NEWYou can now listen to Fox News articles!

President Biden has reiterated that tackling surging inflation is his top priority, but economists have blamed rising prices on his giant COVID-19 stimulus package.

Biden declared his administration’s top priority was “getting price increases under control” earlier this month after the Department of Labor reported that inflation soared 9.1% over the last 12 months. The president also endorsed the Inflation Reduction Act, a bill that would increase tax revenue by $739 billion while attempting to lower pharmaceutical prices and investing in a wide swath of clean energy programs.

“This is the action the American people have been waiting for,” Biden said after the bill was announced by Sen. Joe Manchin, D-W.Va., Wednesday. “This addresses the problems of today – high health care costs and overall inflation – as well as investments in our energy security for the future.”

AVERAGE AMERICAN WORKER HAS LOST $3,400 IN ANNUAL WAGES UNDER BIDEN THANKS TO INFLATION

The bill, though, would have little impact on inflation in the long-term and lead to a slight rise in prices over the next few years, according to a study from the Penn Wharton Budget Model published Friday.

In addition, economists have overwhelmingly pegged inflation on Biden’s past actions.

“It’s pretty telling when you look at what prices were doing year over year, and you compare that to what they’re doing now at a monthly rate,” E.J. Antoni, an economist and research fellow at The Heritage Foundation, told Fox News Digital in an interview. “Prices are increasing as fast right now in a month, basically, as they did in a whole year.”

He noted that when Biden took office year-over year inflation was 1.4%. In June alone prices increased 1.3%, a rate that, if annualized, would surpass 15%.

MANCHIN-SCHUMER SPENDING BILL TARGETS TAX LOOPHOLE FAVORED BY INVESTORS

“So, what happened in the meantime? Well, a massive amount of government spending,” Antoni continued. “You get the American Rescue Plan and after that inflation just explodes.”

“It caused direct spending into the economy, it handed out more money that wasn’t needed and the result was you increase the amount of money without increasing the amount of goods and services,” he said.

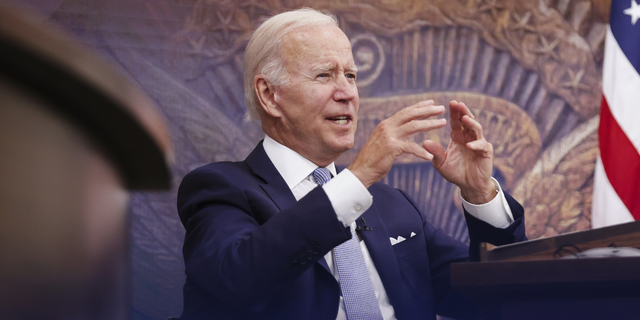

President Biden has repeatedly promoted the American Rescue Plan and said it helped the economy, despite economists saying it contributed to skyrocketing inflation. (AP Photo/Andrew Harnik)

In March 2021, Democrats passed the American Rescue Plan (ARP), a massive $1.9 trillion COVID-19 stimulus package that was among Biden’s first priorities after taking office. The legislation sent checks worth $1,400 to most Americans and increased the child tax credit to between $3,000-3,600 per child.

A March analysis from economists at the Federal Reserve Bank of San Francisco showed that U.S. inflation rates have outpaced other developed countries largely due to “fiscal support measures designed to counteract the severity of the pandemic’s economic effect.” The analysis showed that federal stimulus, including the ARP, boosted inflation by about 3%.

SMALL BUSINESS GROUPS RIP MANCHIN, SCHUMER DEAL: ‘MISERY FOR MANY MORE AMERICANS’

“The ARP was a major factor in driving inflation,” Michael Strain, an economist and the American Enterprise Institute’s director of economic policy studies, wrote in a February column for National Review.

Strain, like the San Francisco Fed economists, concluded that the ARP increased inflation by 3%.

President Joe Biden speaks in Washington, Thursday, July 28, 2022. The drumbeat of recession grew louder after the U.S. economy shrank for a second straight quarter, as decades-high inflation undercut consumer spending and Federal Reserve interest-rate hikes stymied businesses and housing. (Oliver Contreras/Bloomberg via Getty Images)

Dean Baker, a senior economist at the left-leaning Center for Economic and Policy Research, forecasted the 2021 stimulus spending boosted inflation by 1-2%.

“While some stimulus was justified, lawmakers shot a $1.9 trillion bazooka at a $420 billion output gap,” Brian Riedl, an economist and senior fellow at the Manhattan Institute, said during a Senate hearing in April. “And this was just weeks after the December 2020 stimulus law poured in $900 billion. Economists on the left and right, such as Lawrence Summers, warned this excessive stimulus would bring inflation. They were right.”

CLICK HERE TO GET THE FOX NEWS APP

Riedl added that other actions taken by the Biden administration have also contributed to surging inflation. He said increased tariffs on Canadian lumber imports as well as other goods like Chinese solar panels, Buy America provisions that increase infrastructure costs, a policy that increases government contract prices and deferring student loan payments have all added to inflationary pressures.

“There is no easy path to bringing down inflation, but the first rule should be to do no harm,” he continued. “That means resisting calls for more aggressive federal spending as well as ensuring that businesses can operate efficiently without expensive tariffs and over-regulation.”