There was some good news and some bad news in today's jobs report - first the bad news: the August payrolls number came in at 142K, a small miss to estimates of a 165K print, if a big jump from the downward revised July print of 89K. The good news, however, is that while the payrolls print missed, the unemployment rate actually dipped from that critical "Sahm's Rule trigger" level of 4.3%, to 4.2%, in line with expectations. So bottom line: the number could be better, but it is certainly not bad enough to trigger a 50bps rate cut in two weeks.

Here are the details.

As noted above, in August, the US added 142K jobs...

... which was slightly below estimates of a 165K print, but hardly some crazy outlier as in previous months.

Then again, as has become the norm, both previous months were revised sharply lower, so once again expect the August print to suffer the same fate. Specifically, the BLS said that the payroll print for June was revised down by 61,000, from +179,000 to +118,000, and the change for July was revised down by 25,000, from +114,000 to +89,000. With these revisions, employment in June and July combined is 86,000 lower than previously reported It also means that 4 consecutive job prints have been revised lower, and 6 of the past 7.

Developing.

There was some good news and some bad news in today’s jobs report – first the bad news: the August payrolls number came in at 142K, a small miss to estimates of a 165K print, if a big jump from the downward revised July print of 89K. The good news, however, is that while the payrolls print missed, the unemployment rate actually dipped from that critical “Sahm’s Rule trigger” level of 4.3%, to 4.2%, in line with expectations. So bottom line: the number could be better, but it is certainly not bad enough to trigger a 50bps rate cut in two weeks.

Here are the details.

As noted above, in August, the US added 142K jobs…

… which was slightly below estimates of a 165K print, but hardly some crazy outlier as in previous months.

Then again, as has become the norm, both previous months were revised sharply lower, so once again expect the August print to suffer the same fate. Specifically, the BLS said that the payroll print for June was revised down by 61,000, from +179,000 to +118,000, and the change for July was revised down by 25,000, from +114,000 to +89,000. With these revisions, employment in June and July combined is 86,000 lower than previously reported It also means that 4 consecutive job prints have been revised lower, and 6 of the past 7.

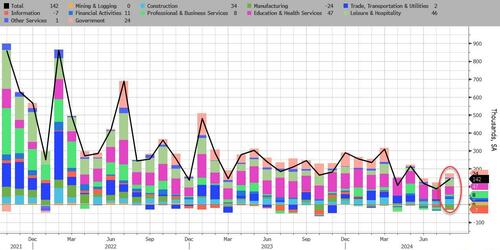

Looking at the components, while most sectors tracked by the Establishment survey posted an increase (see more details below), the all-important manufacturing sector lost 24K job, the second worst month for the sector in 3 years!

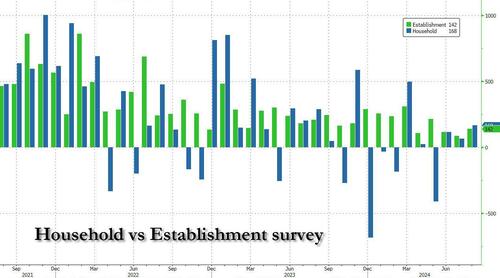

But And while the Establishment survey was disappointing, the Household survey was – for once – rather strong, showing a 168K increase in Employed workers.

And since the number of unemployed workers declined modestly, from 7.163MM to 7.115MM, the all important unemployment rate also dropped from 4.3% – which as we noted last month was that critical Sahm Rule recession trigger level – to 4.2%, matching estimates, and a level which according to most means the Fed will only cut 25bps in two weeks (as opposed to 50bps). Among the major worker groups, Black unemployment rate dropped to 6.1% in August from 6.3%, while the White jobless rate held at 3.8%. The Asian and Hispanic rates each climbed, to 4.1% and 5.5% respectively.

Among the unemployed, the number of people on temporary layoff declined by 190,000 to 872,000 in August, mostly offsetting an increase in the prior month. The number of permanent job losers was essentially unchanged at 1.7 million in August.

The number of long-term unemployed (those jobless for 27 weeks or more) was virtually unchanged at 1.5 million in August. The long-term unemployed accounted for 21.3 percent of all unemployed people.

The labor force participation rate remained at 62.7% in August and is little changed over the year. The employment-population ratio also was unchanged in August, at 60.0%, but is down by 0.4 percentage point over the year.

The number of people not in the labor force who currently want a job, at 5.6 million, changed little in August. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.4 million, was little changed in August. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, changed little at 367,000 in August

As for wages, which a few months ago is all anyone cared about, these actually printed hotter than expected, rising 0.4% MoM, double the 0.2% increase last month. Average hourly earnings also rose to 3.8% YoY, up from 3.6% and beating the estimate of 3.7%. Was that it for the decline in earnings?

Indeed, for those focused on the ugly side of the jobs report – if only to justify a 50 bps rate cut – Bloomberg’s Chris Anstey notes that “while many are focusing on the lower-than-expected payrolls figure, I’d note the direction of travel here for August isn’t down, it’s up”

- Payroll growth accelerated in August.

- Employment gains in the household survey also quickened.

- The unemployment rate fell.

- Wage gains accelerated.

Apollo’s Chief Economist Torsten Slok agreed, sasying that the data broadly show improvements over July figures: “This report is better than in July,” Slok says.“This economy is not slowing down in the way that markets are anticipating. We will not get eight cuts over the next 12 months.”

Of course, much of this is purely optics, and as we will detail shortly, it was all thanks to a surge in part-time workers and illegal immigrants (more in a follow up post).

Taking a closer look at the actual jobs, the BLS reported that employment growth in August was in line with average job growth in recent months but was below the average monthly gain of 202,000 over the prior 12 months. In August, job gains occurred in construction and health care.

- Construction employment rose by 34,000 in August, higher than the average monthly gain of 19,000 over the prior 12 months. Over the month, heavy and civil engineering construction added 14,000 jobs, and employment in nonresidential specialty trade contractors continued to trend up (+14,000). That said, expect a major drop here now that construction jobs openings cratering.

- Health care added 31,000 jobs in August, about half the average monthly gain of 60,000 over the prior 12 months. In August, employment rose in ambulatory health care services (+24,000) and hospitals (+10,000).

- In August, employment in social assistance continued its upward trend (+13,000) but at a slower pace than the average monthly gain over the prior 12 months (+21,000). Individual and family services added 18,000 jobs over the month.

- Employment in manufacturing edged down in August (-24,000), reflecting a decline of 25,000 in durable goods industries. Manufacturing employment has shown little net change over the year.

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; leisure and hospitality; other services; and government.

And visually:

So what does that mean for the Fed’s upcoming rate cut? While the payrolls number was disappointing, it was nowhere near panic-inducing, which is what a 50bps rate cut would signal. As CIBC economist Ali Jaffery notes, it’s going to be up to the Fed speakers today to really set expectations when it comes to 25 or 50: “There were many mixed elements in today’s report that leaves the Fed call up in the air, and upcoming Fed speakers insights will provide some clues into how they are reading today’s report.”

A cautious take comes from Bloomberg Intelligence Chief US Interest Rate Strategist Ira Jersey who writes that “with the downward revisions, the market may not completely price out the chance of a 50-bp cut at the next Fed meeting, even with wages remaining solid. Next week’s inflation data will now be the final determinate.”

His Bloomberg Intel colleague Childe-Freeman notes that once prior-month revisions are taken into consideration, we have a confirmed, marked weakening in the US employment data, but the breakdown — see the fall in the unemployment rate — gives some relief.

“No compelling, obvious case in the 25-bp vs. 50-bp rate cut debate but nothing there to deter the cyclically driven more bearish dollar outlook. Whether the Fed starts with 25bp or 50bpo is no game changer in that respect.”

Meanwhile, Blackrock PM Jeffrey Rosenberg told Bloomberg TV that the danger is if the Fed goes by 50 this month it could suggest concerns about the economy — rather that providing reassurance that the policymakers are acting in time to head off a recession.

But perhaps the biggest clue about the upcoming rate cut came not from the jobs report, but from the Fed whisperer Nick Timiraos who looked at the John Williams speech delivered this morning, and said that his “prepared remarks don’t make any effort to lay the groundwork for a 50 basis point cut.”

John Williams’s prepared remarks don’t make any effort to lay the groundwork for a 50 basis point cut.

Williams says “policy can be moved to a more neutral setting over time.”

He’s doing Q&A now, and if the person asking questions decides to ask about monetary policy instead… https://t.co/Q7zc6vhAU1

— Nick Timiraos (@NickTimiraos) September 6, 2024

In short, safe to say it will be 25bps.

Loading…