California is several years into one of the worst droughts in state history, sending the price of water across the Golden State to record highs.

The price of water on the Nasdaq Veles California Water Index topped $1,144.14 an acre-foot on June 27, up more than 56% since the start of the year and 350% since the beginning of 2020.

Nasdaq Veles California Water Index is the world's first water futures contract. It's based on the state's five actively traded water markets and is priced in US dollars per Acre Foot ($/AF).

Since the index is an aggregate, some drought-stricken areas are trading much higher than others.

Sarah Woolf, president of Water Wise, a water brokerage and consultancy based in Fresno, told Bloomberg that water trading in the Westlands Water District, a water district in central California, is around $2,000 AF. It's also the most significant agricultural water district in the country. It has been a focal point for many controversial water issues in California because of its increasing demand for crops.

In "California To Cut Water To Cities And Farmland Amid Persisting Drought" and "California's Farmland Rapidly Turns To Dust Amid Water Crisis," we have pointed out how the historic drought has forced even those who hold the most senior water rights to reduce consumption under California Governor Gavin Newsom state of emergency.

Woolf said high water prices make it uneconomical for farmers to maintain farmland. In California's San Joaquin Valley, a million acres of cropland or more could be reduced to dust in the next few decades due to strict water restrictions.

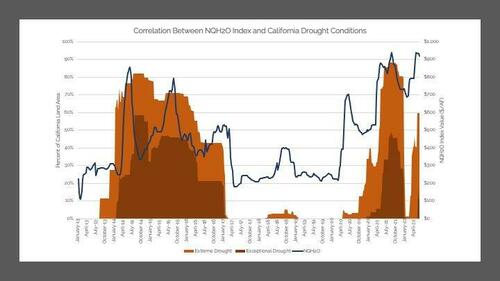

The water index has a strong positive correlation to drought conditions in the state.

Water is a precious and scarce commodity in California. There's also a growing presence of groups against Wall Street commodifying water in the state and have asked for the Commodity Futures Trading Commission to shutter water trading because it's "dystopic and horrifying."

If Wall Street can manipulate gold markets, imagine what big institutional traders can do in water markets...

California is several years into one of the worst droughts in state history, sending the price of water across the Golden State to record highs.

The price of water on the Nasdaq Veles California Water Index topped $1,144.14 an acre-foot on June 27, up more than 56% since the start of the year and 350% since the beginning of 2020.

Nasdaq Veles California Water Index is the world’s first water futures contract. It’s based on the state’s five actively traded water markets and is priced in US dollars per Acre Foot ($/AF).

Since the index is an aggregate, some drought-stricken areas are trading much higher than others.

Sarah Woolf, president of Water Wise, a water brokerage and consultancy based in Fresno, told Bloomberg that water trading in the Westlands Water District, a water district in central California, is around $2,000 AF. It’s also the most significant agricultural water district in the country. It has been a focal point for many controversial water issues in California because of its increasing demand for crops.

In “California To Cut Water To Cities And Farmland Amid Persisting Drought” and “California’s Farmland Rapidly Turns To Dust Amid Water Crisis,” we have pointed out how the historic drought has forced even those who hold the most senior water rights to reduce consumption under California Governor Gavin Newsom state of emergency.

Woolf said high water prices make it uneconomical for farmers to maintain farmland. In California’s San Joaquin Valley, a million acres of cropland or more could be reduced to dust in the next few decades due to strict water restrictions.

The water index has a strong positive correlation to drought conditions in the state.

Water is a precious and scarce commodity in California. There’s also a growing presence of groups against Wall Street commodifying water in the state and have asked for the Commodity Futures Trading Commission to shutter water trading because it’s “dystopic and horrifying.”

If Wall Street can manipulate gold markets, imagine what big institutional traders can do in water markets…