disclosed the $75.5 billion worth of stock had been sold in Q2, indicating that at least $25 billion worth of sales took place without being revealed on the 13F.

While we muse over this puzzle, here is the full breakdown of Berkshire's latest 13F

Source: Edgar.

At the start of August, we reported the shocking news revealed deep inside the Berkshire 10Q, that billionaire Warren Buffett had sold more than half of his AAPL holdings (approximately 400 million shares according to our calculations)…

… as part of Berkshire’s biggest portfolio liquidation on record, one which saw some $75.5 billion in stock sales during the second quarter of 2024.

Loading…