Tesla shares are up 4% in New York, reaching their highest intra-day levels in months, as Wall Street analysts kicked off the week by updating clients on third-quarter vehicle delivery estimates. Barclays is slightly more optimistic than the consensus, while Goldman's forecast aligns with the broader market expectations.

Barclays analyst Dan Levy expects third-quarter deliveries of about 470k vehicles, exceeding the 461k consensus.

In Levy's view, this possible beat could drive the stock higher. He said the third-quarter volume delivery strength is mainly due to China, while the European market remains weak. He added that the forecast beat would roll positive sentiment into Tesla's Robotaxi Day on Oct. 10 (already a preview of the taxi?). Tesla is expected to release vehicle delivery figures for the quarter on Oct. 2.

In a separate note, Goldman analyst Mark Delaney believes third-quarter deliveries are expected to print around 460k (up 4% QoQ and up 6% YoY). He noted this is approximately in line with the Visible Alpha consensus data.

Delaney provided further insight into how his team arrived at the 460,000 estimate:

Based on registration, insurance and third party data for China, Europe and the US quarter to date, we now expect 3Q24 deliveries of ~460K (up 4% qoq and up 6% yoy), down from our prior estimate of ~475K.

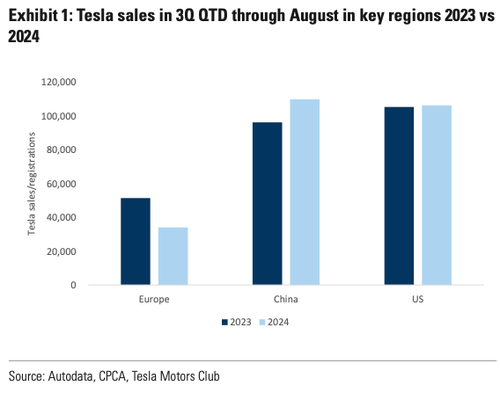

Regionally we believe that sales have been strong in China, flattish in the US, and weak in Europe on a yoy basis. Specifically: 1) Europe - Tesla registrations in Europe are down in the low-to-mid 30% range yoy for July plus August (although flattish vs. the first two months of 2Q24). However, data from the handful of countries in Europe that report registrations daily (the UK, Norway, Netherlands, Spain, Sweden, Denmark) as tracked by EU-EVs shows a pick-up yoy in the month of September. We assume 3Q in total is down low double digits to mid teens yoy in Europe. 2) China - Sales data for the first two months of the quarter per CPCA, and weekly insurance data, show double digit growth in China both qoq and yoy. We believe volumes are up in the low 20% range yoy. 3) US - Motor Intelligence estimates for the US market through August suggest a flattish market yoy (with growth from Cybertruck offset by declines in other models).

We also modestly lower our 4Q estimate to 501K (up 3% yoy and 9% qoq) from 505K prior. Our estimate implies flat to down volumes yoy excluding Cybertruck, but implying some seasonal pick-up qoq. For the year, we now model 2024 deliveries of 1.79 mn (-1% yoy).

Our new estimates for 3Q and 4Q of 460K/501K compare to Visible Alpha consensus of 457k/489k.

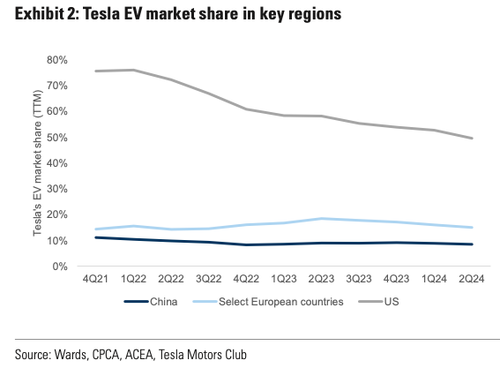

Recall that Tesla's EV market share was about 50% in the US, low to mid teens in Europe, and around 10% in China as of 2Q24 (Exhibit 2).

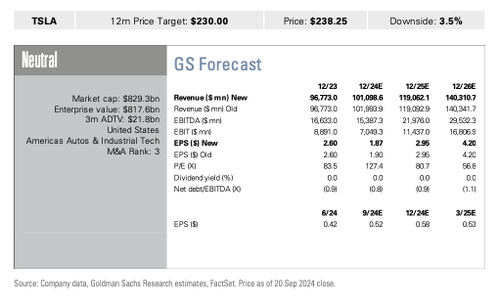

On the back of the lower deliveries and in turn lower revenue for 2024, we lower our 2024 EPS estimate including SBC to $1.87 from $1.90. We maintain our 2025/2026 EPS estimates of $2.95/$4.20. Excluding SBC, we now model 2024/25/26 EPS of $2.28/$3.35/$4.60.

The analyst provides clients with his thoughts on the robotaxi unveil scheduled for Oct. 10:

A) Time frames based on technology readiness and logistical/permitting considerations.

The time frame to begin and scale robotaxi operations will be one important item for investors to analyze in our opinion.

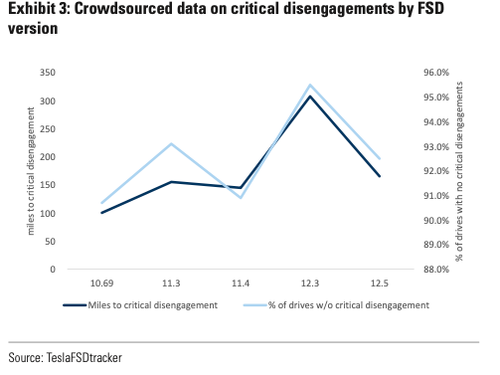

The underlying ability of FSD (full self driving) to operate without a human in the driver seat is a critical aspect of this. Per data from TeslaFSDTracker, the miles driven between critical interventions is at 150-300 with V12 of FSD (Exhibit 3). While this is an improvement from V10 and V11 of FSD, and >90% of drives have no critical disengagements, this distance is well below the 600-700k miles between crashes on average for a US driver (although not every self-reported critical intervention may have resulted in a crash). That said, this is crowd-sourced data with a relatively limited sample size, and Tesla has stated that its interventions and technology are making significant progress.

Tesla's consumer vehicles are currently L2 (in other words the driver is required to take over and has ultimate responsibility for the vehicle even when FSD is on). As Tesla begins a robotaxi business, we'll be interested to learn more about how Tesla's approach to its sensor stack and use of remote assistance evolves. On sensors, although Tesla uses only vision with Models 3 and Y, some Model S and X vehicles use radar. We believe high definition radar could help offer redundancy that is needed for a robotaxi especially in certain weather conditions, although we recognize the company's opinion on the capabilities of vision/cameras.With respect to remote assistance, we believe Tesla may offer human support from remote locations (similar to others such as Waymo/Baidu/Aurora) especially to help in unusual situations.

We also believe Tesla will need to consider operational and logistical items in a few regards, including customer service, maintenance/depots/cleaning, insurance, and permits. To that end, Tesla offers its own insurance in 12 states, including Arizona, Nevada, and Texas. The favorable weather and regulatory environment in these states, as well as the fact that Tesla offers insurance in those locations, suggests to us that one or more of these states may be whereTesla begins commercial operations.

If Tesla uses a vehicle without certain hardware (e.g. there is no steering wheel) it will need approval from NHTSA. Therefore, we believe that Tesla's robotaxi/Cybercab may be designed to be flexible (e.g. a pedal and wheel can be added if required) so the company can still operate without a NHTSA exemption if necessary (or if some states/cities mandate a safety driver be present during early operations).

We believeTesla will target to begin operating a robotaxi business next year based on the comments the company has made on the progress it is making (although we note that Tesla has historically been too optimistic on time frames to reach L4 capability).

Possible sneak preview of the robotaxi?

🔥🔥🔥 Tesla Robotaxi/CyberCab spotted with heavy camouflage during testing at Warner Bros. studio! pic.twitter.com/nr89KKcItn

— Tesla Newswire (@TeslaNewswire) September 13, 2024

Delaney maintained a 'Neutral' rating on Tesla stock with a 12-month price target of around $230, which is based on 65x applied to Q5-Q8E EPS, including SBC.

However, there are some downside risks the analyst said clients should consider:

Key downside risks to our view relate to potentially larger vehicle price reductions than we expect, increased competition in EVs, slower EV demand, delays with products/capabilities like FSD/4680, key person risk, the internal control environment, margins, and operational risks associated with Tesla's high degree of vertical integration. downside risks to our view.

Inversely...

Upside risks include faster EV adoption and/or share gain by Tesla, a stronger macroeconomic environment for new vehicle sales more generally, earlier new product launches than we expect, and an earlier/larger impact from AI enabled products (e.g., FSD, Optimus and robotaxis) than we currently anticipate.

GS Price Forecast for Tesla:

Tesla's shares are up 4% on Monday. The big picture is that shares have oscillated between $300 and $100 for the last 2.5 years. In other words, as Cathie Woods describes, basing.

All eyes on delivery data from Tesla on Oct. 2, followed by Robotaxi Day on Oct. 10.

Tesla shares are up 4% in New York, reaching their highest intra-day levels in months, as Wall Street analysts kicked off the week by updating clients on third-quarter vehicle delivery estimates. Barclays is slightly more optimistic than the consensus, while Goldman’s forecast aligns with the broader market expectations.

Barclays analyst Dan Levy expects third-quarter deliveries of about 470k vehicles, exceeding the 461k consensus.

In Levy’s view, this possible beat could drive the stock higher. He said the third-quarter volume delivery strength is mainly due to China, while the European market remains weak. He added that the forecast beat would roll positive sentiment into Tesla’s Robotaxi Day on Oct. 10 (already a preview of the taxi?). Tesla is expected to release vehicle delivery figures for the quarter on Oct. 2.

In a separate note, Goldman analyst Mark Delaney believes third-quarter deliveries are expected to print around 460k (up 4% QoQ and up 6% YoY). He noted this is approximately in line with the Visible Alpha consensus data.

Delaney provided further insight into how his team arrived at the 460,000 estimate:

Based on registration, insurance and third party data for China, Europe and the US quarter to date, we now expect 3Q24 deliveries of ~460K (up 4% qoq and up 6% yoy), down from our prior estimate of ~475K.

Regionally we believe that sales have been strong in China, flattish in the US, and weak in Europe on a yoy basis. Specifically: 1) Europe – Tesla registrations in Europe are down in the low-to-mid 30% range yoy for July plus August (although flattish vs. the first two months of 2Q24). However, data from the handful of countries in Europe that report registrations daily (the UK, Norway, Netherlands, Spain, Sweden, Denmark) as tracked by EU-EVs shows a pick-up yoy in the month of September. We assume 3Q in total is down low double digits to mid teens yoy in Europe. 2) China – Sales data for the first two months of the quarter per CPCA, and weekly insurance data, show double digit growth in China both qoq and yoy. We believe volumes are up in the low 20% range yoy. 3) US – Motor Intelligence estimates for the US market through August suggest a flattish market yoy (with growth from Cybertruck offset by declines in other models).

We also modestly lower our 4Q estimate to 501K (up 3% yoy and 9% qoq) from 505K prior. Our estimate implies flat to down volumes yoy excluding Cybertruck, but implying some seasonal pick-up qoq. For the year, we now model 2024 deliveries of 1.79 mn (-1% yoy).

Our new estimates for 3Q and 4Q of 460K/501K compare to Visible Alpha consensus of 457k/489k.

Recall that Tesla’s EV market share was about 50% in the US, low to mid teens in Europe, and around 10% in China as of 2Q24 (Exhibit 2).

On the back of the lower deliveries and in turn lower revenue for 2024, we lower our 2024 EPS estimate including SBC to $1.87 from $1.90. We maintain our 2025/2026 EPS estimates of $2.95/$4.20. Excluding SBC, we now model 2024/25/26 EPS of $2.28/$3.35/$4.60.

The analyst provides clients with his thoughts on the robotaxi unveil scheduled for Oct. 10:

A) Time frames based on technology readiness and logistical/permitting considerations.

The time frame to begin and scale robotaxi operations will be one important item for investors to analyze in our opinion.

The underlying ability of FSD (full self driving) to operate without a human in the driver seat is a critical aspect of this. Per data from TeslaFSDTracker, the miles driven between critical interventions is at 150-300 with V12 of FSD (Exhibit 3). While this is an improvement from V10 and V11 of FSD, and >90% of drives have no critical disengagements, this distance is well below the 600-700k miles between crashes on average for a US driver (although not every self-reported critical intervention may have resulted in a crash). That said, this is crowd-sourced data with a relatively limited sample size, and Tesla has stated that its interventions and technology are making significant progress.

Tesla’s consumer vehicles are currently L2 (in other words the driver is required to take over and has ultimate responsibility for the vehicle even when FSD is on). As Tesla begins a robotaxi business, we’ll be interested to learn more about how Tesla’s approach to its sensor stack and use of remote assistance evolves. On sensors, although Tesla uses only vision with Models 3 and Y, some Model S and X vehicles use radar. We believe high definition radar could help offer redundancy that is needed for a robotaxi especially in certain weather conditions, although we recognize the company’s opinion on the capabilities of vision/cameras.With respect to remote assistance, we believe Tesla may offer human support from remote locations (similar to others such as Waymo/Baidu/Aurora) especially to help in unusual situations.

We also believe Tesla will need to consider operational and logistical items in a few regards, including customer service, maintenance/depots/cleaning, insurance, and permits. To that end, Tesla offers its own insurance in 12 states, including Arizona, Nevada, and Texas. The favorable weather and regulatory environment in these states, as well as the fact that Tesla offers insurance in those locations, suggests to us that one or more of these states may be whereTesla begins commercial operations.

If Tesla uses a vehicle without certain hardware (e.g. there is no steering wheel) it will need approval from NHTSA. Therefore, we believe that Tesla’s robotaxi/Cybercab may be designed to be flexible (e.g. a pedal and wheel can be added if required) so the company can still operate without a NHTSA exemption if necessary (or if some states/cities mandate a safety driver be present during early operations).

We believeTesla will target to begin operating a robotaxi business next year based on the comments the company has made on the progress it is making (although we note that Tesla has historically been too optimistic on time frames to reach L4 capability).

Possible sneak preview of the robotaxi?

🔥🔥🔥 Tesla Robotaxi/CyberCab spotted with heavy camouflage during testing at Warner Bros. studio! pic.twitter.com/nr89KKcItn

— Tesla Newswire (@TeslaNewswire) September 13, 2024

Delaney maintained a ‘Neutral’ rating on Tesla stock with a 12-month price target of around $230, which is based on 65x applied to Q5-Q8E EPS, including SBC.

However, there are some downside risks the analyst said clients should consider:

Key downside risks to our view relate to potentially larger vehicle price reductions than we expect, increased competition in EVs, slower EV demand, delays with products/capabilities like FSD/4680, key person risk, the internal control environment, margins, and operational risks associated with Tesla’s high degree of vertical integration. downside risks to our view.

Inversely…

Upside risks include faster EV adoption and/or share gain by Tesla, a stronger macroeconomic environment for new vehicle sales more generally, earlier new product launches than we expect, and an earlier/larger impact from AI enabled products (e.g., FSD, Optimus and robotaxis) than we currently anticipate.

GS Price Forecast for Tesla:

Tesla’s shares are up 4% on Monday. The big picture is that shares have oscillated between $300 and $100 for the last 2.5 years. In other words, as Cathie Woods describes, basing.

All eyes on delivery data from Tesla on Oct. 2, followed by Robotaxi Day on Oct. 10.

Loading…