Housing affordability in the United States has taken a sharp turn for the worse in recent years, as house prices surged to historical highs during and after the pandemic and mortgage rates have risen steeply over the past three years, as the Fed tried to rein in inflation.

It all began with a surge in demand for houses during the Covid-19 pandemic, when many Americans, flush with cash from government stimulus checks, reevaluated their living situation and sought more space amid stay-at-home orders and the sudden possibility of remote work. Further fueling demand were the historically low mortgage rates after the Fed had slashed interest rates to near zero at the onset of the pandemic.

At the same time, supply of new and existing homes was very constrained, as construction was disrupted by Covid restrictions and would-be sellers refrained from putting their house on the market during this uncertain time. This imbalance caused a rapid increase in home prices across the country, pushing many potential buyers out of the market, a trend that was exacerbated when the Fed started to tighten its policy stance in March 2022 in its efforts to cool inflation.

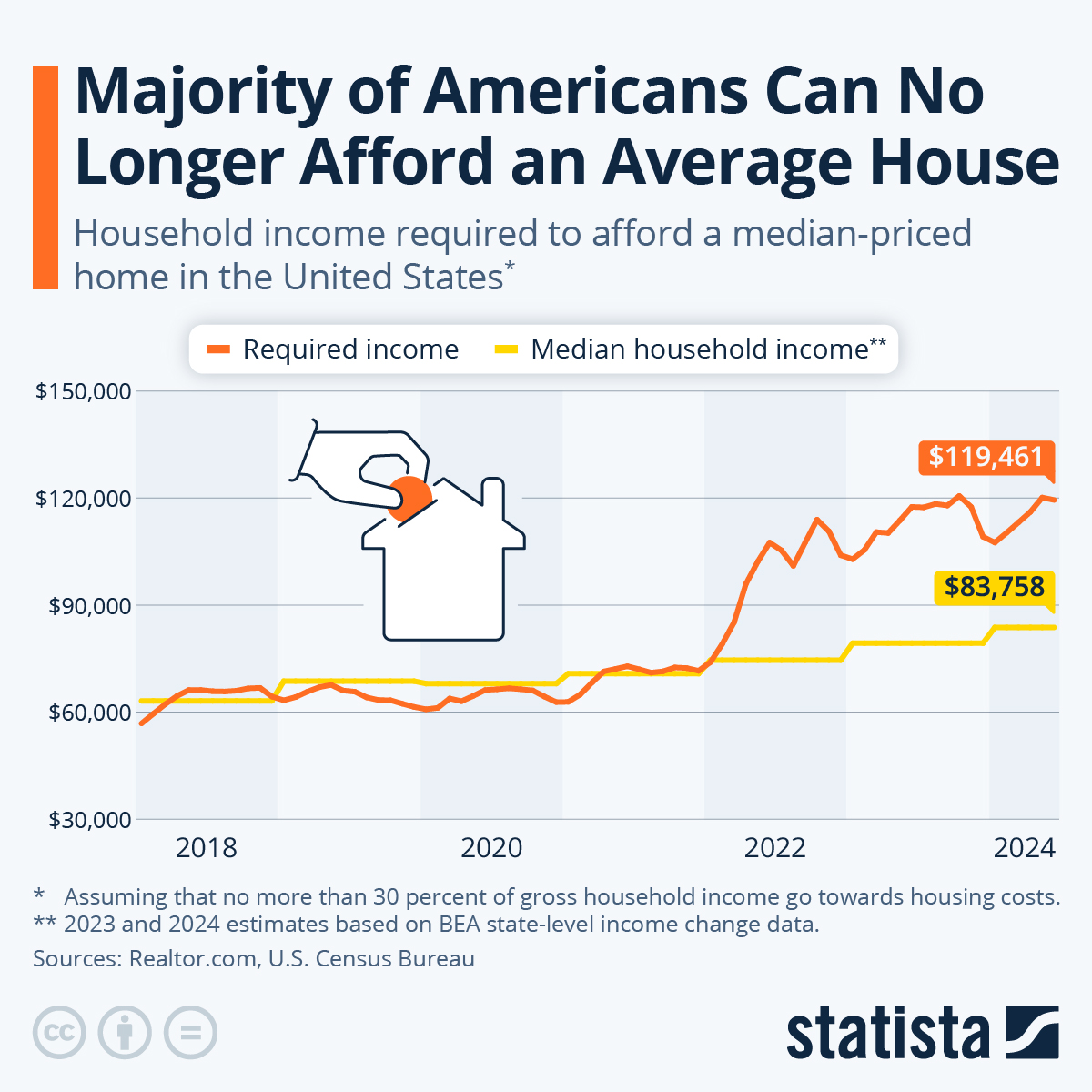

As Statista's Felix Richter shows in the chart below, according to data compiled by the National Association of Realtors, buying an average home is now out of reach for the majority of Americans, as the annual household income needed to afford a median-priced home without too much financial strain has shot up 60 percent since January 2022.

You will find more infographics at Statista

Back then, the minimum income to buy a mid-range house – around $380,000 at the time – was $74,000, roughly in line with the national median income.

Since then a massive affordability gap has opened up, as a required income of $120,000 stands opposite a median income of around $84,000 – more than 40 percent shy of what would be needed.

Housing affordability in the United States has taken a sharp turn for the worse in recent years, as house prices surged to historical highs during and after the pandemic and mortgage rates have risen steeply over the past three years, as the Fed tried to rein in inflation.

It all began with a surge in demand for houses during the Covid-19 pandemic, when many Americans, flush with cash from government stimulus checks, reevaluated their living situation and sought more space amid stay-at-home orders and the sudden possibility of remote work. Further fueling demand were the historically low mortgage rates after the Fed had slashed interest rates to near zero at the onset of the pandemic.

At the same time, supply of new and existing homes was very constrained, as construction was disrupted by Covid restrictions and would-be sellers refrained from putting their house on the market during this uncertain time. This imbalance caused a rapid increase in home prices across the country, pushing many potential buyers out of the market, a trend that was exacerbated when the Fed started to tighten its policy stance in March 2022 in its efforts to cool inflation.

As Statista’s Felix Richter shows in the chart below, according to data compiled by the National Association of Realtors, buying an average home is now out of reach for the majority of Americans, as the annual household income needed to afford a median-priced home without too much financial strain has shot up 60 percent since January 2022.

You will find more infographics at Statista

Back then, the minimum income to buy a mid-range house – around $380,000 at the time – was $74,000, roughly in line with the national median income.

Since then a massive affordability gap has opened up, as a required income of $120,000 stands opposite a median income of around $84,000 – more than 40 percent shy of what would be needed.

Loading…