Authored by Mike Shedlock via MishTalk.com,

Credit card usage surged $46 billion in the second quarter as consumers struggle to maintain their standard of living...

Please consider the New York Fed Household Debt and Credit Report for 2022 Q2.

-

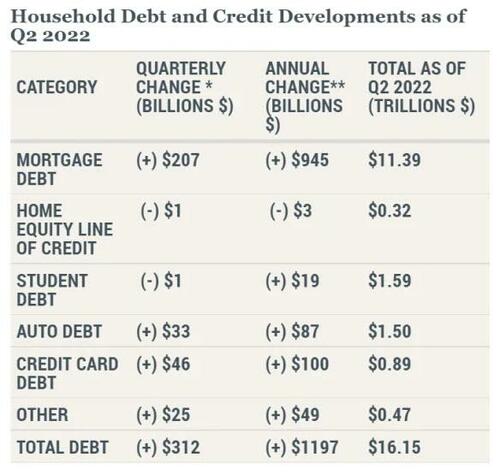

Total household debt rose $312 billion, or 2 percent, in the second quarter of 2022 to reach $16.15 billion, according to the latest Quarterly Report on Household Debt and Credit.

-

Mortgage balances—the largest component of household debt—climbed $207 billion and stood at $11.39 trillion as of June 30.

-

Credit card balances had a $46 billion increase since the first quarter. The 13% year-over-year increase marked the largest in more than 20 years.

-

Aggregate limits on cards marked their largest increase in over ten years.

-

Transitions into delinquency ticked up but remained very low compared to historical levels.

-

Auto loan balances increased by $33 billion in the second quarter, continuing the upward trajectory that has been in place since 2011.

-

Student loan balances now stand at $1.59 trillion, roughly unchanged from the first quarter of 2022.

-

Other balances, which include retail cards and other consumer loans, increased by a robust $25 billion.

-

In total, non-housing balances grew by $103 billion, a 2.4% increase from the previous quarter, the largest increase seen since 2016.

Spending Q&A

Q: Why did we have had two quarters of negative GDP with all that spending?

A: Inflation adjusted spending which drives GDP is not keeping up with inflation.

It appears that the alleged pandemic savings has all been spent given that consumers are increasingly turning to their credit cards.

Regardless, the debt keeps piling up.

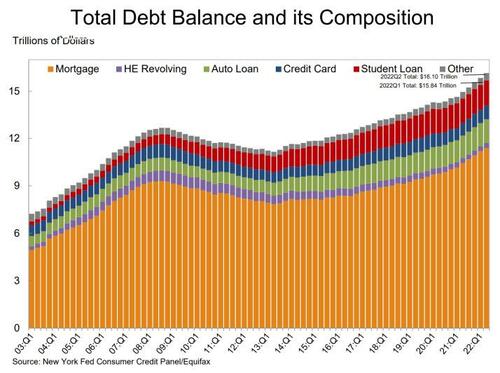

Total Debt Balance and Its Compensation

Hooray, total debt made another new high.

Aggregate household debt balances increased by $312 billion in the second quarter of 2022, a 2.0% rise from 2022 Q1.

Balances now stand at $16.15 trillion and have increased by $2 trillion since the end of 2019, just before the pandemic recession.

* * *

Authored by Mike Shedlock via MishTalk.com,

Credit card usage surged $46 billion in the second quarter as consumers struggle to maintain their standard of living…

Please consider the New York Fed Household Debt and Credit Report for 2022 Q2.

-

Total household debt rose $312 billion, or 2 percent, in the second quarter of 2022 to reach $16.15 billion, according to the latest Quarterly Report on Household Debt and Credit.

-

Mortgage balances—the largest component of household debt—climbed $207 billion and stood at $11.39 trillion as of June 30.

-

Credit card balances had a $46 billion increase since the first quarter. The 13% year-over-year increase marked the largest in more than 20 years.

-

Aggregate limits on cards marked their largest increase in over ten years.

-

Transitions into delinquency ticked up but remained very low compared to historical levels.

-

Auto loan balances increased by $33 billion in the second quarter, continuing the upward trajectory that has been in place since 2011.

-

Student loan balances now stand at $1.59 trillion, roughly unchanged from the first quarter of 2022.

-

Other balances, which include retail cards and other consumer loans, increased by a robust $25 billion.

-

In total, non-housing balances grew by $103 billion, a 2.4% increase from the previous quarter, the largest increase seen since 2016.

Spending Q&A

Q: Why did we have had two quarters of negative GDP with all that spending?

A: Inflation adjusted spending which drives GDP is not keeping up with inflation.

It appears that the alleged pandemic savings has all been spent given that consumers are increasingly turning to their credit cards.

Regardless, the debt keeps piling up.

Total Debt Balance and Its Compensation

Hooray, total debt made another new high.

Aggregate household debt balances increased by $312 billion in the second quarter of 2022, a 2.0% rise from 2022 Q1.

Balances now stand at $16.15 trillion and have increased by $2 trillion since the end of 2019, just before the pandemic recession.

* * *