Oil and gasoline futures moved higher early Monday as the National Hurricane Center tracked a potential tropical system that threatened parts of the US Gulf Coast later this week. The storm could slam into the upper Texas and Louisiana coasts, accounting for about 60% of US refining capacity.

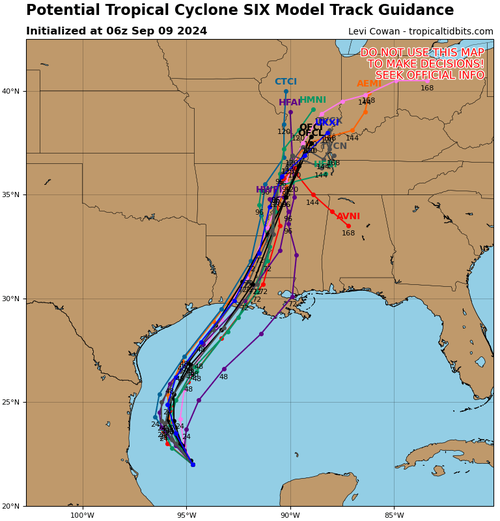

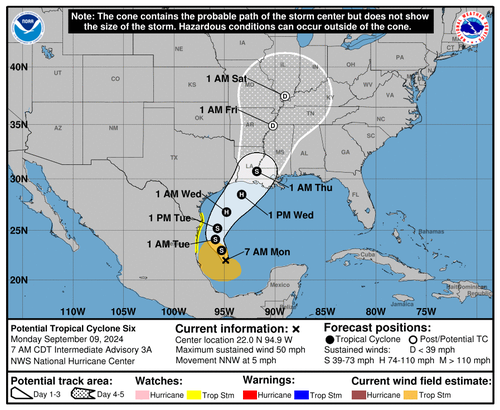

Potential Tropical Cyclone Six, or Invest 91L, churns in the southwestern Gulf of Mexico early Monday and is forecasted to become a hurricane before it reaches the northwestern US Gulf Coast late Wednesday. The storm emerges right on time, at the peak of the Atlantic hurricane season. It is interesting to note that this hurricane season has been very quiet.

"While it is too soon to pinpoint the exact location and magnitude of impacts, the potential for life-threatening storm surge and damage winds are increasing for portions of the Upper Texas and Louisiana coastlines beginning Tuesday night," the NHC wrote in its latest update.

The latest hurricane trajectory models show strong consensus that the tropical system could make landfall along the Louisiana coast.

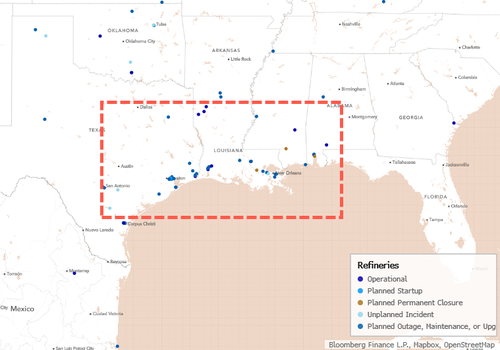

This area of the Gulf Coast is home to approximately 60% of US refining capacity. Bloomberg data shows several refineries are in the storm's cone of uncertainty.

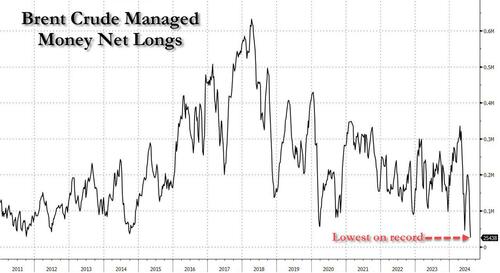

"A small recovery in prices is underway this morning, inspired by hurricane warnings that might threaten the US Gulf Coast, but the wider conversation remains on where demand will come from and what OPEC+ can do," PVM analyst John Evans told Reuters.

In recent weeks, Goldman's commodity analyst—now without "supercycle" permeable Jeff Currie—Daan Struyven slashed his expected range for Brent oil prices by $5 to $70-$85 per barrel, citing weaker Chinese oil demand, high inventories, and rising US shale production. The biggest driver for the cut is his belief that "OPEC will raise production in Q4..."

Morgan Stanley has also recently revised its oil price forecasts downward, reflecting expectations of increased supply from OPEC and non-OPEC producers amid signs of weakening global demand. The bank now anticipates that while the crude oil market will remain tight through the third quarter, it will begin to stabilize in the fourth quarter and potentially move into a surplus by 2025.

Morgan Stanley has cut its forecast for the fourth quarter to $80 per barrel, down from $85, and now expects prices to gradually decline to $75 per barrel by the end of 2025, slightly lower than their previous estimate of $76.

None of this is new to the market, where sentiment is ultra-bear...

However, a tropical system that supercharges in the Gulf of Mexico's warm waters and knocks out a few refineries could easily send energy prices back up. That would spike gas prices at the pump again, putting the Biden-Harris team in a difficult spot ahead of the November elections.

Oil and gasoline futures moved higher early Monday as the National Hurricane Center tracked a potential tropical system that threatened parts of the US Gulf Coast later this week. The storm could slam into the upper Texas and Louisiana coasts, accounting for about 60% of US refining capacity.

Potential Tropical Cyclone Six, or Invest 91L, churns in the southwestern Gulf of Mexico early Monday and is forecasted to become a hurricane before it reaches the northwestern US Gulf Coast late Wednesday. The storm emerges right on time, at the peak of the Atlantic hurricane season. It is interesting to note that this hurricane season has been very quiet.

“While it is too soon to pinpoint the exact location and magnitude of impacts, the potential for life-threatening storm surge and damage winds are increasing for portions of the Upper Texas and Louisiana coastlines beginning Tuesday night,” the NHC wrote in its latest update.

The latest hurricane trajectory models show strong consensus that the tropical system could make landfall along the Louisiana coast.

This area of the Gulf Coast is home to approximately 60% of US refining capacity. Bloomberg data shows several refineries are in the storm’s cone of uncertainty.

“A small recovery in prices is underway this morning, inspired by hurricane warnings that might threaten the US Gulf Coast, but the wider conversation remains on where demand will come from and what OPEC+ can do,” PVM analyst John Evans told Reuters.

In recent weeks, Goldman’s commodity analyst—now without “supercycle” permeable Jeff Currie—Daan Struyven slashed his expected range for Brent oil prices by $5 to $70-$85 per barrel, citing weaker Chinese oil demand, high inventories, and rising US shale production. The biggest driver for the cut is his belief that “OPEC will raise production in Q4…”

Morgan Stanley has also recently revised its oil price forecasts downward, reflecting expectations of increased supply from OPEC and non-OPEC producers amid signs of weakening global demand. The bank now anticipates that while the crude oil market will remain tight through the third quarter, it will begin to stabilize in the fourth quarter and potentially move into a surplus by 2025.

Morgan Stanley has cut its forecast for the fourth quarter to $80 per barrel, down from $85, and now expects prices to gradually decline to $75 per barrel by the end of 2025, slightly lower than their previous estimate of $76.

None of this is new to the market, where sentiment is ultra-bear…

However, a tropical system that supercharges in the Gulf of Mexico’s warm waters and knocks out a few refineries could easily send energy prices back up. That would spike gas prices at the pump again, putting the Biden-Harris team in a difficult spot ahead of the November elections.

Loading…