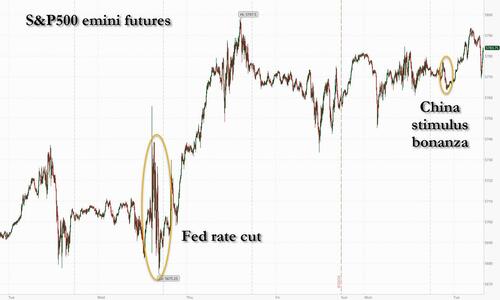

US equity futures are higher, led by tech with small-caps underperforming, as European stocks jump near record high (even as Europe slides deeper into recession) and Asian markets surge after China’s announced a flurry of "stronger than expected" stimulus measures which aided China and Hong Kong equities to more than 4% gains. As of 8:00am, S&P and Nasdaq futures were up 0.1%, fluctuating between gains and losses, as traders were unsure if China's massive stimulus would prove to be inflationary and thus crush the Fed's hopes for an accelerated easing campaign. The news of China's multiple rate cuts and market-supporting measures (full details here) is also boosting the commodity complex with both Energy and Base Metals seeing gains. And with commodities once again flying, bond yields are 1-4bps higher as the curve bear steepens. The USD is mixed as the yen slides now that the carry trade is once again back on thanks to China. As JPM notes this morning, while the US has been the anchor for global growth, "a China reboot will also benefit the globe though may create another inflation pressure," so keep an eye on commodities and bond yields over the coming weeks. Higher yields are not a headwind to stocks but when yields set new highs (e.g., 10Y > 5%) that is when US Equities are disrupted. On the macro calendar we have the September Phillly Fed non-manufacturing activity (8:30am), July FHFA house price index and S&P CoreLogic house prices (9am), September consumer confidence and Richmond Fed manufacturing index (10am); Fed speakers scheduled include Bowman at 9am.

In premarket trading, US-listed Chinese stocks surged after China’s central bank announced a slew of measures aiming to boost the economy, housing sector and the stock market; among the biggest movers were Alibaba (BABA) + 5.7%, JD.com (JD) + 8.2%, and NetEase (NTES) +6.2%. Here are some other notable premarket movers:

- Hawaiian Electric Industries (HE) slips after pricing an offering

- Liberty Broadband (LBRDA) shares soar 20% after John Malone’s cable company proposed an all-stock merger with Charter Communications (CHTR)

- Light & Wonder (LNW) falls after saying it had received an order from the US District Court for the District of Nevada granting gambling machine manufacturer Aristocrat a preliminary injunction relating to L&W’s Dragon Train game

- Miniso (MNSO) extends Monday’s decline after announcing a plan to buy a majority stake in Yonghui Superstores

- Salesforce (CRM) gains as Piper Sandler raised its recommendation on the stock to overweight from neutral, seeing free cash flow per share doubling by 2029

- Starbucks (SBUX) falls as Jefferies assigned an underperform rating, saying it’s too early to get excited about the company’s prospects for a turnaround even with a new CEO in charge

- Walmart (WMT) rises after Truist Securities upgraded the retailer to buy from hold. Costco (COST) declines after Truist downgraded the stock

Overnight market sentiment is euphoric after PBOC governor Pan Gongsheng announced a barrage of policy easing measures this morning, including a 20bp primary policy rate cut, a 50bp RRR cut and a 50bp interest rate cut on existing mortgages. Summary of stimulus package:

- 50bp RRR cut (Governor Pan flagged the central bank will consider cutting RRR further by year-end);

- 20bp cut to policy rate (7d OMO rate);

- Governor Pan flagged this would guide MLF rate lower by 30bp and lower LPRs and deposit rates by 20-25bp;

- Lowering mortgage rates (by ~50bp as estimated by PBOC), and lowering the downpayment ratio of second-home purchase to the level for first-home purchase (to 15% from 25% previously);

- Launching new monetary policy tools to support stock market development (i.e., supporting brokerages, mutual funds and insurance companies to borrow liquidity from PBOC via asset pledges);

- Launching special-purpose relending to guide bank to provide funding for list companies on their share buybacks.

China’s broad package of monetary stimulus on Tuesday included reduced reserve requirements for banks and at least 800 billion yuan ($114 billion) of liquidity support for stocks. According to Goldman, the announcement was "one of the largest / strongest moves by the PBOC since probably the height of COVID" and while "until now, its been fairly piecemeal in nature and rather uncoordinated leaving lukewarm reactions, today’s joint PBOC, CBRC and NFRA press conference was the setting with expectations are high for further fiscal / property market easing over the coming weeks - though there remains obvious questions on the efficacy of all of this through to the real economy in the context of oversupply and a continued cautious consumer." As a result, this move appears to signal greater openness to easing from senior policymakers, but more fiscal easing measures are needed to boost domestic demand (they will come now that China has announced no more half measures). Given the guidance from the PBOC governor, Goldman expects another 25bp RRR cut in Q4 for this year, and maintain a forecast for additional RRR/policy rate cuts in 2025 (two 25bp RRR cuts in Q1/Q3 and two 10bp policy rate cuts in Q2/Q4 2025).

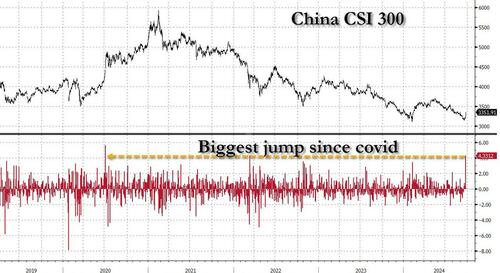

Beijing's poilcy stimulus blitz sent China’s stocks soaring the most in fueled by the central bank’s latest blitz of policy measures designed to stem the worsening economic outlook and market mood. After a modest open, equities gathered steam after People’s Bank of China Governor Pan Gongsheng’s announcement, with traders assessing if the stimulus package was sufficiently robust. By the close,, the benchmark CSI 300 index surged more than 4.3%, the biggest jump since the March 2020 Covid panic.

Still, it will take time for the economic impact of any stimulus to feed through, Michael Sneyd, head of cross-asset and macro quantitative strategy at BNP Paribas, told Bloomberg TV. “That China stimulus news is probably not enough to take off those downside risks in the European economy just yet.”

Meanwhile, back in the US, a handful of Fed officials on Monday left open the door to the possibility of more large interest-rate cuts to come, saying that the current level is still weighing on the economy. Chicago Fed President Austan Goolsbee said that “we have a long way to come down to get the interest rate to something like neutral.” Although he and his colleagues made clear that incoming data will determine what comes next.

In short: China jumping on the stimulus bandwagon just in time for the US to aggressively cut, means we have all the makings of a global superbubble.

Investors are now awaiting data on the Fed’s preferred price metric and US personal spending later this week for further clues on the depth of future reductions. US Traders have been wagering on nearly three-quarters of a point of policy easing by year-end, suggesting at least one more major rate cut is in store.

And sure enough, European stocks, having been hammered by the lack of a credible China stimulus for years, erupted higher tracking a China-led rally in Asia. The Stoxx 600 is up 0.6%, with luxury and mining sectors the biggest benefactors. UK machinery firm Smiths is the day’s biggest laggard after preliminary FY2024 results. Here are the biggest European movers:

- European sectors with high exposure to China, including miners, luxury-goods makers and automakers, gain strongly after the Asian nation announced measures to boost growth and shore up its property market

- TUI rises as much as 3.2% after the travel company said it experienced a strong end to the summer season, leaving it confident it can deliver its annual guidance, and made a promising start to the winter season

- Raspberry Pi rises as much as 9.5% after the British PC maker reported a 61% increase in 1H revenue, boosted by pricier Raspberry Pi 5 boards; the stronger-than-expected 1H is likely followed by a weaker 2H

- AMS-Osram shares jump as much as 16% after UBS lifts its recommendation for the Swiss chip-maker to buy from neutral, citing limited liquidity and leverage concerns and a clear path to further deleveraging

- Smiths Group drops as much as 8.3%, the most since 2021, after the UK machinery firm releases its preliminary results for FY24 and FY25 targets. Jefferies says consensus expectations for FY25 may “drift”

- Saab falls as much as 7.4% to the lowest since March after Bank of America downgraded its rating on the Swedish weapons and defense systems manufacturer to neutral, trimming its price target to SEK240

- Aurubis shares drop as much as 3.7% after Hauck & Aufhaeuser analysts downgraded their recommendation on the firm. Shares had slid more than 10% on Monday after the firm’s profit guidance missed estimates

- Dunelm shares drop as much as 7.5%, the most since September 2022, after its deputy chairman sold shares in the British homeware retailer at a discount to the last closing price

Meanwhile, Asian stocks headed for their highest close since February 2022 as a slew of measures from China to support its struggling economy boosted sentiment on the region’s equities. The MSCI Asia Pacific Index rose as much as 1%, with Tencent, TSMC and Alibaba among the biggest boosts. Stocks rallied in mainland China and in Hong Kong, with the CSI 300 index closing up 4.3% in its best day in more than four years. The Hang Seng China Enterprises index surged over 5%. China’s stimulus package, which includes a reduction to a key policy rate and $113 billion of liquidity support for the stock market, helped ease concerns that authorities are reluctant to take bold policy steps. Investors were already warming toward emerging market assets following the Federal Reserve’s 50-basis-point rate cut, and a sustainable rebound in Chinese shares can provide an additional boost to the region. The stimulus has “raised the expectations that more is coming,” providing support for the stock market, Grace Tam, chief investment advisor at BNP Paribas Wealth Management, said in a Bloomberg TV interview. “The market will expect more support on the fiscal side,” she added.

In FX, the Bloomberg Dollar Spot Index is little changed. The yen is the weakest of the G-10 currencies, falling 0.6% against the greenback. The Aussie dollar reversed its post-RBA gain after Governor Bullock said a hike was not explicitly considered at today’s meeting.

In rates, Gilts lead a sell off in European government bonds, with UK 10-year yields rising 6 bps to 3.98%. Treasuries 10-year yields are up 4 bps to 3.79% amid fears China may overstimulate and derail the Fed's easing plans.

Commodities also benefited from China's panic, with WTI rising 2.6% to $72.20 a barrel, and as a major Israeli strike on Hezbollah targets in Lebanon kept tensions high in the Middle East. Gold hit a fresh record of $2,640.11 per ounce. Iron ore and copper climb over 1%.

Looking at today's calendar, we get September Philadelphia Fed non-manufacturing activity (8:30am), July FHFA house price index and S&P CoreLogic house prices (9am), September consumer confidence and Richmond Fed manufacturing index (10am). Fed speakers scheduled include Bowman at 9am.

Market Snapshot

- S&P 500 futures up 0.3% to 5,791.50

- STOXX Europe 600 up 0.8% to 520.21

- MXAP up 0.9% to 188.95

- MXAPJ up 1.3% to 593.95

- Nikkei up 0.6% to 37,940.59

- Topix up 0.5% to 2,656.73

- Hang Seng Index up 4.1% to 19,000.56

- Shanghai Composite up 4.2% to 2,863.13

- Sensex up 0.1% to 85,042.00

- Australia S&P/ASX 200 down 0.1% to 8,141.97

- Kospi up 1.1% to 2,631.68

- German 10Y yield little changed at 2.2%

- Euro up 0.3% to $1.1140

- Brent Futures up 1.5% to $75.03/bbl

- Gold spot down 0.0% to $2,628.41

- US Dollar Index little changed at 100.81

Top Overnight News

- China unveiled its most aggressive package of stimulus measures since the pandemic as the gov’t rushes to bolster the economy (steps include interest rate cuts, including the 7-day reverse repo, bank RRRs, and mortgage borrowing costs, along with liquidity injections aimed at bolstering stocks). RTRS

- BOJ’s Ueda downplays the potential for an Oct rate hike, saying high uncertainty warranted a patient approach to tightening. WSJ

- Australia’s RBA leaves rates unchanged at 4.35%, as was widely expected, although the forward guidance turned slightly dovish at the margin as further tightening wasn’t discussed. RTRS

- Zelensky says he believes Russia’s war on his country is closer to an end than many believe. Czech Republic president Petr Pavel said Ukraine needs to be realistic and accept that an end to the war will probably involve ceding some territory to Russia. ABC News / NYT

- Washington believes Israel has significantly weakened Hezbollah with recent strikes but is working “feverishly” to prevent an IDF ground incursion into Lebanon. CNN

- Private credit is set to face a “reckoning moment” and period of difficulty unseen since 2008 amid inflation and recession risks, NY Life CIO Jae Yoon said. He emphasized that the risk was not “Armageddon” level, but said the flood of capital had led to too much debt concentration. BBG

- Visa will be hit with an antitrust lawsuit by the DOJ on Tuesday following a years-long review of the firm’s business practices. FT

- Former President Donald Trump threatened to hit US farm machinery maker Deere & Co. with steep tariffs if the company moves production to Mexico during an event on American farmers and trade. “I’m just notifying John Deere right now, if you do that, we’re putting a 200% tariff on everything that you want to sell into the United States,” Trump said Monday, citing reports about the company shifting manufacturing to Mexico. BBG

- GameStop said it raised $400M from its latest ATM offering program (this means the company now has ~$4.6B in cash/securities, or nearly 50% of the present market cap). RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following gains on Wall St. and China's various stimulus measures. ASX 200 was subdued amid the RBA rate decision where the central bank unsurprisingly opted for a hawkish hold. Nikkei 225 gapped above the 38,000 level as it played catch up on its return from the long weekend. Hang Seng and Shanghai Comp were boosted after the PBoC, NDRC and NRFA press briefing where PBoC Governor Pan announced a cut in the RRR by 50bps and the 7-day reverse repo rate by 20bps to 1.50%, while it will reduce the MLF rate and guide the LPR lower. Furthermore, support measures were also announced for the property industry and China will create new tools to support the stable development of the stock market, as well as allow funds and brokers to tap PBoC funds to buy stock.

Top Asian News

- Former US President Trump said regarding his tariff plans that he doesn't need Congress and would have the right to impose them himself, according to Washington Post's Stein.

- BoJ Governor Ueda says it is desirable for FX to move stability reflecting fundamentals; global market remains somewhat unstable; must watch market developments with strong sense of urgency for the time being. Says the unwinding of short-term speculative JPY positions, which were partially behind the August rout, have likely run their course. Says he wants scrutinise each month's service price data in gauging development in underlying inflation. BoJ natural rate of interest was among the factors taken into account when setting policy. Does not comment on short-term FX fluctuations.

European bourses, Stoxx 600 (+0.9%) began the session on a very strong footing, taking impetus from a strong APAC session overnight, which was sparked by a flurry of Chinese stimulus efforts. As it stands, European indices are firmer across the board and near session highs. European sectors hold a strong positive bias, with the best performers in Europe largely a beneficiary of the aforementioned Chinese stimulus efforts; Basic Resources, Consumer Products (particularly Luxury) and Tech all top the pile. Real Estate and Utilities are found towards the foot of the pile. US Equity Futures (ES +0.2% NQ +0.4% RTY +0.2%) are modestly firmer across the board, taking impetus from a strong European session which has digested and benefited from China’s stimulus bazooka.

Top European News

- ECB President Lagarde says the ECB is almost at the 2% target, wants to make sure they reach the target and remain there, according to comments on The Daily Show.

- ECB's Muller says "it's reasonable to expect more cuts if outlook holds".

- UK PM Starmer is to argue that tough decisions are needed for the UK national renewal and say in his speech on Tuesday that there are no easy answers, according to FT. It was also reported by Huffington Post that PM Starmer is to warn of more pain to come as he pledges a new Britain.

- French Finance Minister Armand says they are working on the latest estimates for the 2024 budget deficit, aiming to be able to present "something credible".

FX

- USD is showing a mixed performance vs. peers in the current risk environment; stronger vs. JPY and CHF but softer vs. EUR, CAD, GBP. DXY is currently contained within yesterday's 100.71-101.22.

- EUR is able to gain against the USD despite more dismal data from Germany which saw a miss across the board on IFO metrics. EUR/USD has been able to hold above the 1.11 mark throughout the session and has climbed as high as 1.1139 but is yet to challenge Monday's 1.1167 peak.

- Cable has once again eked out another marginal YTD high, this time at 1.3375. There hasn't been anything fresh during today's session to drive the move and instead looks to be more a continuation of the current trend. UK PM Starmer is to speak at the UK Labour Party Conference at 14:00BST.

- JPY is struggling alongside the current pro-risk sentiment seen overnight in China and in Europe. Ueda spoke earlier but comments did not look particularly dovish and in-fact could be seen as slightly more hawkish vs his prior comments. USD/JPY has been able to eclipse last week's 144.49 peak with focus now on a test of the 145 mark.

- AUD/USD is unable to benefit from the Chinese stimulus efforts with greater attention on events at the RBA. The Bank delivered what was seen as another hawkish hold. However, AUD/USD was subsequently dragged lower by comments from the RBA Governor stating that, unlike the prior meeting, the board did not discuss a rate hike.

Fixed Income

- USTs are weighed on by the broader risk tone and down to a 114-13+ base. Support comes in at Monday’s 114-11+ trough before the figure. Fed's Bowman and US 2yr supply.

- Bunds are softer below 134.50 but still clear of Monday’s 134.02 base, potentially weighed on by somewhat hawkish remarks from Ueda (vs his post-policy announcement speech) and the strengthening risk tone more generally given substantial Chinese stimulus overnight. Poor German Ifo data spurred no real reaction in the complex.

- Gilts are pressured and moving in-line with peers; BoE's Bailey spoke earlier, but added little. Gilts initially opened higher by 13 ticks but have since faded and lost the 99 handle to a 98.73 trough.

- UK sells GBP 1.5bln 0.75% 2033 I/L Gilt: b/c 3.17x (prev. 2.94x) and real yield 0.486% (prev. 0.462%).

- Germany sells EUR 3.708bln vs exp. EUR 4.5bln 2.70% 2026 Schatz: b/c 2.4x (prev. 2.5x), average yield 2.14% (prev. 2.41%) and retention 17.6% (prev. 16.93%).

Commodities

- A firm session thus far for the crude complex amid the overnight raft of Chinese stimulus announced which takes some sting out of the Chinese demand woes which has plagued the crude markets for much of this year and amid the heightened geopolitical environment in Lebanon/Israel.

- Upward bias across precious metals but to varying degrees. Spot gold sees the shallowest gains, potentially amid less demand for havens in a risk-on environment. XAU overnight printed yet another fresh All-time-high at USD 2,640.18/oz (vs low 2,622.68/oz).

- Base metals are higher across the board as the raft of Chinese stimulus announced overnight boosts demand prospects for the sector. 3M LME copper topped USD 9,700/t.

- BP (BP/ LN) cut oil and gas production at two US Gulf of Mexico platforms and curtailed output at two others, while it is removing non-essential staff from five US Gulf of Mexico platforms ahead of a predicted hurricane.

- Chevron (CVX) announced it was evacuating non-essential personnel from all Gulf of Mexico platforms including Anchor, Big Foot, Blind Faith, Jack/St. Malo, Petronius and Tahiti.

- NHC says Hurricane John is just inland over southern Mexico. Life-threatening winds, storm surges and flash flooding continues in the warning area; more recently, John has been downgraded to a tropical storm, moving north-westward; life threatening flash flooding to continue along southern Mexican coast for the next few days

- Ukrainian President Zelensky said he held talks with Japanese PM Kishida on energy supplies in light of Russian attacks.

Geopolitics: Middle East

- IDF Radio, citing military sources, say "We have a long way ahead and we are still at the beginning", via Al Arabiya.

- "Senior Israeli official says a ground operation in Lebanon could be considered if political track does not lead to the return of the Israeli residents to the north", according journalist Soylu.

- Hamas armed wing said field commander Mahmoud Al-Nader was killed in an Israeli strike on southern Lebanon on Monday.

- US President Biden and UAE's leader said after their meeting that a two-state solution is the only framework for resolving the conflict, while it was also reported that the UAE expressed deep concern over Israeli attacks on southern Lebanon.

- US State Department senior official said the US has been working hard in recent days to find a diplomatic solution to the spike in fighting between Israel and Hezbollah, while the key focus for Secretary of State Blinken's discussion with allies is on finding an off-ramp to prevent further escalation and the US has some "concrete ideas" that it is going to be discussing to prevent escalation in the region.

- US Deputy Treasury Secretary told the Bank of Israel Governor of US concern about threats by some within the Israeli government to sever correspondent banking relationships between Israeli and Palestinian banks, while the Deputy Treasury Secretary insisted these relationships should be extended for at least a year and stressed these relations would be critical to preventing an economic crisis in the West Bank.

- EU's Borrell said the escalation in Lebanon is extremely worrying and that they are almost in a full-fledged war, while he added that they are still working to stop escalation in Lebanon but the worst expectations are becoming reality.

- Iran’s President said US policies support and encourage Israel in its open war and Washington's actions contradict its words, while Iran reaffirms that an open regional war will not be in the interest of anyone in the region and the world. Furthermore, he said Iran has sufficient capacity to strike Israel and their response will be at the right time and in the appropriate way, while he added that Israel's assassination of Haniyeh will not be without a response and their reply is coming.

- Iran’s President said at the UN Summit of the Future that Tehran aspires to “a world free of nuclear weapons and a Middle East free of weapons of mass destruction, without any preconditions”, according to journalist Abas Aslani via X.

- Iran's Foreign Minister denied statements attributed to Iran's President about a willingness to reduce tensions with Israel, while the Foreign Minister added that Israel will receive a response to attacks in due course, according to Al-Arabiya.

- "The response to the new air force airstrikes in Lebanon would not only come from Lebanon, but from other resistance axes such as Yemen", according to Houthi sources cited by Lebanese newspaper Al-Akhbar.

Geopolitics: Other

- Ukrainian President Zelensky said Ukraine's war with Russia is 'closer to the end' and separately commented that US decisive action now could hasten an end to Russian aggression next year, according to ABC News and Reuters.

- EU's Borrell said it is clear that Russia has been receiving new weapons in particular, missiles from Iran, while he added that G7 will hold talks about providing long-range missiles to Ukraine to strike Russian territory.

- Venezuela's highest court approved an arrest warrant for Argentine President Milei who is a vocal critic and ideological rival of Venezuelan President Maduro, according to AFP News Agency. Argentine Justice requests international arrest of Venezuelan President Maduro for alleged human rights violations

US Event Calendar

- 08:30: Sept. Philadelphia Fed Non-Manufactu, est. -9.3, prior -25.1

- 09:00: July S&P/Case-Shiller US HPI YoY, prior 5.42%

- 09:00: July FHFA House Price Index MoM, est. 0.2%, prior -0.1%

- 09:00: July S&P/CS 20 City MoM SA, est. 0.40%, prior 0.42%

- 09:00: July S&P CS Composite-20 YoY, est. 5.90%, prior 6.47%

- 10:00: Sept. Conf. Board Expectations, prior 82.5

- 10:00: Sept. Conf. Board Present Situation, prior 134.4

- 10:00: Sept. Richmond Fed Index, est. -12, prior -19

- 10:00: Sept. Conf. Board Consumer Confidenc, est. 104.0, prior 103.3

DB's Jim Reid concludes the overnight wrap

The most exciting thing about yesterday for me was losing my AirPod Pro headphones on the train on the way to the office and then nervously tracking them on the "find my" feature to the South Coast of England and back to London twice before I met them later after tracking the train in an emotionally charged reunion. They were on the floor under the seat where I had dropped them. It's a miracle no one took them or handed them in which would have been pretty annoying/inconvenient. I'm off to Paris this morning so a few days without headphones would have been irritating. Let's hope I don't leave them on the plane as I'm not sure it'll be quite so easy to retrieve them!

As my headphones went on two seaside day trips yesterday, markets put in a mixed performance as further strength in the US supported the S&P 500 (+0.28%) to a new record (the 40th of the year), despite mounting concern about Europe’s economic weakness. The main driver for that were the latest flash PMIs for September, which painted a divergent picture from around the world. So in the US, positive numbers helped bolster hopes for soft landing, whilst weakness in Europe led investors to dial up the chance that the ECB would accelerate their rate cuts and move again at the next meeting in October. That meant it was a pretty varied session across different asset classes, and even as the S&P 500 hit a new high, there were some subplots pointing to concern at the same time. Notably, the classic safe haven of gold hit a fresh all-time high in nominal terms, closing at $2,628/oz.

Overnight, Asian equity markets are mostly rising with Chinese markets leading the way following additional stimulus measures announced from Beijing. As I check my screens, the Hang Seng (+3.28%) is outperforming with the Shanghai Composite (+2.38%) and the CSI (+2.07%) also strong. PBOC Governor Pan Gongsheng announced a multitude of measures today including cutting banks’ required reserve ratio (RRR) by 0.5 percentage point, bringing it down to 9.5% for major banks whilst reducing the 7-day reverse repo rate by 0.2 percentage points to 1.5%. Additionally, the central bank will cut outstanding mortgage rates and relax rules for second-home purchases. Elsewhere, the Nikkei is up +0.67% while the KOSPI (+0.07%) is holding on to its gains. S&P 500 (-0.17%) and NASDAQ futures (-0.18%) are lower though. As I type the RBA have left rates on hold. Before the decision 16bps of cuts were priced in before year-end, this has dipped by 1-2bps in the initial reaction to the accompanying statement.

Back to yesterday and the flash PMIs dictated a lot of the sentiment in markets, as the European numbers raised fears that the economy wasn’t as resilient as some had thought. In particular, the composite PMI for the Euro Area was back in contractionary territory for the first time in 7 months, at 48.9 (vs. 50.5 expected), and both the French (47.4) and German (47.2) numbers were beneath 50 as well. The euro PMI also saw the composite employment index fall to its lowest since early 2021, at 49.3, led by a decline in Germany. So that led to mounting expectations that the ECB might speed up the pace of their rate cuts from the quarterly pace they’ve delivered so far, and instead start cutting at every meeting. In fact, overnight index swaps lifted the chance of an October rate cut to 41% yesterday, having been at just 26% by Friday’s close.

With growing anticipation for another ECB rate cut, that helped sovereign bond yields to fall back across much of the continent, with yields on 10yr bunds down -5.0bps. Significantly, the moves also meant the German 2s10s yield curve dis-inverted for the first time since November 2022, ending the session at +0.4bps. So a significant milestone, and that echoes the re-steepening that’s happened in the US as well. Weaker European data and lower rates also saw the euro post its worst day against the dollar in nearly four weeks (-0.33%).

Meanwhile in France, yesterday also brought a fresh widening in the Franco-German 10yr spread, which moved up +2.5bps to 78bps. That’s its highest level since the market turmoil in early August, and not far off its recent closing peak of 82bps, shortly before the first round of the legislative election in the summer. The move follows the announcement of new ministers over the weekend, but there’s still uncertainty about how long this government will survive, as they don’t have a majority in the National Assembly, and will rely on other parties not voting them down.

In the US however, there was quite a different picture yesterday, as the flash PMIs pointed to ongoing economic resilience. For instance, the composite PMI was at 54.4 (vs. 54.3 expected), continuing the run since May where all the readings have had a 54 handle. So that suggested that the economy’s strength was continuing into September, and that fears of a downturn weren’t evident in the data so far. Risk assets also got a fresh boost from the latest Fed speakers, who affirmed their plan to keep cutting rates. In particular, Chicago Fed President Goolsbee said that there would likely be “many more rate cuts over the next year”. However, there was a signal that 50bp rate cuts may not continue, with Minneapolis Fed President Kashkari saying that “we will probably take smaller steps unless the data changes materially”.

For now at least, investors are still completely split on the size of the Fed’s next move, with futures pricing in a 54% chance of another 50bp cut in November. So we might find ourselves with a real sense of déjà vu over the coming weeks if that remains in the balance. Bear in mind we’ve still got a couple more jobs reports as well beforehand, so plenty of time for that to shift. But in the meantime, Treasury yields were little changed yesterday, with the 2yr down -0.4bps to 3.59%, while the 10yr yield was up +0.9bps to 3.75%. That left the 2s10s yield curve at +16bps, its steepest closing level since June 2022. In my CoTD yesterday (link here) I looked at our rates strategists' latest view. If they are correct this will be a rare rate cutting cycle where 10yr US yields go up. See my piece for the info and all the links to their latest pieces on this.

The stronger US data supported US equities, helping the S&P 500 (+0.28%) to achieve its 40th all-time high of 2024 so far. In fact, the index is almost up +20% on a YTD basis. And for what it’s worth, if it manages two consecutive years up at least +20% (having risen +24.2% in 2023), it would be the first time it’s managed that since 1997-98. In terms of yesterday’s drivers, the S&P’s gains were quite broad-based, with over 70% of constituents higher on the day, led by energy (+1.31%) and consumer discretionary (+1.30%) stocks. The tech mega caps also outperformed with the Magnificent 7 (+0.71%) closing at a 2-month high, albeit still almost -6% beneath its peak. Over in Europe, concerns about political uncertainty and an economic downturn failed to prevent gains, with the STOXX 600 up +0.40% yesterday. That said, European credit spreads did underperform, widening for the first time in eight sessions (+7bps for HY).

To the day ahead now, and central bank speakers include the ECB’s Muller, Escriva and Nagel, along with the Fed’s Bowman. Data releases include the Ifo’s business climate indicator for Germany in September, and the Conference Board’s consumer confidence indicator for the US in September. We’ll also get the FHFA’s house price index for July.

US equity futures are higher, led by tech with small-caps underperforming, as European stocks jump near record high (even as Europe slides deeper into recession) and Asian markets surge after China’s announced a flurry of “stronger than expected” stimulus measures which aided China and Hong Kong equities to more than 4% gains. As of 8:00am, S&P and Nasdaq futures were up 0.1%, fluctuating between gains and losses, as traders were unsure if China’s massive stimulus would prove to be inflationary and thus crush the Fed’s hopes for an accelerated easing campaign. The news of China’s multiple rate cuts and market-supporting measures (full details here) is also boosting the commodity complex with both Energy and Base Metals seeing gains. And with commodities once again flying, bond yields are 1-4bps higher as the curve bear steepens. The USD is mixed as the yen slides now that the carry trade is once again back on thanks to China. As JPM notes this morning, while the US has been the anchor for global growth, “a China reboot will also benefit the globe though may create another inflation pressure,” so keep an eye on commodities and bond yields over the coming weeks. Higher yields are not a headwind to stocks but when yields set new highs (e.g., 10Y > 5%) that is when US Equities are disrupted. On the macro calendar we have the September Phillly Fed non-manufacturing activity (8:30am), July FHFA house price index and S&P CoreLogic house prices (9am), September consumer confidence and Richmond Fed manufacturing index (10am); Fed speakers scheduled include Bowman at 9am.

In premarket trading, US-listed Chinese stocks surged after China’s central bank announced a slew of measures aiming to boost the economy, housing sector and the stock market; among the biggest movers were Alibaba (BABA) + 5.7%, JD.com (JD) + 8.2%, and NetEase (NTES) +6.2%. Here are some other notable premarket movers:

- Hawaiian Electric Industries (HE) slips after pricing an offering

- Liberty Broadband (LBRDA) shares soar 20% after John Malone’s cable company proposed an all-stock merger with Charter Communications (CHTR)

- Light & Wonder (LNW) falls after saying it had received an order from the US District Court for the District of Nevada granting gambling machine manufacturer Aristocrat a preliminary injunction relating to L&W’s Dragon Train game

- Miniso (MNSO) extends Monday’s decline after announcing a plan to buy a majority stake in Yonghui Superstores

- Salesforce (CRM) gains as Piper Sandler raised its recommendation on the stock to overweight from neutral, seeing free cash flow per share doubling by 2029

- Starbucks (SBUX) falls as Jefferies assigned an underperform rating, saying it’s too early to get excited about the company’s prospects for a turnaround even with a new CEO in charge

- Walmart (WMT) rises after Truist Securities upgraded the retailer to buy from hold. Costco (COST) declines after Truist downgraded the stock

Overnight market sentiment is euphoric after PBOC governor Pan Gongsheng announced a barrage of policy easing measures this morning, including a 20bp primary policy rate cut, a 50bp RRR cut and a 50bp interest rate cut on existing mortgages. Summary of stimulus package:

- 50bp RRR cut (Governor Pan flagged the central bank will consider cutting RRR further by year-end);

- 20bp cut to policy rate (7d OMO rate);

- Governor Pan flagged this would guide MLF rate lower by 30bp and lower LPRs and deposit rates by 20-25bp;

- Lowering mortgage rates (by ~50bp as estimated by PBOC), and lowering the downpayment ratio of second-home purchase to the level for first-home purchase (to 15% from 25% previously);

- Launching new monetary policy tools to support stock market development (i.e., supporting brokerages, mutual funds and insurance companies to borrow liquidity from PBOC via asset pledges);

- Launching special-purpose relending to guide bank to provide funding for list companies on their share buybacks.

China’s broad package of monetary stimulus on Tuesday included reduced reserve requirements for banks and at least 800 billion yuan ($114 billion) of liquidity support for stocks. According to Goldman, the announcement was “one of the largest / strongest moves by the PBOC since probably the height of COVID” and while “until now, its been fairly piecemeal in nature and rather uncoordinated leaving lukewarm reactions, today’s joint PBOC, CBRC and NFRA press conference was the setting with expectations are high for further fiscal / property market easing over the coming weeks – though there remains obvious questions on the efficacy of all of this through to the real economy in the context of oversupply and a continued cautious consumer.” As a result, this move appears to signal greater openness to easing from senior policymakers, but more fiscal easing measures are needed to boost domestic demand (they will come now that China has announced no more half measures). Given the guidance from the PBOC governor, Goldman expects another 25bp RRR cut in Q4 for this year, and maintain a forecast for additional RRR/policy rate cuts in 2025 (two 25bp RRR cuts in Q1/Q3 and two 10bp policy rate cuts in Q2/Q4 2025).

Beijing’s poilcy stimulus blitz sent China’s stocks soaring the most in fueled by the central bank’s latest blitz of policy measures designed to stem the worsening economic outlook and market mood. After a modest open, equities gathered steam after People’s Bank of China Governor Pan Gongsheng’s announcement, with traders assessing if the stimulus package was sufficiently robust. By the close,, the benchmark CSI 300 index surged more than 4.3%, the biggest jump since the March 2020 Covid panic.

Still, it will take time for the economic impact of any stimulus to feed through, Michael Sneyd, head of cross-asset and macro quantitative strategy at BNP Paribas, told Bloomberg TV. “That China stimulus news is probably not enough to take off those downside risks in the European economy just yet.”

Meanwhile, back in the US, a handful of Fed officials on Monday left open the door to the possibility of more large interest-rate cuts to come, saying that the current level is still weighing on the economy. Chicago Fed President Austan Goolsbee said that “we have a long way to come down to get the interest rate to something like neutral.” Although he and his colleagues made clear that incoming data will determine what comes next.

In short: China jumping on the stimulus bandwagon just in time for the US to aggressively cut, means we have all the makings of a global superbubble.

Investors are now awaiting data on the Fed’s preferred price metric and US personal spending later this week for further clues on the depth of future reductions. US Traders have been wagering on nearly three-quarters of a point of policy easing by year-end, suggesting at least one more major rate cut is in store.

And sure enough, European stocks, having been hammered by the lack of a credible China stimulus for years, erupted higher tracking a China-led rally in Asia. The Stoxx 600 is up 0.6%, with luxury and mining sectors the biggest benefactors. UK machinery firm Smiths is the day’s biggest laggard after preliminary FY2024 results. Here are the biggest European movers:

- European sectors with high exposure to China, including miners, luxury-goods makers and automakers, gain strongly after the Asian nation announced measures to boost growth and shore up its property market

- TUI rises as much as 3.2% after the travel company said it experienced a strong end to the summer season, leaving it confident it can deliver its annual guidance, and made a promising start to the winter season

- Raspberry Pi rises as much as 9.5% after the British PC maker reported a 61% increase in 1H revenue, boosted by pricier Raspberry Pi 5 boards; the stronger-than-expected 1H is likely followed by a weaker 2H

- AMS-Osram shares jump as much as 16% after UBS lifts its recommendation for the Swiss chip-maker to buy from neutral, citing limited liquidity and leverage concerns and a clear path to further deleveraging

- Smiths Group drops as much as 8.3%, the most since 2021, after the UK machinery firm releases its preliminary results for FY24 and FY25 targets. Jefferies says consensus expectations for FY25 may “drift”

- Saab falls as much as 7.4% to the lowest since March after Bank of America downgraded its rating on the Swedish weapons and defense systems manufacturer to neutral, trimming its price target to SEK240

- Aurubis shares drop as much as 3.7% after Hauck & Aufhaeuser analysts downgraded their recommendation on the firm. Shares had slid more than 10% on Monday after the firm’s profit guidance missed estimates

- Dunelm shares drop as much as 7.5%, the most since September 2022, after its deputy chairman sold shares in the British homeware retailer at a discount to the last closing price

Meanwhile, Asian stocks headed for their highest close since February 2022 as a slew of measures from China to support its struggling economy boosted sentiment on the region’s equities. The MSCI Asia Pacific Index rose as much as 1%, with Tencent, TSMC and Alibaba among the biggest boosts. Stocks rallied in mainland China and in Hong Kong, with the CSI 300 index closing up 4.3% in its best day in more than four years. The Hang Seng China Enterprises index surged over 5%. China’s stimulus package, which includes a reduction to a key policy rate and $113 billion of liquidity support for the stock market, helped ease concerns that authorities are reluctant to take bold policy steps. Investors were already warming toward emerging market assets following the Federal Reserve’s 50-basis-point rate cut, and a sustainable rebound in Chinese shares can provide an additional boost to the region. The stimulus has “raised the expectations that more is coming,” providing support for the stock market, Grace Tam, chief investment advisor at BNP Paribas Wealth Management, said in a Bloomberg TV interview. “The market will expect more support on the fiscal side,” she added.

In FX, the Bloomberg Dollar Spot Index is little changed. The yen is the weakest of the G-10 currencies, falling 0.6% against the greenback. The Aussie dollar reversed its post-RBA gain after Governor Bullock said a hike was not explicitly considered at today’s meeting.

In rates, Gilts lead a sell off in European government bonds, with UK 10-year yields rising 6 bps to 3.98%. Treasuries 10-year yields are up 4 bps to 3.79% amid fears China may overstimulate and derail the Fed’s easing plans.

Commodities also benefited from China’s panic, with WTI rising 2.6% to $72.20 a barrel, and as a major Israeli strike on Hezbollah targets in Lebanon kept tensions high in the Middle East. Gold hit a fresh record of $2,640.11 per ounce. Iron ore and copper climb over 1%.

Looking at today’s calendar, we get September Philadelphia Fed non-manufacturing activity (8:30am), July FHFA house price index and S&P CoreLogic house prices (9am), September consumer confidence and Richmond Fed manufacturing index (10am). Fed speakers scheduled include Bowman at 9am.

Market Snapshot

- S&P 500 futures up 0.3% to 5,791.50

- STOXX Europe 600 up 0.8% to 520.21

- MXAP up 0.9% to 188.95

- MXAPJ up 1.3% to 593.95

- Nikkei up 0.6% to 37,940.59

- Topix up 0.5% to 2,656.73

- Hang Seng Index up 4.1% to 19,000.56

- Shanghai Composite up 4.2% to 2,863.13

- Sensex up 0.1% to 85,042.00

- Australia S&P/ASX 200 down 0.1% to 8,141.97

- Kospi up 1.1% to 2,631.68

- German 10Y yield little changed at 2.2%

- Euro up 0.3% to $1.1140

- Brent Futures up 1.5% to $75.03/bbl

- Gold spot down 0.0% to $2,628.41

- US Dollar Index little changed at 100.81

Top Overnight News

- China unveiled its most aggressive package of stimulus measures since the pandemic as the gov’t rushes to bolster the economy (steps include interest rate cuts, including the 7-day reverse repo, bank RRRs, and mortgage borrowing costs, along with liquidity injections aimed at bolstering stocks). RTRS

- BOJ’s Ueda downplays the potential for an Oct rate hike, saying high uncertainty warranted a patient approach to tightening. WSJ

- Australia’s RBA leaves rates unchanged at 4.35%, as was widely expected, although the forward guidance turned slightly dovish at the margin as further tightening wasn’t discussed. RTRS

- Zelensky says he believes Russia’s war on his country is closer to an end than many believe. Czech Republic president Petr Pavel said Ukraine needs to be realistic and accept that an end to the war will probably involve ceding some territory to Russia. ABC News / NYT

- Washington believes Israel has significantly weakened Hezbollah with recent strikes but is working “feverishly” to prevent an IDF ground incursion into Lebanon. CNN

- Private credit is set to face a “reckoning moment” and period of difficulty unseen since 2008 amid inflation and recession risks, NY Life CIO Jae Yoon said. He emphasized that the risk was not “Armageddon” level, but said the flood of capital had led to too much debt concentration. BBG

- Visa will be hit with an antitrust lawsuit by the DOJ on Tuesday following a years-long review of the firm’s business practices. FT

- Former President Donald Trump threatened to hit US farm machinery maker Deere & Co. with steep tariffs if the company moves production to Mexico during an event on American farmers and trade. “I’m just notifying John Deere right now, if you do that, we’re putting a 200% tariff on everything that you want to sell into the United States,” Trump said Monday, citing reports about the company shifting manufacturing to Mexico. BBG

- GameStop said it raised $400M from its latest ATM offering program (this means the company now has ~$4.6B in cash/securities, or nearly 50% of the present market cap). RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following gains on Wall St. and China’s various stimulus measures. ASX 200 was subdued amid the RBA rate decision where the central bank unsurprisingly opted for a hawkish hold. Nikkei 225 gapped above the 38,000 level as it played catch up on its return from the long weekend. Hang Seng and Shanghai Comp were boosted after the PBoC, NDRC and NRFA press briefing where PBoC Governor Pan announced a cut in the RRR by 50bps and the 7-day reverse repo rate by 20bps to 1.50%, while it will reduce the MLF rate and guide the LPR lower. Furthermore, support measures were also announced for the property industry and China will create new tools to support the stable development of the stock market, as well as allow funds and brokers to tap PBoC funds to buy stock.

Top Asian News

- Former US President Trump said regarding his tariff plans that he doesn’t need Congress and would have the right to impose them himself, according to Washington Post’s Stein.

- BoJ Governor Ueda says it is desirable for FX to move stability reflecting fundamentals; global market remains somewhat unstable; must watch market developments with strong sense of urgency for the time being. Says the unwinding of short-term speculative JPY positions, which were partially behind the August rout, have likely run their course. Says he wants scrutinise each month’s service price data in gauging development in underlying inflation. BoJ natural rate of interest was among the factors taken into account when setting policy. Does not comment on short-term FX fluctuations.

European bourses, Stoxx 600 (+0.9%) began the session on a very strong footing, taking impetus from a strong APAC session overnight, which was sparked by a flurry of Chinese stimulus efforts. As it stands, European indices are firmer across the board and near session highs. European sectors hold a strong positive bias, with the best performers in Europe largely a beneficiary of the aforementioned Chinese stimulus efforts; Basic Resources, Consumer Products (particularly Luxury) and Tech all top the pile. Real Estate and Utilities are found towards the foot of the pile. US Equity Futures (ES +0.2% NQ +0.4% RTY +0.2%) are modestly firmer across the board, taking impetus from a strong European session which has digested and benefited from China’s stimulus bazooka.

Top European News

- ECB President Lagarde says the ECB is almost at the 2% target, wants to make sure they reach the target and remain there, according to comments on The Daily Show.

- ECB’s Muller says “it’s reasonable to expect more cuts if outlook holds”.

- UK PM Starmer is to argue that tough decisions are needed for the UK national renewal and say in his speech on Tuesday that there are no easy answers, according to FT. It was also reported by Huffington Post that PM Starmer is to warn of more pain to come as he pledges a new Britain.

- French Finance Minister Armand says they are working on the latest estimates for the 2024 budget deficit, aiming to be able to present “something credible”.

FX

- USD is showing a mixed performance vs. peers in the current risk environment; stronger vs. JPY and CHF but softer vs. EUR, CAD, GBP. DXY is currently contained within yesterday’s 100.71-101.22.

- EUR is able to gain against the USD despite more dismal data from Germany which saw a miss across the board on IFO metrics. EUR/USD has been able to hold above the 1.11 mark throughout the session and has climbed as high as 1.1139 but is yet to challenge Monday’s 1.1167 peak.

- Cable has once again eked out another marginal YTD high, this time at 1.3375. There hasn’t been anything fresh during today’s session to drive the move and instead looks to be more a continuation of the current trend. UK PM Starmer is to speak at the UK Labour Party Conference at 14:00BST.

- JPY is struggling alongside the current pro-risk sentiment seen overnight in China and in Europe. Ueda spoke earlier but comments did not look particularly dovish and in-fact could be seen as slightly more hawkish vs his prior comments. USD/JPY has been able to eclipse last week’s 144.49 peak with focus now on a test of the 145 mark.

- AUD/USD is unable to benefit from the Chinese stimulus efforts with greater attention on events at the RBA. The Bank delivered what was seen as another hawkish hold. However, AUD/USD was subsequently dragged lower by comments from the RBA Governor stating that, unlike the prior meeting, the board did not discuss a rate hike.

Fixed Income

- USTs are weighed on by the broader risk tone and down to a 114-13+ base. Support comes in at Monday’s 114-11+ trough before the figure. Fed’s Bowman and US 2yr supply.

- Bunds are softer below 134.50 but still clear of Monday’s 134.02 base, potentially weighed on by somewhat hawkish remarks from Ueda (vs his post-policy announcement speech) and the strengthening risk tone more generally given substantial Chinese stimulus overnight. Poor German Ifo data spurred no real reaction in the complex.

- Gilts are pressured and moving in-line with peers; BoE’s Bailey spoke earlier, but added little. Gilts initially opened higher by 13 ticks but have since faded and lost the 99 handle to a 98.73 trough.

- UK sells GBP 1.5bln 0.75% 2033 I/L Gilt: b/c 3.17x (prev. 2.94x) and real yield 0.486% (prev. 0.462%).

- Germany sells EUR 3.708bln vs exp. EUR 4.5bln 2.70% 2026 Schatz: b/c 2.4x (prev. 2.5x), average yield 2.14% (prev. 2.41%) and retention 17.6% (prev. 16.93%).

Commodities

- A firm session thus far for the crude complex amid the overnight raft of Chinese stimulus announced which takes some sting out of the Chinese demand woes which has plagued the crude markets for much of this year and amid the heightened geopolitical environment in Lebanon/Israel.

- Upward bias across precious metals but to varying degrees. Spot gold sees the shallowest gains, potentially amid less demand for havens in a risk-on environment. XAU overnight printed yet another fresh All-time-high at USD 2,640.18/oz (vs low 2,622.68/oz).

- Base metals are higher across the board as the raft of Chinese stimulus announced overnight boosts demand prospects for the sector. 3M LME copper topped USD 9,700/t.

- BP (BP/ LN) cut oil and gas production at two US Gulf of Mexico platforms and curtailed output at two others, while it is removing non-essential staff from five US Gulf of Mexico platforms ahead of a predicted hurricane.

- Chevron (CVX) announced it was evacuating non-essential personnel from all Gulf of Mexico platforms including Anchor, Big Foot, Blind Faith, Jack/St. Malo, Petronius and Tahiti.

- NHC says Hurricane John is just inland over southern Mexico. Life-threatening winds, storm surges and flash flooding continues in the warning area; more recently, John has been downgraded to a tropical storm, moving north-westward; life threatening flash flooding to continue along southern Mexican coast for the next few days

- Ukrainian President Zelensky said he held talks with Japanese PM Kishida on energy supplies in light of Russian attacks.

Geopolitics: Middle East

- IDF Radio, citing military sources, say “We have a long way ahead and we are still at the beginning”, via Al Arabiya.

- “Senior Israeli official says a ground operation in Lebanon could be considered if political track does not lead to the return of the Israeli residents to the north”, according journalist Soylu.

- Hamas armed wing said field commander Mahmoud Al-Nader was killed in an Israeli strike on southern Lebanon on Monday.

- US President Biden and UAE’s leader said after their meeting that a two-state solution is the only framework for resolving the conflict, while it was also reported that the UAE expressed deep concern over Israeli attacks on southern Lebanon.

- US State Department senior official said the US has been working hard in recent days to find a diplomatic solution to the spike in fighting between Israel and Hezbollah, while the key focus for Secretary of State Blinken’s discussion with allies is on finding an off-ramp to prevent further escalation and the US has some “concrete ideas” that it is going to be discussing to prevent escalation in the region.

- US Deputy Treasury Secretary told the Bank of Israel Governor of US concern about threats by some within the Israeli government to sever correspondent banking relationships between Israeli and Palestinian banks, while the Deputy Treasury Secretary insisted these relationships should be extended for at least a year and stressed these relations would be critical to preventing an economic crisis in the West Bank.

- EU’s Borrell said the escalation in Lebanon is extremely worrying and that they are almost in a full-fledged war, while he added that they are still working to stop escalation in Lebanon but the worst expectations are becoming reality.

- Iran’s President said US policies support and encourage Israel in its open war and Washington’s actions contradict its words, while Iran reaffirms that an open regional war will not be in the interest of anyone in the region and the world. Furthermore, he said Iran has sufficient capacity to strike Israel and their response will be at the right time and in the appropriate way, while he added that Israel’s assassination of Haniyeh will not be without a response and their reply is coming.

- Iran’s President said at the UN Summit of the Future that Tehran aspires to “a world free of nuclear weapons and a Middle East free of weapons of mass destruction, without any preconditions”, according to journalist Abas Aslani via X.

- Iran’s Foreign Minister denied statements attributed to Iran’s President about a willingness to reduce tensions with Israel, while the Foreign Minister added that Israel will receive a response to attacks in due course, according to Al-Arabiya.

- “The response to the new air force airstrikes in Lebanon would not only come from Lebanon, but from other resistance axes such as Yemen”, according to Houthi sources cited by Lebanese newspaper Al-Akhbar.

Geopolitics: Other

- Ukrainian President Zelensky said Ukraine’s war with Russia is ‘closer to the end’ and separately commented that US decisive action now could hasten an end to Russian aggression next year, according to ABC News and Reuters.

- EU’s Borrell said it is clear that Russia has been receiving new weapons in particular, missiles from Iran, while he added that G7 will hold talks about providing long-range missiles to Ukraine to strike Russian territory.

- Venezuela’s highest court approved an arrest warrant for Argentine President Milei who is a vocal critic and ideological rival of Venezuelan President Maduro, according to AFP News Agency. Argentine Justice requests international arrest of Venezuelan President Maduro for alleged human rights violations

US Event Calendar

- 08:30: Sept. Philadelphia Fed Non-Manufactu, est. -9.3, prior -25.1

- 09:00: July S&P/Case-Shiller US HPI YoY, prior 5.42%

- 09:00: July FHFA House Price Index MoM, est. 0.2%, prior -0.1%

- 09:00: July S&P/CS 20 City MoM SA, est. 0.40%, prior 0.42%

- 09:00: July S&P CS Composite-20 YoY, est. 5.90%, prior 6.47%

- 10:00: Sept. Conf. Board Expectations, prior 82.5

- 10:00: Sept. Conf. Board Present Situation, prior 134.4

- 10:00: Sept. Richmond Fed Index, est. -12, prior -19

- 10:00: Sept. Conf. Board Consumer Confidenc, est. 104.0, prior 103.3

DB’s Jim Reid concludes the overnight wrap

The most exciting thing about yesterday for me was losing my AirPod Pro headphones on the train on the way to the office and then nervously tracking them on the “find my” feature to the South Coast of England and back to London twice before I met them later after tracking the train in an emotionally charged reunion. They were on the floor under the seat where I had dropped them. It’s a miracle no one took them or handed them in which would have been pretty annoying/inconvenient. I’m off to Paris this morning so a few days without headphones would have been irritating. Let’s hope I don’t leave them on the plane as I’m not sure it’ll be quite so easy to retrieve them!

As my headphones went on two seaside day trips yesterday, markets put in a mixed performance as further strength in the US supported the S&P 500 (+0.28%) to a new record (the 40th of the year), despite mounting concern about Europe’s economic weakness. The main driver for that were the latest flash PMIs for September, which painted a divergent picture from around the world. So in the US, positive numbers helped bolster hopes for soft landing, whilst weakness in Europe led investors to dial up the chance that the ECB would accelerate their rate cuts and move again at the next meeting in October. That meant it was a pretty varied session across different asset classes, and even as the S&P 500 hit a new high, there were some subplots pointing to concern at the same time. Notably, the classic safe haven of gold hit a fresh all-time high in nominal terms, closing at $2,628/oz.

Overnight, Asian equity markets are mostly rising with Chinese markets leading the way following additional stimulus measures announced from Beijing. As I check my screens, the Hang Seng (+3.28%) is outperforming with the Shanghai Composite (+2.38%) and the CSI (+2.07%) also strong. PBOC Governor Pan Gongsheng announced a multitude of measures today including cutting banks’ required reserve ratio (RRR) by 0.5 percentage point, bringing it down to 9.5% for major banks whilst reducing the 7-day reverse repo rate by 0.2 percentage points to 1.5%. Additionally, the central bank will cut outstanding mortgage rates and relax rules for second-home purchases. Elsewhere, the Nikkei is up +0.67% while the KOSPI (+0.07%) is holding on to its gains. S&P 500 (-0.17%) and NASDAQ futures (-0.18%) are lower though. As I type the RBA have left rates on hold. Before the decision 16bps of cuts were priced in before year-end, this has dipped by 1-2bps in the initial reaction to the accompanying statement.

Back to yesterday and the flash PMIs dictated a lot of the sentiment in markets, as the European numbers raised fears that the economy wasn’t as resilient as some had thought. In particular, the composite PMI for the Euro Area was back in contractionary territory for the first time in 7 months, at 48.9 (vs. 50.5 expected), and both the French (47.4) and German (47.2) numbers were beneath 50 as well. The euro PMI also saw the composite employment index fall to its lowest since early 2021, at 49.3, led by a decline in Germany. So that led to mounting expectations that the ECB might speed up the pace of their rate cuts from the quarterly pace they’ve delivered so far, and instead start cutting at every meeting. In fact, overnight index swaps lifted the chance of an October rate cut to 41% yesterday, having been at just 26% by Friday’s close.

With growing anticipation for another ECB rate cut, that helped sovereign bond yields to fall back across much of the continent, with yields on 10yr bunds down -5.0bps. Significantly, the moves also meant the German 2s10s yield curve dis-inverted for the first time since November 2022, ending the session at +0.4bps. So a significant milestone, and that echoes the re-steepening that’s happened in the US as well. Weaker European data and lower rates also saw the euro post its worst day against the dollar in nearly four weeks (-0.33%).

Meanwhile in France, yesterday also brought a fresh widening in the Franco-German 10yr spread, which moved up +2.5bps to 78bps. That’s its highest level since the market turmoil in early August, and not far off its recent closing peak of 82bps, shortly before the first round of the legislative election in the summer. The move follows the announcement of new ministers over the weekend, but there’s still uncertainty about how long this government will survive, as they don’t have a majority in the National Assembly, and will rely on other parties not voting them down.

In the US however, there was quite a different picture yesterday, as the flash PMIs pointed to ongoing economic resilience. For instance, the composite PMI was at 54.4 (vs. 54.3 expected), continuing the run since May where all the readings have had a 54 handle. So that suggested that the economy’s strength was continuing into September, and that fears of a downturn weren’t evident in the data so far. Risk assets also got a fresh boost from the latest Fed speakers, who affirmed their plan to keep cutting rates. In particular, Chicago Fed President Goolsbee said that there would likely be “many more rate cuts over the next year”. However, there was a signal that 50bp rate cuts may not continue, with Minneapolis Fed President Kashkari saying that “we will probably take smaller steps unless the data changes materially”.

For now at least, investors are still completely split on the size of the Fed’s next move, with futures pricing in a 54% chance of another 50bp cut in November. So we might find ourselves with a real sense of déjà vu over the coming weeks if that remains in the balance. Bear in mind we’ve still got a couple more jobs reports as well beforehand, so plenty of time for that to shift. But in the meantime, Treasury yields were little changed yesterday, with the 2yr down -0.4bps to 3.59%, while the 10yr yield was up +0.9bps to 3.75%. That left the 2s10s yield curve at +16bps, its steepest closing level since June 2022. In my CoTD yesterday (link here) I looked at our rates strategists’ latest view. If they are correct this will be a rare rate cutting cycle where 10yr US yields go up. See my piece for the info and all the links to their latest pieces on this.

The stronger US data supported US equities, helping the S&P 500 (+0.28%) to achieve its 40th all-time high of 2024 so far. In fact, the index is almost up +20% on a YTD basis. And for what it’s worth, if it manages two consecutive years up at least +20% (having risen +24.2% in 2023), it would be the first time it’s managed that since 1997-98. In terms of yesterday’s drivers, the S&P’s gains were quite broad-based, with over 70% of constituents higher on the day, led by energy (+1.31%) and consumer discretionary (+1.30%) stocks. The tech mega caps also outperformed with the Magnificent 7 (+0.71%) closing at a 2-month high, albeit still almost -6% beneath its peak. Over in Europe, concerns about political uncertainty and an economic downturn failed to prevent gains, with the STOXX 600 up +0.40% yesterday. That said, European credit spreads did underperform, widening for the first time in eight sessions (+7bps for HY).

To the day ahead now, and central bank speakers include the ECB’s Muller, Escriva and Nagel, along with the Fed’s Bowman. Data releases include the Ifo’s business climate indicator for Germany in September, and the Conference Board’s consumer confidence indicator for the US in September. We’ll also get the FHFA’s house price index for July.

Loading…