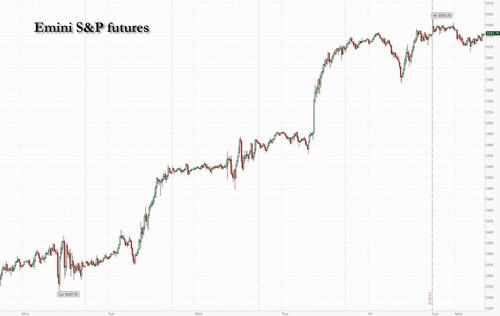

Futures are flat after trading in a narrow overnight range, with small-caps outperforming. As of 7:45am ET S&P futures are up 0.1% at 5,581, after last week's face-ripping rally which pushed the S&P to within 2% of the all time highs, while Nasdasq futures are unchanged as Mag7 and Semis start the week lower but broad-based strength is limiting losses. Bond yields are 1-2bps lower while broad dollar weakness sees USD/JPY re-test 145 level before rebounding back above 146, while WTI crude oil futures drop around 1%, underpinning Treasuries. Commodities are lower with Energy and Metals weaker while Softs are catching a bid. This week is expected to be a low liquidity week with events centered around the DNC and Jackson Hole with NVDA earnings looming next week. The macro data focus is on Flash PMIs, Housing Data, and Regional Activity updates. Fed Minutes are not expected to be catalytic with Jackson Hole kicking off on Aug 22. Q2 earnings season approaches its close with consumer-related / Retailers earnings this week and NVDA next week.

In premarket trading, AMD shares rose 2% after the company agreed to buy server maker ZT Systems in a cash and stock transaction valued at $4.9 billion, adding data center technology that will bolster its efforts to challenge Nvidia. Shares in European defense firms including Rheinmetall AG tumbled after a report that Germany will no longer grant new requests for aid to Ukraine as the government seeks to rein in spending. Here are some other notable premarket movers:

- Estee Lauder falls 6% after forecasting annual revenue growth below analysts’ expectations, a sign that the cosmetics company’s long-awaited recovery has hit another roadblock.

- FuboTV shares rise 13%, poised to extend gains after Fox, Warner Bros. Discovery and Walt Disney were blocked by a judge from launching their streaming sports service one week before its rollout.

- HP slips 2% as Morgan Stanley issued a downgrade, saying the computer hardware company now offers limited upside to estimates and on valuation.

- Liquidia drops 37% after the FDA said the company’s Yutrepia inhalation powder can’t be approved until May next year as a treatment for adults with pulmonary arterial hypertension and pulmonary hypertension.

- Shake Shack and Dutch Bros shares fall after Piper Sandler cuts to neutral as the broker tempers view on the fast casual sub-sector. Shake Shack -3%, Dutch Bros -2%

- Xperi rises 19% after the company said late Friday that it agreed to sell Perceive assets to Amazon.com for $80m in cash.

- ZIM Integrated Shipping gains 14% after boosting its adjusted Ebitda guidance for the full year.

Traders are starting a relatively quiet week on a cautious footing after recovering risk appetite last week left the S&P 500 close to a record high. After the Aug. 5 swoon, some buyers are re-emerging to help the main US stock gauge recoup more than half its summer losses even as hedge funds are once again shorting the bounce (having done the same in most of June and July).

“Things have come back, things feel more measured now,” Louise Dudley, portfolio manager for global equities at Federated Hermes, said in an interview with Bloomberg TV. “In that medium term there is some volatility and we’re definitely looking to take advantage of some of those price moves. Some of the large-cap cap names are still offering some of the top-growth opportunities.”

The key event is slated for Friday, when Fed Chair Jerome Powell is expected to give fresh insights on the course of US monetary policy at the central bank’s Jackson Hole economic symposium in Wyoming. “We expect Powell to hold forth on the medium-term strategy for the Fed,” Seth Carpenter, chief global economist at Morgan Stanley, wrote in a note.

Soft-landing bets are also helping to drive the recovery in equities. Goldman Sachs at the weekend trimmed the probability of a US recession in the next year to 20% from 25%, citing last week’s retail sales and jobless claims data, just days after raising it from 15% to 25%. If the August jobs report set for release on Sept. 6 “looks reasonably good, we would probably cut our recession probability back to 15%,” Goldman economists led by Jan Hatzius wrote in a report to clients on Saturday.

Elsewhere, the Democratic National Convention kicks off Monday in Chicago as party officials and celebrities rally around Kamala Harris, who may or may not be an idiot.

European stocks inch higher with the Stoxx 600 up 0.1%, and looking to extend its winning streak to five sessions. Basic resources is the strongest performing sector, while technology and energy stocks are the biggest laggards. Here are some of the biggest European movers on Monday:

- Plus500 shares rise as much as 7% to a record high after the financial trading platform said it expects annual results to be ahead of expectations, which analysts believe will lift consensus estimates. Analysts also noted its cash balance exceeded $1 billion for the first time, providing the firepower needed to keep returning cash to shareholders as it launched a new buyback.

- Metso Oyj and Sandvik AB gained when trading started on Monday after Swedish business daily Dagens Industri reported that large shareholders in Metso were pushing for a merger between the mining equipment operations of both companies.

- Rheinmetall falls as much as 5% after the Frankfurter Allgemeine Zeitung reported that Germany will no longer grant new requests for aid to Ukraine as the government seeks to rein in spending.

- Other defense firms also fell: Hensoldt -6.9%, Renk -3.6%, Kongsberg -2.5%, Saab -4.1%, BAE Systems -2.6%, Dassault Aviation -3% and Leonardo -2.7%.

- DSM-Firmenich falls as much as 5.7% as traders pointed to a free-float adjustment announcement from index provider Stoxx.

Earlier in the session, stocks in Asia advanced for a second session, helped by gains in regional currencies and a further rally in Chinese technology shares following some earnings beats. The MSCI Asia Pacific Index rose as much as 0.9% after jumping 2.5% on Friday. Japan’s Seven & i Holdings Co. was the biggest contributor to gains on the benchmark after a report on a buyout offer. Shares of Chinese e-commerce company JD.com extended a post-earnings rally.Equities in Hong Kong were among the top performers in Asia, with the Hang Seng China Enterprises Index closing up 1%. Onshore Chinese shares also rose. More cities have scrapped official sale price restrictions on newly-built homes, a step to allow steeper price declines to amid sluggish demand, the 21st Century Business Herald reported on Monday. Japanese stocks were an outlier, weakening as a stronger yen dimmed the earnings prospect of export firms.

In FX, the dollar slipped, with some traders unwinding bets on a return to the White House by Donald Trump. On the other end, the Japanese yen surged amid broad weakness in the US dollar as traders positioned ahead of key central bank events later in the week. Bank of Japan Governor Kazuo Ueda appears in parliament on Friday, and Federal Reserve Chair Jerome Powell speaks at Jackson Hole later the same day. USD/JPY is down 1.1% against the greenback at ~146.05, having dropped as low as 145. The Bloomberg Dollar Spot Index falls 0.3%.

“If we look at the polls, if we look at Harris’s solid performance in the last three weeks, the market has got to be thinking, were we hasty in putting on that Trump trade in June or July?,” Jane Foley, head of FX strategy at Rabobank, said in an interview with Bloomberg TV. “The market has to rethink that. If the market is less inclined to be putting on Trump trades, that could soften the dollar.”

In rates, treasuries hold small gains across long-end of the curve, where 30-year yields are ~1bp lower vs Friday’s close, as bunds outperform over early London session. 10-year TSY yields fall 2bps to 3.86% with bunds outperforming by 1bp in the sector and gilts trading broadly in line.

In commodities, oil prices decline, with WTI falling 1% to trade near $75.90 a barrel; oil declined for the fourth time in five sessions as traders tracked US-led efforts to secure a cease-fire in the 10-month old conflict in Gaza, while the Russia-Ukraine war is escalating. Spot gold falls $7 to around $2501/oz. Bitcoin falls 2%.

Looking at today's calendar, the data slate includes July Leading Index at 10am New York time; ahead this week are manufacturing and services PMIs and new home sales, and July 31 FOMC meeting minutes on Wednesday. Fed speakers scheduled for the session include Waller at 9:15am

Market Snapshot

- S&P 500 futures little changed at 5,573.50

- STOXX Europe 600 little changed at 511.94

- MXAP up 0.5% to 183.72

- MXAPJ up 0.8% to 573.15

- Nikkei down 1.8% to 37,388.62

- Topix down 1.4% to 2,641.14

- Hang Seng Index up 0.8% to 17,569.57

- Shanghai Composite up 0.5% to 2,893.67

- Sensex little changed at 80,435.57

- Australia S&P/ASX 200 up 0.1% to 7,980.45

- Kospi down 0.8% to 2,674.36

- German 10Y yield little changed at 2.22%

- Euro up 0.2% to $1.1044

- Brent Futures down 0.5% to $79.27/bbl

- Gold spot down 0.1% to $2,506.51

- US Dollar Index down 0.32% to 102.13

Top Overnight News

- The race for the White House will reach a fever pitch this week, with Vice President Kamala Harris and Republican nominee Donald Trump battling for momentum — and attention — around the Democratic National Convention in Chicago.

- Republicans warned Donald Trump to get serious on policy or he could lose and cautioned that his 'showman' tactics could cost him the chance of a second term in the White House, according to The Telegraph.

- Wall Street is betting that Federal Reserve Chair Jerome Powell will confirm that interest-rate cuts are coming at the central bank’s annual confab in Jackson Hole, Wyoming. But as the debate shifts from “will they or won’t they?” to “how big will they go?” — stock traders may be left wanting.

- The yen rallied against the dollar, leading gains among Group-of-10 currencies before comments from top central bank officials this week.

- Just as bond traders grow more assured that inflation is finally under control, a camp of investors is quietly building up protection against the risk of a future spike in prices.

- Fed’s Daly (voter) said recent data gave her more confidence that inflation is under control and it is time to consider adjusting rates from their current level, while she noted the Fed needs to take a gradual approach to reducing borrowing costs, according to FT.

- Fed's Goolsbee (non-voter) said on Friday that he has concerns for 2024 and that they have crosscurrents. Goolsbee added he is concerned that the Fed set this level of rates over a year ago and inflation and the labour market are cooling faster than expected, while he thinks the Fed should take a step back and think about it.

- Goldman Sachs cuts the probability of a US recession in the next 12 months to 20% from 25%; cites last week's Retail Sales and IJC metrics. Says could lower it to 15% in the event that the August jobs report "looks reasonably good".

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with a somewhat cautious tone amid geopolitical uncertainty after Hamas rejected the latest ceasefire proposal and as participants await this week's key events including the Jackson Hole Symposium. ASX 200 traded rangebound as outperformance in gold miners and utilities was offset by weakness in consumer stocks. Nikkei 225 swung between gains and losses and traded on both sides of the 38,000 level after mixed Machinery Orders data, while the index was then pressured again later in the session alongside a firmer currency. Hang Seng and Shanghai Comp. gained amid stimulus hopes after Premier Li hinted on Friday at targeted measures to smooth the economic cycle and promote consumption, while a recent report noted weak Chinese data raised the pressure for Beijing to provide support and revived talk of regarding the idea of China issuing shopping vouchers.

Top Asian News

- China’s Vice Premier is to co-chair a regular meeting between Chinese and Russian leaders with Russia’s Deputy PM on August 19th-20th, according to Chinese state media.

- Singaporean PM Wong warned that increasing tensions between the US and China will have an impact on Singapore’s economy and the broader region, according to FT.

European bourses, Stoxx 600 (+0.1%) began the week on a mixed footing and generally traded on either side of the unchanged mark. European sectors are mixed with the breadth of the market fairly narrow. Basic Resources takes the top spot, in a paring to some of the hefty selling pressure seen in the prior session. Healthcare is found at the foot of the pile, joined by Tech. US Equity Futures (ES -0.1%, NQ -0.1%, RTY +0.1%) are mixed and also trade on either side of the unchanged mark, ahead of what will be a catalyst packed week.

Top European News

- Metso Dismisses Media Report of Mining Merger With Sandvik

- UK Energy Bills Set to Rise This Winter on Higher Gas Prices

FX

- DXY is on the backfoot, going as low as 102.00 predominantly amid gains in the JPY and EUR. From a macro perspective, Fed's Daly and Goolsbee have delivered dovish remarks ahead of Powell on Friday.

- EUR/USD has extended its rise on a 1.10 handle and printed a fresh YTD peak at 1.1050 with the pair now at levels not seen since December last year.

- GBP is firmer vs. the broadly softer USD with not much in the way of UK-specific newsflow ahead of flash PMI metrics on Wednesday. Cable has been as high as 1.2975 with attention on a test of 1.30.

- JPY is by far the best performer across the majors vs. the USD as traders continue to focus on the expected upcoming Fed cutting cycle in the run up to the Jackson Hole Symposium this week (note, a 25bps hike by the BoJ is now priced for September 2025).

- Antipodeans both gaining vs. the USD with AUD benefiting from some of the positivity surrounding China amid the revival of talk over the idea of China issuing shopping vouchers to boost consumption.

- PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1548 (prev. 7.1464).

Fixed Income

- USTs are bid, but not quite performing as well as Bunds are; holding at 113-09+ highs with resistance from Friday & Thursday at 113-12 & 113-23 respectively.

- A firmer start to the week with Bunds leading the complex marginally after Germany came to a deal on its 2025 budget which will not fund any new Ukraine aid, as part of a measure to limit spending. Thus far, Bunds to a 134.58 peak, just shy of Friday's 134.65 best with little of note until 135.00.

- Gilts are in a very narrow 99.98-100.09 range, which is entirely within Thursday's 99.67-100.19 spread. UK-specific docket is light.

Commodities

- Crude is subdued intraday but largely in consolidation mode following Friday's losses. The Dollar weakness has done little to prop up the crude complex in recent sessions, whilst the geopolitical risks appear to be overshadowed by demand concerns. Brent sits near the lower bound of a USD 78.94-79.81/bbl parameter.

- A mixed picture across precious metals despite the softer Dollar and as catalysts over the weekend were light. Spot gold trades on either side of USD 2,500/oz.

- Mostly firmer trade across base metals, albeit largely as a function of the softer Dollar. Desks have cited the recent trimming of losses by copper on alleviating fears of a US recession amid recent economic data.

- Norway’s Equinor said production at Gullfaks C Platform in the North Sea is shut and it evacuated some workers from the platform as a precaution following a well incident, while it is unclear when production will restart but output at other Gullfaks platforms are running as normal.

- Algeria is to immediately supply Lebanon with fuel to operate electric power stations and return electricity to the country, according to Algerian state radio cited by Reuters.

- Iran said it is ready to tranship Russian gas through its territory, according to TASS.

- BHP Escondida workers union said it could relaunch a strike if the Co. does not rectify its position over contract talks as soon as possible.

Geopolitics: Middle East

- Israeli military said it conducted an airstrike in Lebanon’s Nabatieh which targeted a Hezbollah depot, while it was separately reported that Israel targeted the towns of Houla and Beit Leif in Lebanon during airstrikes on Sunday night, according to Al Jazeera. Furthermore, an Israeli airstrike targeted agricultural land northeast of the Nuseirat refugee camp in the central Gaza Strip and it was also reported that 10 people were killed in an Israeli strike on central Gaza’s Zawaida.

- IDF said it detected the launch of a number of suspicious air targets from Lebanon towards areas in the Western Galilee.

- Israeli PM Netanyahu’s office said the Israeli negotiating team expressed cautious optimism in advancing a Gaza hostage deal. PM Netanyahu's office also said Israel is in complex negotiations and there are things it can and cannot be flexible about, according to Reuters.

- Hamas on Sunday rejected an updated US proposal for a ceasefire and hostage deal in Gaza and blamed Israeli PM Netanyahu for moving the goalposts and the US for indulging him, according to Axios.

- Hamas said the new ceasefire proposal presented by the US at talks in Doha responds to Israeli PM Netanyahu’s rejection of a permanent ceasefire and complete withdrawal from Gaza, while it added that the proposal placed new conditions in the issue of a hostages exchange and retracted other issues hindering a deal, according to Reuters.

- US President Biden said they will not give up and a Gaza ceasefire is still possible. It was separately reported that US Secretary of State Blinken arrived in Israel to renew the push for a Gaza ceasefire.

- US Secretary of State Blinken says "This is the best and perhaps the last chance to release the hostages and reach an agreement"; "We have decisive efforts to deploy troops and deter any attacks on Israel", via Sky News Arabia.

- Iranian Foreign Ministry says "we affirm our right to respond to the attack on our sovereignty and we will do so at the appropriate time", via Al Jazeera

Geopolitics: Other

- Chinese Premier is to visit Russia from August 20th to August 22nd, according to Interfax; Premier Li will meet with Russian and Belarussian counterparts, and will hold in-depth exchanges on bilateral relations.

- Pipeline at oil and chemical plant in Russia's Bashkiria set on fire, via Tass

- IAEA said nuclear safety at Ukraine’s Zaporizhzhia nuclear power plant is deteriorating following a drone strike that hit the road around the plant site perimeter, while it stated there were no casualties and no impact to equipment, but there was an impact to the road between the two main gates of the plant.

- Russia captured the village of Svyrydonivka in Ukraine’s Donetsk, according to TASS.

- Belarusian President Lukashenko said troops were deployed along the entire border with Ukraine, according to RIA.

- North Korea condemned Ukraine’s attack against Russian territory as an act of terror and invasion backed by the US and the West. North Korea said the anti-Russia policy of the US is driving the global security environment to the brink of World War 3, while North Korea will stand with Russia as it seeks to protect its sovereignty and realise international justice, according to KCNA.

- US, South Korean and Japanese leaders pledged to consult on regional challenges, provocations and threats, while they said they are resolved to maintain peace and stability in the Indo-Pacific.

- China's Coast Guard said Philippine Coast Guard vessels illegally intruded into the waters adjacent to Sabina Shoal without permission from the Chinese government and one of the Philippine vessels ignored China's repeated solemn warnings and deliberately collided with the Chinese vessel in an 'unprofessional and dangerous' manner. The Philippines later commented that the Philippine Coast Guard encountered 'unlawful, aggressive manoeuvres' in the South China Sea from Chinese Coast Guard vessels which resulted in structural damage to both Philippine Coast Guard vessels.

US Event Calendar

- 10:00: July Leading Index, est. -0.4%, prior -0.2%

Central Bank Speakers

- 09:15: Fed’s Waller Gives Welcoming Remarks

DB's Jim Reid concludes the overnight wrap

As we move into the latter part of August, this week’s centre of attention for investors will be the Jackson Hole Economic Symposium that runs from Thursday evening through Saturday. Markets approach this in a much better mood than looked likely two weeks ago as the extreme volatility seen at the start of August seems almost a distant memory. The S&P 500 is on its best 7-day run since October 2022 (+6.82%) and has moved to within 2% of its all-time high, while the VIX ended last week at 14.80, down to below 15 for the first time in over three weeks. This comes as a 50bp Fed rate cut in September is now just over 30% priced, down from being fully priced on August 5 and 55% a week ago.

The overall title at Jackson Hole this year is “Reassessing the Effectiveness and Transmission of Monetary Policy” and central bankers will surely feel more satisfied with their policy levers than the last two times they met at the Wyoming retreat. The 2022 symposium came as inflation neared double digits across many developed economies with rates markets undergoing a sharp hawkish repricing, while a higher-for-longer focus saw Treasury yields reach post-GFC highs in the run-up to the 2023 gathering, with the 10yr yield then touching 5% last October. By contrast, this year’s event comes with US PCE inflation down to 2.5%, the unemployment rate up by 0.6pp since the start of 2024 and the Fed keeping rates on hold for the past 12 months. 10yr Treasuries are back below 4% as markets are pricing 95bps of Fed rate cuts across the remaining three meetings this year and 200bps of easing by next October.

In this context, investors will be keenly watching for signals on the timing and pace of rate cuts, especially from Fed Chair Powell’s speech at 10am EST (3pm LDN) on Friday. Our US economists don’t expect him to pre-commit to any particular rate cut trajectory but to signal that the Fed has gained sufficient confidence that it will soon be appropriate to begin easing policy, with rate cuts justified by both sides of the Fed’s dual mandate. They see rate cuts as likely to be framed as dialling back restraint, leaving the exact path data dependent. With r-star uncertain and policy risks evident following the election, rate cuts beyond the first 75-125bps are more uncertain.

Other scheduled Jackson Hole speakers include BoE Governor Bailey late on Friday and ECB Chief Economist Lane on Saturday. Ahead of this, we will also get the latest Fed and ECB meeting minutes on Wednesday and Thursday, respectively, which may offer some colour on the strength of the conditional September rate cut signals that both central banks sent at their July meetings. Elsewhere, tomorrow Sweden’s Riksbank is expected to deliver a second 25bps cut of its easing cycle, with markets pricing a c. 20% likelihood of a larger 50bps cut.

On the data front, this week’s main event will come with the flash August PMIs out in the US, euro area, UK and Japan on Thursday. Last month’s slippage of the US manufacturing PMI to below 50 (at 49.6) contributed to a rise in US recession fears that has since ebbed, while in the euro area activity surveys have consistently disappointed over the past two months. Another notable release will be Wednesday’s Q1 Quarterly Census of Employment and Wages (QCEW) in the US, which will provide preliminary benchmark revisions to the payrolls data. Our US economists see a negative revision as likely but, with this covering the period up to March 2024 that had seen particularly robust strong payrolls gains, any broader negative read-though may be limited.

Turning to politics, today will see the start of the US Democratic National Convention in Chicago, which comes as Kamala Harris enjoys a stabilising modest lead over Donald Trump in opinion polls for the November election. The FiveThirtyEight national average gives her a +2.6pt lead, with a smaller advantage on average across the swing states. Politics will also be in the headlines in Japan as on August 20 the LDP is due to finalise the schedule for its September leadership election. This follows Premier Minister Kishida's announcement last week that he would not run again, with our Japan economist addressing the implications of the change of PM in his latest outlook here.

Overnight in Asia, a weaker dollar is putting pressure on stocks in Japan and Korea, with Chinese equities outperforming. The dollar is -0.97% weaker against the yen this morning, touching the 146 level for the first time since 8 August, and is down -1.39% against the won, with the Nikkei 225 and the Kospi falling -1.68% and -0.61%, respectively. The moves are in stark contrast with a +1.06% jump in the Hang Seng, with the CSI 300 also advancing (+0.41%). Chinese assets will stay in focus amid tomorrow’s 1-yr and 5-yr loan prime rate decision. In US contracts, S&P 500 and Nasdaq futures are near flat overnight. Treasuries are also little changed, with the 2yr yield +0.5bps higher.

Recapping last week now, a US CPI print that was soft enough to affirm the disinflation narrative coupled with strong retail sales data served to cement a soft landing narrative. Friday’s data added to the general optimism, with the University of Michigan sentiment survey for August posting its first increase in five months at 67.8 (vs 66.9 expected) and the NY Fed services business index returning to positive territory for the first time since May, rising from -4.5 to 1.8.

With these data releases suggesting both a successful disinflation process and resilience of the US economy, equity markets were in a buoyant mood, with the S&P 500 rising +3.93% in its largest weekly gain since November 2023. Friday saw the S&P (+0.20%) extend its run to seven consecutive daily gains, its joint longest run this year. Tech outperformed, as the NASDAQ powered ahead by +5.29% (+0.21% Friday). The Mag-7 were up +6.23% as Nvidia stole the show with an +18.93% rally, its largest weekly gain since May 2023. Over in Europe, the equity gains were slightly more modest, with the STOXX 600 rising +2.46% (+0.31% Friday). Credit markets also benefited from the risk-on mood, with US IG spreads (-6bps) seeing their largest weekly decline since January.

In bond markets, Friday’s -4.3bps decline left 2yr yields little changed over the week (-0.3bps). On the other hand, 10yr yields retreated -5.7bps (and -3.0bps on Friday), to 3.88%. In Europe, 10yr German bunds saw a modest sell-off (+2.2bps) despite falling -1.5bps on Friday. Amid the risk-on mood and lower rates, the broad dollar index retreated -0.65% (-0.50% Friday) to its lowest level since January, with the euro closing above 1.10 against the dollar for the first time this year (+1.01% on the week to 1.103).

Lastly, in commodities, gold had a very strong week. Spot gold prices rose +3.16% (and +2.13% on Friday), moving above $2,500/oz for the first time ever. Oil whipsawed on the week, with a -1.58% reversal on Friday leaving Brent +0.13% over the week at $79.66/bbl.

Futures are flat after trading in a narrow overnight range, with small-caps outperforming. As of 7:45am ET S&P futures are up 0.1% at 5,581, after last week’s face-ripping rally which pushed the S&P to within 2% of the all time highs, while Nasdasq futures are unchanged as Mag7 and Semis start the week lower but broad-based strength is limiting losses. Bond yields are 1-2bps lower while broad dollar weakness sees USD/JPY re-test 145 level before rebounding back above 146, while WTI crude oil futures drop around 1%, underpinning Treasuries. Commodities are lower with Energy and Metals weaker while Softs are catching a bid. This week is expected to be a low liquidity week with events centered around the DNC and Jackson Hole with NVDA earnings looming next week. The macro data focus is on Flash PMIs, Housing Data, and Regional Activity updates. Fed Minutes are not expected to be catalytic with Jackson Hole kicking off on Aug 22. Q2 earnings season approaches its close with consumer-related / Retailers earnings this week and NVDA next week.

In premarket trading, AMD shares rose 2% after the company agreed to buy server maker ZT Systems in a cash and stock transaction valued at $4.9 billion, adding data center technology that will bolster its efforts to challenge Nvidia. Shares in European defense firms including Rheinmetall AG tumbled after a report that Germany will no longer grant new requests for aid to Ukraine as the government seeks to rein in spending. Here are some other notable premarket movers:

- Estee Lauder falls 6% after forecasting annual revenue growth below analysts’ expectations, a sign that the cosmetics company’s long-awaited recovery has hit another roadblock.

- FuboTV shares rise 13%, poised to extend gains after Fox, Warner Bros. Discovery and Walt Disney were blocked by a judge from launching their streaming sports service one week before its rollout.

- HP slips 2% as Morgan Stanley issued a downgrade, saying the computer hardware company now offers limited upside to estimates and on valuation.

- Liquidia drops 37% after the FDA said the company’s Yutrepia inhalation powder can’t be approved until May next year as a treatment for adults with pulmonary arterial hypertension and pulmonary hypertension.

- Shake Shack and Dutch Bros shares fall after Piper Sandler cuts to neutral as the broker tempers view on the fast casual sub-sector. Shake Shack -3%, Dutch Bros -2%

- Xperi rises 19% after the company said late Friday that it agreed to sell Perceive assets to Amazon.com for $80m in cash.

- ZIM Integrated Shipping gains 14% after boosting its adjusted Ebitda guidance for the full year.

Traders are starting a relatively quiet week on a cautious footing after recovering risk appetite last week left the S&P 500 close to a record high. After the Aug. 5 swoon, some buyers are re-emerging to help the main US stock gauge recoup more than half its summer losses even as hedge funds are once again shorting the bounce (having done the same in most of June and July).

“Things have come back, things feel more measured now,” Louise Dudley, portfolio manager for global equities at Federated Hermes, said in an interview with Bloomberg TV. “In that medium term there is some volatility and we’re definitely looking to take advantage of some of those price moves. Some of the large-cap cap names are still offering some of the top-growth opportunities.”

The key event is slated for Friday, when Fed Chair Jerome Powell is expected to give fresh insights on the course of US monetary policy at the central bank’s Jackson Hole economic symposium in Wyoming. “We expect Powell to hold forth on the medium-term strategy for the Fed,” Seth Carpenter, chief global economist at Morgan Stanley, wrote in a note.

Soft-landing bets are also helping to drive the recovery in equities. Goldman Sachs at the weekend trimmed the probability of a US recession in the next year to 20% from 25%, citing last week’s retail sales and jobless claims data, just days after raising it from 15% to 25%. If the August jobs report set for release on Sept. 6 “looks reasonably good, we would probably cut our recession probability back to 15%,” Goldman economists led by Jan Hatzius wrote in a report to clients on Saturday.

Elsewhere, the Democratic National Convention kicks off Monday in Chicago as party officials and celebrities rally around Kamala Harris, who may or may not be an idiot.

European stocks inch higher with the Stoxx 600 up 0.1%, and looking to extend its winning streak to five sessions. Basic resources is the strongest performing sector, while technology and energy stocks are the biggest laggards. Here are some of the biggest European movers on Monday:

- Plus500 shares rise as much as 7% to a record high after the financial trading platform said it expects annual results to be ahead of expectations, which analysts believe will lift consensus estimates. Analysts also noted its cash balance exceeded $1 billion for the first time, providing the firepower needed to keep returning cash to shareholders as it launched a new buyback.

- Metso Oyj and Sandvik AB gained when trading started on Monday after Swedish business daily Dagens Industri reported that large shareholders in Metso were pushing for a merger between the mining equipment operations of both companies.

- Rheinmetall falls as much as 5% after the Frankfurter Allgemeine Zeitung reported that Germany will no longer grant new requests for aid to Ukraine as the government seeks to rein in spending.

- Other defense firms also fell: Hensoldt -6.9%, Renk -3.6%, Kongsberg -2.5%, Saab -4.1%, BAE Systems -2.6%, Dassault Aviation -3% and Leonardo -2.7%.

- DSM-Firmenich falls as much as 5.7% as traders pointed to a free-float adjustment announcement from index provider Stoxx.

Earlier in the session, stocks in Asia advanced for a second session, helped by gains in regional currencies and a further rally in Chinese technology shares following some earnings beats. The MSCI Asia Pacific Index rose as much as 0.9% after jumping 2.5% on Friday. Japan’s Seven & i Holdings Co. was the biggest contributor to gains on the benchmark after a report on a buyout offer. Shares of Chinese e-commerce company JD.com extended a post-earnings rally.Equities in Hong Kong were among the top performers in Asia, with the Hang Seng China Enterprises Index closing up 1%. Onshore Chinese shares also rose. More cities have scrapped official sale price restrictions on newly-built homes, a step to allow steeper price declines to amid sluggish demand, the 21st Century Business Herald reported on Monday. Japanese stocks were an outlier, weakening as a stronger yen dimmed the earnings prospect of export firms.

In FX, the dollar slipped, with some traders unwinding bets on a return to the White House by Donald Trump. On the other end, the Japanese yen surged amid broad weakness in the US dollar as traders positioned ahead of key central bank events later in the week. Bank of Japan Governor Kazuo Ueda appears in parliament on Friday, and Federal Reserve Chair Jerome Powell speaks at Jackson Hole later the same day. USD/JPY is down 1.1% against the greenback at ~146.05, having dropped as low as 145. The Bloomberg Dollar Spot Index falls 0.3%.

“If we look at the polls, if we look at Harris’s solid performance in the last three weeks, the market has got to be thinking, were we hasty in putting on that Trump trade in June or July?,” Jane Foley, head of FX strategy at Rabobank, said in an interview with Bloomberg TV. “The market has to rethink that. If the market is less inclined to be putting on Trump trades, that could soften the dollar.”

In rates, treasuries hold small gains across long-end of the curve, where 30-year yields are ~1bp lower vs Friday’s close, as bunds outperform over early London session. 10-year TSY yields fall 2bps to 3.86% with bunds outperforming by 1bp in the sector and gilts trading broadly in line.

In commodities, oil prices decline, with WTI falling 1% to trade near $75.90 a barrel; oil declined for the fourth time in five sessions as traders tracked US-led efforts to secure a cease-fire in the 10-month old conflict in Gaza, while the Russia-Ukraine war is escalating. Spot gold falls $7 to around $2501/oz. Bitcoin falls 2%.

Looking at today’s calendar, the data slate includes July Leading Index at 10am New York time; ahead this week are manufacturing and services PMIs and new home sales, and July 31 FOMC meeting minutes on Wednesday. Fed speakers scheduled for the session include Waller at 9:15am

Market Snapshot

- S&P 500 futures little changed at 5,573.50

- STOXX Europe 600 little changed at 511.94

- MXAP up 0.5% to 183.72

- MXAPJ up 0.8% to 573.15

- Nikkei down 1.8% to 37,388.62

- Topix down 1.4% to 2,641.14

- Hang Seng Index up 0.8% to 17,569.57

- Shanghai Composite up 0.5% to 2,893.67

- Sensex little changed at 80,435.57

- Australia S&P/ASX 200 up 0.1% to 7,980.45

- Kospi down 0.8% to 2,674.36

- German 10Y yield little changed at 2.22%

- Euro up 0.2% to $1.1044

- Brent Futures down 0.5% to $79.27/bbl

- Gold spot down 0.1% to $2,506.51

- US Dollar Index down 0.32% to 102.13

Top Overnight News

- The race for the White House will reach a fever pitch this week, with Vice President Kamala Harris and Republican nominee Donald Trump battling for momentum — and attention — around the Democratic National Convention in Chicago.

- Republicans warned Donald Trump to get serious on policy or he could lose and cautioned that his ‘showman’ tactics could cost him the chance of a second term in the White House, according to The Telegraph.

- Wall Street is betting that Federal Reserve Chair Jerome Powell will confirm that interest-rate cuts are coming at the central bank’s annual confab in Jackson Hole, Wyoming. But as the debate shifts from “will they or won’t they?” to “how big will they go?” — stock traders may be left wanting.

- The yen rallied against the dollar, leading gains among Group-of-10 currencies before comments from top central bank officials this week.

- Just as bond traders grow more assured that inflation is finally under control, a camp of investors is quietly building up protection against the risk of a future spike in prices.

- Fed’s Daly (voter) said recent data gave her more confidence that inflation is under control and it is time to consider adjusting rates from their current level, while she noted the Fed needs to take a gradual approach to reducing borrowing costs, according to FT.

- Fed’s Goolsbee (non-voter) said on Friday that he has concerns for 2024 and that they have crosscurrents. Goolsbee added he is concerned that the Fed set this level of rates over a year ago and inflation and the labour market are cooling faster than expected, while he thinks the Fed should take a step back and think about it.

- Goldman Sachs cuts the probability of a US recession in the next 12 months to 20% from 25%; cites last week’s Retail Sales and IJC metrics. Says could lower it to 15% in the event that the August jobs report “looks reasonably good”.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with a somewhat cautious tone amid geopolitical uncertainty after Hamas rejected the latest ceasefire proposal and as participants await this week’s key events including the Jackson Hole Symposium. ASX 200 traded rangebound as outperformance in gold miners and utilities was offset by weakness in consumer stocks. Nikkei 225 swung between gains and losses and traded on both sides of the 38,000 level after mixed Machinery Orders data, while the index was then pressured again later in the session alongside a firmer currency. Hang Seng and Shanghai Comp. gained amid stimulus hopes after Premier Li hinted on Friday at targeted measures to smooth the economic cycle and promote consumption, while a recent report noted weak Chinese data raised the pressure for Beijing to provide support and revived talk of regarding the idea of China issuing shopping vouchers.

Top Asian News

- China’s Vice Premier is to co-chair a regular meeting between Chinese and Russian leaders with Russia’s Deputy PM on August 19th-20th, according to Chinese state media.

- Singaporean PM Wong warned that increasing tensions between the US and China will have an impact on Singapore’s economy and the broader region, according to FT.

European bourses, Stoxx 600 (+0.1%) began the week on a mixed footing and generally traded on either side of the unchanged mark. European sectors are mixed with the breadth of the market fairly narrow. Basic Resources takes the top spot, in a paring to some of the hefty selling pressure seen in the prior session. Healthcare is found at the foot of the pile, joined by Tech. US Equity Futures (ES -0.1%, NQ -0.1%, RTY +0.1%) are mixed and also trade on either side of the unchanged mark, ahead of what will be a catalyst packed week.

Top European News

- Metso Dismisses Media Report of Mining Merger With Sandvik

- UK Energy Bills Set to Rise This Winter on Higher Gas Prices

FX

- DXY is on the backfoot, going as low as 102.00 predominantly amid gains in the JPY and EUR. From a macro perspective, Fed’s Daly and Goolsbee have delivered dovish remarks ahead of Powell on Friday.

- EUR/USD has extended its rise on a 1.10 handle and printed a fresh YTD peak at 1.1050 with the pair now at levels not seen since December last year.

- GBP is firmer vs. the broadly softer USD with not much in the way of UK-specific newsflow ahead of flash PMI metrics on Wednesday. Cable has been as high as 1.2975 with attention on a test of 1.30.

- JPY is by far the best performer across the majors vs. the USD as traders continue to focus on the expected upcoming Fed cutting cycle in the run up to the Jackson Hole Symposium this week (note, a 25bps hike by the BoJ is now priced for September 2025).

- Antipodeans both gaining vs. the USD with AUD benefiting from some of the positivity surrounding China amid the revival of talk over the idea of China issuing shopping vouchers to boost consumption.

- PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1548 (prev. 7.1464).

Fixed Income

- USTs are bid, but not quite performing as well as Bunds are; holding at 113-09+ highs with resistance from Friday & Thursday at 113-12 & 113-23 respectively.

- A firmer start to the week with Bunds leading the complex marginally after Germany came to a deal on its 2025 budget which will not fund any new Ukraine aid, as part of a measure to limit spending. Thus far, Bunds to a 134.58 peak, just shy of Friday’s 134.65 best with little of note until 135.00.

- Gilts are in a very narrow 99.98-100.09 range, which is entirely within Thursday’s 99.67-100.19 spread. UK-specific docket is light.

Commodities

- Crude is subdued intraday but largely in consolidation mode following Friday’s losses. The Dollar weakness has done little to prop up the crude complex in recent sessions, whilst the geopolitical risks appear to be overshadowed by demand concerns. Brent sits near the lower bound of a USD 78.94-79.81/bbl parameter.

- A mixed picture across precious metals despite the softer Dollar and as catalysts over the weekend were light. Spot gold trades on either side of USD 2,500/oz.

- Mostly firmer trade across base metals, albeit largely as a function of the softer Dollar. Desks have cited the recent trimming of losses by copper on alleviating fears of a US recession amid recent economic data.

- Norway’s Equinor said production at Gullfaks C Platform in the North Sea is shut and it evacuated some workers from the platform as a precaution following a well incident, while it is unclear when production will restart but output at other Gullfaks platforms are running as normal.

- Algeria is to immediately supply Lebanon with fuel to operate electric power stations and return electricity to the country, according to Algerian state radio cited by Reuters.

- Iran said it is ready to tranship Russian gas through its territory, according to TASS.

- BHP Escondida workers union said it could relaunch a strike if the Co. does not rectify its position over contract talks as soon as possible.

Geopolitics: Middle East

- Israeli military said it conducted an airstrike in Lebanon’s Nabatieh which targeted a Hezbollah depot, while it was separately reported that Israel targeted the towns of Houla and Beit Leif in Lebanon during airstrikes on Sunday night, according to Al Jazeera. Furthermore, an Israeli airstrike targeted agricultural land northeast of the Nuseirat refugee camp in the central Gaza Strip and it was also reported that 10 people were killed in an Israeli strike on central Gaza’s Zawaida.

- IDF said it detected the launch of a number of suspicious air targets from Lebanon towards areas in the Western Galilee.

- Israeli PM Netanyahu’s office said the Israeli negotiating team expressed cautious optimism in advancing a Gaza hostage deal. PM Netanyahu’s office also said Israel is in complex negotiations and there are things it can and cannot be flexible about, according to Reuters.

- Hamas on Sunday rejected an updated US proposal for a ceasefire and hostage deal in Gaza and blamed Israeli PM Netanyahu for moving the goalposts and the US for indulging him, according to Axios.

- Hamas said the new ceasefire proposal presented by the US at talks in Doha responds to Israeli PM Netanyahu’s rejection of a permanent ceasefire and complete withdrawal from Gaza, while it added that the proposal placed new conditions in the issue of a hostages exchange and retracted other issues hindering a deal, according to Reuters.

- US President Biden said they will not give up and a Gaza ceasefire is still possible. It was separately reported that US Secretary of State Blinken arrived in Israel to renew the push for a Gaza ceasefire.

- US Secretary of State Blinken says “This is the best and perhaps the last chance to release the hostages and reach an agreement”; “We have decisive efforts to deploy troops and deter any attacks on Israel”, via Sky News Arabia.

- Iranian Foreign Ministry says “we affirm our right to respond to the attack on our sovereignty and we will do so at the appropriate time”, via Al Jazeera

Geopolitics: Other

- Chinese Premier is to visit Russia from August 20th to August 22nd, according to Interfax; Premier Li will meet with Russian and Belarussian counterparts, and will hold in-depth exchanges on bilateral relations.

- Pipeline at oil and chemical plant in Russia’s Bashkiria set on fire, via Tass

- IAEA said nuclear safety at Ukraine’s Zaporizhzhia nuclear power plant is deteriorating following a drone strike that hit the road around the plant site perimeter, while it stated there were no casualties and no impact to equipment, but there was an impact to the road between the two main gates of the plant.

- Russia captured the village of Svyrydonivka in Ukraine’s Donetsk, according to TASS.

- Belarusian President Lukashenko said troops were deployed along the entire border with Ukraine, according to RIA.

- North Korea condemned Ukraine’s attack against Russian territory as an act of terror and invasion backed by the US and the West. North Korea said the anti-Russia policy of the US is driving the global security environment to the brink of World War 3, while North Korea will stand with Russia as it seeks to protect its sovereignty and realise international justice, according to KCNA.

- US, South Korean and Japanese leaders pledged to consult on regional challenges, provocations and threats, while they said they are resolved to maintain peace and stability in the Indo-Pacific.

- China’s Coast Guard said Philippine Coast Guard vessels illegally intruded into the waters adjacent to Sabina Shoal without permission from the Chinese government and one of the Philippine vessels ignored China’s repeated solemn warnings and deliberately collided with the Chinese vessel in an ‘unprofessional and dangerous’ manner. The Philippines later commented that the Philippine Coast Guard encountered ‘unlawful, aggressive manoeuvres’ in the South China Sea from Chinese Coast Guard vessels which resulted in structural damage to both Philippine Coast Guard vessels.

US Event Calendar

- 10:00: July Leading Index, est. -0.4%, prior -0.2%

Central Bank Speakers

- 09:15: Fed’s Waller Gives Welcoming Remarks

DB’s Jim Reid concludes the overnight wrap

As we move into the latter part of August, this week’s centre of attention for investors will be the Jackson Hole Economic Symposium that runs from Thursday evening through Saturday. Markets approach this in a much better mood than looked likely two weeks ago as the extreme volatility seen at the start of August seems almost a distant memory. The S&P 500 is on its best 7-day run since October 2022 (+6.82%) and has moved to within 2% of its all-time high, while the VIX ended last week at 14.80, down to below 15 for the first time in over three weeks. This comes as a 50bp Fed rate cut in September is now just over 30% priced, down from being fully priced on August 5 and 55% a week ago.

The overall title at Jackson Hole this year is “Reassessing the Effectiveness and Transmission of Monetary Policy” and central bankers will surely feel more satisfied with their policy levers than the last two times they met at the Wyoming retreat. The 2022 symposium came as inflation neared double digits across many developed economies with rates markets undergoing a sharp hawkish repricing, while a higher-for-longer focus saw Treasury yields reach post-GFC highs in the run-up to the 2023 gathering, with the 10yr yield then touching 5% last October. By contrast, this year’s event comes with US PCE inflation down to 2.5%, the unemployment rate up by 0.6pp since the start of 2024 and the Fed keeping rates on hold for the past 12 months. 10yr Treasuries are back below 4% as markets are pricing 95bps of Fed rate cuts across the remaining three meetings this year and 200bps of easing by next October.

In this context, investors will be keenly watching for signals on the timing and pace of rate cuts, especially from Fed Chair Powell’s speech at 10am EST (3pm LDN) on Friday. Our US economists don’t expect him to pre-commit to any particular rate cut trajectory but to signal that the Fed has gained sufficient confidence that it will soon be appropriate to begin easing policy, with rate cuts justified by both sides of the Fed’s dual mandate. They see rate cuts as likely to be framed as dialling back restraint, leaving the exact path data dependent. With r-star uncertain and policy risks evident following the election, rate cuts beyond the first 75-125bps are more uncertain.

Other scheduled Jackson Hole speakers include BoE Governor Bailey late on Friday and ECB Chief Economist Lane on Saturday. Ahead of this, we will also get the latest Fed and ECB meeting minutes on Wednesday and Thursday, respectively, which may offer some colour on the strength of the conditional September rate cut signals that both central banks sent at their July meetings. Elsewhere, tomorrow Sweden’s Riksbank is expected to deliver a second 25bps cut of its easing cycle, with markets pricing a c. 20% likelihood of a larger 50bps cut.

On the data front, this week’s main event will come with the flash August PMIs out in the US, euro area, UK and Japan on Thursday. Last month’s slippage of the US manufacturing PMI to below 50 (at 49.6) contributed to a rise in US recession fears that has since ebbed, while in the euro area activity surveys have consistently disappointed over the past two months. Another notable release will be Wednesday’s Q1 Quarterly Census of Employment and Wages (QCEW) in the US, which will provide preliminary benchmark revisions to the payrolls data. Our US economists see a negative revision as likely but, with this covering the period up to March 2024 that had seen particularly robust strong payrolls gains, any broader negative read-though may be limited.

Turning to politics, today will see the start of the US Democratic National Convention in Chicago, which comes as Kamala Harris enjoys a stabilising modest lead over Donald Trump in opinion polls for the November election. The FiveThirtyEight national average gives her a +2.6pt lead, with a smaller advantage on average across the swing states. Politics will also be in the headlines in Japan as on August 20 the LDP is due to finalise the schedule for its September leadership election. This follows Premier Minister Kishida’s announcement last week that he would not run again, with our Japan economist addressing the implications of the change of PM in his latest outlook here.

Overnight in Asia, a weaker dollar is putting pressure on stocks in Japan and Korea, with Chinese equities outperforming. The dollar is -0.97% weaker against the yen this morning, touching the 146 level for the first time since 8 August, and is down -1.39% against the won, with the Nikkei 225 and the Kospi falling -1.68% and -0.61%, respectively. The moves are in stark contrast with a +1.06% jump in the Hang Seng, with the CSI 300 also advancing (+0.41%). Chinese assets will stay in focus amid tomorrow’s 1-yr and 5-yr loan prime rate decision. In US contracts, S&P 500 and Nasdaq futures are near flat overnight. Treasuries are also little changed, with the 2yr yield +0.5bps higher.

Recapping last week now, a US CPI print that was soft enough to affirm the disinflation narrative coupled with strong retail sales data served to cement a soft landing narrative. Friday’s data added to the general optimism, with the University of Michigan sentiment survey for August posting its first increase in five months at 67.8 (vs 66.9 expected) and the NY Fed services business index returning to positive territory for the first time since May, rising from -4.5 to 1.8.

With these data releases suggesting both a successful disinflation process and resilience of the US economy, equity markets were in a buoyant mood, with the S&P 500 rising +3.93% in its largest weekly gain since November 2023. Friday saw the S&P (+0.20%) extend its run to seven consecutive daily gains, its joint longest run this year. Tech outperformed, as the NASDAQ powered ahead by +5.29% (+0.21% Friday). The Mag-7 were up +6.23% as Nvidia stole the show with an +18.93% rally, its largest weekly gain since May 2023. Over in Europe, the equity gains were slightly more modest, with the STOXX 600 rising +2.46% (+0.31% Friday). Credit markets also benefited from the risk-on mood, with US IG spreads (-6bps) seeing their largest weekly decline since January.

In bond markets, Friday’s -4.3bps decline left 2yr yields little changed over the week (-0.3bps). On the other hand, 10yr yields retreated -5.7bps (and -3.0bps on Friday), to 3.88%. In Europe, 10yr German bunds saw a modest sell-off (+2.2bps) despite falling -1.5bps on Friday. Amid the risk-on mood and lower rates, the broad dollar index retreated -0.65% (-0.50% Friday) to its lowest level since January, with the euro closing above 1.10 against the dollar for the first time this year (+1.01% on the week to 1.103).

Lastly, in commodities, gold had a very strong week. Spot gold prices rose +3.16% (and +2.13% on Friday), moving above $2,500/oz for the first time ever. Oil whipsawed on the week, with a -1.58% reversal on Friday leaving Brent +0.13% over the week at $79.66/bbl.

Loading…