By Russell Clark, author of the Capital Flows and Asset Markets substack

For the last 8 years or so, shorting oil on any sign of recession in either the US or China has been a good trade. Hence I can understand the temptation to see the inverted yield curve, or weakening activity in China and US as signs to get short oil. There are however some big problems with a bearish oil view here.

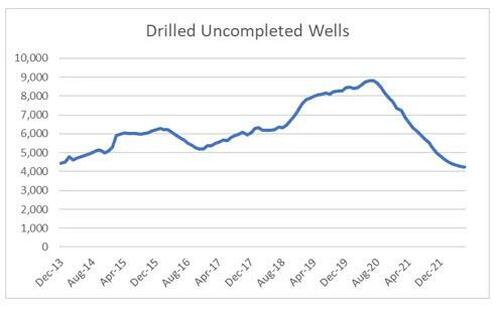

From 2013 onwards US shale drillers were engaged in a manic rush to drill wells, leading not to only fast growth in US energy production, but a sizable inventory of Drilled, Uncompleted (DUC) wells. Today, that inventory of wells is still falling.

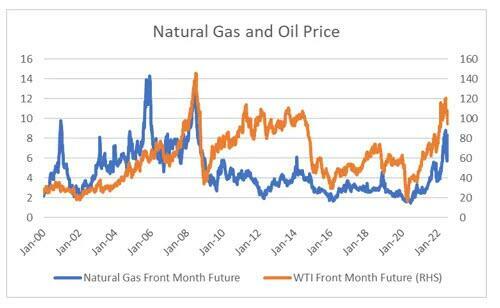

Shale drilling tends to produce more gas than oil, so the signs of oversupply first emerged in the natural gas market. As a rough rule, oil trades at 10 times the price of gas in the US (on an energy basis it should be 7, but natural gas is more difficult to transport). Hence the period from 2012 onwards offered a good opportunity to short oil as the natural has market was telling you it as at least 50% overvalued. That is not the case today, with natural gas pricing similar to the pre-shale days.

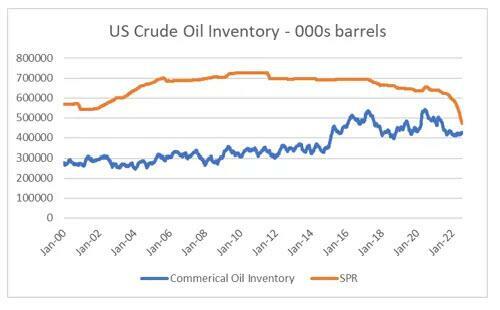

US inventory of oil is actually at the lowest levels since 2003. This is been driven by a collapse in the Strategic Petroleum Reserve (SPR) to the lowest level since 1984. Some people argue that with the US now a net oil exporter the SPR is no longer needed. This may well be the case, it is still not hard to see the depletion of the SPR as oil bullish.

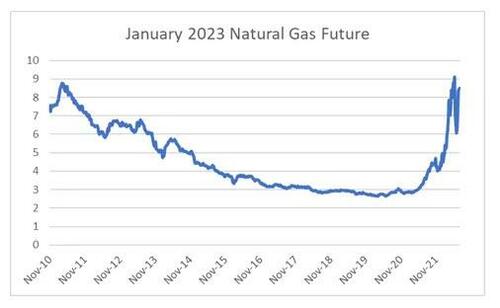

The real dagger to the bearish oil thesis is the tightness of the natural gas market. As natural gas is a very seasonal market, I like looking at specific dates in the future to avoid choppiness in pricing. When I look at the January 2023 natural gas future, you can see clearly it was in a brutal bear market from 2011 to early 2020. Current pricing is still at USD 8.50, well up from the lows of USD 3 in 2019.

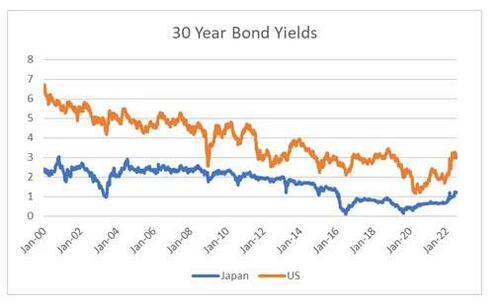

Of course a sizable recession will drive oil lower, but natural gas markets are implying there is still considerable tightness in the energy market. Oil prices could fall if there is a massive recession, and deflation shock. This could happen, and many traders are pointing to a rally in treasuries as confirmation. My problem with this view is that 30 year Japanese bond yields which have been the LEAD bond market for treasuries is not giving a strong deflation signal at all.

Shorting oil while inventories are falling, and the JGB market is still indicating elevated inflation concerns strikes me a poor risk reward. To my mind, I think energy prices are more likely to higher from here.

By Russell Clark, author of the Capital Flows and Asset Markets substack

For the last 8 years or so, shorting oil on any sign of recession in either the US or China has been a good trade. Hence I can understand the temptation to see the inverted yield curve, or weakening activity in China and US as signs to get short oil. There are however some big problems with a bearish oil view here.

From 2013 onwards US shale drillers were engaged in a manic rush to drill wells, leading not to only fast growth in US energy production, but a sizable inventory of Drilled, Uncompleted (DUC) wells. Today, that inventory of wells is still falling.

Shale drilling tends to produce more gas than oil, so the signs of oversupply first emerged in the natural gas market. As a rough rule, oil trades at 10 times the price of gas in the US (on an energy basis it should be 7, but natural gas is more difficult to transport). Hence the period from 2012 onwards offered a good opportunity to short oil as the natural has market was telling you it as at least 50% overvalued. That is not the case today, with natural gas pricing similar to the pre-shale days.

US inventory of oil is actually at the lowest levels since 2003. This is been driven by a collapse in the Strategic Petroleum Reserve (SPR) to the lowest level since 1984. Some people argue that with the US now a net oil exporter the SPR is no longer needed. This may well be the case, it is still not hard to see the depletion of the SPR as oil bullish.

The real dagger to the bearish oil thesis is the tightness of the natural gas market. As natural gas is a very seasonal market, I like looking at specific dates in the future to avoid choppiness in pricing. When I look at the January 2023 natural gas future, you can see clearly it was in a brutal bear market from 2011 to early 2020. Current pricing is still at USD 8.50, well up from the lows of USD 3 in 2019.

Of course a sizable recession will drive oil lower, but natural gas markets are implying there is still considerable tightness in the energy market. Oil prices could fall if there is a massive recession, and deflation shock. This could happen, and many traders are pointing to a rally in treasuries as confirmation. My problem with this view is that 30 year Japanese bond yields which have been the LEAD bond market for treasuries is not giving a strong deflation signal at all.

Shorting oil while inventories are falling, and the JGB market is still indicating elevated inflation concerns strikes me a poor risk reward. To my mind, I think energy prices are more likely to higher from here.